When it comes to investing, the first things that come to mind are the North American, Euro-zone, or Chinese investment markets. The truth is that the Asia-Pacific region has numerous established small-cap and medium-cap organizations that have a lot of legroom for growth, given the innovative nature of the area and the readily available consumer markets.

Australia is part of this Asia-Pacific region. However, due to the developed nature of the Australian economy compared to the other countries, the Australian investment market finds itself isolated and in very few regional ETFs.

The good news for investors interested in the Australian investment market is that its strong financials have necessitated the need for Australian-based exchange-traded funds and the inclusion of Australian equities in international funds.

What is the composition of Australian ETFs?

An ETF is an investment vehicle made up of a basket of like economic characteristics investment assets. As such, UK ETFs comprise organizations operating in the UK; those that invest at least 70% of their total assets or generate at least 75% of their revenues from the UK economy.

There are European and US exchange-traded funds with exposure to the UK economy, but we look at the ETFs with a biasness to the UK equity market.

Top 7 Australian ETFs

UK ETFs might not have the popularity of Wall Street exchange-traded funds or the phenomenal returns of Chinese ETFs. However, they still give investors geographical portfolio diversification and access to one of the oldest economies in the world.

The top seven ETFs giving investors exposure to the UK equity market are as follows.

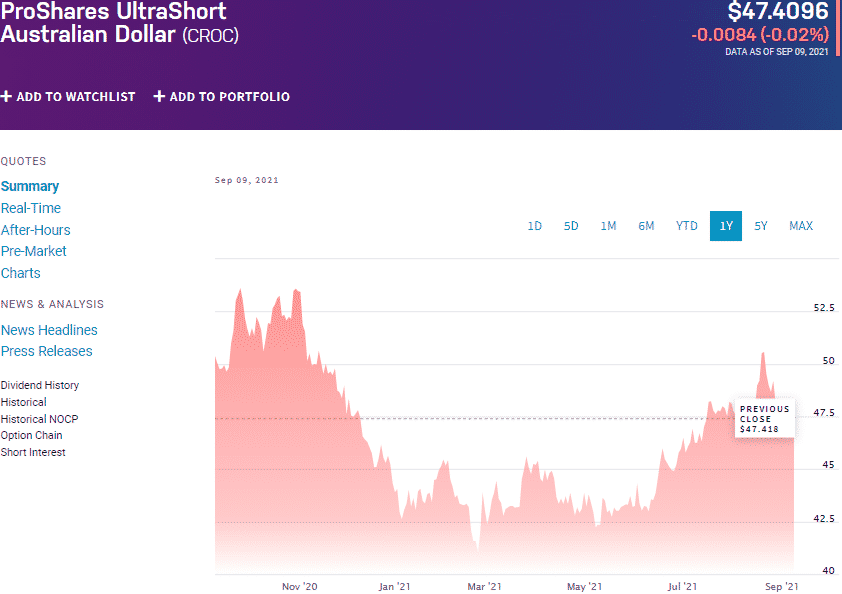

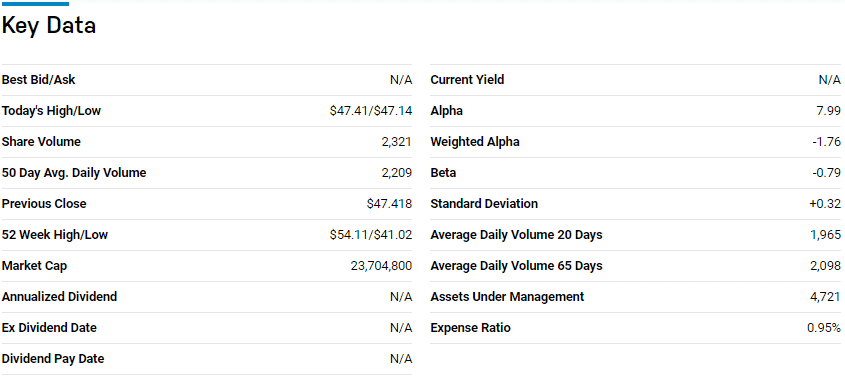

Best inverse Australia ETF: ProShares UltraShort Australian Dollar ETF (CROC)

Price: $47.41

Expense ratio: 1.03%

This inverse leveraged Australian ETF tracks the performance of the AUD/USD spot exchange with the sole objective of providing daily amplified inverse returns, -X2. It primarily deals in future contracts of its underlying index except for unforeseen events affecting future contracts when it switches to forward contracts. It’s an excellent investment for investors to take advantage of the volatility of the Aussie dollar and hedge against Australian-held investments.

