ETF full name: Invesco CurrencyShares Canadian Dollar Trust

Segment: currency

ETF provider: Invesco

|

FXC key details |

||

| Issuer | Invesco | |

| Inception date | 21st June 2006 | |

| Expense ratio | 0.4% | |

| Average Daily $ Volume | $3.36 million | |

| Investment objective | Hedge | |

| Investment geography | Currency | |

| Benchmark | CAD/USD Spot Exchange | |

| Net Assets under Management | $170.69 million | |

About the FXC ETF

Investors interested in the Canadian and US markets got a gift on 21st June 2006, the Invesco CurrencyShares Canadian Dollar Trust Fund, FXC. Through the FXC, investors had an avenue to hedge against exchange rate exposure on their investments across the American border in the north, Canada. They also got an exchange-traded fund to use as a bet against the American Dollar.

The FXC comprises a single currency. The Canadian Dollar is commonly known as the “loonie,” making it a non-diversified exchange-traded fund. It has a relatively low 60-day average spread of 0.02%.

FXC fact-set analytics insight

The Invesco CurrencyShares Canadian Dollar Trust Fund tries to match the performance of the “loonie” after expenses. Therefore, investors gain exposure to the Canadian Dollar spot exchange cost-effectively and at relatively lower risk than the traditional forex market.

This currency ETF holds a deposit account with JPMorgan of physical “loonies to ensure accurate tracking of its spot exchange.” However, the FXC deposit account has the following limitations:

- The deposits are not insured hence a higher credit risk on the deposits.

- Taxation on distributions and share sales is at standard income rates, effectively increasing the ETFs holding cost.

- Unlike the tracked spot exchange, CAD/USD, this forex ETF has no provision for overnight lending rates.

FXC ETF positively correlates to the Canadian Dollar: if the USD is bearish, the FXC is bullish, and vice versa.

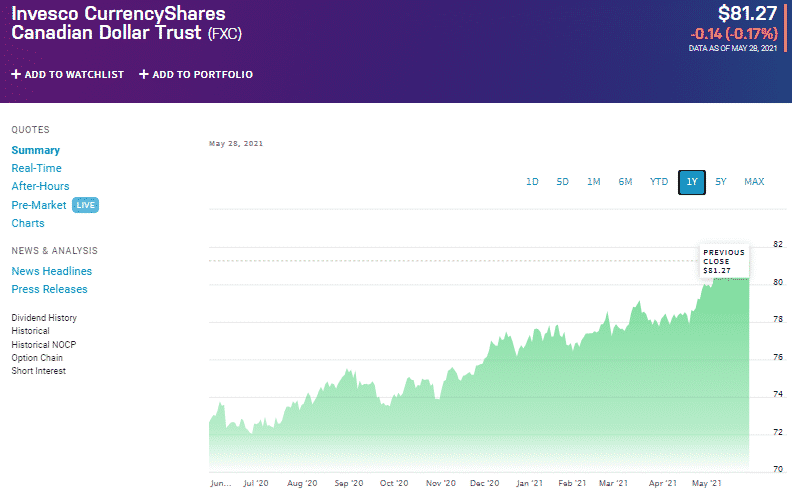

FXC annual performance analysis

Despite being neighbors, the United States took quite a hit in comparison. It is, therefore, no wonder that the dominant North American currency for 2020 was the “loonie,” amassing a year return of 13.46%.

The coronavirus vaccine has made strides in ensuring the speedy recovery of the American economy and the resurgence of dollar value. However, the Canadian Dollar seems keen to replicate its 12-month performance if the year-to-date return of 5.29% is anything to go by.

The FXC exchange-traded fund boasts $170.69 million in assets under management.

FXC ETF RATING |

|||||

|

Resource |

ETF DATABASE | ETF.com | MarketWatch | Morningstar.com |

Money.usnews.com |

|

IPO Rating |

A- | B | 1 | N/A |

N/A |

|

IPO ESG Rating |

N/A | N/A | N/A | N/A | N/A |

FXC key holdings

Invesco CurrencyShares Canadian Dollar Trust Fund is a single forex spot exchange exchange-traded fund. Therefore, rather than having underlying assets like other ETFs, it holds the CAD in a deposit account.

The fund manager also engages the deposit account in index swaps, options trading, and futures contracts trading through the deposit account at JPMorgan. The result of all these activities is an average monthly dividend of $0.06.

Industry outlook

Currently, the USD/CAD is trading within sight of yearly support. Moreover, most trading indicators are, in the short term, in support of bearish trend continuation.

However, analysts at FXStreet advise against jumping into the bearish bandwagon. These jitters are on the back of the expected job losses to the tune of 20,000.

Since the FXC’s primary objective is to mimic the USD/CAD spot exchange as closely as possible, investors should watch the support level and the expected job reports and adjust any open positions accordingly.

Comments