Do you plan to invest in a diversified group of assets or a specific industry? If yes, then finding the best online broker and platform for ETFs for trading is the step to take.

To help you handle any surprises that may be coming your way, we’ve created a list of the five best ETF brokers. We’ll cover the features that make them beneficial and guide you on selecting the most suitable one for ETF trading and investing.

Best brokers for ETF trading

Remember to consider a few critical points whenever going through the best brokers for ETF trading.

The ease of use is another crucial factor you should consider whenever making this comparison. Some brokers/platforms are clunky, while others deliver an exceptional user experience.

Don’t forget to check advanced features, like if the broker/platform can run margin trading and supports a live-data application programming interface.

So, which are the best online brokers and platforms for ETFs trading?

TOP 1. TechBerry: Best Automated Social Trading Platform

TechBerry has established itself as a top social trading platform that uses its AI algorithm to gather data from thousands of accounts to formulate the best strategy. Subscribers can rest easy similar to ETF investing, but not worry about the drawdown because the Infinite plan reimburses up to 100% of their losses. It supports several reliable forex fund management funds that are regulated by authorities such as the FCA, CySEC, FSA, CFTC, etc.

techberry.onlineThe service includes real-time trade monitoring to witness the average monthly gains of 11.2% and minimal drawdowns. FIDC banks cover the insurance for funds, making it a highly reputable and trustworthy social trading broker. There are six types of packages, including a free trial. Each varies in reimbursements, deposits, service fees, etc. Subscribers can use a plan configurator on the website to calculate their gains.

Highlights

- Free trial period for 14 days.

- Assistance through a personal manager to answer your inquiries.

- Funds are insured by providing up to 100% reimbursements.

- Get special benefits with custom pricing.

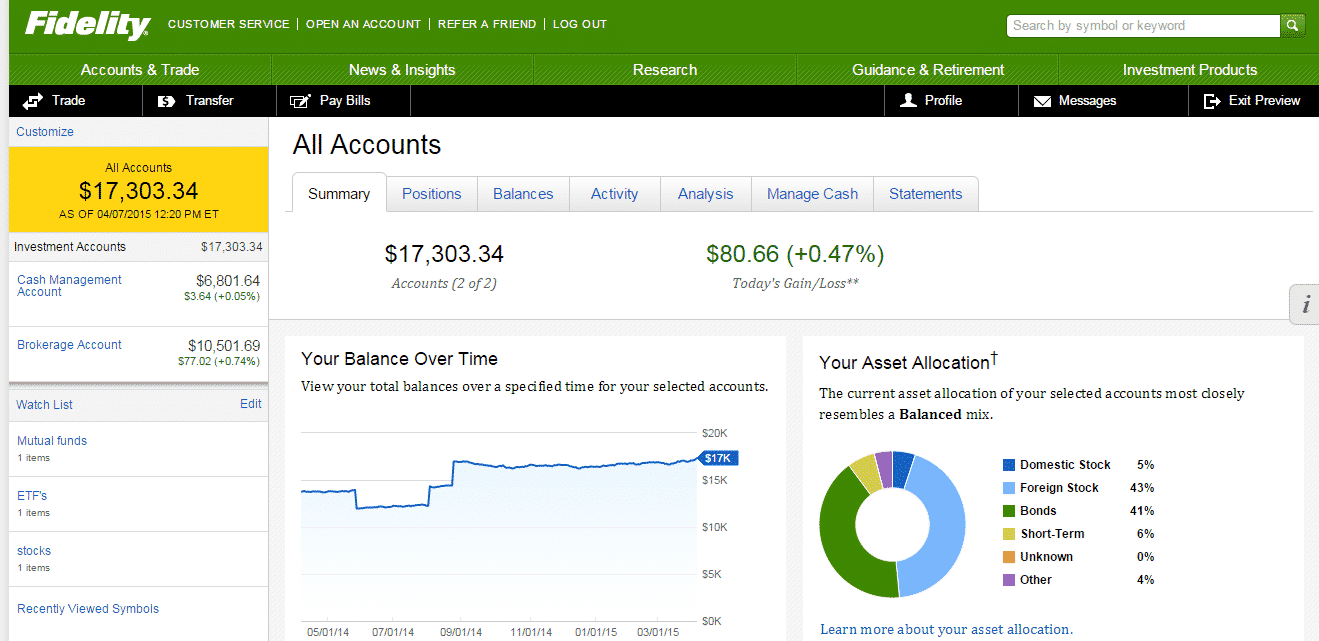

TOP 2. Fidelity: ETF broker for beginners

With Fidelity ETF online broker, you will access a vast range of research tools. You don’t give out any amount to invest in these funds because they don’t charge any expense ratio.

