In times of economic uncertainty, commodity prices go up, especially those with store of value as a feature. Globally, gold and silver are metals accepted as universal stores of value. The problem of commodities as an investment is the considerable initial investment capital and storage requirements.

There is also a considerable investment in security for their safekeeping regarding precious metals. Due to all these factors, the commodity ETFs market developed, allowing investors to have a stake in the commodity market without holding them physically.

As such, silver ETFs expose investors to the silver market. With 3x silver ETFs, they expose investors to the leveraged silver markets.

What are leveraged silver ETFs?

Conventional silver ETFs are organizations in the silver value chain, from silver mining and exploration to silver utilization for industrial purposes and ancillary services organizations. In contrast, leveraged ETFs comprise pools of futures contracts and derivatives that ensure daily amplified results to the tracked index.

Leveraged silver ETFs to watch and buy

Silver is a great commodity to hedge against volatility. If the recent sell-offs and unprecedented bullish runs are anything to go by, equity markets will be highly volatile in the post coronavirus pandemic.

The only challenge with silver is that it is a byproduct metal of base metals hence not entirely under the conventional demand and supply rules. It is more volatile than other precious metals, providing opportunities for day traders to make money. The 3x silver ETFs below are in a great position to utilize these volatilities.

№ 1. ProShares Ultra Silver (AGQ)

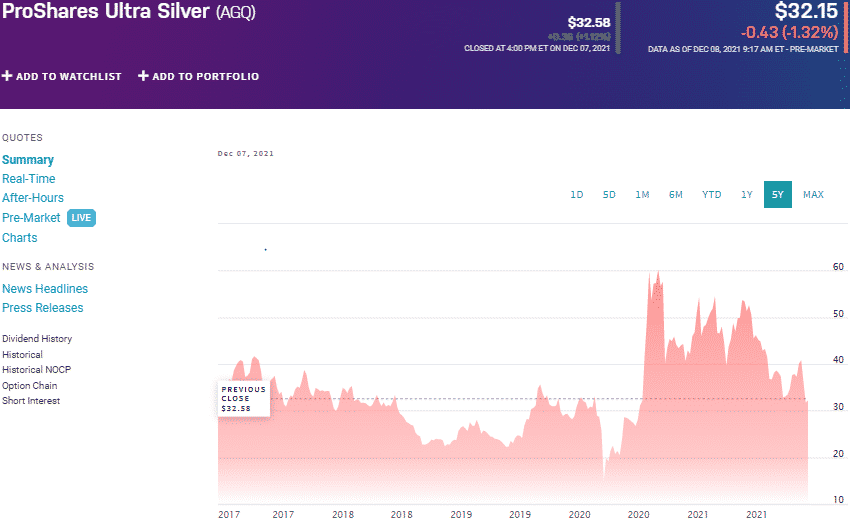

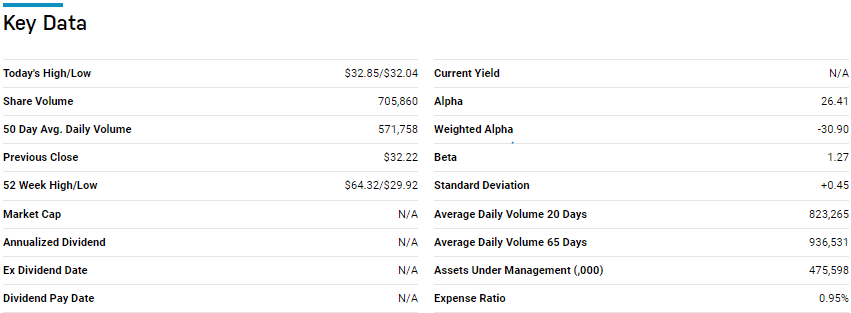

Price: $32.15

Expense ratio: 0.95%

AGQ chart

The ProShares Ultra Silver ETF seeks the returns of the Bloomberg Silver SubindexSM twice daily. This leveraged silver ETF does not hold or invest directly in any commodity. It invests under the fund manager’s discretion in any combination of the following financial instruments of its composite index; future contracts, swap deals, options, and future agreements.

AGQ ETF boasts $475.5 million in assets under management, with an expense ratio of 0.95%. Even with the compounding effect of leveraged ETF, the AGQ ETF has 3-year returns of 39.89% shows it can make phenomenal returns in volatile markets.

