What do you do when the investment markets are highly volatile? Seek a hedge asset whose movement is not tied to the equity markets. What can investors in digital assets and cryptos do to mitigate against the high volatility characteristic of this niche? Incorporate stablecoins in their crypto fund.

Blockchain technology provides unignorable efficiencies and cost-saving avenues, and the authorization of associated contracts will continue producing coins. In addition, despite the current crypto stump, the global young populace’s appetite for decentralized finance systems continues to expand, expanding the demand for cryptos.

This phenomenon is, in turn, driving demand for stablecoins as a crypto fund hedge option to ensure survival before the global acceptance of cryptos and the resulting stability.

Why should investors bother investing in stablecoins?

To understand why crypto investors need stablecoins as part of their portfolios, we need to understand stable coins’ DNA. Stablecoins are cryptos whose value is pegged on a physical asset; the value of the stable coin reflects the intrinsic value of the physical asset it backs.

As such, rather than the value of stablecoins being influenced by the speculative nature of digital assets and the resulting volatility, their value increases or decreases only when the price of the coupled physical asset fluctuates. What’s more, the liquidation of a stablecoin gains investor ownership of the physical asset it represents.

The top 5 stablecoins to include in your crypto fund portfolio

Like all investment assets, cryptocurrencies experience a market downturn. However, the highly speculative nature of these markets results in higher volatility levels that can result in financial ruin in a matter of minutes.

For example, in the last 12 months, Bitcoin has declined a mind-boggling -42.9%. This volatility and unpredictability are driving the accelerated adoption of stablecoins. This adoption does not forgive all stablecoins from the volatility of crypto markets. Those ahead of the pack have solid fundamentals to weather the cryptocurrency storms while providing some sanity to a crypto fund and a chance at some profits.

No.1 PAX Gold (PAXG)

Price: $1849.58

Market capitalization: $616.95 M

PAXG chart

When the markets are highly volatile, where do investors look for a hedge to mitigate against return erosion, commodity market more so gold. Charles Cascarilla and co thought that the same would work for the volatility of the crypto markets, and they were not wrong. Through their gold-backed ERC 20 token, PAXG, the highly volatile crypto space can be hedged using gold hassle-free and convenient. By ensuring tradability in a multitude of exchanges, this gold-backed stable coin achieves high liquidity levels making it one of the most popular and stable digital assets available. Every PAX Gold coin is backed by a fraction of the London Good Delivery gold bar.

This highly liquid and stable gold-backed coin is currently trading with a 24-hour volume of $20.15 M. It has a market cap of $616.94 million, with all of the available 333601 coins in circulation.

No.2 Dai (DAI)

Price: $1.00

Market capitalization: $6.77 B

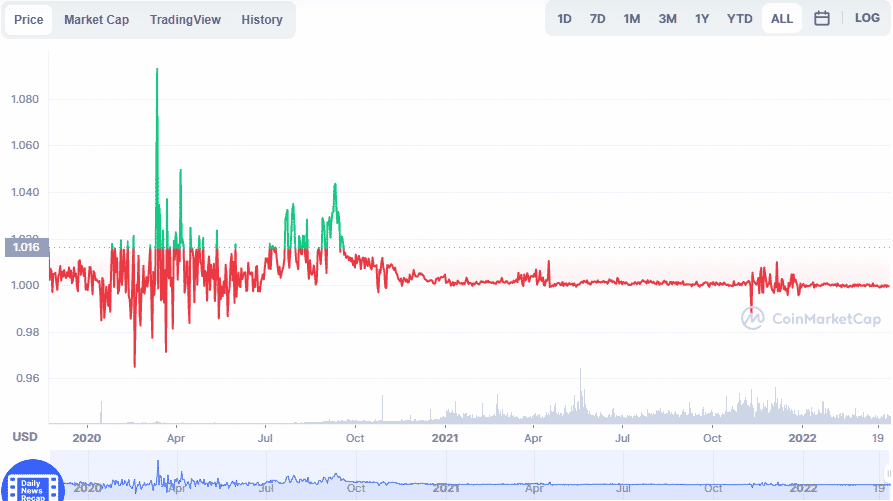

DAI chart

Dai coin is one of the most popular stablecoins around the globe, and it is pegged to the dollar. However, it is a mainstay in the stablecoin market because of its multi-collateralization attribute, which other feasible cryptos can back.

