The foremost cannabis industry analyst, BDS analytics, forecast a 20% year-on-year growth of the North American cannabis industry.

The most significant part of the North American cannabis industry goes to the US, but this is only possible because of the spread of recreational marijuana across the states, which is only possible because of the 2018 Canadian legalization of recreational marijuana. This single act set a precedent for the phenomenal growth of the recreational marijuana niche and the entire global cannabis industry.

Since that fated day in 2018, the Canadian marijuana industry has experienced exponential growth; a 10% average annual increase in the number of medicinal marijuana prescriptions, a 16% average yearly growth in the cannabis oil niche market, and a 6% average yearly growth in the sales of dried marijuana.

BDS Analytics forecast a 26% year-on-year growth of the Canadian cannabis industry. To put this into perspective, in 2020, cannabis stores recorded sales of $2.6 billion, with 2021 sales projections being $4 billion.

Overview of the Canadian cannabis ETF market

Whereas other economies are still trying to figure out the role of the cannabis industry, Canada has an already well-established industry that is ripe for money minting. The industry is in a stage where it is experiencing cannabis-related IPOs almost monthly, with organizations keen to make profits from this emerging market.

The problem with emerging markets and the marijuana niche is that the legal framework has not matured. As such, the industry is highly dynamic, resulting in very volatile cannabis equities. So, is the Canadian cannabis market a good investment niche? Yes!

Individual stocks might be too volatile for risk-averse investors or don’t have the time to keep on rebalancing their cannabis portfolio. The good news is that there are exchange-traded fund choices that not only caution against this inherent volatility of emerging markets but diversifies a portfolio further and reduces the overall portfolio risk. Canadian ETFs comprise a basket of organizations in the cannabis supply chain, from farm equipment and machinery to dispensing stores.

The best dividend ETFs for Q4 2021

Since the legalization of cannabis in 2018 in Canada, the global community has experienced an unprecedented opinion change on pot matters. More and more countries are looking at Canada as a reference for their marijuana legislation, having seen the medicinal benefits and its impact on the economy.

Despite all these positive milestones, this industry is still in its infancy, with market participants experiencing fluctuation in the modus operandi and, as a result, equity volatility. The beauty of the Canadian cannabis industry is that the federal frameworks are robust enough to encourage the sector’s expansion, unlike the US cannabis industry, which is still grappling with the ideal legalities for growth and expansion.

Having partnered with Germany and other European powerhouses to do extensive marijuana research and help set a framework for its legalization in the partner companies, the Canadian pot industry is in for a significant high. The following three Canadian marijuana ETFs can accrue massive gains by taking advantage of marijuana cultivation and distribution growth.

