China might be home to the most state-owned corporations, but it is also home to many publicly traded global leading organizations. The ongoing trade tensions between the US and China have resulted in the NYSE delisting on some Chinese companies. However, those with no Chinese military ties are still available for investing.

Research shows that most investors have a bias towards home-grown investment options. Sadly, the US exchange-traded funds only represent 56% of the ETF global market. Given that China is the second-largest economy, investing in Chinese ETFs is excellent geographical portfolio diversification.

What is the composition of Chinese ETFs?

An ETF, by definition, is an investment in a vehicle comprising a pool of assets that have similar economic characteristics.

Chinese ETFs are exchange-traded funds made up of companies either solely based in mainland China, those found in Hong Kong, or those that combine assets from the regions mentioned above and Taiwan to trade as the Chinese region ETFs.

Therefore, Chinese ETFs are those exchange-traded funds that invest at least 70% of their total assets in companies in the Chinese region or derive 75% of their revenues from the area.

Top 7 Chinese ETFs

Wall Street exchange-traded funds headquartered might be the most exchanged products globally, but they only account for slightly more than half of the ETF global market. A look into the investment market, especially the ETF market, shows that when one geographical region is experiencing economic turmoil, the other regions are experiencing a bullish run.

Investing in Chinese ETFs as of now comes at a risk given US trade sanctions with the territory. However, having a few eggs nestled in the globe’s second-largest economy is a hedge against the US economic downturn while diversifying its geographical portfolio.

Chinese ETFs have underperformed US-based ETFs in the last year, but there have been 80% returns over the previous five years. This performance shows the potential for the Chinese markets to mint investors’ money. As more state-operated Chinese companies go public, and it continues to be an innovation hub, investors have opportunities for wealth accumulation.

The following seven ETFs expose investors to several Chinese sectors while minimizing individual Chinese stock-picking risk.

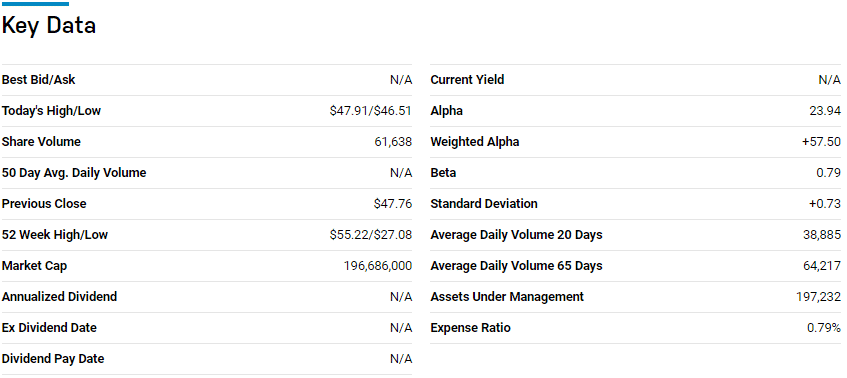

Best China clean technology ETF: KraneShares MSCI China Clean Technology ETF (KGRN)

Price: $46.83

Expense ratio: 0.79%

KGRN chart

With the human rights and environmental impact issues coupled with Chinese equities, investing with a conscience is at the forefront of many investors. The KraneShares MSCI China Clean Tech ETF exposes investors to real estate, industrial, and technology companies, practicing more environmentally friendly operations.

A non-diversified ETF tracks the MSCI China IMI Environment 10/40 Index, investing at least 80% in its underlying index and associated depository receipts.

In its portfolio, the top three holdings are NIO Inc. – 9.71%, BYD Co. ltd Class H shares – 9.41%, and Li Auto Inc. – 9.11%.

The KGRN ETF boasts $196.66 million in assets under management, with an expense ratio of 0.79%. It is one of the few Chinese ETFs to register positive year-to-date returns of 6.05%, making it ideal for short-term and long-term investing, given its 3-year returns of 169.65% since its launch on October 13, 2017.

