The Canadian ETF market can be said to be pedigree. The Toronto Stock Exchange and their Toronto 35 Index Participation Units, TIPS35, laid the groundwork for the first modern-day ETF, the S&P 500 Trust ETF.

Despite the US and Canada share a border and the investment markets of both countries being viewed by most investors as one, Canadian ETFs have a bias towards sectors with natural resource affiliation. In contrast, Wall Street ETFs are more inclined towards the financial services sector, technology, and healthcare.

However, the Toronto Stock Exchange is one more forerunner in the cannabis emerging market space given Canada’s legalization of recreational marijuana use, the only country so far to do so globally.

With the World Bank rating of the 9th largest economy globally, China, the US, and the UK are the most prominent trade partners. So this developed economy is full of investment opportunities.

Despite boasting some big-name corporations such as Shopify and Enbridge, picking individual winning Canadian stocks is a pickle. Rather than deal with this hassle, why not invest in the following Canadian ETFs, reducing the associated investment risk and boosting winning chances.

What is the composition of Canada ETFs?

Many investors don’t differentiate between the Canadian and the US ETF market. In most cases, the Canadian and US economies are so intertwined that it is sometimes difficult to separate them in investment circles.

Since an ETF is a pool of economically like investment assets, Canadian ETFs comprise firms operating in Canada and listed on the Toronto Stock Exchange. Therefore, an ETF to qualify as a Canadian fund must have holdings that invest at least 70% of their total assets or generate at least 75% of their revenues from the Canadian economy.

Top 7 Canada ETFs

Despite being termed a North American investment market, a geographical portfolio diversification strategy is separating the Canadian equity market and investing in it through ETFs. Besides, it has an indirect play on the US economy, given that 50% of Canadian imports value are from the US.

The best ETFs giving investors pure-play Canadian exposure are as follows.

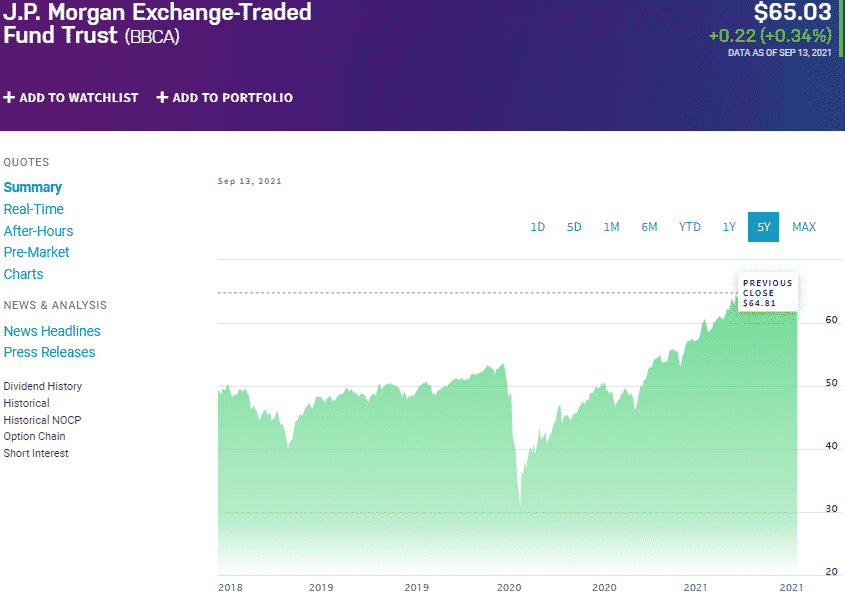

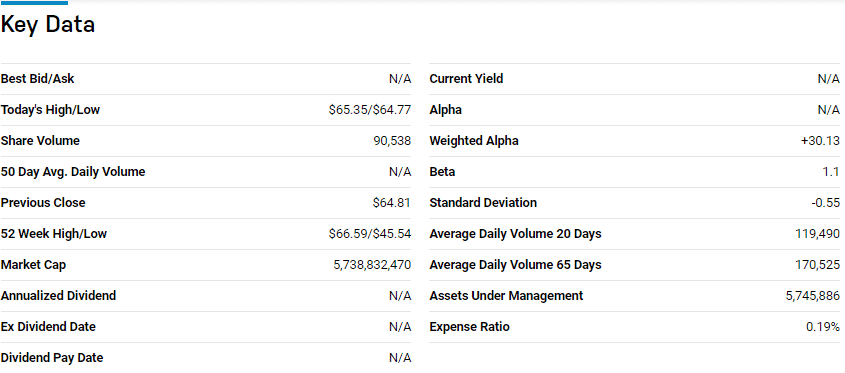

Best growth Canada ETF: JPMorgan BetaBuilders Canadian ETF (BBCA)