Besides this, Fidelity gives you access to several commission-free ETFs. You’re allowed to put your money in iShares Exchange Traded Funds with zero commission if you can’t locate a Fidelity ETF, suiting your needs.

Fidelity gives you access to over 200 mutual funds as well. It is a top-rated firm for beginners and advanced traders that allows you to invest in what you want and develop a portfolio customized as per your investment program.

Discounts

Depending on the size of your investment, there are several promotions you can qualify for:

- $2,500 Fidelity investments bonus

- 300 free trades if you top up with $50,000

- Apple Gift Card (up to $500)

- IRA match by Fidelity

- 500 free trades for two years if you top up with $100,000

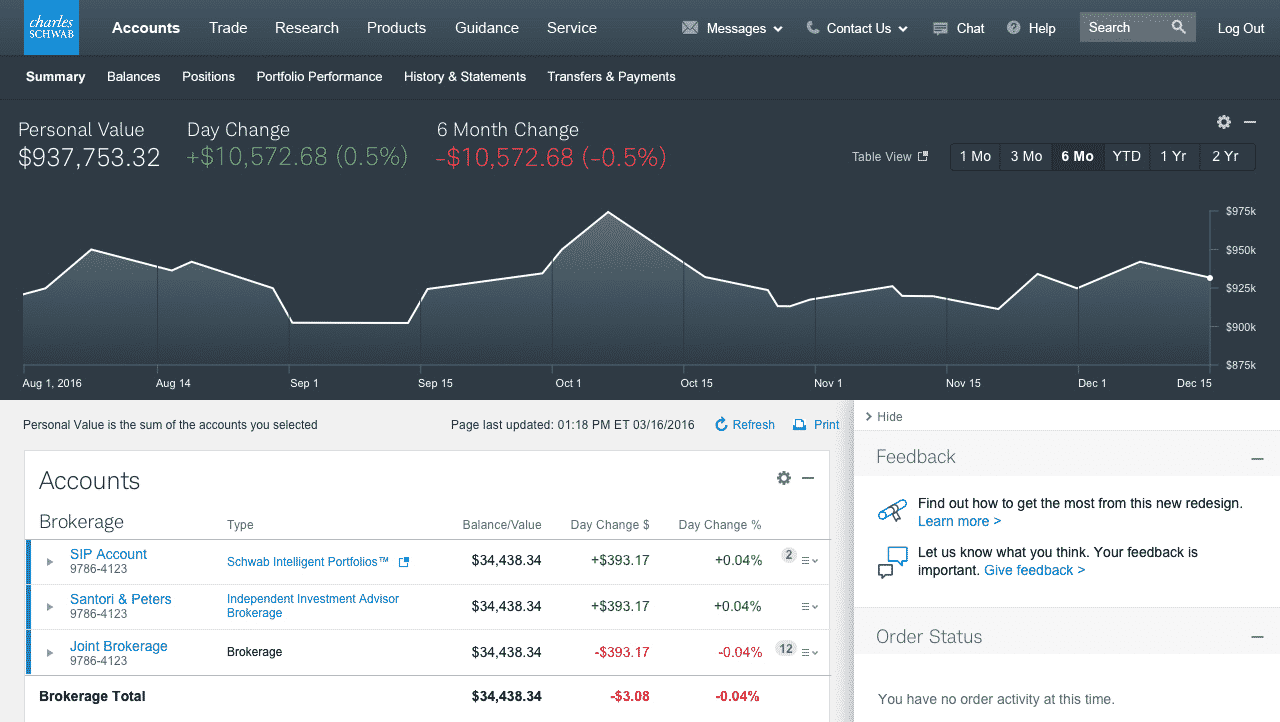

TOP 3. Charles Schwab: ETF online broker advanced traders

Charles Schwab is one of the old-timers of the American financial market, working in banking and trading since 1971. The broker manages its exchange-traded funds and provides trading stocks, futures contracts, and options, has its own products, including ETFs.

