Despite being one of the oldest commodities on the planet, there is still a high demand for precious metals. Investing in gold has always been a lucrative option for those who want to grow wealth.

However, rather than buying gold and keeping it in storage, opting for other investing methods has become popular, and Gold exchange-traded funds are one of them.

Let’s find out a few things that you must know before deciding to buy a Gold ETF.

What is a Gold ETF?

An ETF is an exchange-traded fund that is tradeable on the stock exchange. The physical commodity backs Gold ETFs, and the price movements mimic that of natural gold. Thus, when you buy a Gold ETF, you do not own the physical metal, but you make profits based on the ETF’s rise.

What opportunities for investors through Gold ETFs?

- The entry threshold for investing in ETFs is relatively low. This allows you to invest in precious metal with small start-up capital.

- Liquidity is much higher than with other forms of investment. With ETFs’ help, you can quickly manage your capital and invest in various assets depending on the current market conditions.

- Significant diversification of funds. A low entry threshold, high liquidity of the instrument, and a wide choice allow you to invest in securities of different countries, sectors, and various goods.

How does the ETF work?

The fund that owns the underlying asset owns the physical gold bullion. So, they would put together the fund and sell shares of this fund to investors.

As an investor, you can buy or sell these shares daily, and it’s like owning shares in a stock. But, instead, you own shares in a fund that gold backs.

It is important to note that the Gold ETF price is not the same as physical gold, but rather the fund’s value based on its market performance.

