To most people, Spain is a tourism hotbed. However, for market participants, it is the third-largest investment market in the Eurozone, making it one of the most attractive and competitive markets to invest in. In post-pandemic times, Spain has provided lucrative regulatory frameworks and incentives that have resulted in its foreign investment inflows being ranked the second largest in the European Union.

How do you take advantage of these incentives and make money off this European giant?

What is the composition of Spanish ETFs?

Spanish ETFs comprise either equities solely domiciled in Spain, a combination of equities domiciled in Spain and those that draw significant revenues from its economy, or those with significant resources invested in the economy of this country. The ETFs on this list are those with substantial exposure to the Spanish economy.

Top 7 Spanish ETFs

Spain is the goose that keeps on giving. Apart from being an investment powerhouse in the Eurozone, it is considered the gateway to Europe, the Middle East, Africa, and Latin America due to its geo-positioning, historical, and cultural ties. These seven ETFs give investors exposure to this highly-developed but first-growing economy.

iShares Inc. iShares MSCI Spain ETF (EWP)

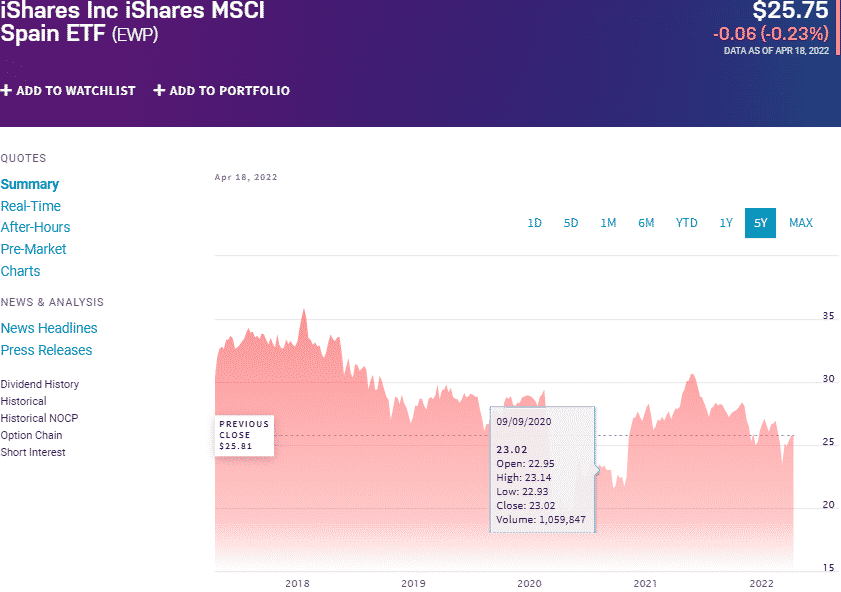

Price: $25.75

Expense ratio: 0.50%

Dividend yield: 3.25%

EWP chart

iShares MSCI Spain ETF tracks the performance of the MSCI Spain 25/50 Index, investing, on the lower limit, 80% of its assets in the holdings of its composite index and investment assets that exhibit like economic characteristics. It exposes investors to the mid-cap and large-cap Spanish equity market.

EWP ETF is ranked № 22 by US News analysts among 77 of the best miscellaneous region funds for long-term investing.

The top three holdings of this fund are:

- Iberdrola SA – 17.67%

- Banco Santander, S.A. – 15.77%

- Banco Bilbao Vizcaya Argentaria, S.A. – 9.69%

The EWP is the most liquid and popular pureplay Spanish ETF with 496.7 million in assets under management, at an expense ratio of 0.50%. Despite having been on a bearish trend for the last three years, this fund still offers the most liquid investment option to the Spanish economy, and with an annual dividend yield of 3.25%, you cannot afford to ignore it; 5-year returns of 1.32%, 3-year returns of 4.66%, and 1-year returns of 4.72%.

