The UK economy is among the top global economies and one of Europe’s big players. However, just like all investment markets, picking individual stocks is troublesome. As such, the hassle-free way of investing in the UK economy and avoiding the volatility of individual stocks is through exchange-traded funds.

Therefore, UK ETFs expose investors to the entire UK economy or a section of the UK economy at a relatively low cost and lower investment risk.

What is the composition of UK ETFs?

An ETF is an investment vehicle made up of a basket of like economic characteristics investment assets. As such, UK ETFs comprise organizations operating in the UK; those that invest at least 70% of their total assets or generate at least 75% of their revenues from the UK economy.

There are European and US exchange-traded funds with exposure to the UK economy, but we look at the ETFs with a biasness to the UK equity market.

Top 7 UK ETFs

UK ETFs might not have the popularity of Wallstreet exchange-traded funds or the phenomenal returns of Chinese ETFs. However, they still give investors geographical portfolio diversification and access to one of the oldest economies in the world.

The top seven ETFs giving investors exposure to the UK equity market are as follows.

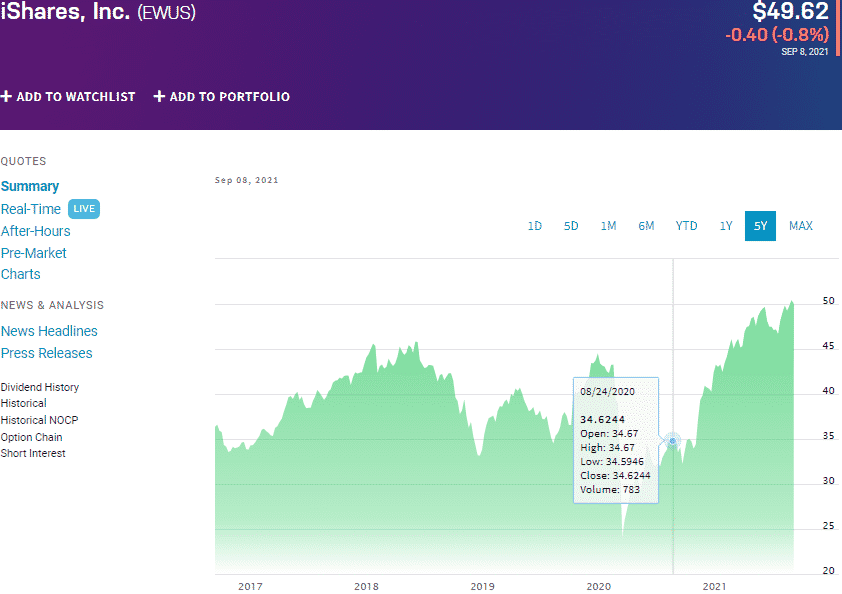

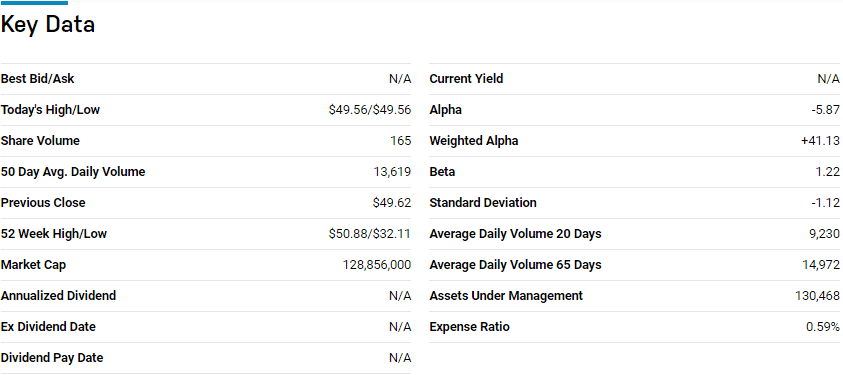

UK small-cap market: iShares MSCI United Kingdom Small-Cap ETF (EWUS)

Price: $49.62

Expense ratio: 0.59%

EWUS chart

Some of the most outstanding equities to invest in are small-cap equity organizations due to their legroom for growth. The downside is that they are highly volatile equities that can easily lead to financial ruin.