The history of Gold ETFs

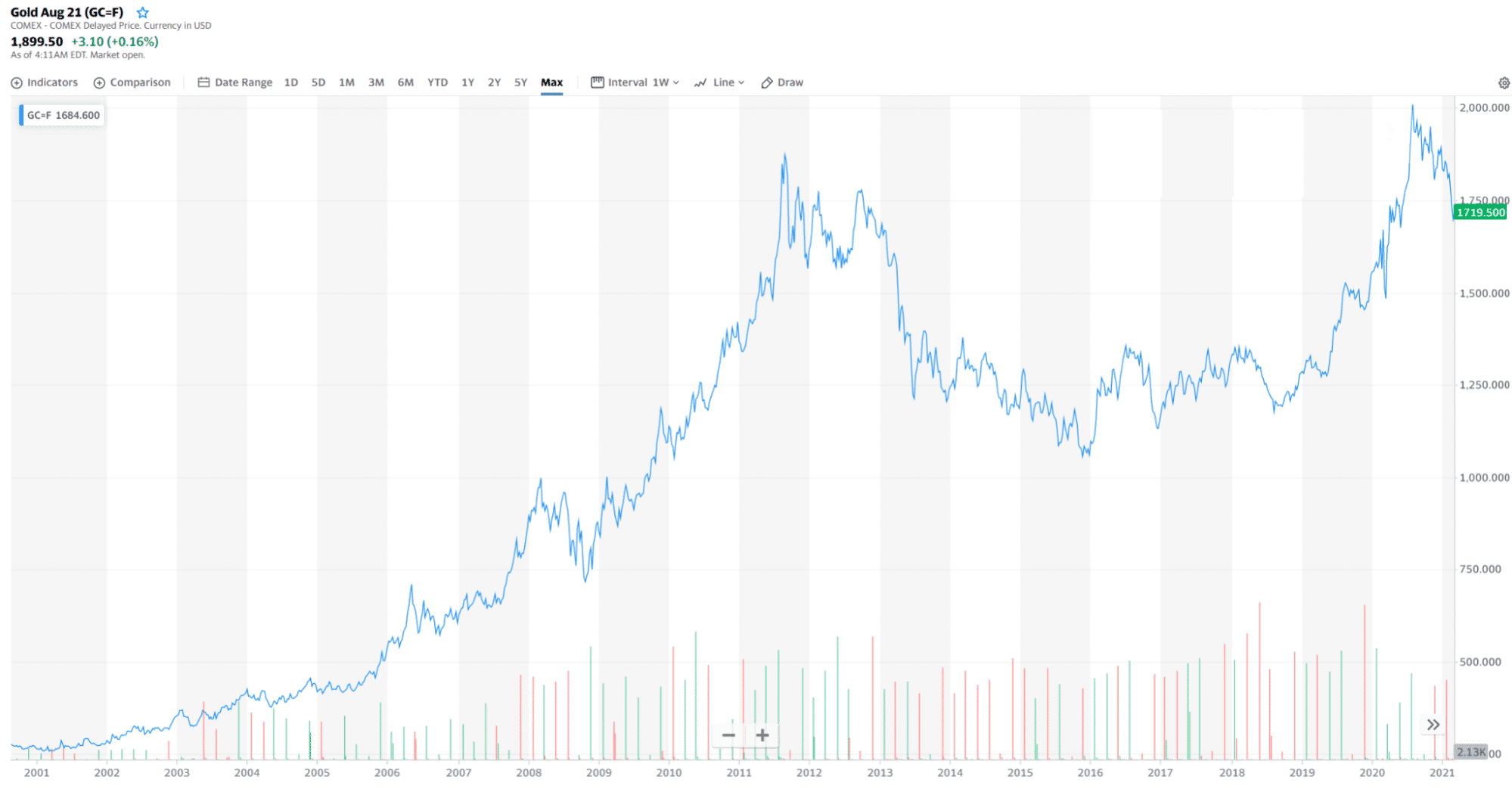

Gold trading has existed for thousands of years, but the markets have changed a lot during this time, and the precious metal has remained the same.

Money is printed on paper, and most financial transactions are carried out over the internet, so physical gold today is a very archaic means of payment. Moving and storing bars costs money, and the quality of the gold can vary.

Gold’s popularity increased again after the dot-com bubble, and many traders wanted a more efficient means of accessing bullion.

Sure, the sight of NYSE traders tossing bars of gold across the floor at each other would have been fun, but getting gold trading on the stock exchanges needed a more practical solution.

And then State Street Global Advisors appeared. In 2004, it launched the SPDR Gold Trust (GLD) in ETF format and gave investors access to gold without moving, storing, and paying for insurance. The GLD tracks the spot price of gold using physical bullion held in a London vault.

What five things do you have to know before buying the Gold ETF?

№ 1. Determine the best ETF

Before investing in an ETF, you first need to determine the best fund.

There are few factors to consider when choosing the right ETF:

- Value of assets

The value of assets should at least be $10 million; anything below this value means that the fund has a small number of investors, which leads to the low liquidity of such a fund.

- Trading volume

The ETF should have sufficient trading volume as it’s an excellent indication of high liquidity. High trading volumes translate to low spreads, which is required to maximize profitability.

- Tracking error

The tracking error measures how closely the fund’s returns are to the benchmark’s return over a specific period. A low tracking error is an indication of a good fund.

- Position in the market

An ETF with a top position in the marketplace would have the most assets, which translates to high liquidity and trade volumes.

№ 2. Hedge with Gold ETFs

As we mentioned earlier, buying gold, whether it be the physical form or investing in an ETF, has proven beneficial to investors. If your portfolio of other assets is at risk, you can use a Gold ETF to hedge against those risks.

This is especially beneficial during economic uncertainty since the value of gold tends to increase because it is a ‘safe haven’ for investors.

№ 3. Notice that Gold ETFs pegs the gold price

We explained that the fund owns the physical gold. They would store the gold in a secure vault in specific locations. When you invest in the ETF, you purchase shares of the funds.

The value of the fund would be affected by the price movements of gold. But important to note is that the Gold ETF and the price of gold are not equivalent; the ETF mimics the action of gold instead. Therefore, supply and demand influence the cost of the ETF.

№ 4. Remember about fees

Just like any other investment, there are specific fees that you will be liable to pay. Depending on your trading style, if you buy and sell ETFs daily, you will be impacted by trading fees such as broker’s commission and spreads. If you trade often, then these fees will be higher.

The fund determines the trading fees; therefore, depending on which ETF you invest in, the costs might differ. The amount can be substantial depending on your investment and trade order sizes.

Another impact on fees is lack of liquidity, and you can quickly determine this by looking at the spreads. If the spreads are wide, it means the fund has low liquidity. You, therefore, do not pay an actual fee, but you will have to hold longer to gain more profit to overcome the high spreads. And this in itself can be risky in such a volatile market.

Other fees to consider when investing in Gold ETFs are capital gains taxes. When you invest in a Gold ETF and keep your investment for more than one year, it is subject to taxes. You will have to pay tax on the profit you make on the ETF.

№ 5. Diversify with Gold ETFs

As a long-term investor, diversifying is an excellent way to guard against unforeseen risks. And using Gold ETFs is an excellent way of minimizing your investment risks. Moreover, this investment is perfect when the USD performance affects your other assets. For example, there is no correlation between gold and the stock market. Therefore, the stock market performance does not affect the value of gold.