Price: $65.03

Expense ratio: 0.19%

The JPMorgan BetaBuilders Canadian ETF tracks the performance of the Morningstar Developed Europe Target Market Exposure Index, exposing investors to the best equities in the leading western and eastern European markets.

An evaluation of 75 Miscellaneous Regional ETFs by US News has this ETF at rank №2 for long-term investment.

The BBCA ETF has $5.71 billion in assets under management, with an expense ratio of 0.19%. With just three years since launch, the BBCA historical performance has proven that it might be worth holding for portfolio growth.

So 3-year returns of 44.05%, pandemic year returns of 37.16%, and year-to-date returns of 22.69%.

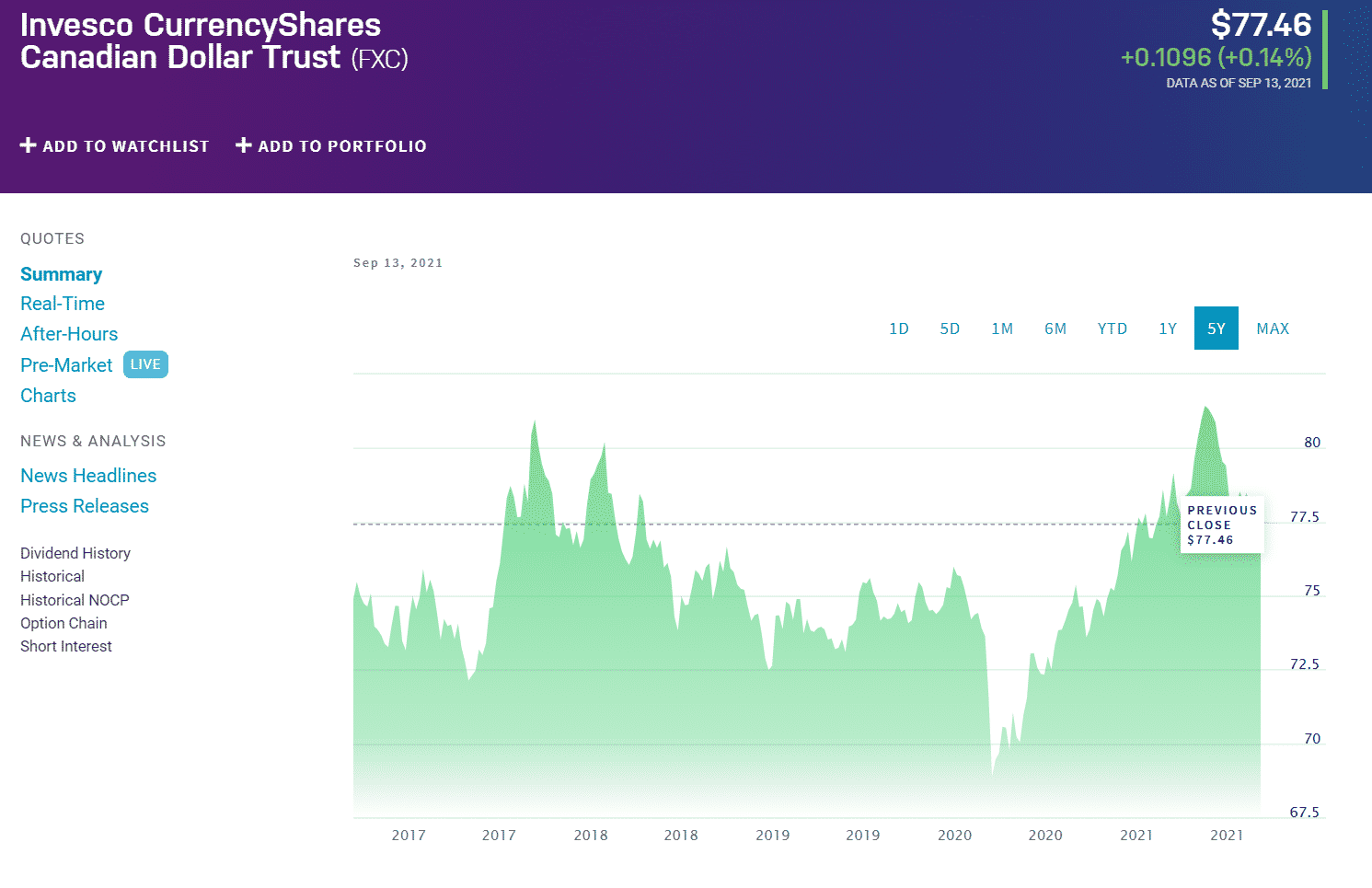