Global X MSCI Super Dividend EAFE ETF (EFAS)

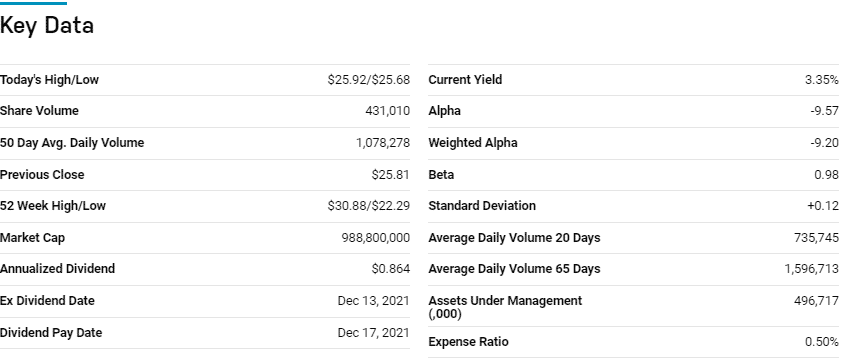

Price: $15.54

Expense ratio: 0.56%

Dividend yield: 4.66%

EFAS chart

Global X MSCI Super Dividend EAFE ETF seeks to replicate the performance of the MSCI EAFE Top 50 Dividend Index, net of fees and expenses. It invests at least 80% of its total assets in its underlying index holdings and securities exhibiting similar economic characteristics to the composite index under holdings to meet its investment objective. Investors gain exposure to the best dividend-paying equities in the eurozone, Australasia, and the far east.

The top three holdings of this fund are:

- BHP Group Ltd – 4.52%

- Lundin Energy AB – 2.92%

- CNP Assurances SA – 2.80%

The EFAS ETF has $11.6 million in assets under management, with an expense ratio of 0.56%. It provides an indirect and diversified play on the Spanish dividend-paying equities providing both value and growth attributes to a fund; 5-year returns of 15.83%, 3-year returns of 12.33%, 1-year returns of 3.78%, and an impressive dividend yield of 4.66%.

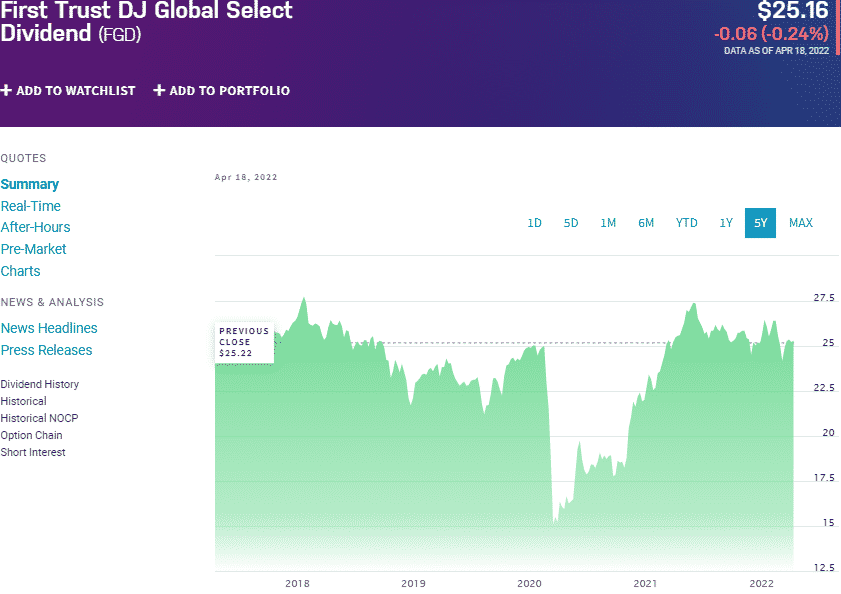

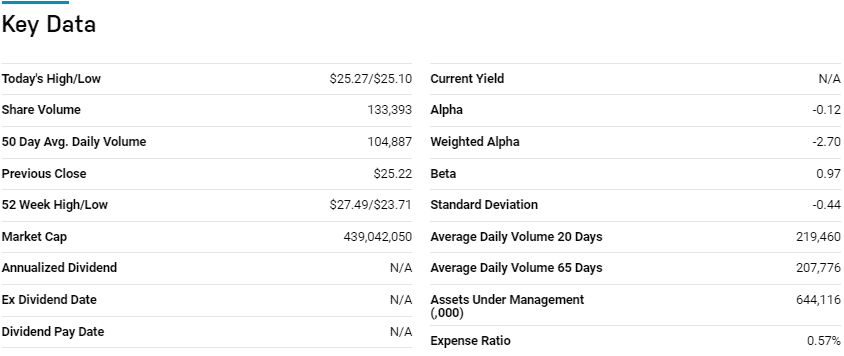

First Trust Dow Jones Global Select Dividend ETF (FGD)

