Learning about expense ratio (ER) is crucial to your success as an investor. Think of it as an overhead cost in running a business. There is nothing you can do to reduce this cost. What you can do is find one or two options with the lowest costs.

Let’s learn about the makeup of an ER, which is critical in selecting mutual funds to invest in. This knowledge can give you an idea of what to expect in return for the money you put in a fund.

What is an expense ratio?

It gives you an estimate of the amount spent on operating expenses. You can obtain this value by using the formula:

ER = overall operating expenses / overall fund assets

The fund deducts a portion of the assets to pay for the operating expenses, thus cutting down on your return as an investor. Even so, this matter is a normal part of doing business.

Be aware of the standard ERs for various classes of mutual funds. The table shows figures are industry standards, but there are some variations in actual practice.

| Type | Range |

| Mutual fund | 0.1% – 1.5% |

| Index fund | < 0.25% |

| Actively managed fund | 0.75% – 1.25% |

What does the ER tell you?

Operating a fund or stock involves cost. That is why the ER varies per stock or fund. The good thing is that these operating expenses are generally constant.

- If a fund incurs a low overhead cost, generally, it will remain that way for some time.

- Funds with high overhead costs will continue to work in that manner.

Management fee takes the most significant cut in the operating costs. The rest of the operational expenses goes to the following:

- Custodial services

- Record keeping

- Legal expenses

- Taxes

- Auditing fee

- Accounting fee

When the fund bears the expenses, this affects the fund’s net asset value for the day. At times, there are expenses directly borne by investors. In this case, the fund will deduct the amount from the account of the investor concerned.

Elements of the ER

While different expenses in a fund may vary, the fund sets these expenses at fixed values. For instance, if a particular expense takes 0.25 percent of the total assets, the fund will keep that expense constant at 0.25 percent despite the variances.

As pointed out earlier, the management fee makes up the bulk of the operating expense. In addition, your fund may have an advertising expense. Based on the FINRA ruling, this type of expense should not exceed one percent.

Buying and selling of assets within the portfolio do not factor into the operating expenses. Therefore, you have to bear the cost of such expenses. Other costs not considered under operating expenses include:

- Redemption costs

- Sales charges

- Loads

Expense ratios to expect

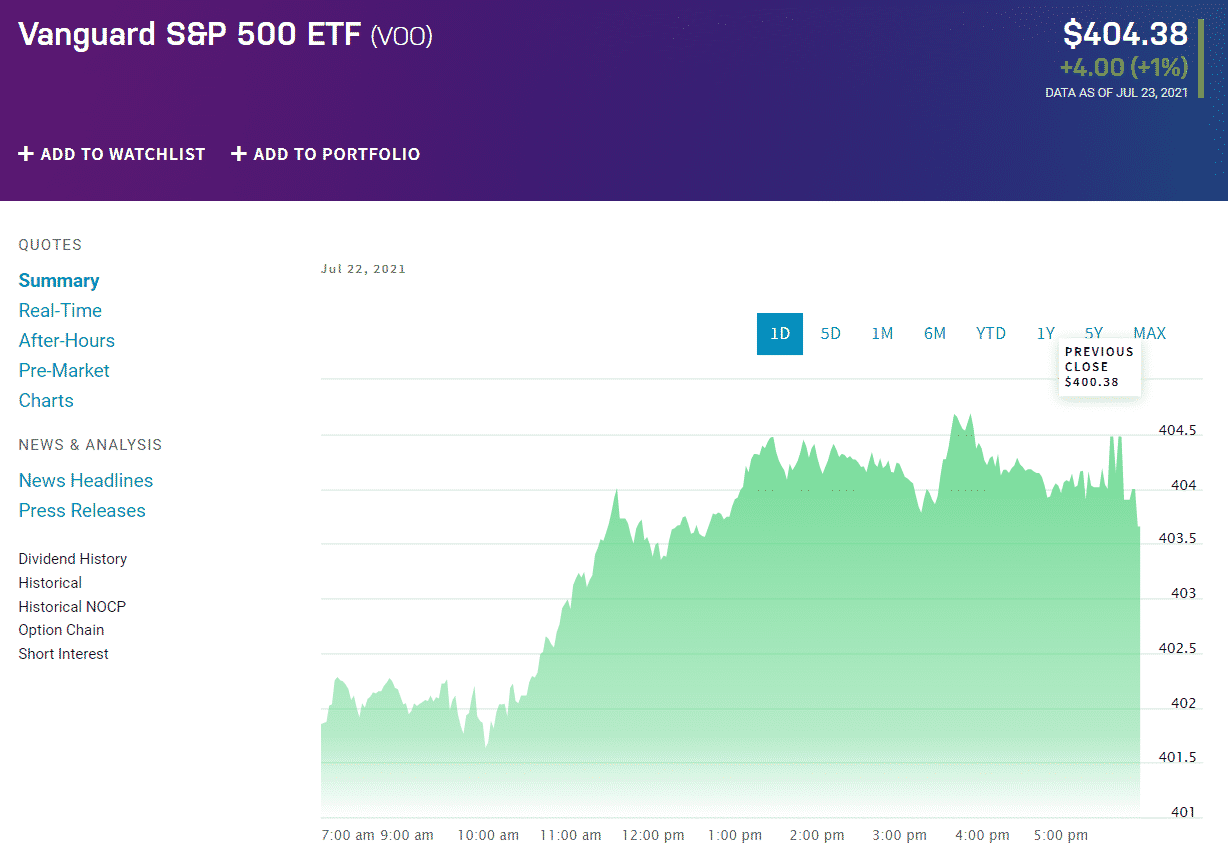

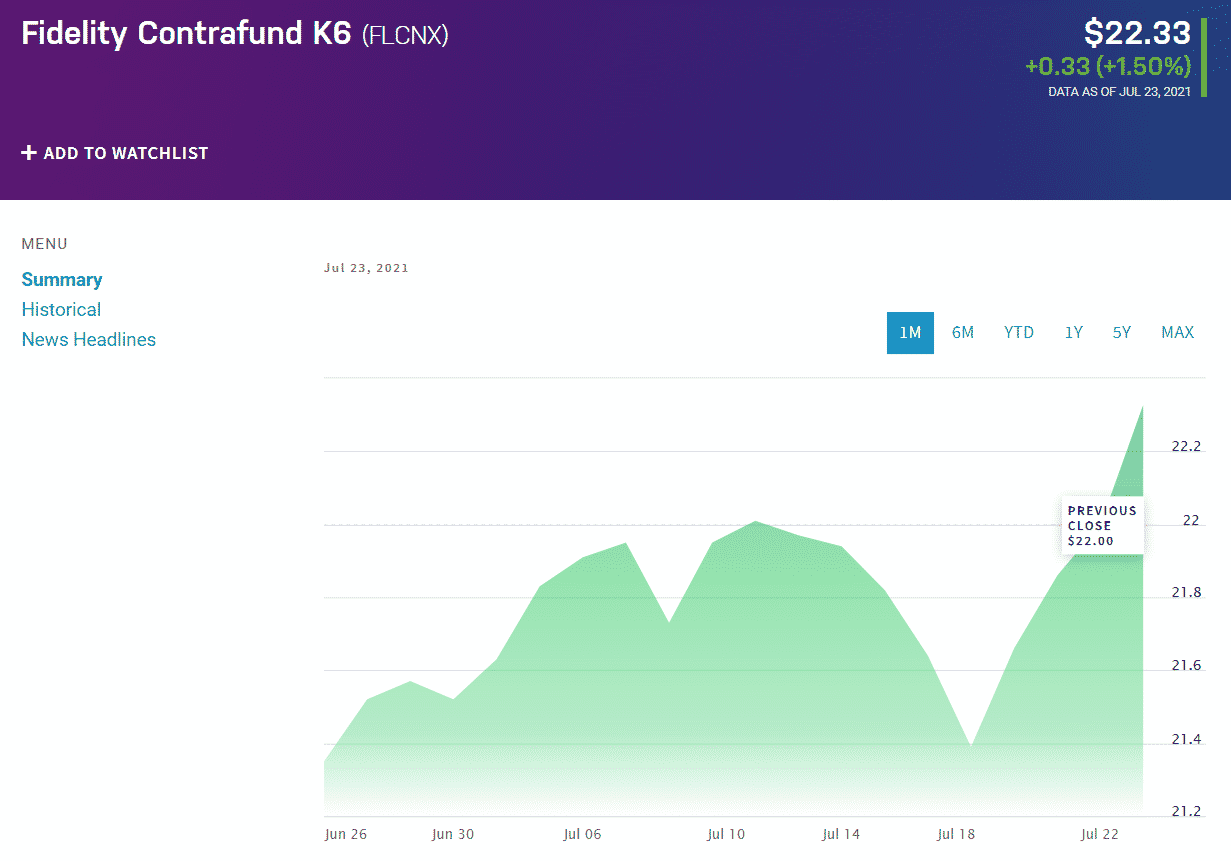

One of the significant factors affecting the value of the ER is whether or not a fund is actively managed. You can see the difference in the table above. Since index funds involve passive management, the ER is comparably lower than do actively managed funds. What an index fund manager does is simulate the portfolio of the mirrored index. This manner of fund management is less active, resulting in lower management fees.

On the other hand, an actively managed fund employs a team of experts to do market analysis, research, and portfolio management. These experts are constantly looking for ways to add new assets into the portfolio and remove less-performing ones.

As a shareholder, you bear the cost of having to use experts to manage the fund. While the fund does not directly deduct this cost from your account, all the other fund shareholders would shoulder the cost through more significant ERs.

A closer look at a management fee

Mutual fund companies charge their investors management fees to maintain the portfolio. That is why management fees are essentially maintenance fees. A mutual fund employs experts to manage the fund. Hiring and keeping these professionals is costly for the fund, but it is necessary to keep the fund running smoothly.

The management fee covers all expenses directly related to funding management. So this includes retaining and hiring investment professionals, which takes up the most considerable management fee. This cost alone can eat from 0.5 percent to 1 percent of the total assets in the fund.

You might think this percentage range is relatively small. However, the actual amount can mean millions of dollars for a fund holding a $1 billion asset. Depending on the caliber of the management team hired to manage the fund, your fund will generally pay higher fees for expert fund managers. The result is an ER that may approach the upper end of the range or even beyond.

Transaction costs