The underlying technology is Ethereum blockchain coupled with a MakerDAO decentralized autonomous organization to enable all this. The MakerDAO vault pools together all deposits to create a collateralized pool for DAI withdrawal, pegged to the dollar’s value in an approximately 1 to 1 ratio. In addition to all this, smart DAI contracts ensure transparency and a stable crypto for use as a hedge against both volatility and green buck currency fluctuations.

DAI currently has a 24-hour trading volume of $211.78 million. It has a market cap of $6.77 billion, with approximately 6.77 billion coins in circulation.

No.3 Tether (USDT)

Price: $0.9994

Market capitalization: $72.49 B

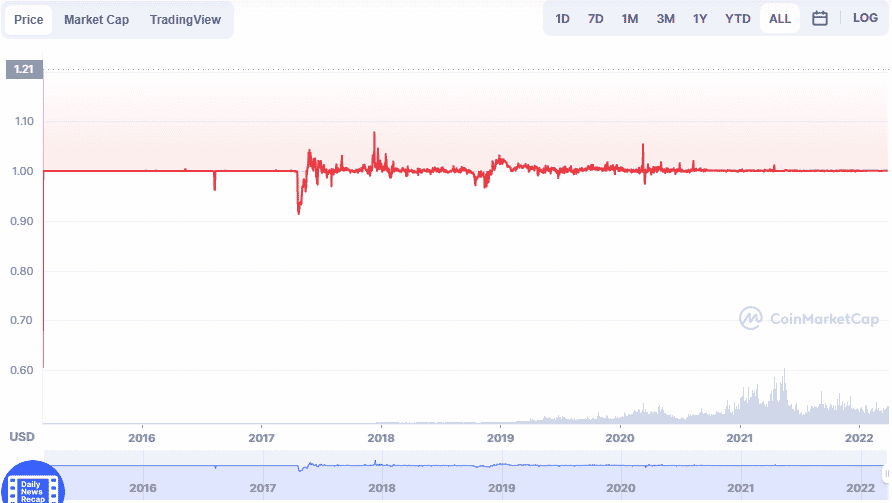

USDT chart

Ethereum and Bitcoin might be the crypto space big boys, but tether is the most liquid and exchanged stablecoin. It might be since it is the pioneer stable coin, created in 2014 under the name Realcoin, and on account of it being the largest stablecoin in weight capitalization.

Tether is pegged to the dollar value and holds cash, fiduciary deposits, commercial paper, reserve repo notes, and treasury bills. The result is a crypto coin that provides investors with anonymity, liquidity, and the global acceptance and stability of the dollar.

This stable, highly liquid cryptocurrency coin is currently trading with a 24-hour volume of $61.28 billion. It has a market cap of $72.49 billion, with approximately 72.49 billion coins in circulation.

No.4 Binance USD (BUSD)