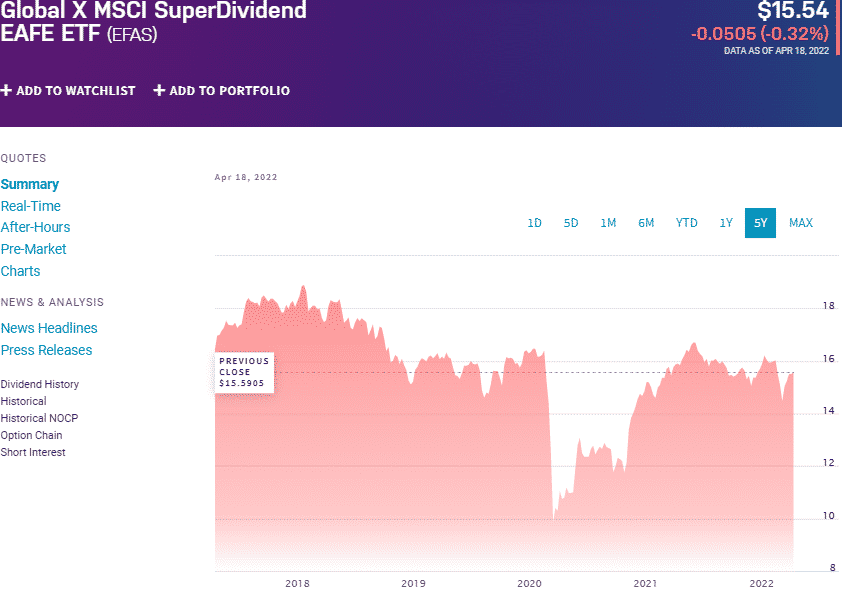

Price: $25.16

Expense ratio: 0.57%

Dividend yield: 4.68%

FGD chart

First Trust Dow Jones Global Select Dividend ETF tracks the price and yield performance of Dow Jones Global Select Dividend Index SM, investing at least 90% of its net assets in the holdings of the tracked index, including depository receipts coupled to the tracked index holdings. It exposes investors to the best 100 dividend-paying equities from developed economies forming part of the Dow Jones World Index SM.

Among 42 of the best global large value funds, USNews has the FGD ETF at No 14 for long-term investing.

The top three holdings of this fund are:

- Fortescue Metals Group Ltd – 2.92%

- A.P. Moller – Maersk A/S Class A – 1.70%

- Rio Tinto plc – 1.63%

The FGD has 650.3 million in assets under management, with investors having to part with $57 annually for a $10000 investment. This ETF offers, in addition to Spain, this ETF offers global exposure to dividend-paying equities in developed economies, including the US. The result is a large value fund that is resilient while providing consistent incomes; 5-year returns of 37.09, 3-year returns of 25.29%, 1-year returns of 4.18%, and more than the decent annual dividend yield 4.68%.