№ 2. ProShares UltraShort Gold (ZSL)

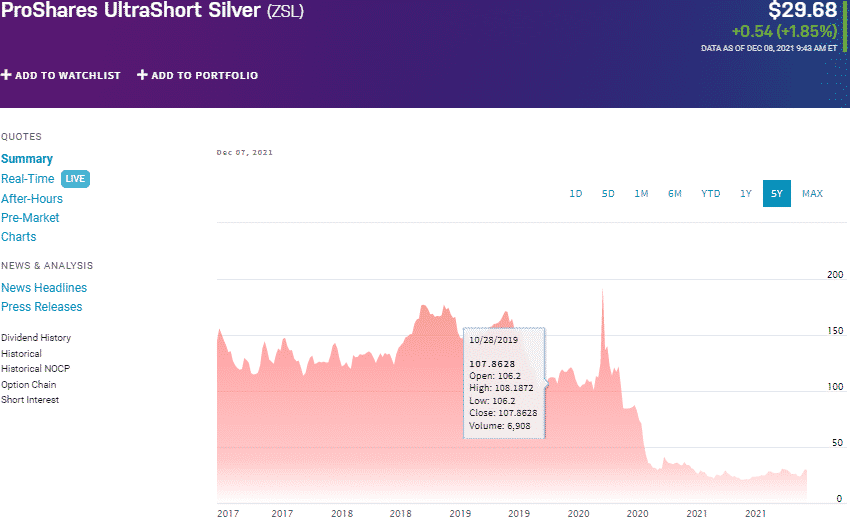

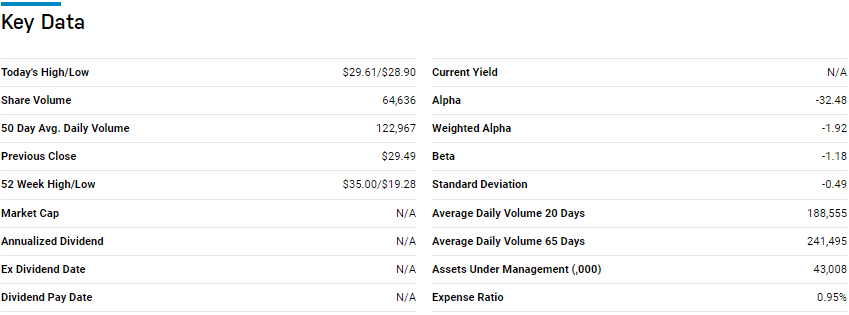

Price: $39.68

Expense ratio: 0.95%

ZSL chart

The ProShares Ultrashort Silver ETF seeks the returns of the Bloomberg Silver SubindexSM twice daily. It invests 95% of its resources in its composite index financial instruments; future contracts, swap agreements, options, and forward agreements.

The ZSL ETF has $43 million in assets under management, with investors having to part with $95 annually for every $10000 investment. Despite the compounding effect of leveraged ETFs, the ProShares Ultrashort Silver ETF has a year-to-date return of 6.35%, putting a strong case for consideration when playing off bearish silver volatility.

It has also been ramping up returns for those that dare to invest in it; 3-months returns of 15.45% and 1-month returns of 14.54%.

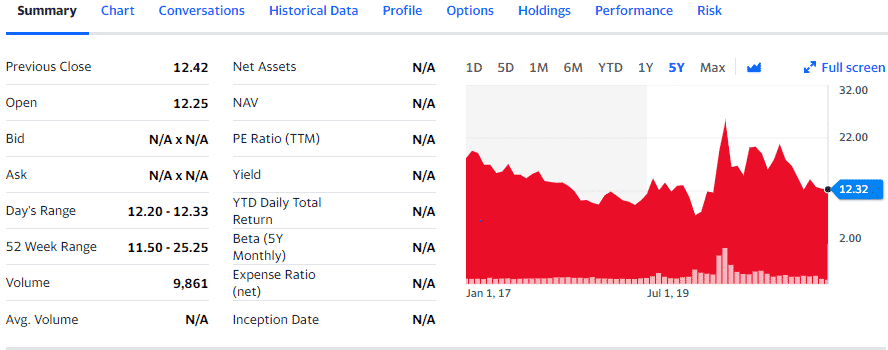

№ 3. BetaPro Silver 2x Daily Bull ETF (HZU)

Price: $12.46

Expense ratio: 1.37%

HZU chart

The BetaPro Silver 2x Daily Bull ETF seeks the Solactive Silver Front Month MD Rolling Futures Index returns twice daily. At the discretion of the fund advisor, it invests in varying financial instruments that will resort to twice the returns of the tracked index daily.

With the slide in the dollar value, economic uncertainty, and rising inflation, the HZU provides an avenue to make extra bucks in bullish markets. In addition, despite the compounding effect, this leveraged silver ETF has had positive returns over the last three years, 10.63%. The only negative is that to trade this ETF, and one has to go through the Toronto exchange since it is not yet listed with the New York Stock Exchange.

Final thoughts

In the short term, all global news touching on the mining sector, inflation, and currency valuation affect the price of silver just like they do the price of gold. Termed as the poor man’s gold, silver provides an alternative to holding gold as a store of value in the uncertain economic environment.

However, silver prices are at the mercy of the demand and supply forces of the base metals. It is a byproduct off. Trading silver requires some savviness, making trading leveraged silver ETFs even more difficult than other leveraged ETFs.

Therefore, leveraged silver ETFs are for experienced traders and require constant monitoring due to their daily resetting feature and compounding effect. They should only be used as daily trading instruments to take advantage of short-term market volatilities.

Comments