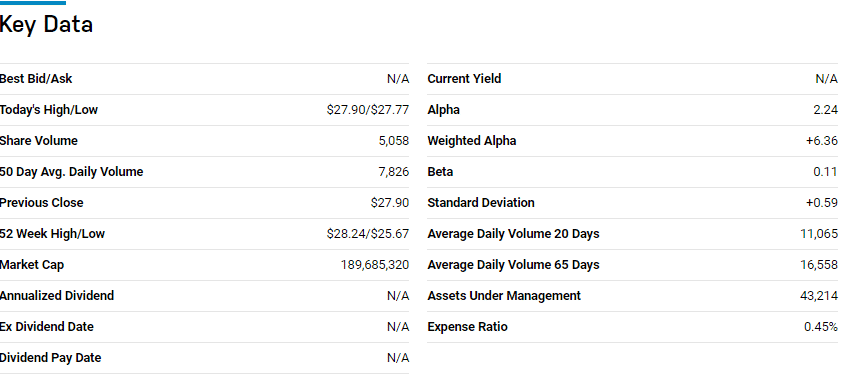

Best Chinese ETF for currency hedge: WisdomTree Chinese Yuan Fund (CYB)

Price: $27.89

Expense ratio: 0.45%

CYB chart

The Chinese government in place monetary policies restricting the bullish run of the Chinese yuan to encourage Chinese products exportation. The Chinese coronavirus origins coupled with the US trade restrictions might finally be the final straw that pushes the government to lift some of its monetary policies, allowing the markets to experience the actual value of the Chinese yuan. It is a scary prospect for those holding Chinese investments.

However, the WisdomTree Chinese Yuan Fund provides an avenue for investors to hedge against any volatility in the yuan, and as a result, cushion their Chinese investment portfolio gain. The CYB is a non-diversified foreign exchange fund with Yuan deposits and interests in the Chinese money markets – invests a minimum of 80% of its total assets in currencies with Chinese economic ties.

The CYB has $43.19 million in assets under management, with an expense ratio of 0.45%. Rather than try to time the market with a heavily regulated Chinese currency, the CYB’s past performance shows it is a great currency hedging ETF; 5-year returns of 18.63%, 3-year returns of 14.32%, pandemic year returns of 8.81%, and year to date returns of 2.18%.