The modern investing and straightforward style is what makes Charles Schwab the best overall ETF online broker. Other features making this firm the best choice include providing $0 commission on State Street SPDR funds, Pimco funds, top-tier provider funds, and Invesco funds. Moreover, with Charles Schwab, you’ll have access to free individual stock trades, exceptional customer support, and comprehensive ETFs insights.

Discounts

There are several suggestions for different user activities:

- Receive up to $500 in Charles Schwab bonus with a qualifying deposit

- Referral reward for new customers

- 500 trades commission-free for the first two years with a qualifying deposit of $100,000

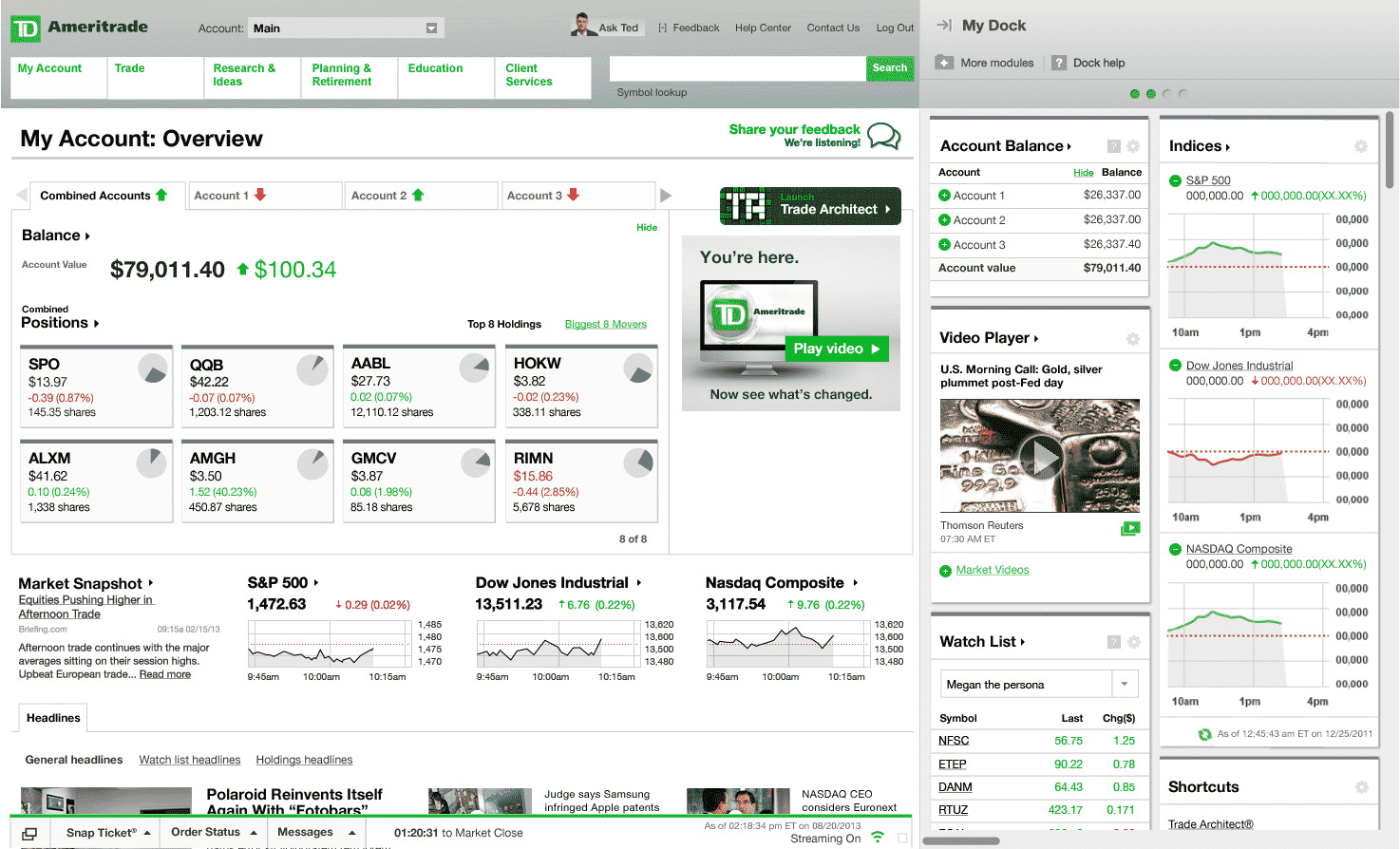

TOP 4. TD Ameritrade: Great trading performance

TD Ameritrade is another top-rated ETF online broker that meets the requirements of beginner investors and active traders. It offers multiple mutual funds, top-notch trading platforms, free commissions on ETF trades, options trades, and online stock. The low-minimum and low-cost funds are other excellent features of the TD Ameritrade ETF online broker.