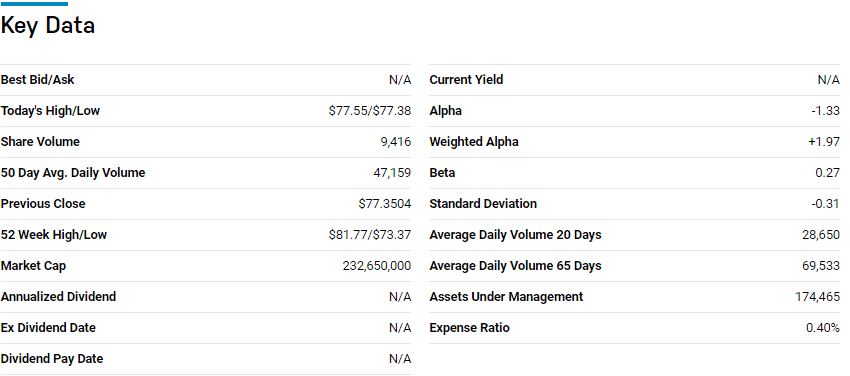

Best currency Canada ETF: Invesco CurrencyShares Canadian Dollar Trust Fund (FXC)

Price: $77.46

Expense ratio: 0.40%

The FXC also provides an avenue for investors in the North American economy to hedge against the green buck, US Dollar, price fluctuation, and the subsequent loss in earnings.

The FXC has $174.79 million in assets under management, with an expense ratio of 0.40%. Despite being the most popular global currency, the US dollar has proven to be very volatile in the face of events affecting the whole globe. In such instances, the Canadian dollar has proven to be an excellent green buck hedge option.

So 5-year returns of 3.24%, 3-year returns of 4.41%, and pandemic year returns of 3.66%.