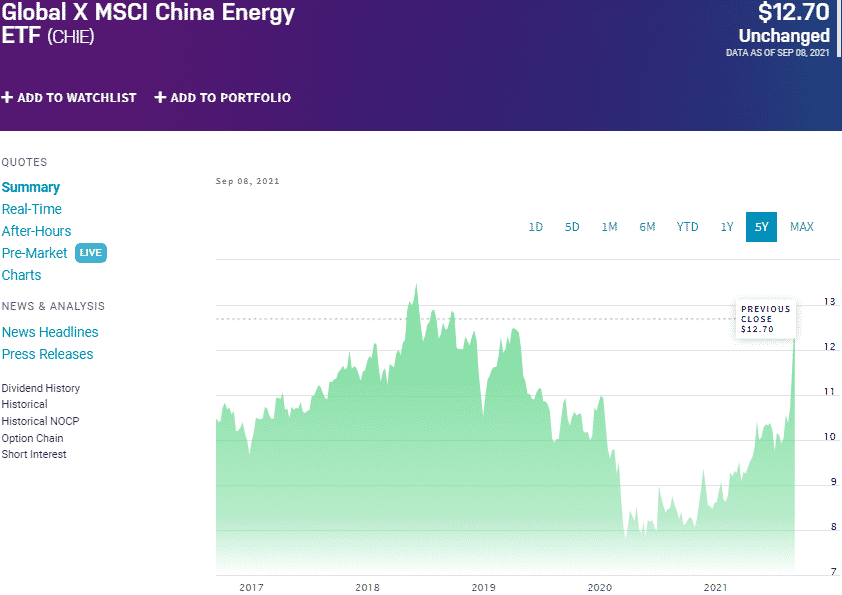

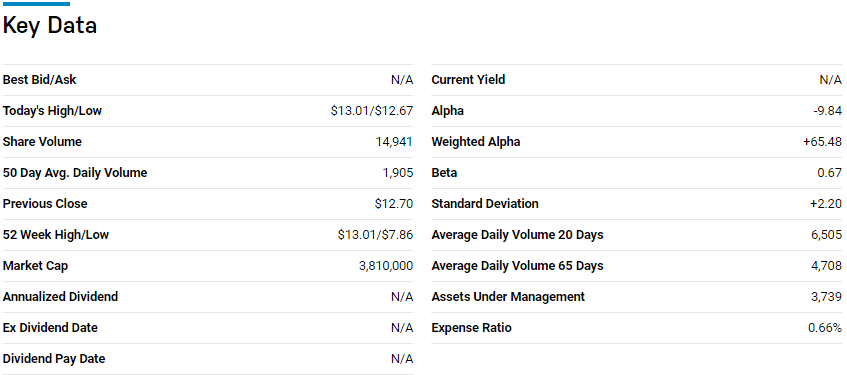

Top Chinese energy ETF: Global X MSCI China Energy ETF (CHIE)

Price: $12.70

Expense ratio: 0.66%

CHIE chart

With a promise to the world to go 100% green energy by 2060, the Chinese energy sector is the place for conscious investing. Investors gain access to this fast-paced sector via the Global X MSCI China Energy ETF, which tracks the MSCI China Energy IMI Plus 10/50 Index. It invests in holdings in the companies tagged as energy organizations making up the MSCI China Investable Market Index.

The CHIE fund has $3.92 million in assets under management, with a net expense ratio of 0.66%. With the global shift to renewable energy, and the historical phenomenon returns of this ETF, this exchange-traded fund is one for wealth growth and accumulation; 5-year returns of 45.59%, 3-year returns of 15.6%, one-year returns of 57.13%, and year-to-date returns of 51.71%.

