Where do investors find a hedge when the equity markets are volatile, inflation hits, and the dollar loses value? Where do investors find a hedge? The commodity market with gold as the most popular option.

Given the current economic turmoil characterized by equity sell-offs, rising interest rates, out-of-control inflation, global geopolitical risks, and a highly volatile cryptocurrency market, where do investors in the digital space find a hedge and some respite? Gold-pegged crypto coins continue to prove their worth in this regard.

Why should investors bother investing in gold-backed coins?

Since the phenomenal run of Bitcoin in 2021 reached the $60000 level, it plummeted as though in search of the bottomless pit before stabilizing and trading between moderate ranges, $28000-$45000. However, 2022 has seen significant retail investors lose whole portfolios, and bitcoin and other cryptos go through their volatility phases to reflect the intrinsic market value. The popularity of fiat-pegged and gold-pegged cryptos has expended to safeguard crypto portfolio funds. They are crypto coins backed by either a fiat currency or pegged to the price of gold, which eliminates speculative trading, with their prices reflecting the value of the coupled asset. The result is stable crypto exchangeable for either physical gold or the fiat currency they represent.

The top 5 gold-backed crypto coins to include in your crypto fund portfolio

2022 has not been the best year for cryptos, the volatility leading many retail investors to financial ruin. Is it the end of the road for cryptos? Not by a long shot, given the appetite for decentralized currencies and financial systems. This phenomenon has accelerated the adoption of gold-backed crypto coins, and the five below are ahead of the pack.

No.1 Tether Gold (XAUT)

Price: $1853.19

Market capitalization: $456856175 M

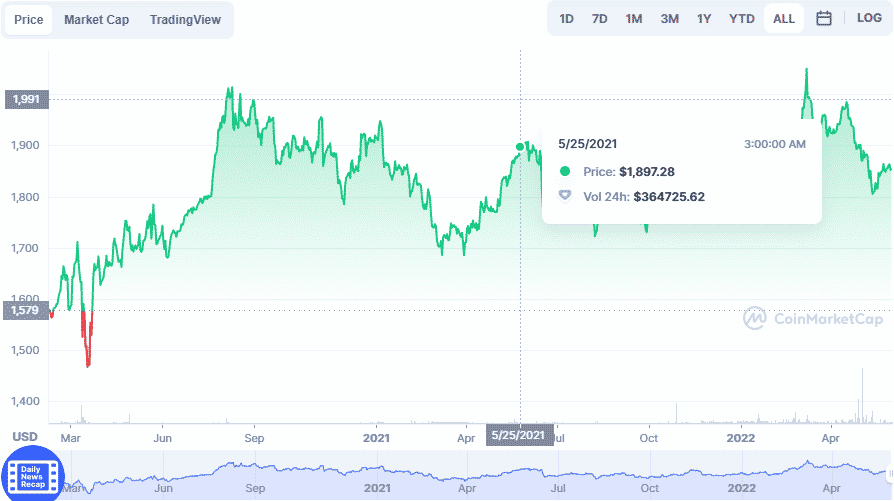

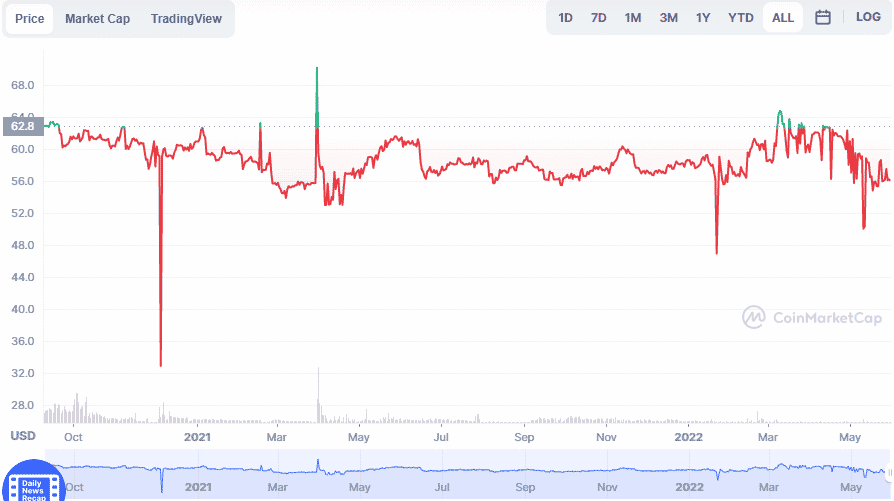

XAUT chart

You cannot invest in gold-backed crypto coins and leave out investment in Tether Gold. After perfecting the art of pegging its digital currency to a fiat currency, the Tether blockchain team, TG Commodities Limited, used this knowledge to develop the XAUT. A single coin is pegged to the value of a single troy ounce of fine gold to reflect the prevailing price of London’s gold delivery bar. The result is a crypto coin that provides investors with the anonymity of digital assets while mitigating against its volatility by holding a physical commodity without the need for storage costs.