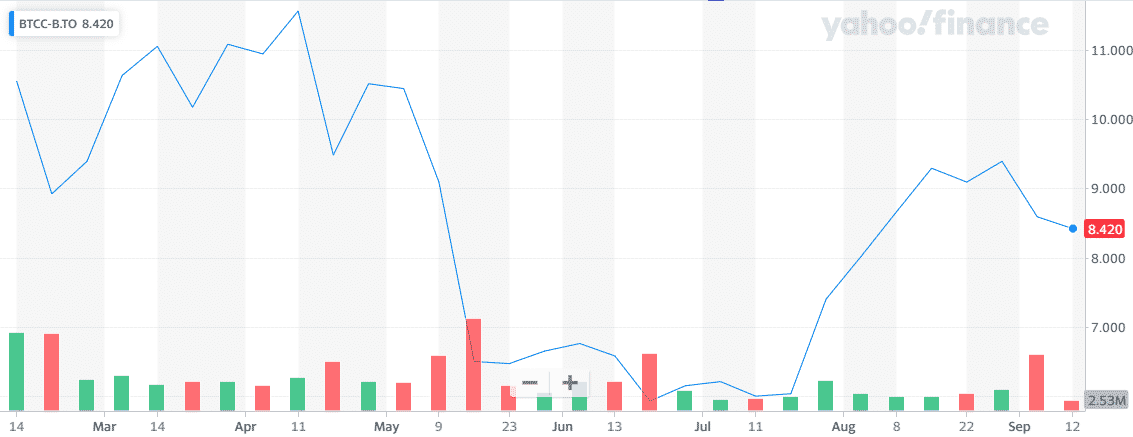

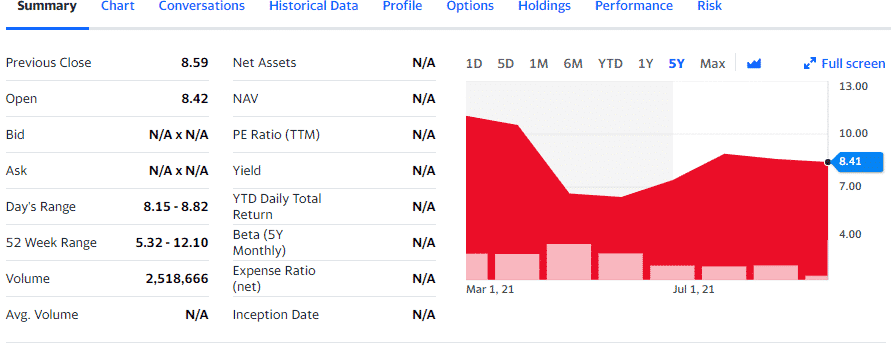

Best cryptocurrency Canada ETF: Purpose Bitcoin ETF (BTCC-B.TO)

Price: $8.42

Expense ratio: 0.80%

Canada seems to be the global risk taker for emerging markets, from marijuana legalization to Bitcoin exchange-traded funds launched on 18th February 2021. The BTCC is the first pure-play cryptocurrency ETF, exposing investors to the value of the Canadian dollar in Bitcoin value.

Taking just a month to cross the $1 BTC value in assets under management, this fund seems like a great way to invest in the volatile Bitcoin cryptocurrency market within acceptable risk levels. The BTCC at present has $1.19 billion in assets under management, with an expense ratio of 1.5%.

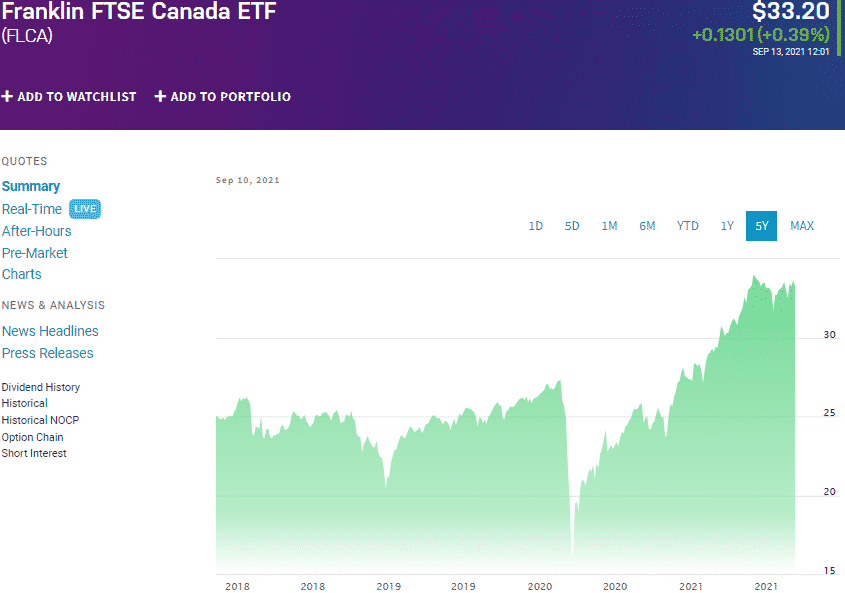

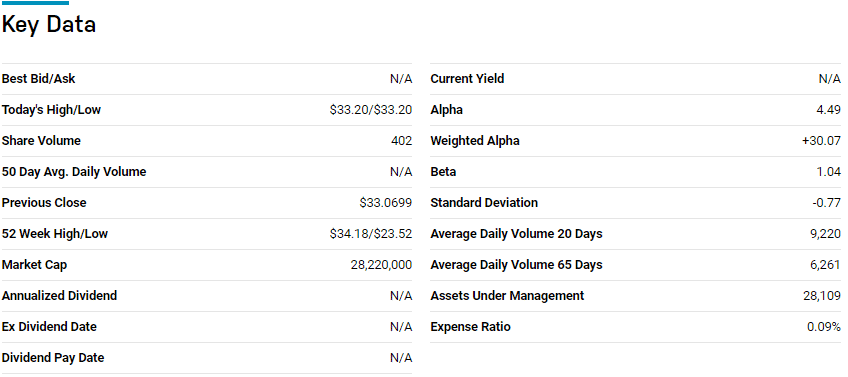

Best equity market Canada ETF: Franklin FTSE Canada ETF (FLCA)