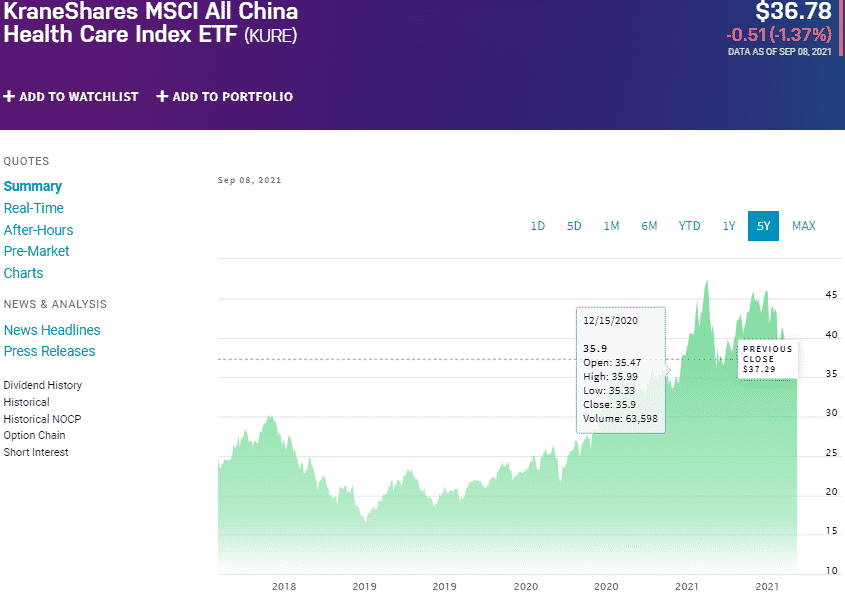

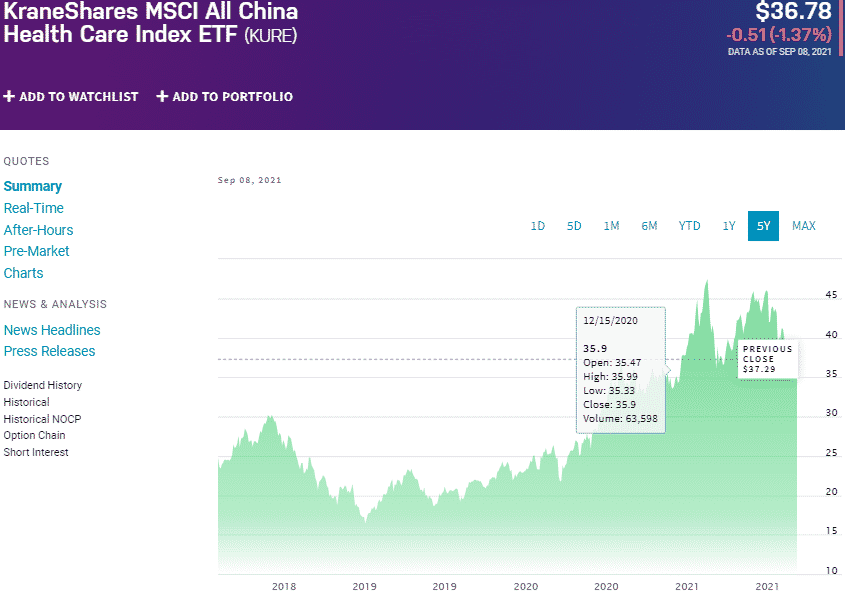

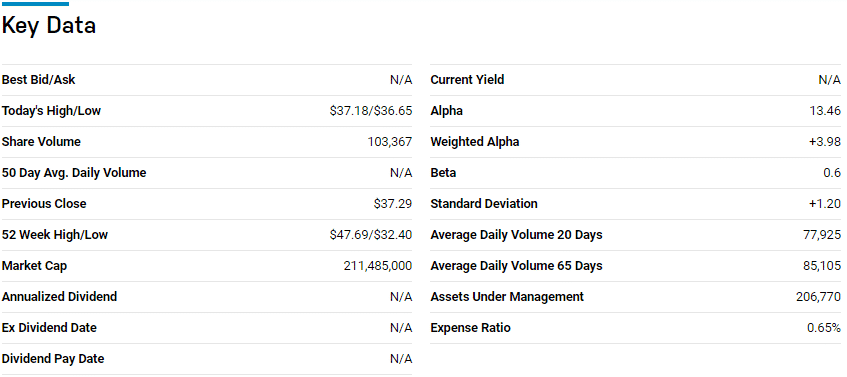

China healthcare ETF: KraneShares MSCI All China Health Care ETF (KURE)

Price: $36.78

Expense ratio: 0.65%

KURE chart

If the coronavirus pandemic revealed anything, it is the robustness and capabilities of the Chinese healthcare system. China was one of the first countries to arrest the spread of the Covid-19 virus and lift cessation of movement, allowing economic activity to resume.

To get exposure to this sector of the Chinese economy, KraneShares MSCI All China Health Care ETF is a great start. It tracks the MSCI China All Shares Health Care 10/40 Index, investing at least 80% in the underlying holding of the index to make it a non-diversified fund.

In its portfolio, the top three holdings are WuXi Biologics Plc. — 8.58%, Shenzhen Mindray Bio-Medical Electronics ltd — 5.60%, and WuXi AppTec Co ltd Class A shares — 4.57%.

The KURE has $212.81 million in assets under management, with an expense ratio of 0.65%. With a launch date On January 31, 2018, the three-year returns of 59.27% and pandemic returns of 9.59% call for a closer look despite the year-to-date returns of -5.81%.

