The previous week, 30th August to 3rd September, saw a record bullish run that resulted in the SPY making a new year high to close the week at $453.05. All the positive weekly data was attributable to the phenomenon of upward movement, with investor expectations continuing the same.

Would the new week see the SPY bullish run pick up the pace, or would it falter?

With two weeks of consecutive Monday opening gap up, coupled with a solid bullish run in the preceding week, investors waited with bated breath for another gap up to confirm continuation bullish

domination. Unfortunately, the market opened with a 0.1% gap down to start trading at $452.70. Despite this being bad news compared to the previous two Monday openings, it would be the highest weekly price for the SPY.

Bearish traders took control of the market from the Tuesday gap to push the market prices down to the previous week’s minor resistance turned support of $451.03 before being pushed back to the $452.31 region. It was terrible news for the bullish traders from this point onwards as the SPY experienced sideways markets coupled with bearish biases. Investors this week seem to be extra cautious about equity valuations as they are at present in the face of delta coronavirus spread and early FED tapering.

With Thursday’s weekly news being expected to buoy the SPY back upwards, the jobless claims came in at a record low, 310K. Still, in retrospect, the open jobs hit a record high to show workers are wary of the rising delta variant cases preferring to stay home. As a result, SPY continued its downward spiral to trade the $448.96-$449.82 range on Friday.

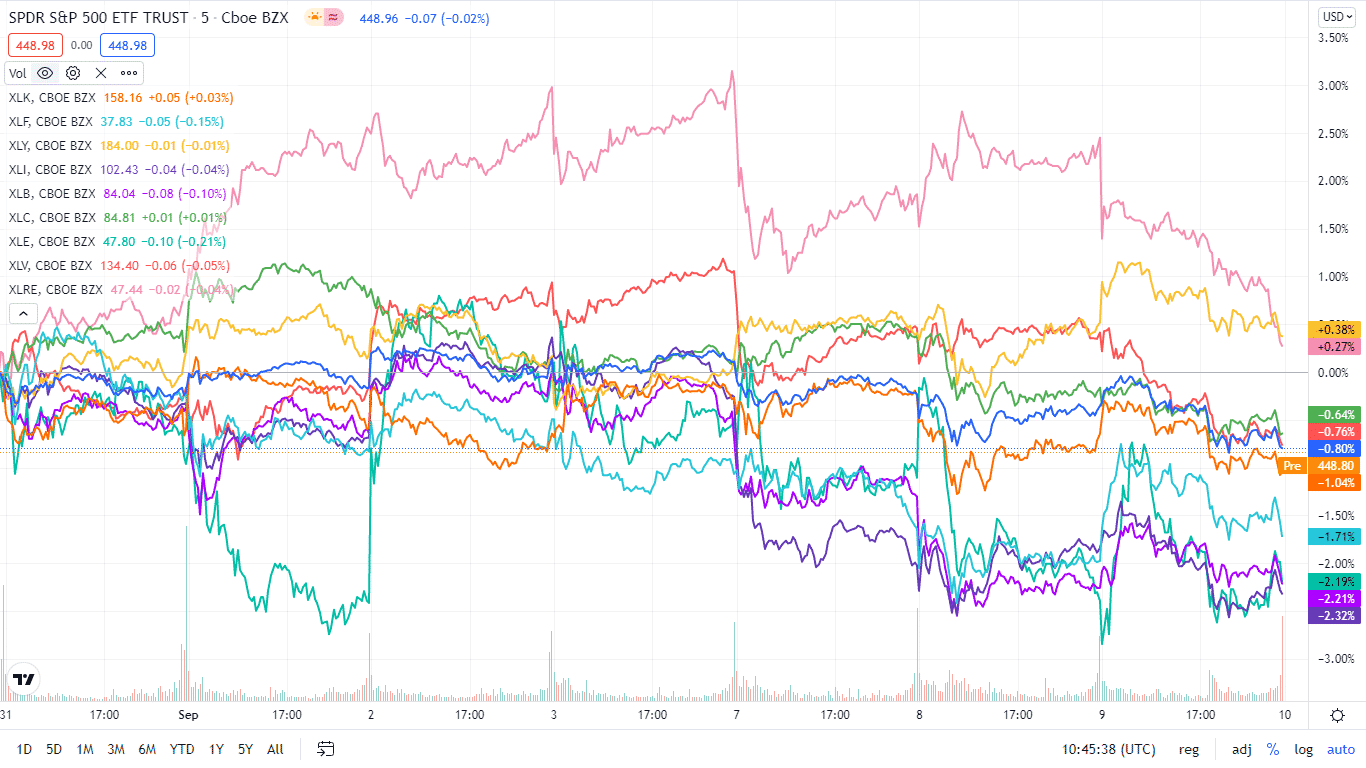

Between the individual sectors making up the S&P 500, a complete shift in the chess game that has been ongoing was experienced.

Gainers of the current week

Utilities sector

The utility sector experienced another week of inflows as consumer sentiments continue to be bearish on the pace of economic recovery, to close the week at +1.38%.

Consumer Discretionary sector

Given the investor jitters on the face of delta variant coronavirus, FED early tapering, and poor weekly economic metrics, it comes as no surprise that consumer discretionary was a gainer. The sector is considered a haven investment option, driving inflows into it to close the week at +0.24%.

Losers of the current week

Sectors that took the brunt of the economic good news were:

Healthcare sector at — 1.81%

Industrial sector at — 2.06%

Real Estate sector at — 2.68%

Despite talks between US President Biden and Chinese President Xi Jinping officially starting talks between the two countries in months, it seems the news has not yet hit the equity markets. The delta variant is also spreading at an alarming rate

resulting in increased covid-related deaths and hospitalization. Couple this with the slowing down of economic resumption, as evidenced by poor than expected results, and 9 out of the 11 SPY sectors closed in the red, with the worst hit being the three above.

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week in the green by breaking down the individual sector performances using their corresponding ETFs.

| The S&P 500 individual sector, weekly performance breakdown | |||

| 1. | Utilities | XLU | 1.38% with the accompanying utilities select sector ETF |

| 2. | Consumer Discretionary | XLY | 0.24% with the accompanying consumer discretionary select sector ETF |

| 3. | Communication Services | XLC | -0.31% with the accompanying communication services select sector ETF |

| 4. | Financial Services | XLF | -0.66% with the accompanying financial select sector ETF |

| 5. | Information Technology | XLK | -0.80% with the accompanying information technology select sector ETF |

| 6. | Consumer Staples | XLP | -0.92% with the accompanying consumer staples select sector ETF |

| 7. | Materials | XLB | -1.6% with the accompanying materials select sector ETF |

| 8. | Energy | XLE | -1.75% with the accompanying energy select sector ETF |

| 9. | Healthcare | XLV | -1.81% with the accompanying healthcare select sector ETF |

| 10. | Industrial | XLI | -2.06% with the accompanying industrial select sector ETF |

| 11. | Real Estate | XLRE | -2.68% with the accompanying real estate select sector ETF |

Comments