This pioneer gold-backed coin is currently trading with a 24-hour volume of $1.14 million. It has a market cap of $456.85 million, with all of the available 246,524 coins in circulation.

No.2 Perth Mint Gold Token (PMGT)

Price: $1862.93

Market capitalization: $2156197

PMGT chart

Global governments might be looking for a way to provide their digital currency and regulate the crypto space, but they already acknowledge those miles ahead. Investors in the PMGT are issued certificates showing digital ownership of gold bars, liquidatable on-demand, and the physical gold bar delivered at a chosen address. One of these coins is the Perth Mint Gold Coin, which has been validated by the government and holds gold in the ratio of 1:1. Unlike other coins, there is no transaction fee attached to this coin and the benefit of owning gold without the hassle of storage.

This gold-backed coin, with governmental acceptance, is currently trading with a 24-hour volume of $20K. It has a market cap of $2.16 million, with all of the available 1157 coins in circulation.

No.3 Digix Gold Token (DGX)

Price: $22.48

Market capitalization: $1227906

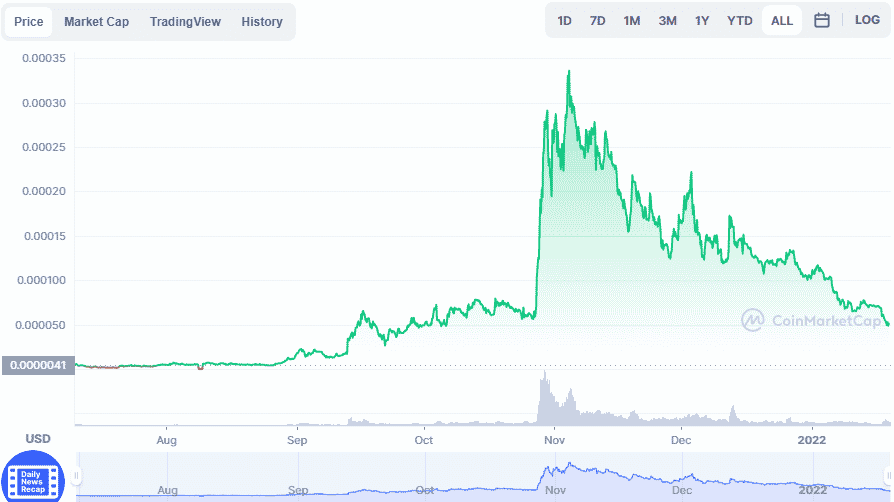

DGX chart

Similar to regular gold trading, the cryptocurrency world understands not everyone has the money to buy a whole bar of gold. It is within this space that the Digix Gold Token operates. Running on Ethereum blockchain, this blockchain ecosystem originating in Singapore specializes in tokenizing physical assets. For the DGX, it procures gold from LMBA approved refiners, Valcambi, Metalor and Produits Artistiques Metaux Precieux (PAMP). This gold is then provided to investors in affordable fractions. A single DGX coin represents a gram of gold, with the actual physical gold stored in Canada and Singapore.

This relatively cheap gold-backed coin is currently trading with a 24-hour volume of $263. It has a market cap of $1.23 million, with 54.6K of the available 58K coins in circulation.