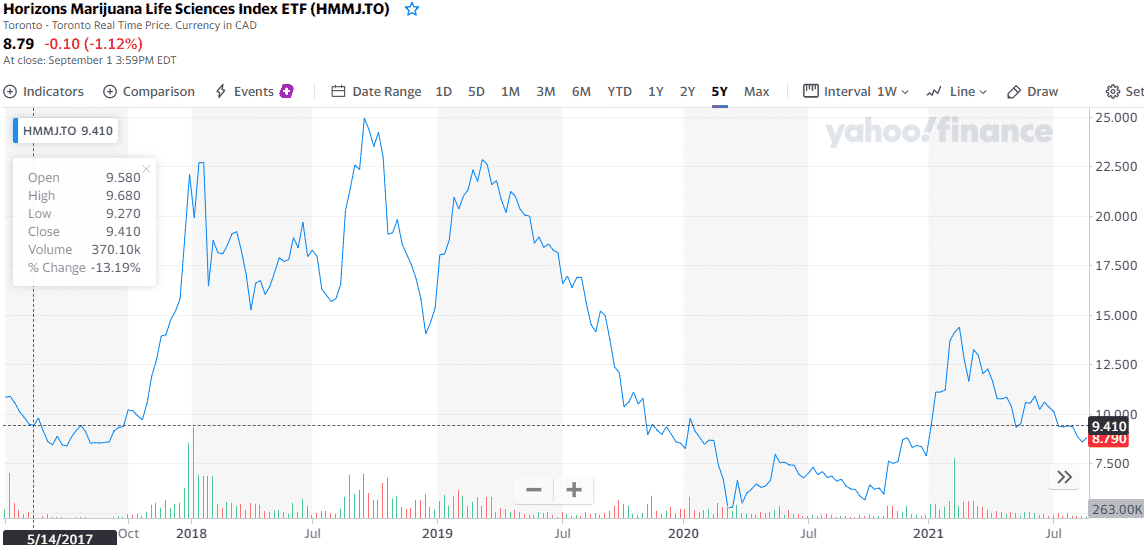

№ 1. Horizons Marijuana Life Sciences Index ETF (HMMJ)

Price: $8.79

Expense ratio 0.75%

Horizons Marijuana Life Sciences Index ETF

The HMMJ is the oldest marijuana ETF. There are two versions of this exchange-traded fund, with the difference being in the base trading currency, the green buck and the Canadian dollar. It tracks a North American Marijuana Index, which Solactive AG provides.

It follows the performance of organizations based in North America with significant revenues from the cannabis industry, marijuana cultivation/distribution, hydroponics and farm equipment companies supplying the cannabis industry, and biotech companies involved in the research and development of cannabis products.

The top three companies in this ETF are Aurora Cannabis Inc. with16.6% weighting, Canopy Growth Corp. with a weighting of 14.8%, and Aphria Inc. with an 11.6% weighting.

This actively managed ETF has $410.04 million in assets under management, with an expense ratio of 0.75%. With a dividend yield of 2.03%, this ETF had the potential for huge returns for its investors as the Canadian cannabis industry blossoms.

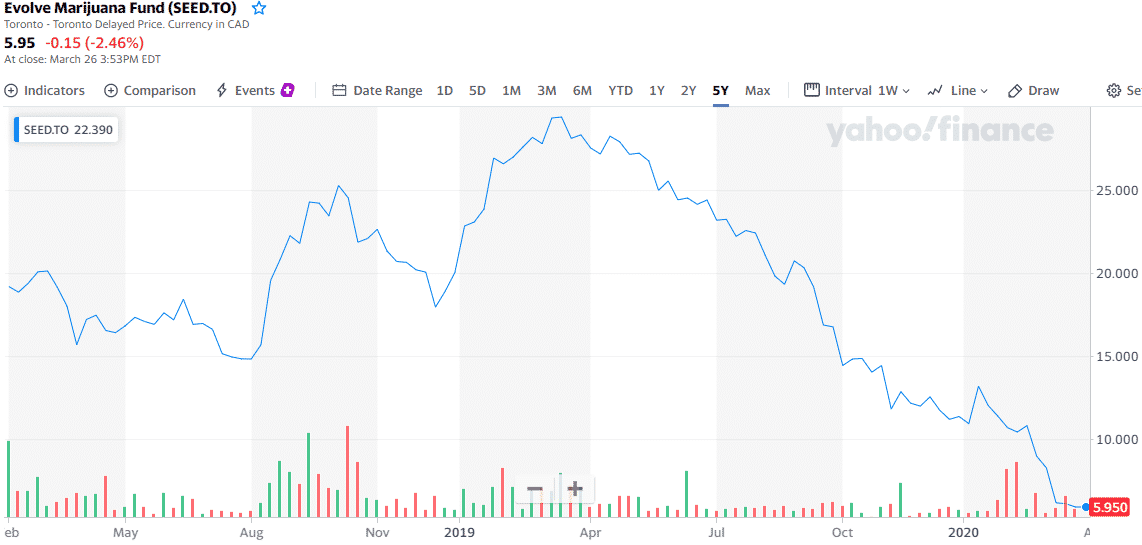

№ 2. Evolve Actively Managed Marijuana ETF (SEED)

Price: $5.95

Expense ratio: 1.13%

Evolve Actively Managed Marijuana ETF

SEED is a Canadian marijuana ETF with tentacles hooked into the international marijuana industry. It does not track any particular index but is an actively managed exchange-traded fund with an objective of enhanced flexibility to deal with the volatile cannabis industry. Its interest lies in both the recreational cannabis niche and the medicinal marijuana niche.