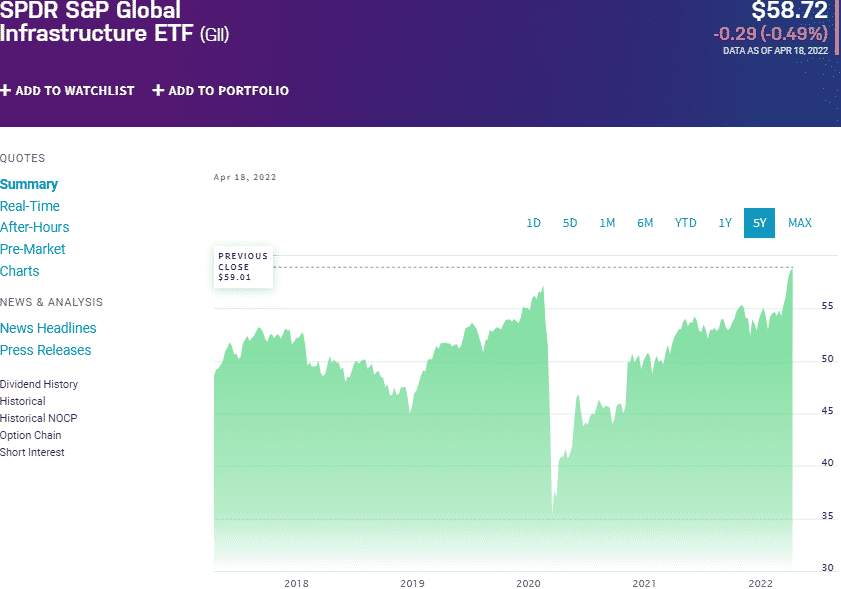

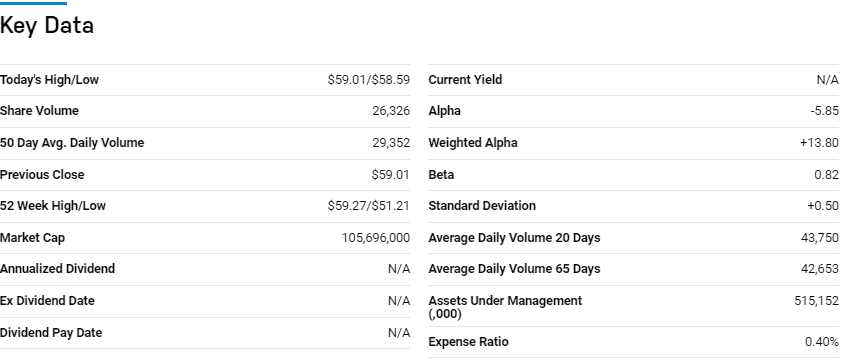

SPDR S&P 500 Global Infrastructure ETF (GII)

Price: $58.72

Expense ratio: 0.40%

Annual dividend yield: 2.26%

GII chart

SPDR S&P 500 Global Infrastructure ETF tracks the performance of the S&P Global Infrastructure Index, net of expenses and fees. It invests at least 80% of its total assets in the holdings of the tracked index and ADRs associated with the composite index. It exposes its investors to 75 of the largest global infrastructure equities.

USNews has the GII ETF of ten global infrastructure funds at No 2 for long-term investing.

The top three holdings of this non-diversified ETF are:

- Transurban Group Ltd. – 4.97%

- Enbridge Inc. – 4.89%

- NextEra Energy, Inc. – 4.82%

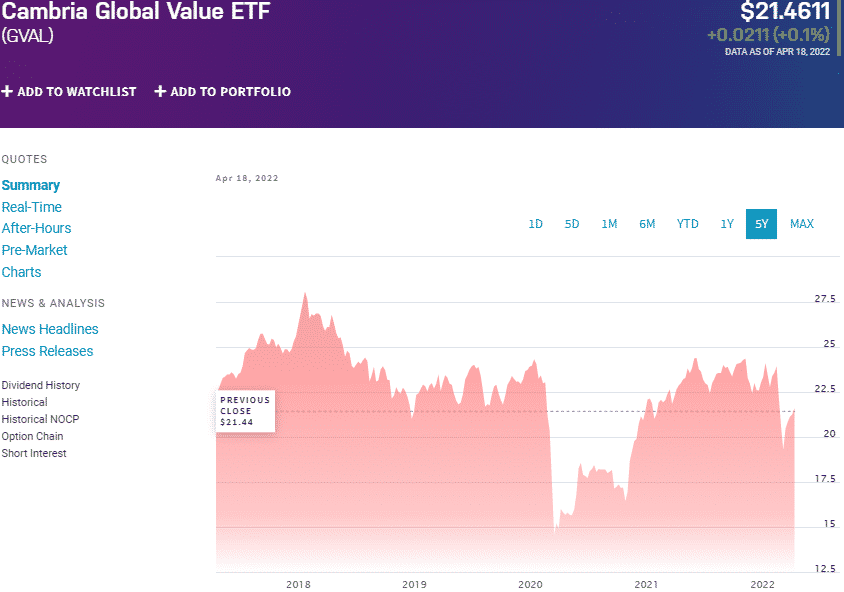

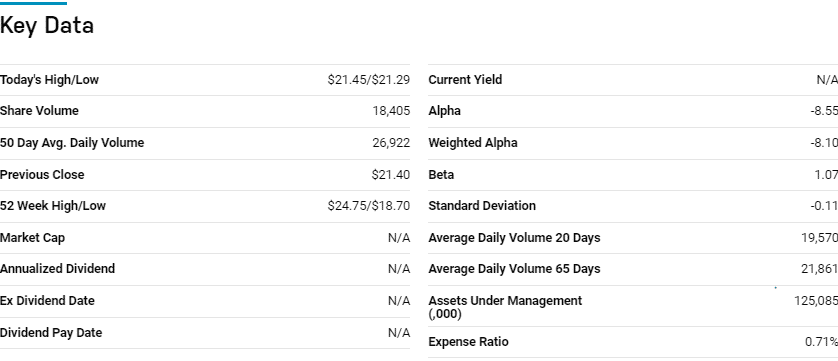

Cambria Global Value ETF (GVAL)

Price: $21.46

Expense ratio: 0.71%

Annual dividend yield: 2.56%

GVAL chart

Cambria Global Value ETF is an actively managed fund that seeks capital appreciation by investing at least 80% of its total assets in developed and emerging markets equity securities, common stocks, and depository receipts with the greatest potential for value.