Price: $33.20

Expense ratio: 0.09%

To play the entire Canadian economy, investors have access to the Franklin FTSE Canadian ETF. It tracks the performance of the FTSE Canada RIC Capped Index, investing at least 80% of its net assets in the underlying holdings of its tracked index.

Its portfolio boasts of the following companies in the top three: Shopify Class A Shares — 10.01%, Royal Bank of Canada — 8.65%, and Toronto Dominion Bank — 7.02%.

The FLCA has $28.20 million in assets under management, with an expense ratio of 0.09%.

It was launched on 2nd November 2017. The three-year returns of 45.53% and pandemic returns of 36.31% beg for a closer look at this ETF. As the world recovers from the novel coronavirus, this ETF offers a different play on the US economy, with the year-to-date returns of 21.67% being a solid indicator of what might be in store.

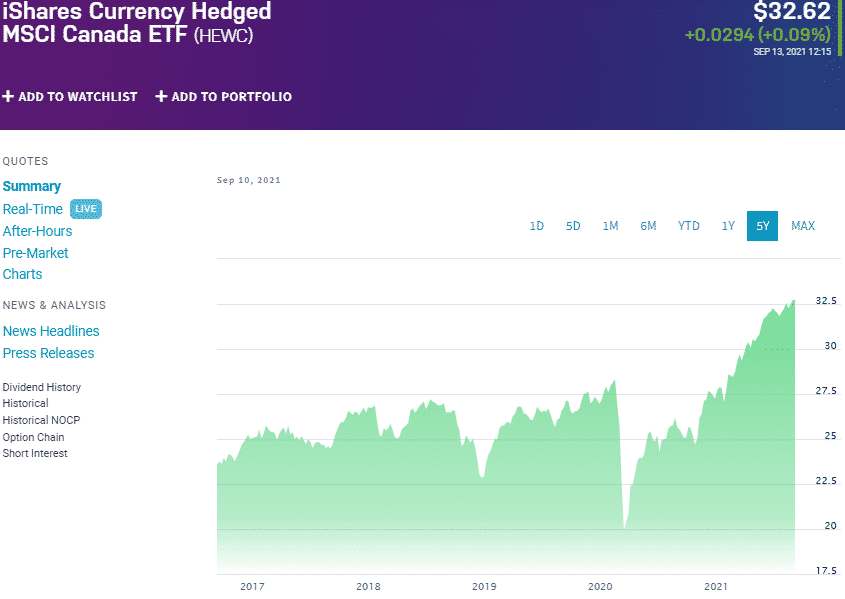

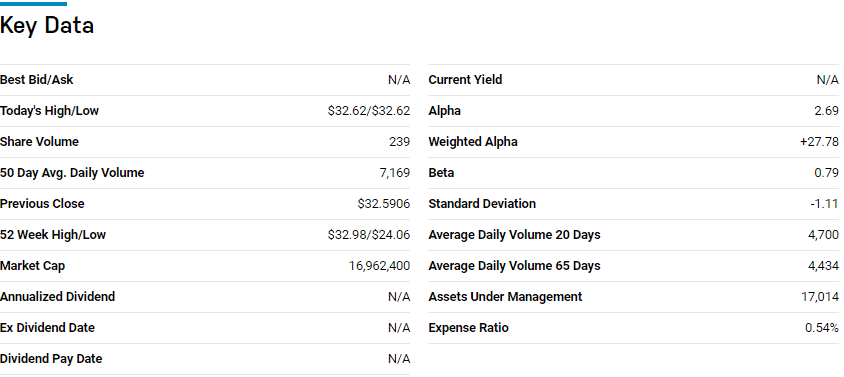

Best currency-hedged Canada ETF: iShares Currency Hedged MSCI Canada ETF (HEWC)

Price: $32.62

Expense ratio: 0.54%

The HEWC has $16.93 million in assets under management, with an expense ratio of 0.54%. Historical performance shows that this ETF is worth being in the crosshairs for investments across the US northern border.