The top three holdings of SEED are Green Thumb Industries with 9.3% weighting, Cresco Labs Inc. with a weighting of 8.8%, and Curaleaf Holdings Inc. with a holding of 8.6%.

SEED has $10.04 million in assets under management, with an expense ratio of 1.13%. With active management, this ETF can take advantage of all opportunities in the cannabis industry.

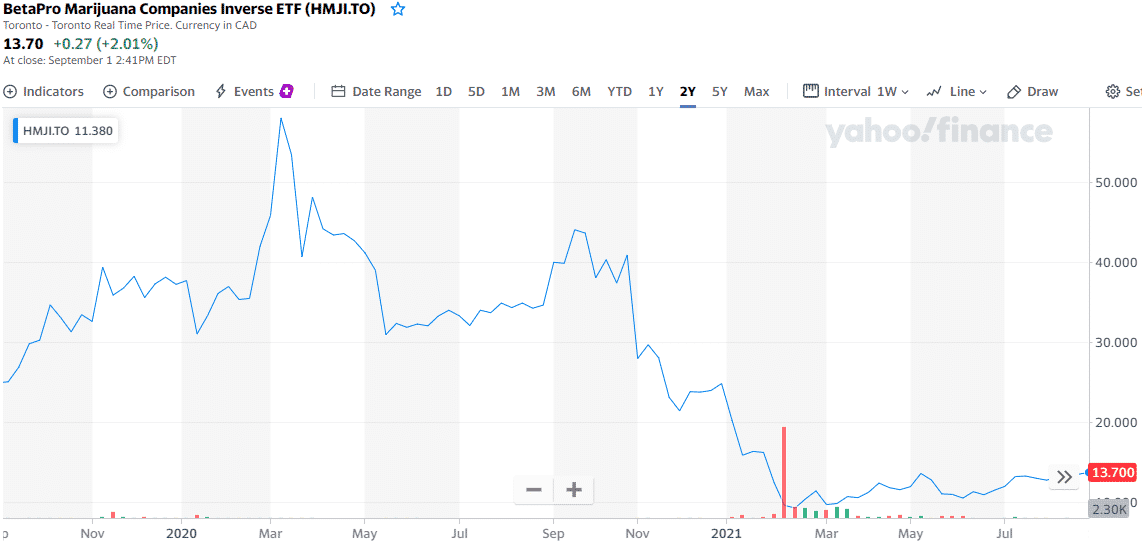

№ 3. BetaPro Marijuana Companies Inverse ETF (ERTH)

Price: $13.70

Dividend yield: 2%

BetaPro Marijuana Companies Inverse ETF

This inverse ETF tracks the performance of the North American MOC Marijuana Index ETF with a view of providing inverse results to the performance of its underlying index.

HMJI has $8.73 million in assets under management, with an expense ratio of 2%. Given the volatility of emerging markets, it is always better to watch an inverse ETF to caution the portfolio in times of market downturn. HMJI is the inverse ETF for gains when the cannabis industry is in decline.

Final thoughts

As more and more countries and specifically the US states legalize medical and recreational marijuana, this niche is bound to explode and experience exponential growth. However, the industry is still in its infancy, with a lot of structured experimentation not to doom the society with opioid addiction.

The fact is that the cannabis industry has proven to be a multi-billion-dollar market with the potential for investors to rake a ton of money. Cannabis ETFs are intelligent to invest in the cannabis industry at a lower risk of a portfolio wipeout from the associated volatility.

When working with sectoral funds, the primary stake is that the accelerated growth of the world economy will lead to a recovery in prices for certain commodities and, possibly, provoke a new price cycle in local markets.

Rather than gamble on economies with no clear cannabis structure, start investing in the Canadian ETFs, which gives you exposure to the global benchmark Cannabis industry.

Comments