No.4 PAX Gold (PAXG)

Price: $1849.58

Market capitalization: $616947776

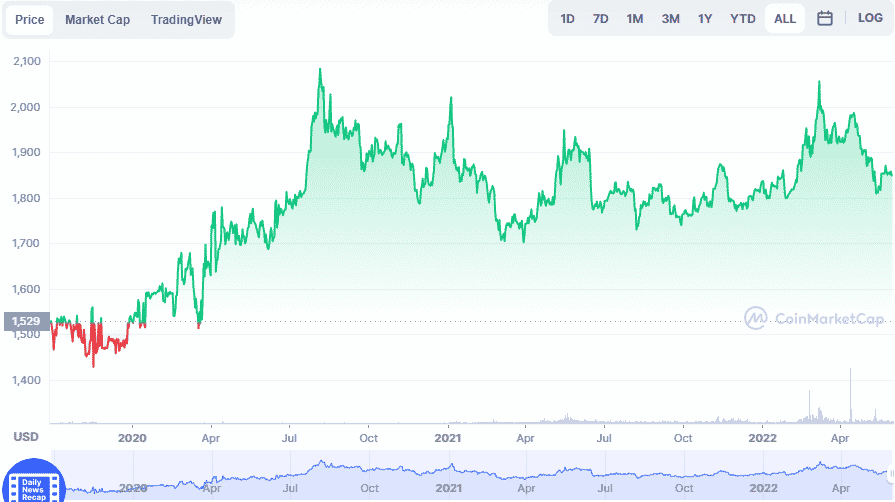

PAXG chart

Similar to other crypto niches, not all gold-backed coins are created equal. Featuring an ERC 20 token backed by gold, Charles Cascarilla and co have created one of the most liquid crypto coins by ensuring it is tradable on various exchanges. The result of all this has been the fulfillment of the objective of this coin, making gold more accessible and easier to trade to crypto investors.

How does it do this? By ensuring each PAXG is backed by a fraction of the London Good Delivery gold bar. The result is a highly liquid cryptocurrency investment asset with the stability and security of gold investing.

This highly liquid gold-backed coin is currently trading with a 24-hour volume of $20.15 M. It has a market cap of $616.94 million, with all of the available 333601 coins in circulation.

No.5 AurusGold Coin (AWG)

Price: $56.04

Market capitalization: $2323847

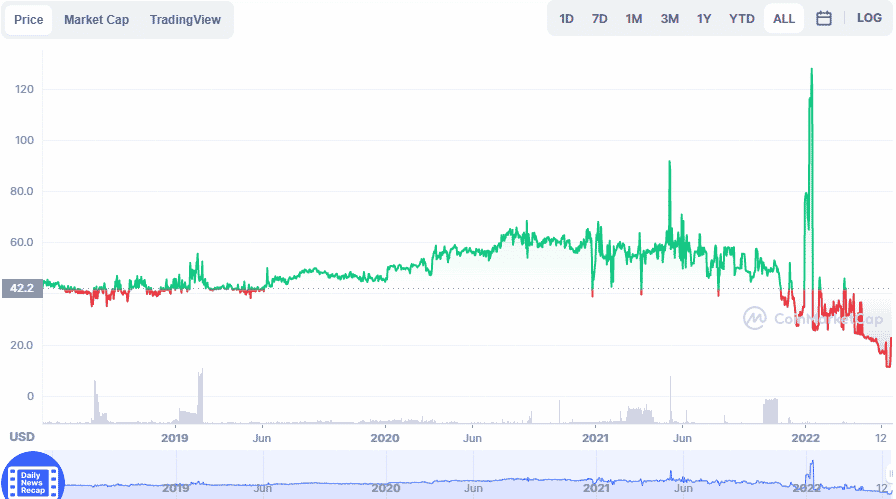

AWG chart

Like the DGX coin, the AWG coin brings a relatively cheaper investment avenue to the gold market. Fronted by traditional gold traders’ refiners and vault operators, this coin runs on Ethereum blockchain technology to provide a highly tradable, divisible, and fungible digital asset backed by gold from LBMA accredited gold providers. Decentralization ensures that, unlike the volatility created by institutional traders in conventional gold markets, this coin is stable and mitigated against a single point of failure. In addition, this ecosystem allows participants to earn yields on the AWG held through the DEX liquidity provision.

This gold-backed coin provided by Aurus, a leader in tokenizing precious metals, is currently trading with a 24-hour volume of $34. It has a market cap of $2.32 million, with 41.47K self-reported coins in circulation.

Final thoughts

Being one of the most famous values and hedge asset stores has not made gold any easier to own, trade, or cheap. On the other hand, despite their consideration as a hedge asset, the volatility of cryptocurrencies has resulted in their shunning. Gold-backed crypto coins bring the best of both worlds, a decentralized, highly liquid digital asset that is stable due to its coupling to the world’s most famous hedge commodity. The five coins above have already mastered this intricate balance and are on the cusp of significant upside potential as the market for gold-backed coins expands.

Comments