The top three holdings of this ETF are:

- iShares MSCI Colombia ETF – 9.36%

- CEZ as – 4.95%

- Jastrzebska Spolka Weglowa S.A. – 3.42%

The GVAL ETF has $109.1 million in assets under management, with an expense ratio of 0.71%. Utilizing a proprietary algorithm to screen for global equities that provide the best value while mitigating against concentration risk by capping weighting based on region, sector, and country results in a consistent return creating fund; 5-year returns of 12.88%, 3-year returns of 0.44%, 1-year returns of -3.01%, and a dividend yield of 2.56%.

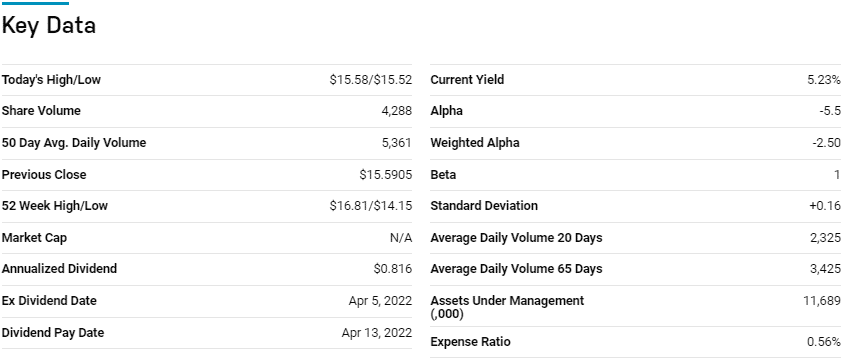

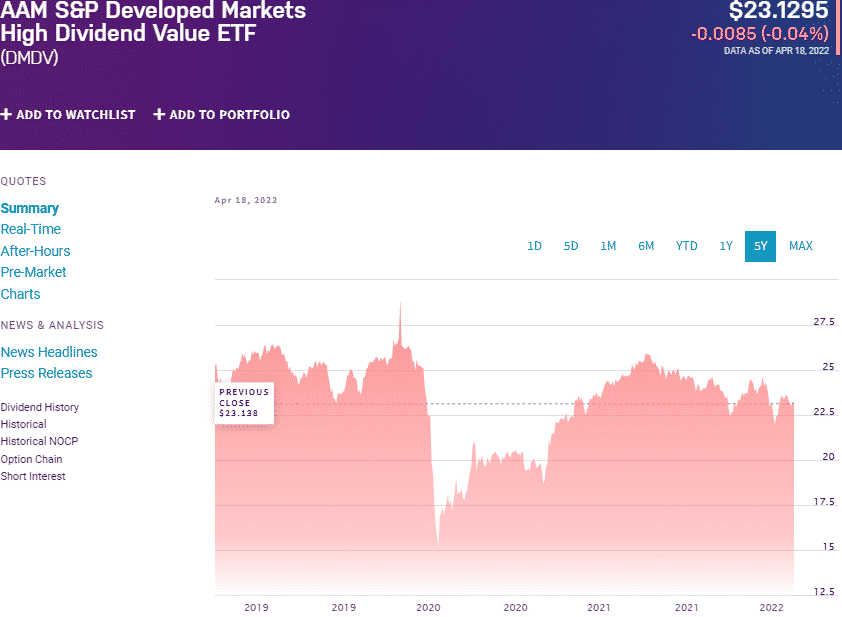

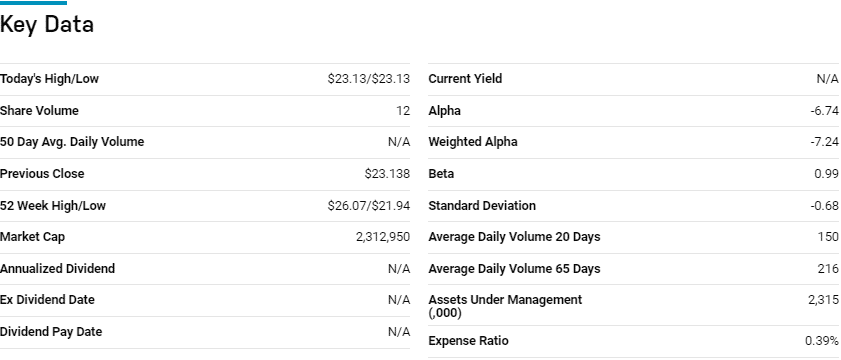

AAM S&P Developed Markets High Dividend Value Fund (DMDV)