Blackrock Financial Management has provided the iShares MSCI United Kingdom Small-Cap ETF to overcome this dilemma while investing in the UK small-cap equity markets. The EWUS tracks the MSCI United Kingdom Small Cap Index, investing at least 80% of its assets in the underlying holdings of its composite index.

In its portfolio, the top three holdings are Intermediate Capital Group – 1.54%, Smith PLC – 1.43%, and Rightmove PLC – 1.41%.

The EWUS ETF has $129.11 million in assets under management, with an expense ratio of 0.59%. In the last five years, it has recorded returns of 51.86%, with the three-year returns standing at 29.17%. With pandemic year returns of 47.02% and current year-to-date returns of 18.04%, this UK small-cap ETF offers excellent post-pandemic investment opportunities as the UK economy recovers.

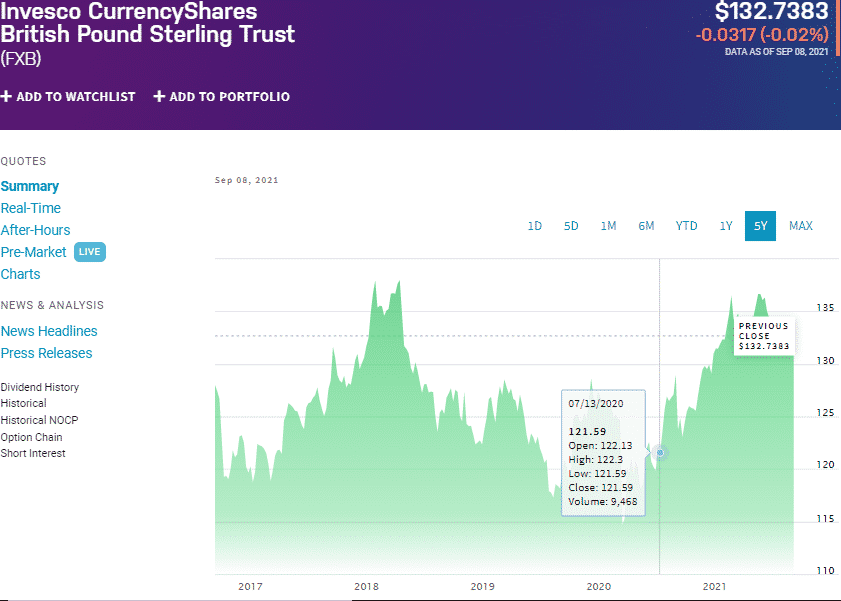

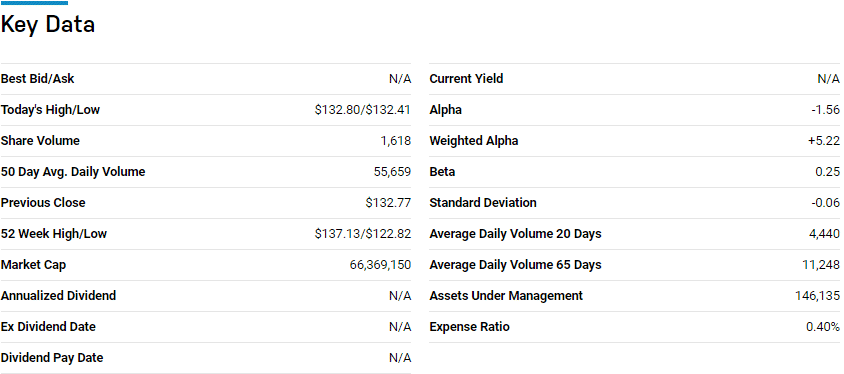

UK currency ETF: Invesco CurrencyShares British Pound Sterling Trust (FXB)

Price: $132.74

Expense ratio: 0.40%

FXB chart

The objective of the Invesco CurrencyShares British Pound Sterling Trust Fund is to track the Pound’s performance after expenses. The FXB, therefore, holds pounds, the official currency of the UK, in a deposit account, which allows for closer tracking of the GBP/USD spot exchange, exposing investors benefits similar to having the pound.