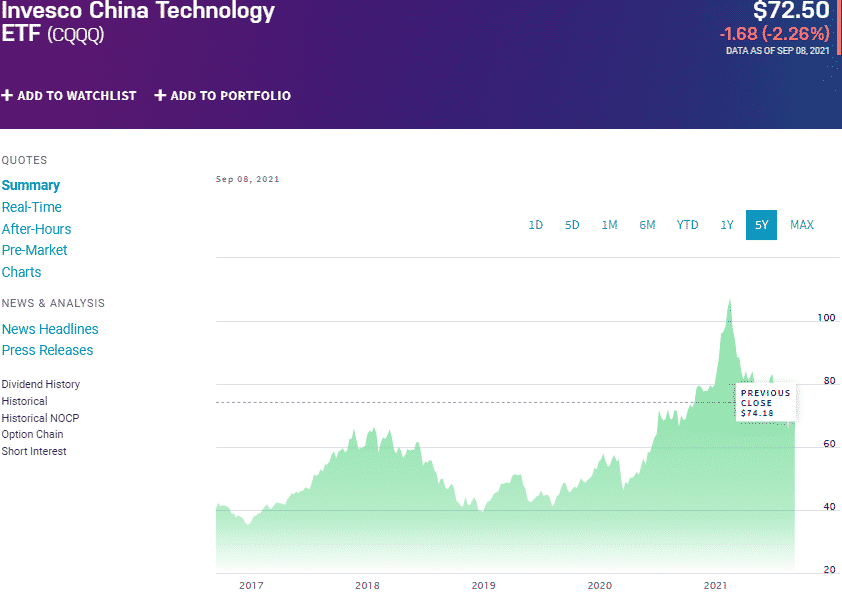

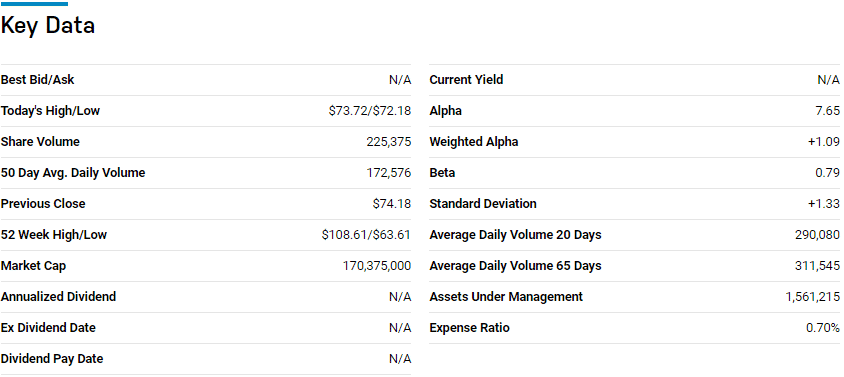

China information technology ETF: Invesco China Technology ETF (CQQQ)

Price: $72.50

Expense ratio: 0.70%

CQQQ chart

China might have been on top of the manufacturing food chain a few years ago, but it has evolved into a global technological powerhouse. To tap into this highly dynamic industry sector, investors have the option of investing in the Invesco China Technology ETF. The CQQQ tracks the FTSE China Incl A 25% Technology Capped Index and invests at least 90% in its underlying holdings and the coupled GDRs and ADRs.

In its portfolio, the top three holdings are Tencent Holdings — 9.40%, Meituan Inc. — 9.01%, and Baidu Inc. — 8.35%.

This non-diversified tech fund has $1.59 billion in assets under management, with an expense ratio of 0.70%. In the short term, this ETF might not look so appealing given the year-to-date returns of -11.94%. However, this ETF looks solid long-term investing, and given the 5-year returns of 84.03% and 3-year returns of 56.52%, the CQQQ ETF gives investors to the tech-heavy Chinese economy.