The CROC has $4.74 million in assets under management, with an expense ratio of 0.95%. Given that this is a short-term investment vehicle for taking advantage of temporal volatilities in the AUD/USD spot exchange, the 3-month returns of 9.31% coupled with year-to-date returns of 8.47% make it a worthwhile asset to keep on the radar.

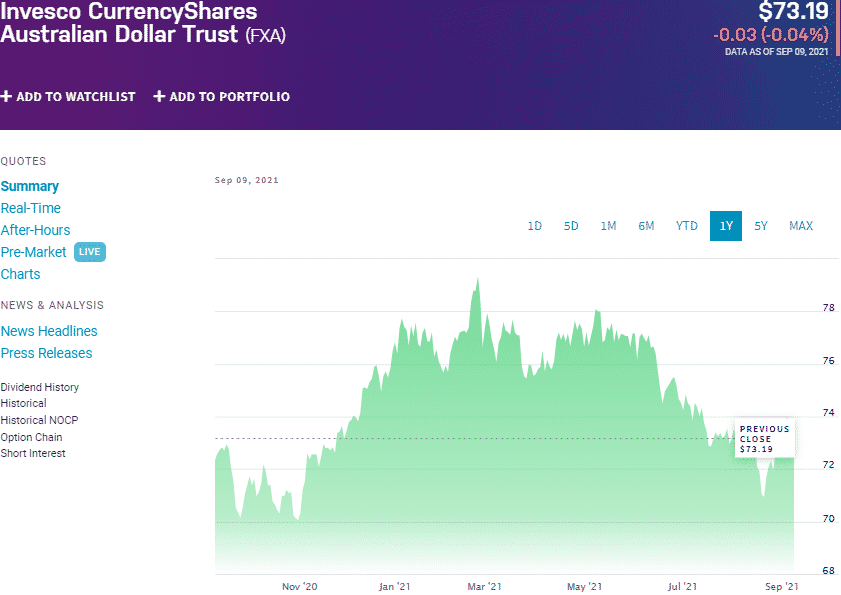

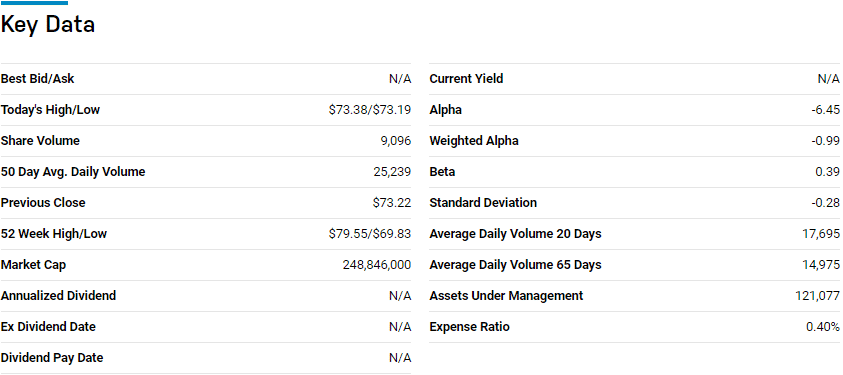

Best currency Australia ETF: Invesco CurrencyShares Australian Trust Fund (FXA)

Price: $73.19

Expense ratio: 0.40%

The novel coronavirus confirmed a long-time held belief that the Australian legal and political system is robust and stable enough to deal with anything-record time to contain the pandemic and resume normalcy.

FXC has $120.66 million in assets under management, with an expense ratio of 0.40%. Despite the year-to-date returns of -4.97%, the historical returns of this currency returns show it is stable and worth looking at for portfolio diversification and hedge against the dollar; 1-year returns of 0.91%, 3-year returns of 3.53%, and 5-year returns of -0.88%.