The FXB also provides an avenue for investors in the UK economy to hedge against currency fluctuation and the subsequent loss in earnings.

The FXB has $145.62 million in assets under management, with an expense ratio of 0.40%. Despite the ravages of the coronavirus on the UK economy, the FXB held steady to close the pandemic year with a 5.05% return. Couple this performance to 3-year and 5-year returns of 5.87% and 1.85%, respectively, which becomes a tremendous green buck hedge asset.

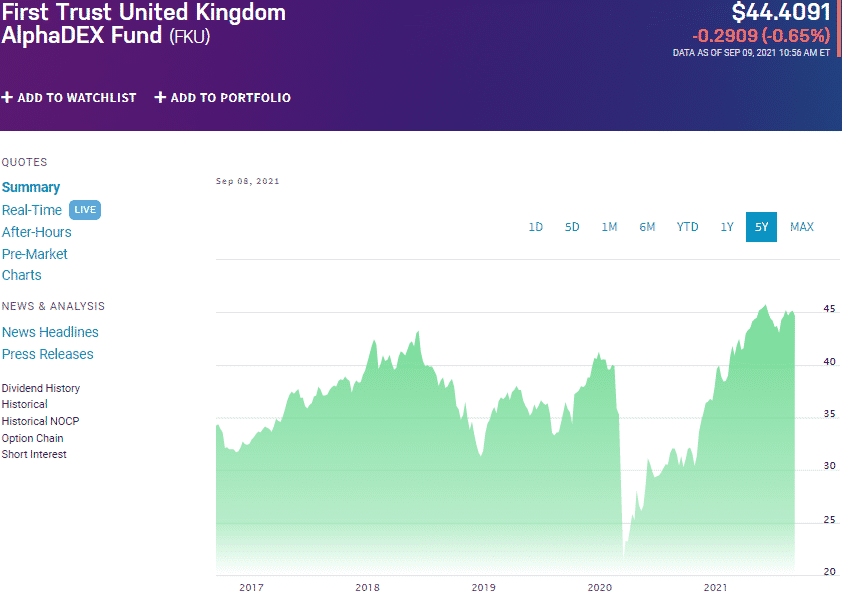

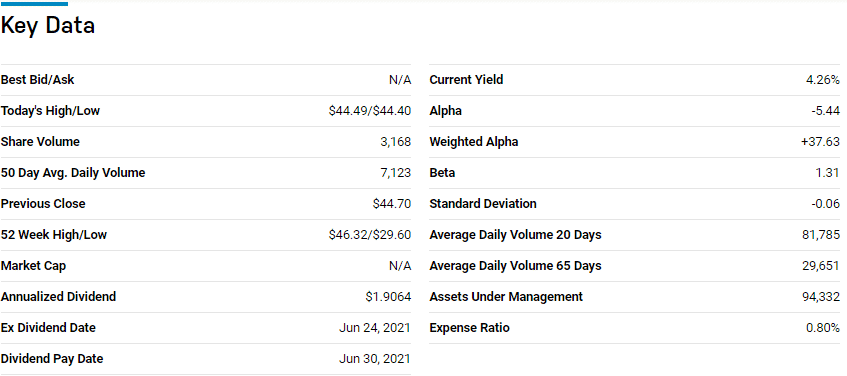

UK consumer discretionary ETF: First Trust United Kingdom AlphaDEX ETF (FKU)

Price: $44.41

Expense ratio: 0.80%

FKU chart

The FKU is not a pure-play consumer discretionary ETF but is biased towards this economic niche, with 30% weighting. The First Trust United Kingdom AlphaDEX® ETF tracks the performance of the NASDAQ AlphaDEX United Kingdom Index, investing at least 90% of its net assets in the underlying holdings of its tracked index.