Therefore, if you invest in a good-performing Gold ETF, you can be assured that your investment is safe as there is an inverse correlation between gold and the USD.

So, diversifying is a form of protecting your investment portfolio.

What are the best top 3 Gold ETFs?

Check out our top ETFs if you want gold-based instruments in your portfolio.

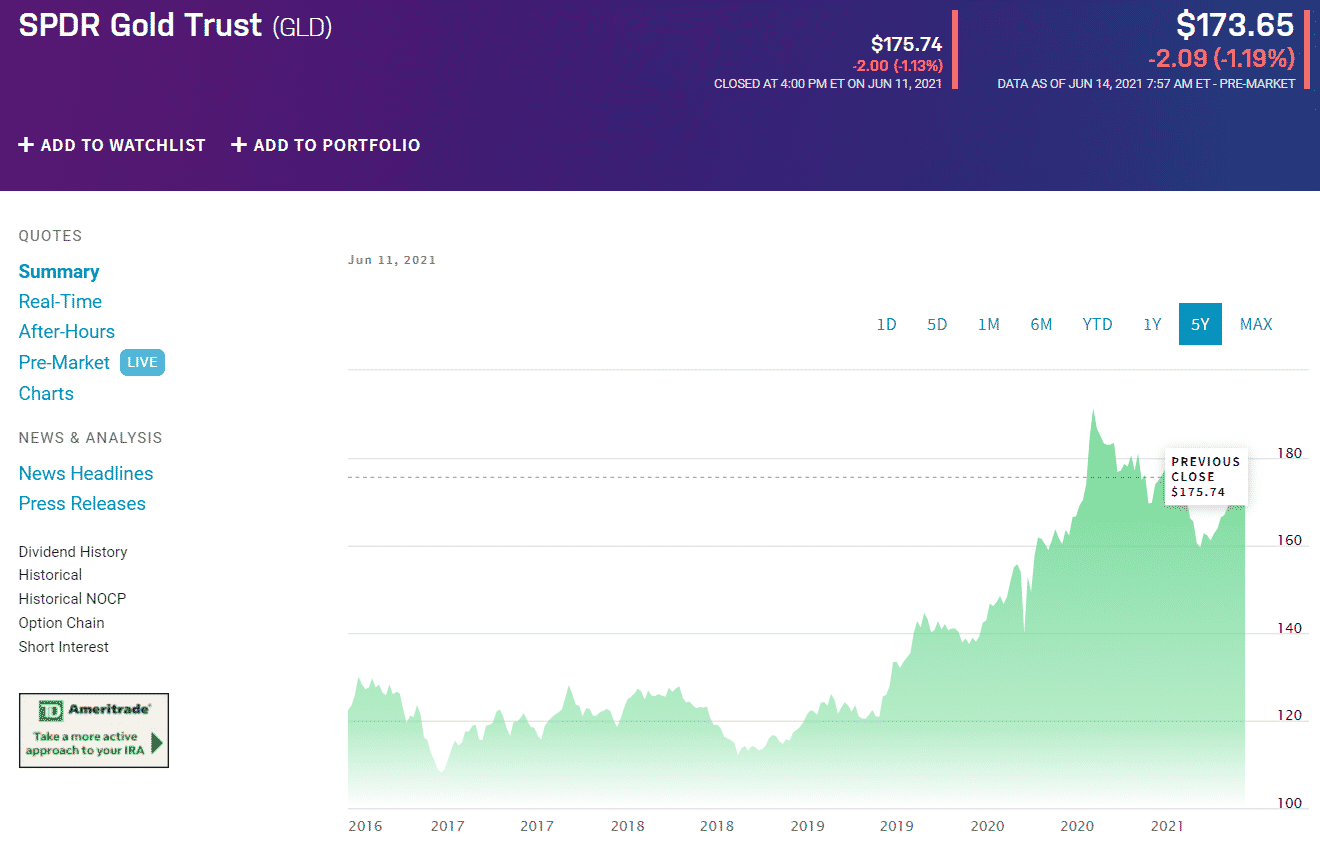

№ 1. SPDR Gold Trust (GLD)

Of course, the largest gold specialization ETF is the SPDR. The SPDR Gold Trust has over $40 billion in assets and uses UK-held bullion to track the spot price of gold. The fund’s expense ratio is 0.40%, but the IRS classifies GLD as a luxury item, so be prepared to pay the bills.