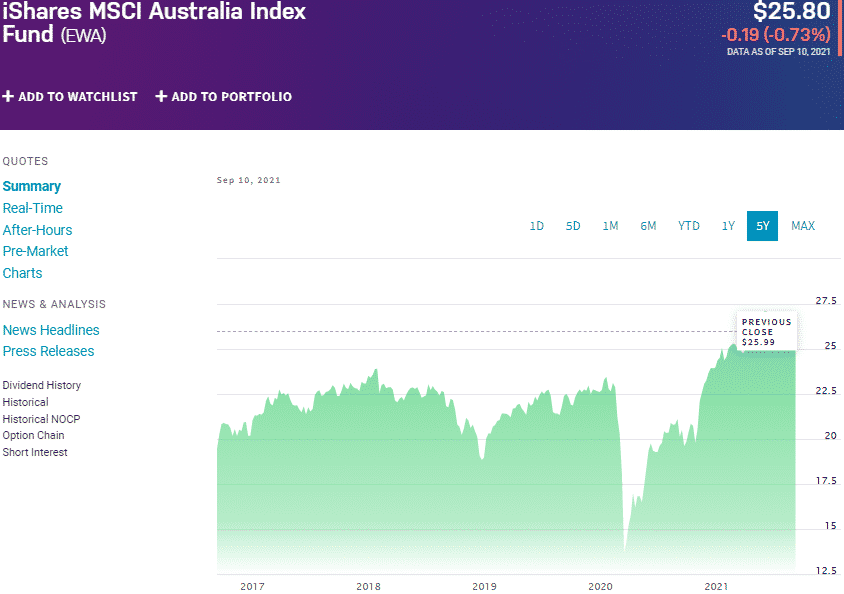

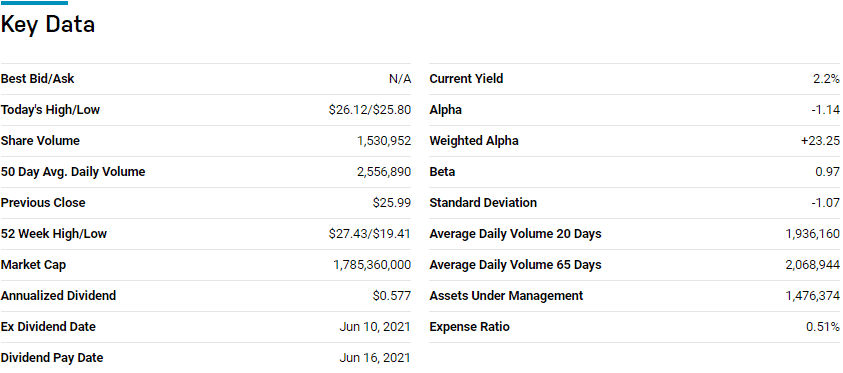

Best blue-chip equity Australia ETF: iShares MSCI Australia ETF (EWA)

Price: $25.80

Expense ratio: 0.51%

The iShares MSCI Australia ETF is the most popular and oldest pure-play Australian exchange-traded fund. It exposes investors to the Australian blue-chip equity market by tracking the MSCI Australia Index. Therefore, it is a non-diversified fund investing at least 80% of its assets in the underlying holdings of its composite index.

In its portfolio, the top three holdings are Commonwealth Bank of Australia – 10.77%, BHP Group ltd – 9.60%, and CSL ltd – 8.01%. With such companies in its portfolio, it is no wonder that the EWA exchange-traded fund is ranked №20 by US News analysts among 78 various regions’ ETFs’ for long-term investing.

The EWA ETF boasts $1.49 billion in assets under management, with an expense ratio of 0.51%. In the last five years, it has recorded returns of 56.49%, with the three-year returns standing at 35.92%.

With pandemic year returns of 29.70% and current year-to-date returns of 10.03%, this Australian blue-chip heavy ETF offers excellent indirect exposure to the Chinese economy, the 5th largest Chinese import supplier, in addition to access to a robust growing pacific region economy.