The FKU fund has $93.41 million in assets under management, with a net expense ratio of 0.80%. Given that the UK economy ranks among the top global consumer markets, coupled with excellent historical returns, this ETF is worth a second look; 5-year returns of 46.21%, 3-year returns of 30.98%, pandemic year returns of 46.04%, and year-to-date returns of 20.39%.

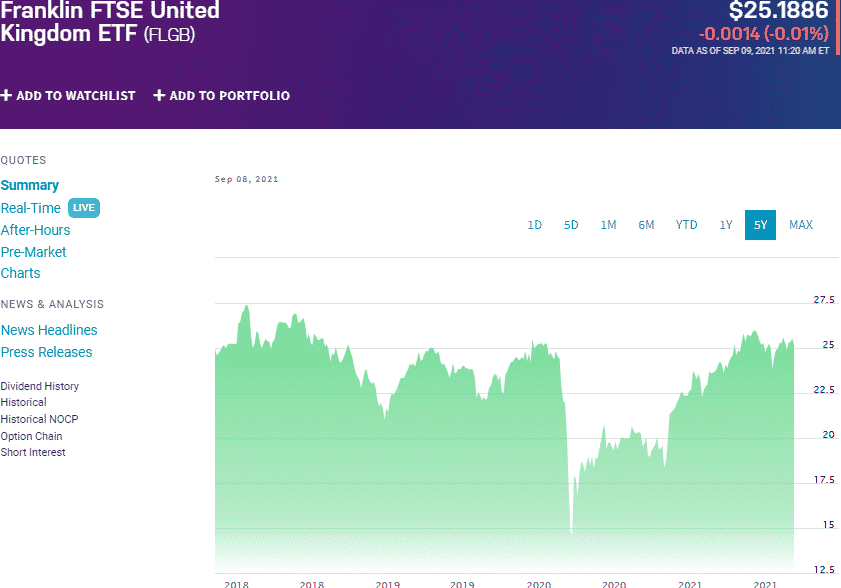

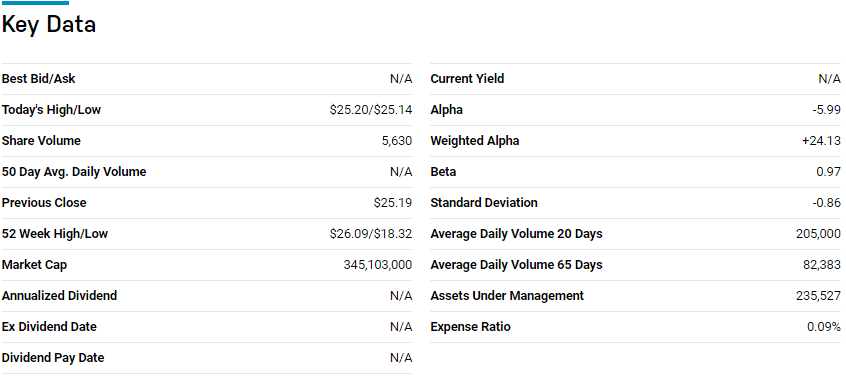

UK industry ETF: Franklin FTSE United Kingdom ETF (FGLB)

Price: $25.119

Expense ratio: 0.09%

FGLB chart

If you want an ETF that has representation from all the sectors of the UK industries, it does not get better than the FB ETF. The Franklin FTSE, United Kingdom ETF, tracks the performance of the FTSE UK RIC Capped Index, investing at least 80% of its net assets in the underlying holdings of its tracked index.

An evaluation of the global miscellaneous ETFs by US News analysts has the FGLB ranked №1.

The FLGB has $344.27 million in assets under management, with the lowest expense ratio among UK ETFs of 0.09%.

Launched on 2nd November 2017, the three-year returns of 15.52% and pandemic returns of 32.56% call for a closer look, given the year-to-date returns of 14.68%.