Apart from the costs involved in hiring fund managers, there are other overhead costs to consider. These costs include auditing, legal, marketing, customer service fees, filing charge, office supplies cost, and additional admin costs.

The above fees do not concern the process of buying and selling assets in the fund. However, they are necessary for the continuous, smooth operation of the fund and to keep it within the requirements of the regulatory bodies.

Take note that buying/selling of assets involves costs not covered under the management fee. These trading activities result in transaction costs. In summary, two costs make up the overall expense ratio. These are management fees and operating expenses.

A good ER

There are some rules of thumb you can follow when analyzing mutual fund options. If a mutual fund invests in big companies, its ER should not go above one percent. If the fund puts money in small companies, the ER should not exceed 1.25 percent.

Therefore, if you see a fund whose ER is greater than the above figures, you already know that the fund is expensive. However, before you make this judgment, check if the fund provides additional services to make your life convenient as an investor. If that is the case, then the higher ER is justified.

Final thoughts

Understanding the meaning of the ER is critical for investors. This factor can have a significant impact on your profitability. Thus, before you put money in a fund that interests you, see that its ER is affordable or reasonably priced. By all means, find one or two mutual funds with the smallest expense ratios to become profitable in the long term.

ETFs that have the lowest fees are not always the best funds to buy. Be sure to compare apples to apples before buying ETFs. For example, make sure the ETFs being compared track the same index. It also helps to look at the history and total assets of the fund.

Performance is important because of the so-called tracking error, which measures the performance of an index fund in replicating or “matching” the performance of a reference index. If a fund does not track an index, low fees may not offset enough for the fund to beat a comparable fund. So don’t forget to compare historical rates in addition to cost ratios.

Comments