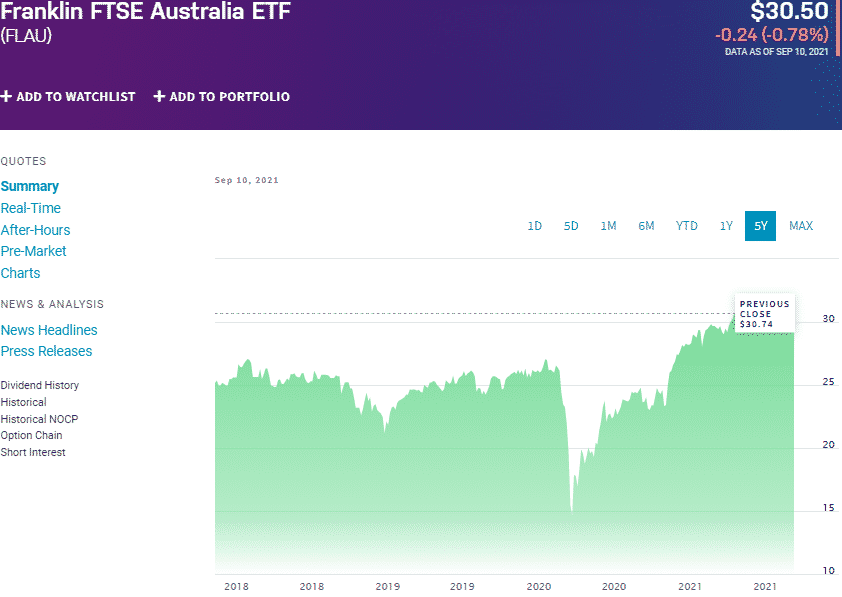

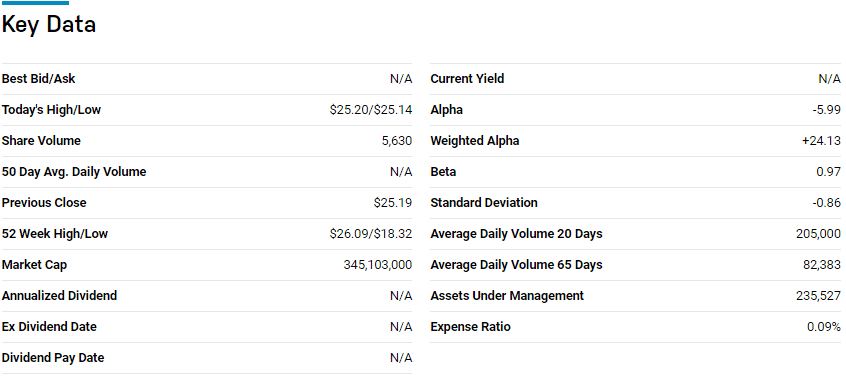

Best industry Australia ETF: Franklin FTSE Australia ETF (FLAU)

Price: $30.50

Expense ratio: 0.09%

If you want an ETF that has representation from all the Australian sectors, the Franklin FTSE Australia exchange-traded fund is the way to go. The FLAU ETF tracks the performance of the FTSE Australia RIC Capped Index, investing at least 80% of its net assets and depository receipts of similar characteristics in the underlying holdings of its tracked index.

The FLAU is a diversified fund cutting across the entire breadth of the Australian economy despite its relatively low resources, $24.84 million in assets under management. Nevertheless, it boasts the lowest expense ratio among Australian ETFs of 0.09%.

Launched on 2nd November 2017, the three-year returns of 39.78% and pandemic returns of 33% call for a closer look. So far, this ETF has recorded year-to-date returns of 9.90%.