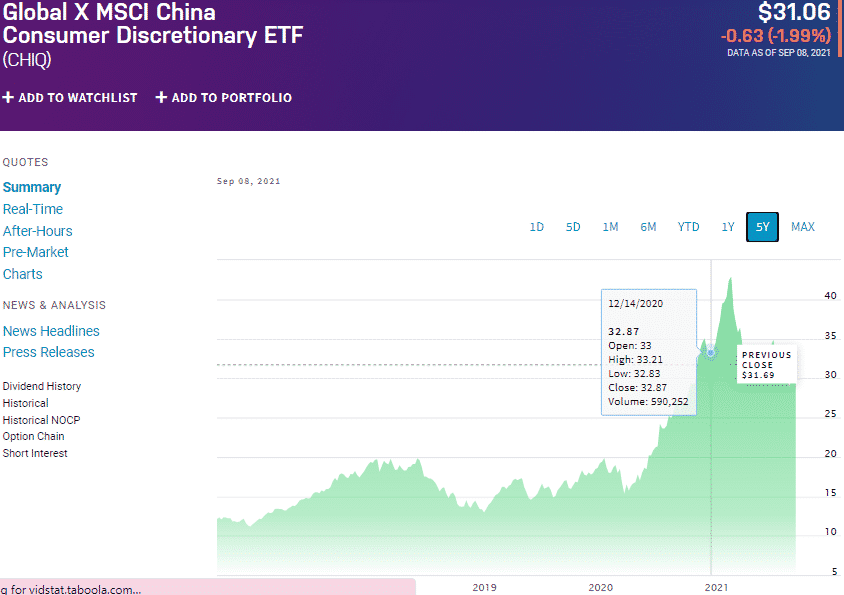

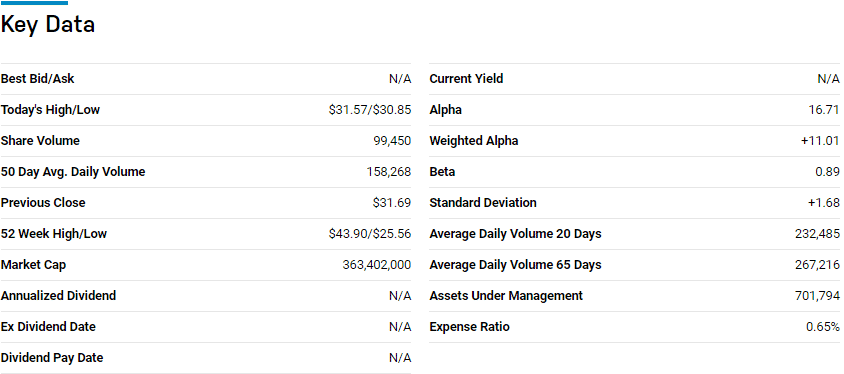

China consumer ETF: Global X China Consumer Disc ETF (CHIQ)

Price: $31.06

Expense ratio: 0.65%

CHIQ chart

Investors gain exposure to a part of the second-largest consumer market globally via the Global X MSCI China Consumer Discretionary ETF in a constant chess game with the US consumer market to be the global consumer big boy. The CHIQ tracks the MSCI China Consumer Discretionary 10/50 Index and invests at least 80% in its underlying holdings and the coupled GDRs and ADRs.

In its portfolio, the top three holdings are Meituan Inc. — 10.11%, Alibaba Group Holdings Ordinary Shares — 8.60%, and Nio Inc. — 7.31%.

This non-diversified consumer discretionary index has $721.37 million in assets under management, with an expense ratio of 0.65%. In the short term, this ETF might not look appealing given the year-to-date returns of -12.07%. However, ETFs are for long-term investing, and given the 5-year returns of 168.21% and 3-year returns of 114.13%, the CHIQ ETF should be on the crosshairs.