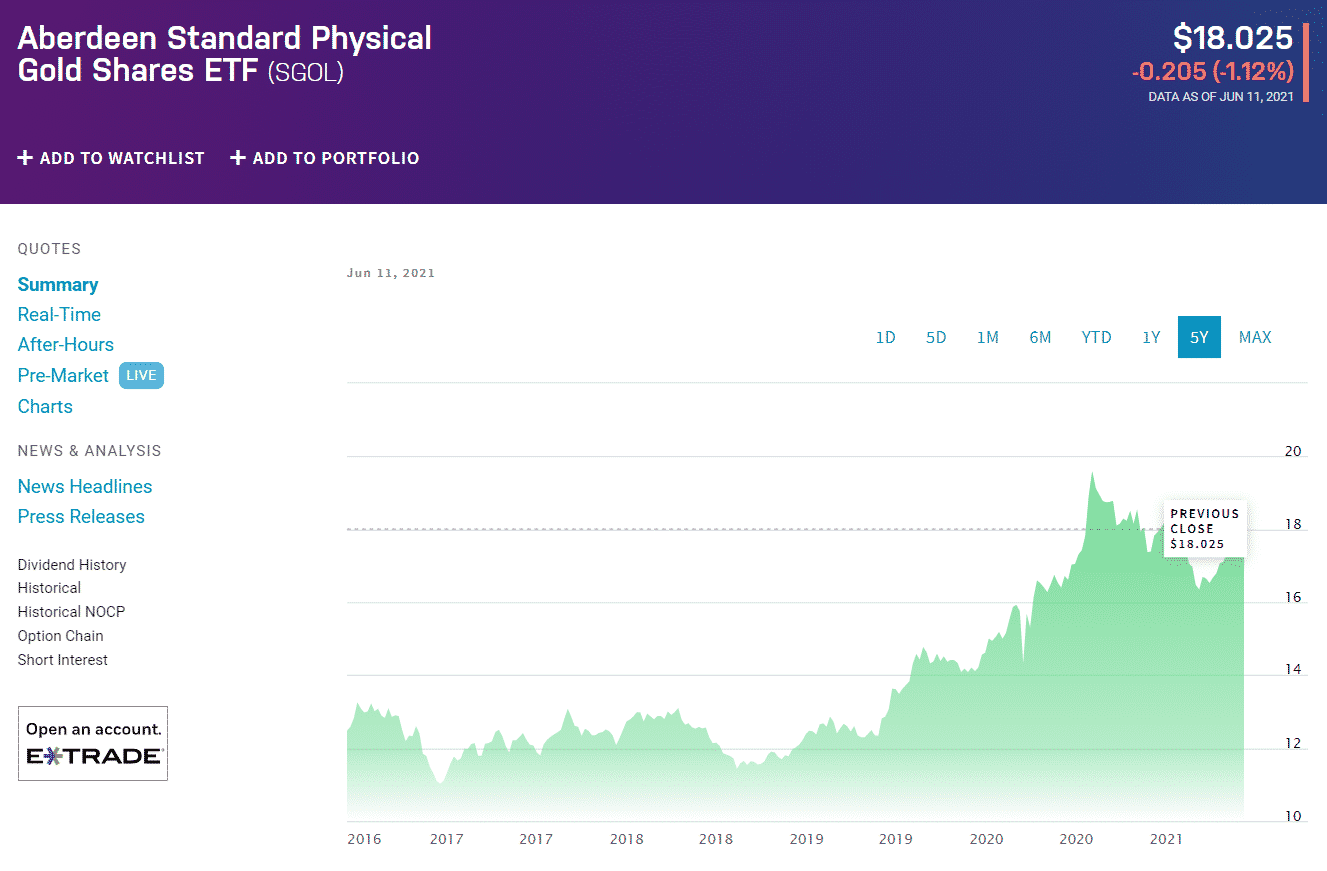

№ 2. Aberdeen Standard Physical Swiss Gold Shares (SGOL)

Aberdeen Standard Physical Swiss Gold Shares (SGOL) fund has a hard-to-pronounce name, but it has a cost ratio of just 0.17% and has over $ 1 billion in assets. The spot price of gold is tracked using bars held in Germany and owned by SGOL, so the IRS will also charge you a lot of tax.