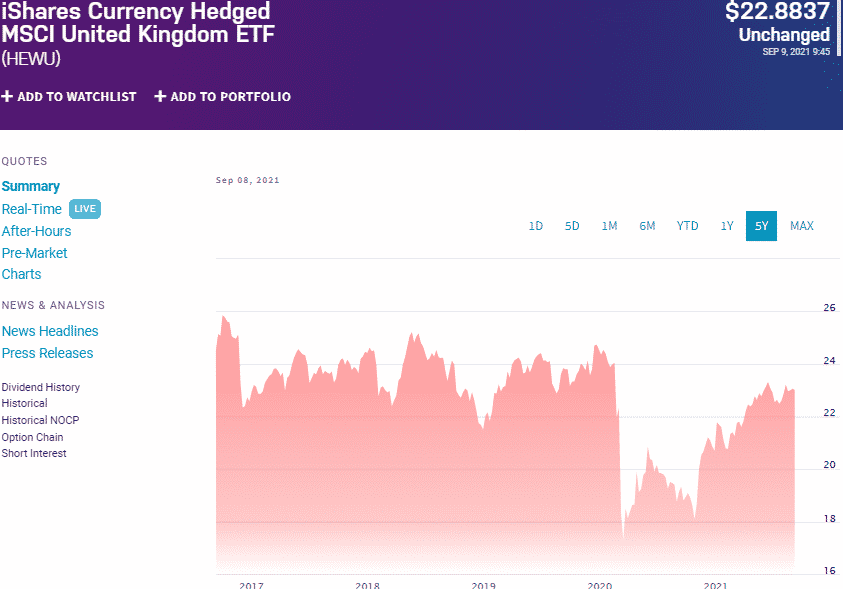

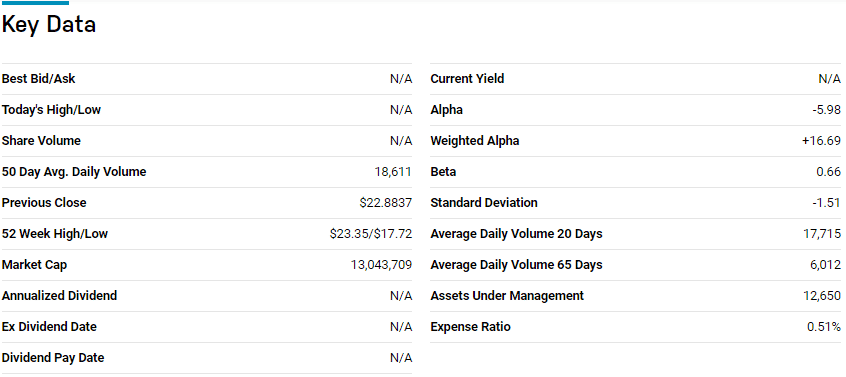

UK currency hedged ETF: iShares Currency Hedged MSCI United Kingdom ETF (HEWU)

Price: $22.88

Expense ratio: 0.70%

HEWU chart

The iShares Currency Hedged MSCI United Kingdom Fund provides investors with an asset that reflects the green buck value in the British Pound by tracking the MSCI United Kingdom 100% Hedged USD Index. It protects the London Stock Exchange investments by hedging them monthly to the US dollar.

In its portfolio, the top three holdings are AstraZeneca PLC — 7.13%, Unilever PLC — 6.08%, and Diageo PLC — 4.65%.

The HEWU has $12.59 million in assets under management, with an expense ratio of 0.51%. With 5-year returns of 25.84%, 3-year returns of 9.27%, pandemic year returns of 24.25%, and year-to-date returns of 13.37%, this exchange-traded fund is worth holding if interested in UK firms with inherent currency risk.