So 5-year returns of 61.60%, 3-year returns of 38.73%, pandemic year returns of 31.92%, and a continuation of these record-breaking returns in the current year with the year-to-date returns standing at 21.14%.

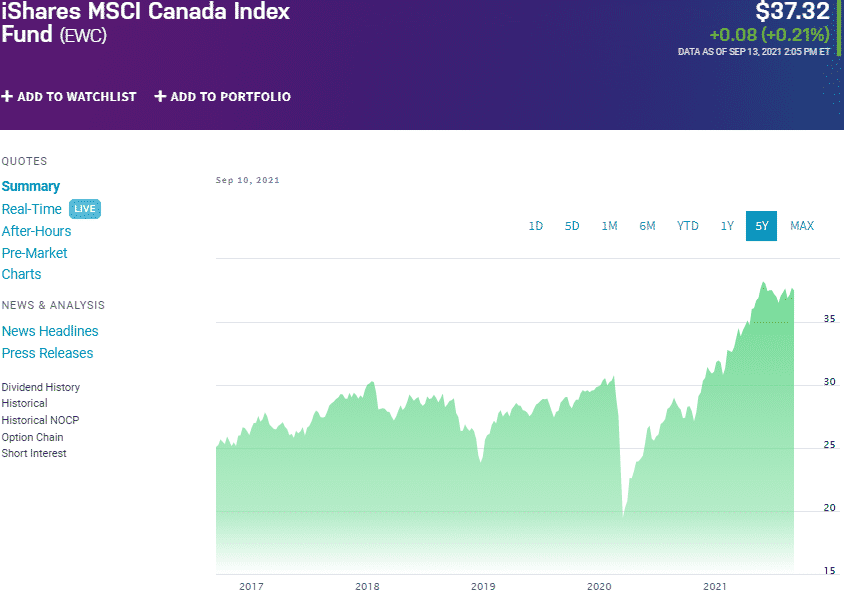

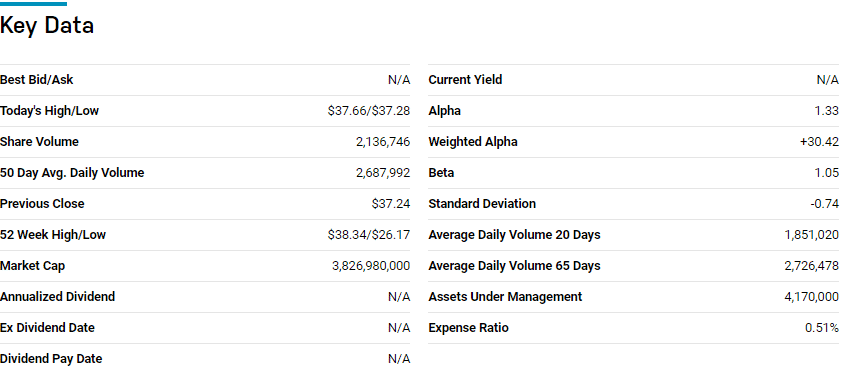

Best blue chip equity market Canada ETF: iShares MSCI Canada ETF (EWC)

Price: $37.32

Expense ratio: 0.51%

The EWC comprises the top blue-chip companies in the Canadian economy. It is a non-diversified fund tracking the MSCI Canadian Index, investing at least 80% of its assets in the underlying holdings of its composite index.

Historical returns are not an indication of future returns, but the figures this Canadian blue-chip ETF has recorded since inception calls for consideration as one to hold.

So 5-years of 63.34%, 3-year returns of 41.48%, pandemic year returns of 36.44%, and year-to-date returns of 21.49%.