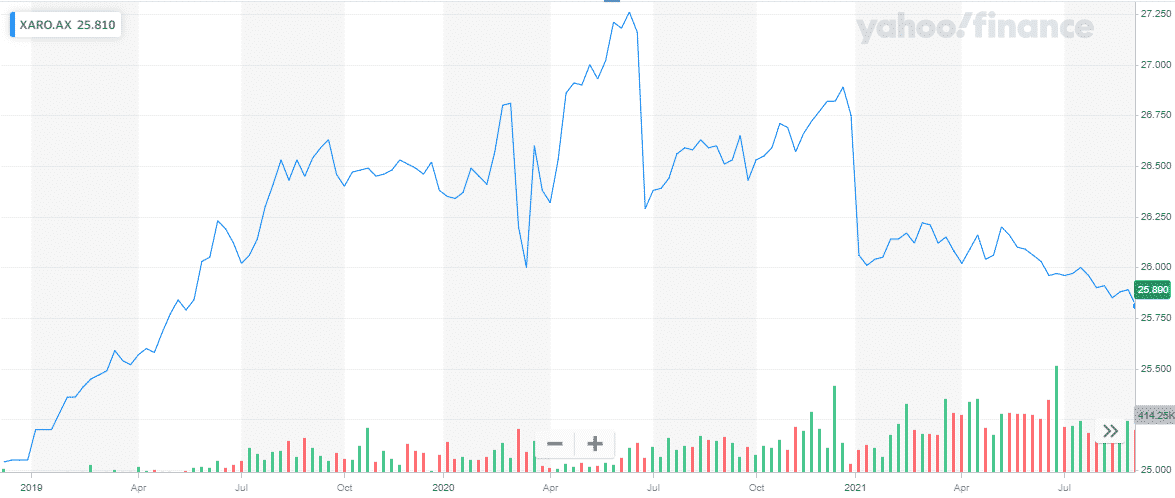

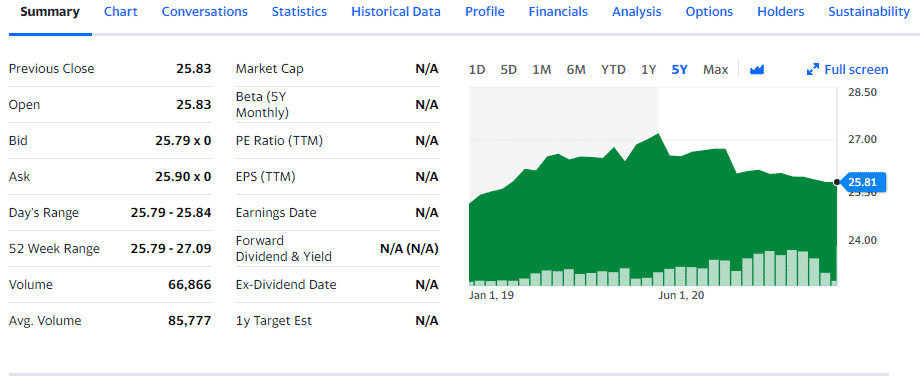

Best bond Australian ETF: Activex Ardea Real Outcome Bond Fund (XARO.AX)