Price: $23.12

Expense ratio: 0.39%

Dividend yield: 4.29%

DMDV chart

The AAM S&P Developed Markets High Dividend Value Fund tracks the total return performance of the S&P Developed Ex-U.S. Dividend and Free Cash Flow Yield Index, investing at least 80% in dividend-paying equities in developed markets ex-US and Korea. The equities it invests in must have realized annual dividend yield within the past 12 months.

The top three holdings of this fund are:

- Canadian Natural Resources Limited – 2.42%

- Pembina Pipeline Corporation – 2.37%

- AGL Energy Limited – 2.30%

The DMDV ETF has $2.3 million in assets under management, with an expense ratio of 0.39%. Concentrating on global equities with a history of not only high dividend yields but sustainable dividend distribution and a pretty even weight distribution provides for a resilient value fund that plays the Spanish income-generating equity segment; 3-year returns of 1.24%, 1-year returns of -1.09%, and a more than the decent annual dividend yield of 4.29%.

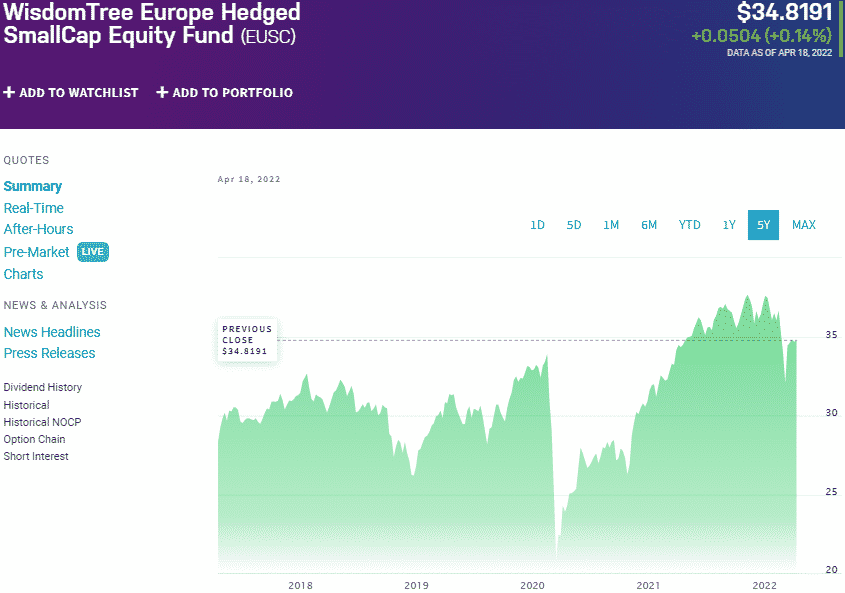

WisdomTree Europe Hedged SmallCap Equity Fund (EUSC)

Price: $34.81

Expense ratio: 0.58%

Dividend yield: 2.47%

EUSC chart

WisdomTree Europe Hedged SmallCap Equity Fund seeks to replicate the performance of the WisdomTree Europe Hedged SmallCap Equity Index, net of fees and expenses. It invests at least 80% of its assets in the holdings of the tracked index and other investment securities of like economic characteristics.

The top three holdings of this fund are:

- Enagas SA – 2.42%

- Proximus SA de droit public – 2.09%

- Acciona SA – 1.93%

The EUSC has $60.7 million in assets under management, with an expense ratio of 0.58%. A unique forex hedge and equity screening methodology provide a fund concentrating on the dividend-paying small-cap eurozone segment, excluding the UK, Sweden, and Switzerland. The result is a diversified play on the Spanish small-cap equity market with value and growth attributes; 5-year returns of 39.90%, 3-year returns of 23.23%, 1-year returns of 3.96%, and a dividend yield of 2.47%.

Final thoughts

A strategic transportation hub, a gateway to almost all the global markets, and the least restrictive international investment regulations make the Spanish economy one of the best to invest in. Experts, including Warren Buffett, believe that the Spanish stock market is undervalued despite all these.

Therefore, even though most are not pureplay, the seven Spanish ETFs above give investors exposure to one of the best investment markets in the Eurozone and at a bargain, with massive potential for value and growth.

Comments