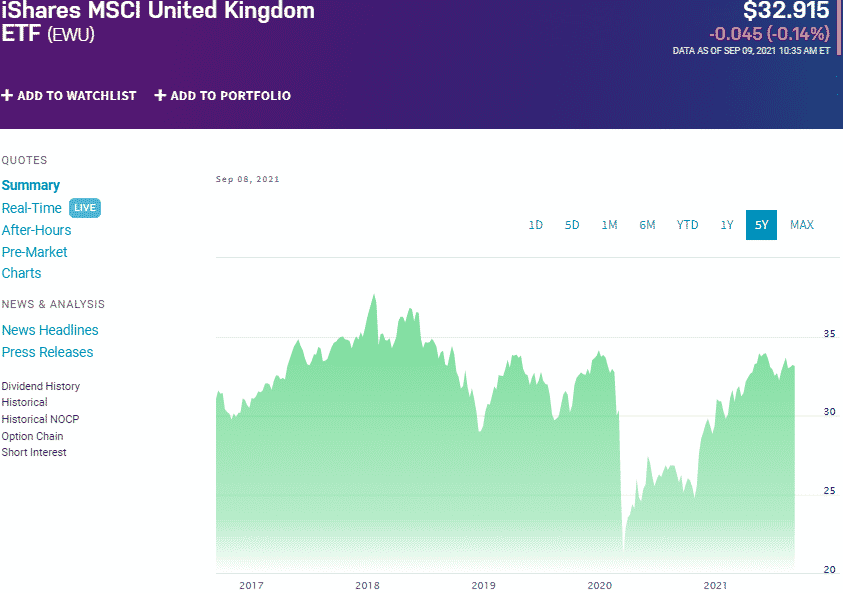

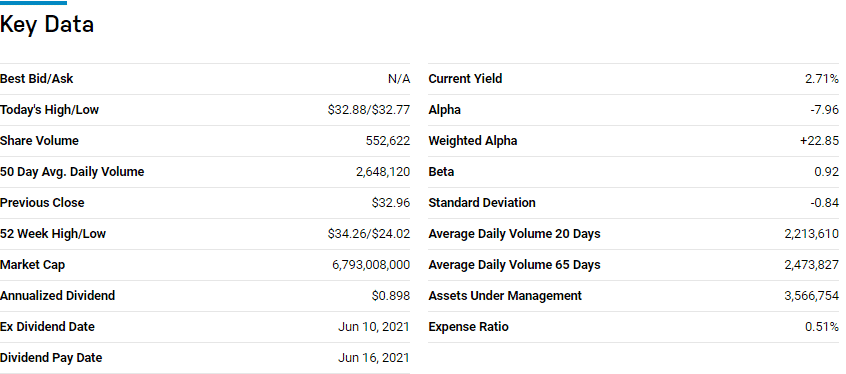

UK blue chip equity market: iShares MSCI United Kingdom ETF (EWU)

Price: $32.92

Expense ratio: 0.51%

EWU chart

The oldest and most popular pure-play UK exchange-traded fund, the EWU exposes investors to the best blue-chip companies in the UK equity market. It is a non-diversified fund tracking the MSCI United Kingdom Index, investing at least 80% of its assets in the underlying holdings of its composite index.

In its portfolio, the top three holdings are AstraZeneca PLC – 7.13%, Unilever PLC – 6.08%, and Diageo PLC – 4.66%.

The EWU ETF boasts $3.54 billion in assets under management, with an expense ratio of 0.51%. In the last five years, it has recorded returns of 22.98%, with the three-year returns standing at 11.96%.

With pandemic year returns of 31.14% and current year-to-date returns of 14.43%, this UK blue-chip heavy ETF offers an excellent post-pandemic investment opportunity as the UK economy recovers.