Price: $1.00

Market capitalization: $18.20 B

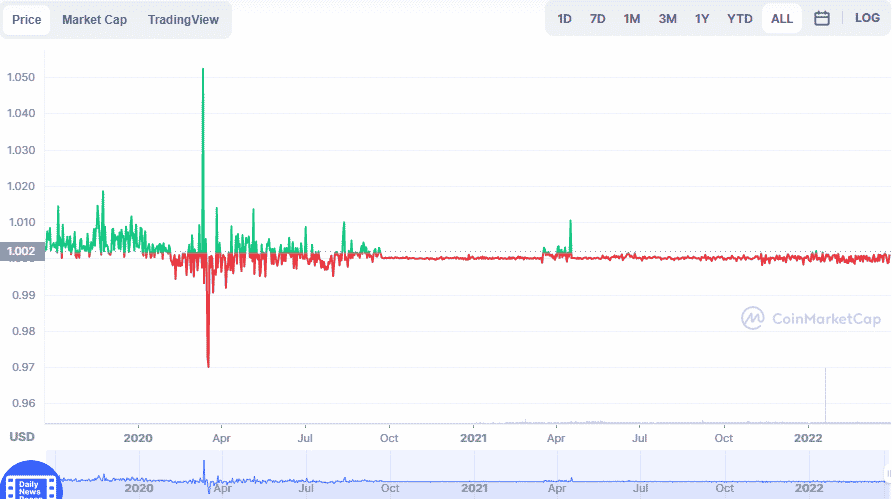

BUSD chart

While other cryptos baffle institutional investors and government agencies, leading to their low adoption and acceptance globally, BUSD has already been approved by the New York State Department of Financial Services (NYDFS), a recognized financial authority.

This dollar-pegged stablecoin is used in the digital asset niche. The traditional business set up; fiat and cryptocurrency digital payment platforms, decentralized and centralized exchanges, digital services, and crypto-wallets. In addition to being pegged to the dollar, reserves of the BUSD enhance its credibility and stability by being held in the form of globally accepted financial instruments, Treasury instruments, and federal deposits.

BUSD currently has a 24-hour trading volume of $6.42 billion. It has a market cap of $18.20 billion, with approximately 18.20 billion coins in circulation.

No.5 USD Coin (USDC)

Price: $1.00

Market capitalization: $53.97 B

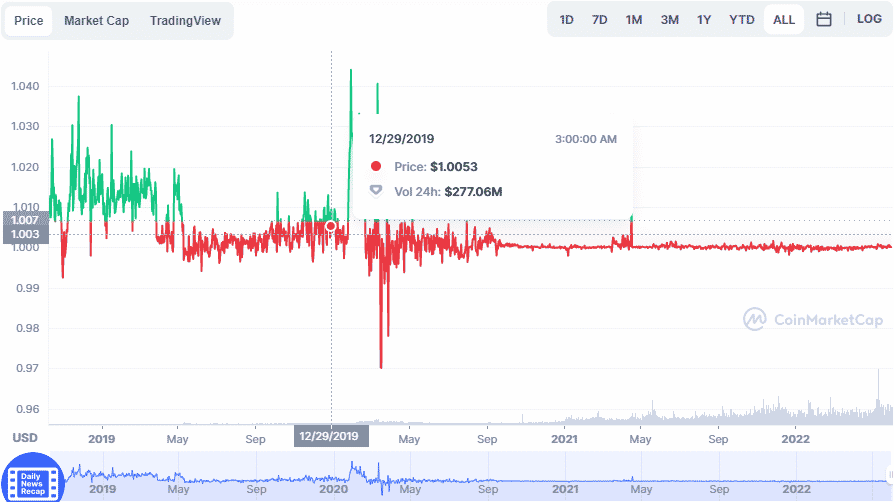

USDC chart

The global market appetite for decentralized finances is on the rise. As such, the global demand for DeFi coins is on the rise. First among these coins is the USD coin and a dollar-pegged cryptocurrency. A brainchild of Coinbase and circle, a global accounting firm for regular auditing, has resulted in regulatory compliance, paving the way for global expansion and acceptance of this coin across other applications, blockchain networks, and businesses. To erode the artificial economic borders globally, this coin is expected to continue holding its own as the globe becomes an all-inclusive marketplace, facilitating everyday payments, peer-to-peer transactions, and borderless commerce.

This stablecoin, with regulatory acceptance, is currently trading with a 24-hour volume of $5.67 billion. It has a market cap of $53.97 billion, with all of the available 53.97 coins in circulation.

Final thoughts

Since the introduction of the first crypto, this market has proven to be highly volatile. This necessitated stable digital assets that provided a hedge in highly volatile markets. Stablecoins fill this role and allow for more digital asset trading, providing liquidity to the crypto market. These five stablecoins have the fundamentals, community backing, and actual physical assets that provide a hedge against the highly volatile crypto markets.

Comments