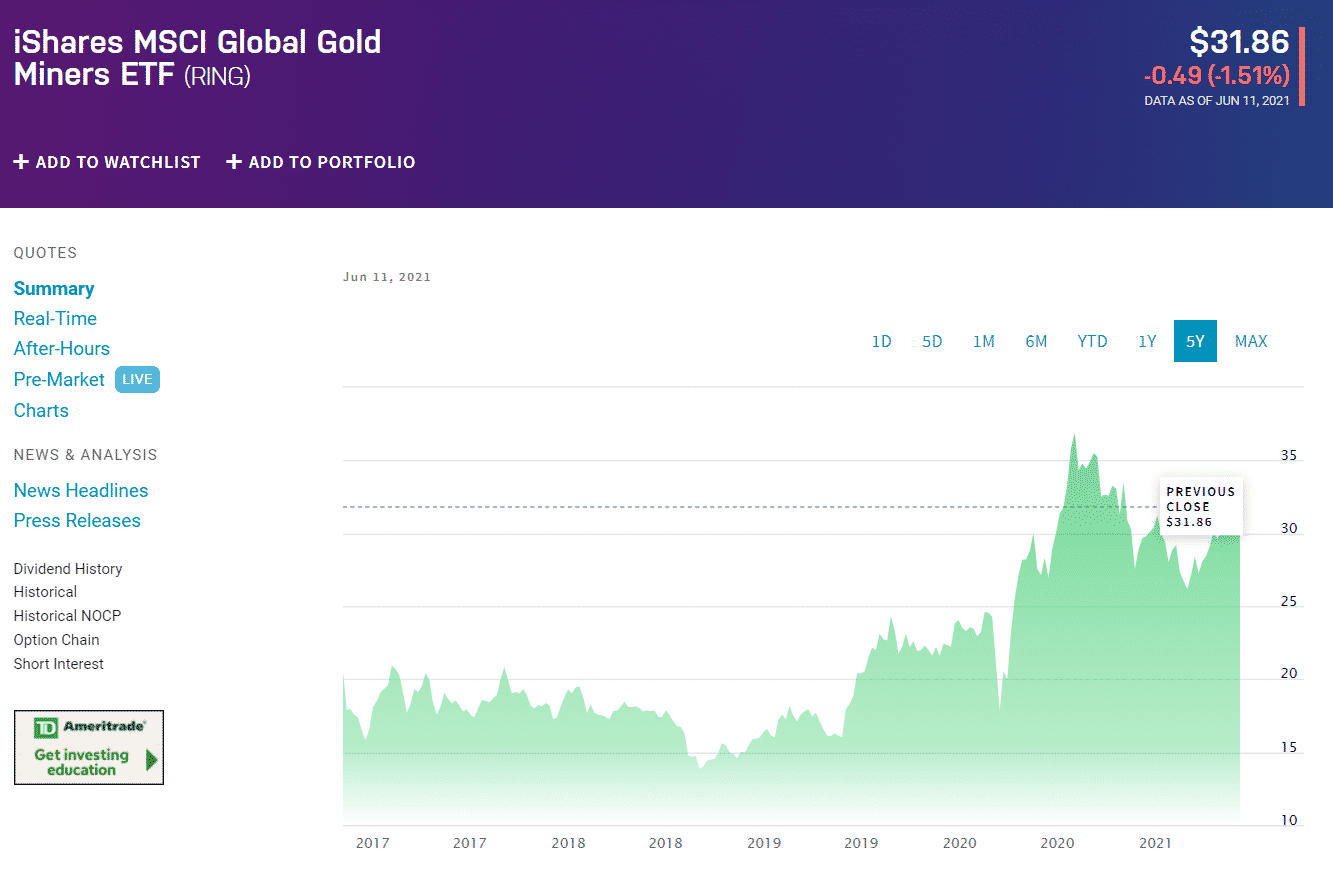

№ 3. iShares MSCI Global Gold Miners ETF (RING)

Instead of holding physical gold, RING invests in stocks of gold-related companies such as Barrick Gold and Newmont Goldcorp. The cost ratio here is 0.39%, but investors are taxed at the standard capital gains rate.

Conclusion

Considering all the above, we can say that there are pros and cons to any investment. Therefore, the onus is on you as an investor to determine what kind of investment suits your objectives. Gold ETFs have multiple benefits, and with the value of gold still increasing, investing in such ETFs would benefit your portfolio in these uncertain times.

Comments