Price: $25.81

Expense ratio: 0.50%

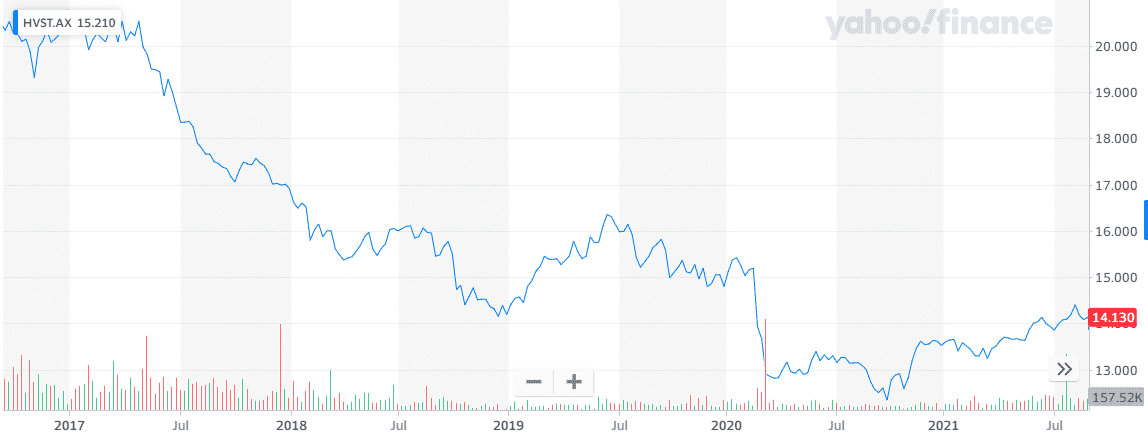

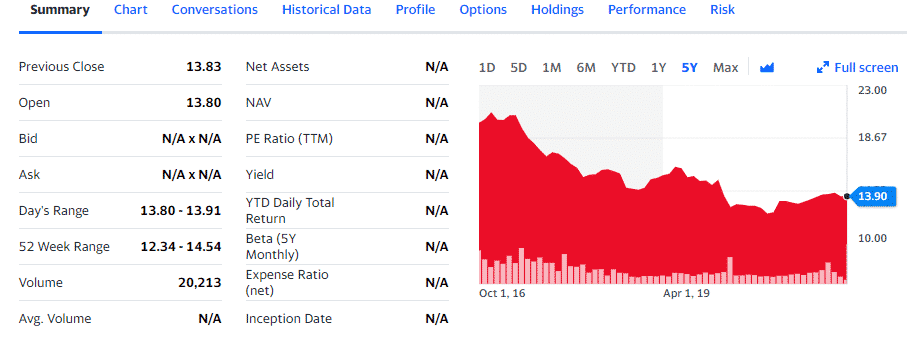

Best dividend Australia ETF: BetaShares Australian Dividend Harvester Fund (HVST.AX)

Price: $13.90

Expense ratio: 0.80%

The BetaShare Australian Dividend Harvester fund is an actively managed exchange-traded fund that does not track any index. Its objective is to provide its investors with X1.5 incomes compared to the Australian equity markets. Therefore, it caters explicitly to investors seeking consistent incomes but at reduced risk levels-excellent for retirees.

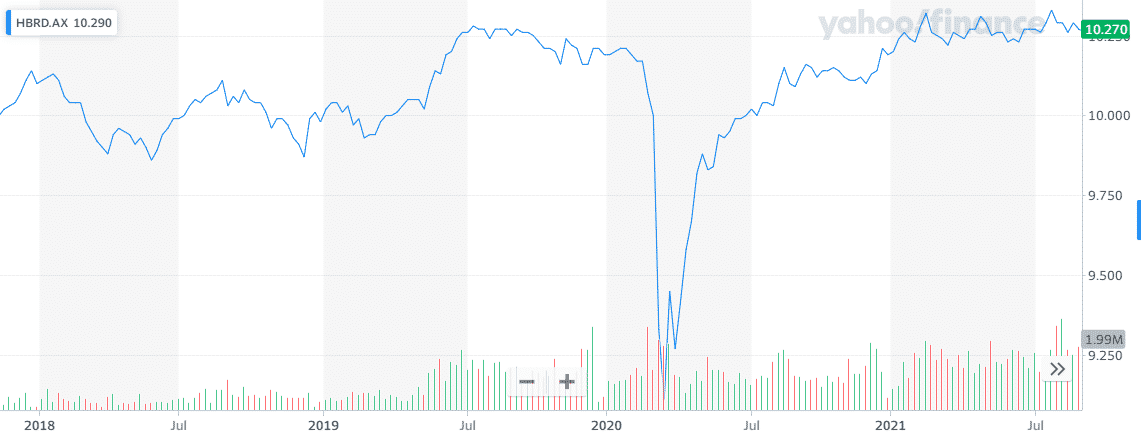

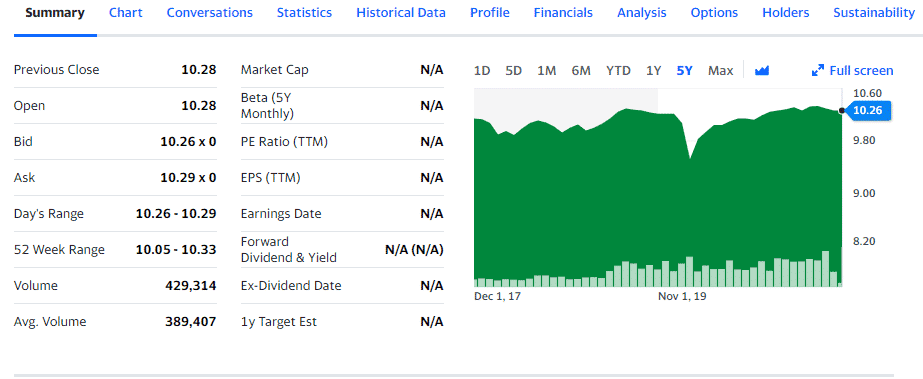

Best hybrid Australia ETF: BetaShares Active Australian Hybrids fund (HBRD.AX)

Price: $10.26

Expense ratio: 0.55%

Final thoughts

The Pacific Islands might be isolated geographically, but the political and economic stability of the region is home to a vibrant equity market. Australia’s leading pacific economy provides numerous opportunities for geographical portfolio diversification and an indirect play on China’s second-largest world economy, given their lucrative trade agreements.

Comments