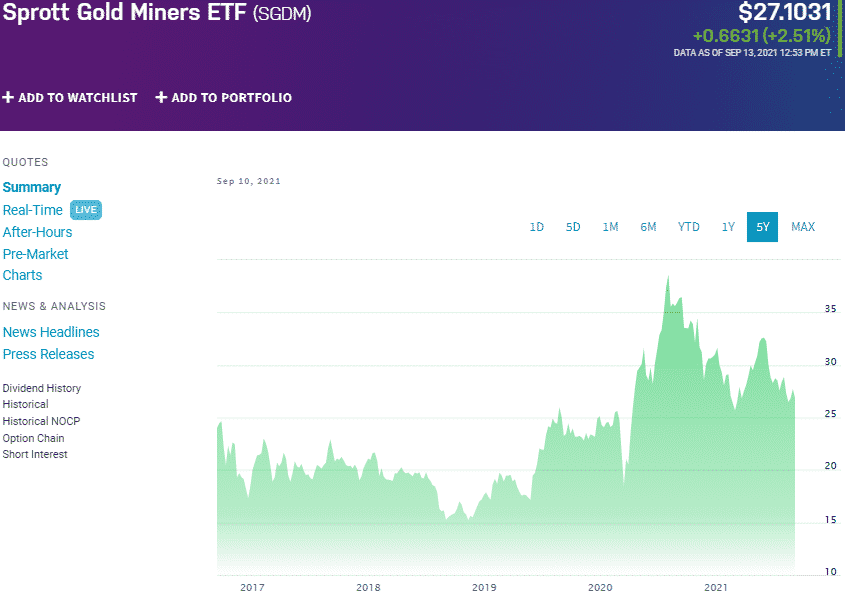

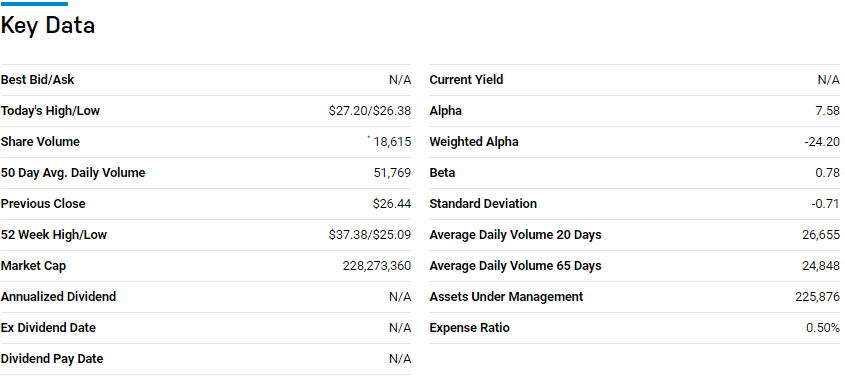

Best gold Canada ETF: Sprott Gold Miners ETF (SGDM)

Price: $27.10

Expense ratio: 0.50%

The Sprott Gold Miners ETF tracks the performance of the Solactive Gold Miners Custom Factors Index, investing at least 90% of its assets in the underlying holdings of the tracked index. Despite having a global reach and including countries listed in the NYSE and Nasdaq, 78% of the underlying holdings are listed in the Toronto Stock Exchange.

These non-diversified ETF top three holdings are Newmont Corp with a weighting of 12.39%, Franco-Nevada Corp with a weighting of 10.91%, and Wheaton Precious Metals Corp with a weighting of 8.50%.

SGDM has $ 222.30 million in assets under management, with an expense ratio of 0.50%. In times of uncertainty, gold has been the go-to investment vehicle for the longest time due to its global acceptance as an alternative currency and store of value.

However, gold is very volatile. The SGDM gives investors an alternative to gold investing with reduced volatility by exposing them to companies involved in the exploration, mining processing, and sale of gold and its byproducts.

Even though the disruption of economic activities by Covid-19 and the subsequent year-to-date returns of 13.45% and pandemic year returns of 25.90%, the three-year returns of 75.52% and 5-year returns 11.19 show, this Canada heavy ETF is worth watching closely as economic activities return to normalcy.

Final thoughts

The Canadian investment market has proven not to take risks given the Toronto Stock Exchange listing of investment vehicles in emerging markets.

In addition to exposing investors to emerging markets with the ability to grow and accumulate, this equity market provides investors a secondary play on the US economy.

The ETFs above are among the best Canadian funds, exposing investors to the different country’s economic niches and a chance to make money.

Comments