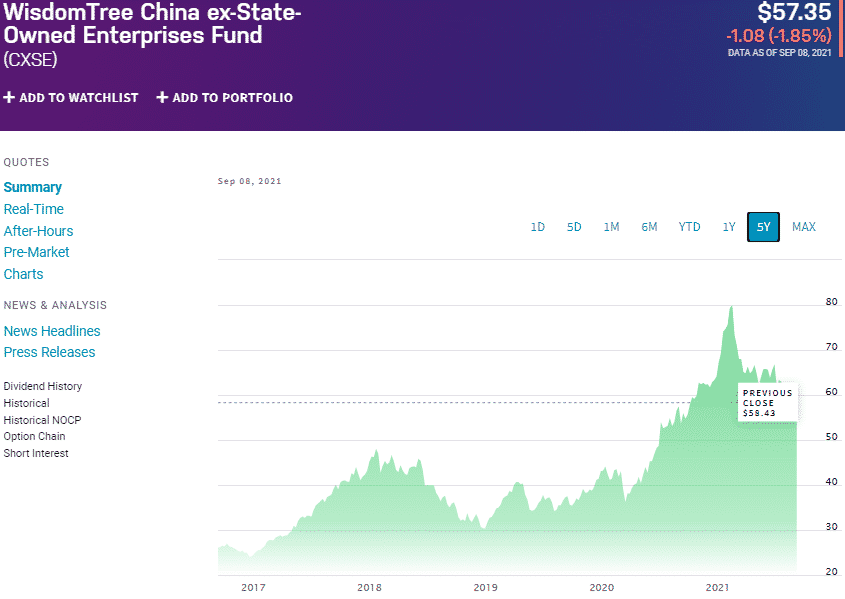

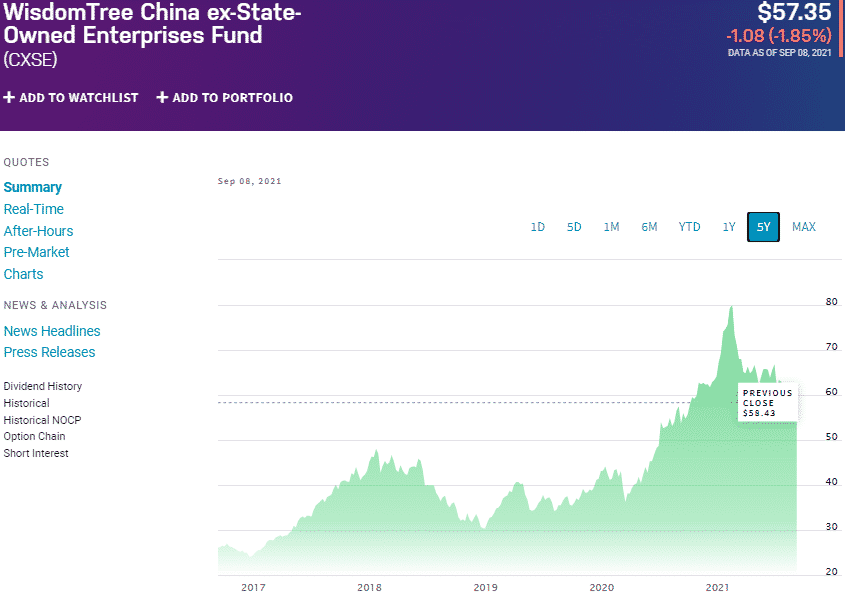

China Industry ETF: WisdomTree China ex-State-Owned Enterprises Fund (CXSE)

Price: $57.35

Expense ratio: 0.32%

CXSE chart

To get exposure to the entire industry breath of the Chinese economy does not get better than the WisdomTree China ex-State-Owned Enterprise Fund, CXSE. This fund exposes investors to the whole publicly traded Chinese investment market by tracking WisdomTree China ex-State-Owned Enterprises Index. The CXSE invests at least 80% in its underlying holdings.

This non-diversified ETF is ranked №4 among exchange-traded funds in the Chinese region by US News. The top three holdings are Tencent Holdings — 11.61%, Alibaba Group Ordinary Shares — 7.18%, and Meituan Inc — 4.47%.

This fund has $1.05 billion in assets under management, with an expense ratio of 0.2%. Despite the year-to-date returns of -12.47%, historical performance shows that this fund is worth looking into as a long-term diversification vehicle; 5-year returns of 130.55% and three years of 35.29%.

Final thoughts

Having a nest in the second largest global economy is a wise investment decision. Given the massive outperformance of Chinese ETFs over the US ETFs in the last three and five years, Chinese ETFs are worth a look despite the current hiccup.

Comments