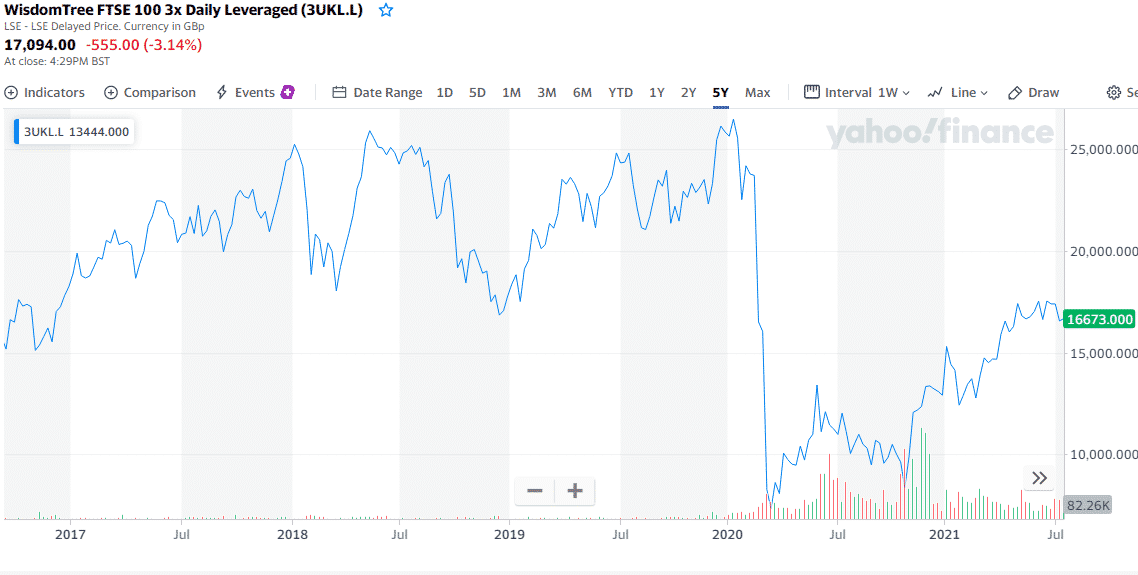

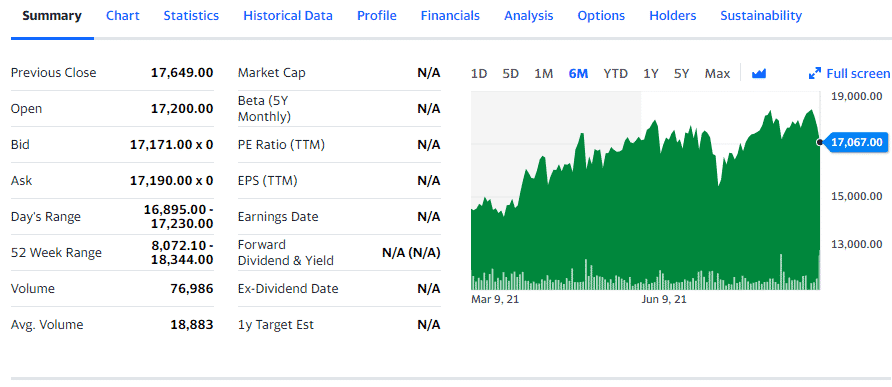

The best UK leveraged ETF: WisdomTree FTSE 100 3X leveraged fund (3UKL.L)

Price: $17.07

Expense ratio: 0.75%

3UKL.L chart

The WisdomTree FTSE 100 3X the leveraged fund tracks the performance of the FTSE 100 Daily Super Leveraged RT

TR Index. Its objective is to offer investors thrice the daily returns of the FTSE 100 Net Dividend TR Index.

Through this non-diversified leveraged ETF, investors get exposure to the top 100 UK large-cap companies. It gives them a chance to make amplified results off the daily volatility in the UK economy.

Unlike other leveraged ETFs, this collateralized leveraged fund has $48.47 million in assets under management and an expense ratio of 0.75%. These leveraged ETFs can amplify your incomes in short UK volatility markets with compounded pandemic daily average returns of 77.34% and year-to-date returns standing at 40.48%.

Final thoughts

The UK economy is one of the largest globally but experienced significant contraction due to the Covid-19 pandemic. The vaccine rollout has seen the UK economy gain traction on its way to full economic resumption on the mass UK populace accepting the vaccine. The ETFs above give investors access to the UK economy and a chance to make money off its resurgence post-pandemic.

Comments