Besides this, the company offers videos, in-branch presentations, articles, ongoing online seminars, quizzes, and slideshows. It hosts educational webcasts 8 hours per day and holds more than forty live events every year at the local branches. Also, the company provides two primary trading platforms that feature corresponding mobile versions.

Discounts

TD Ameritrade gives you access to different offers, such as:

- $0 commission on online option trades, ETF, and online stock

- Free investor education immediately after opening a TD Ameritrade account

- A chance to conduct online trade stocks for $0 per trade

- Trading on the go using the free TD Ameritrade application

- Building and managing portfolio within one place

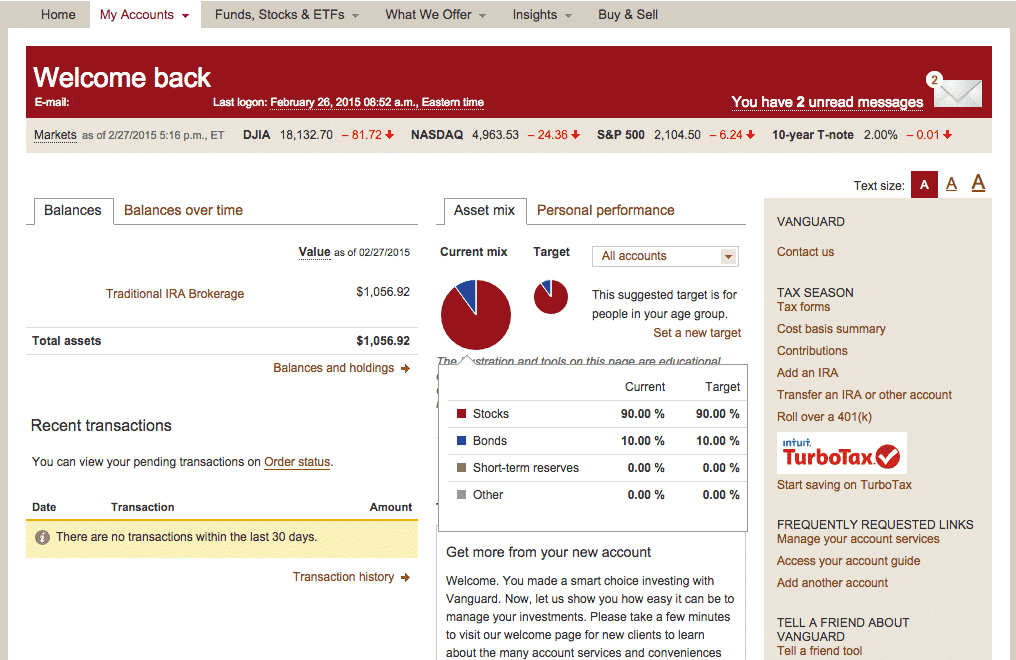

TOP 5. Vanguard: Top choice for long-term investors

Vanguard Group leads when it comes to low-cost investing. This firm provides inexpensive funds to track the market and not beat it. With this ETF online broker, you’ll remain assured of getting an exchange-traded fund dedicated to almost any strategy.

Some of Vanguard’s most popular funds include the Life Strategy funds and Target Retirement Date. It’s these funds that split your investment into bonds and stocks, making it easy for you to adjust the risk amount you’re ready to face.

Another pivotal factor to note is that the Vanguard Group offers its funds in the form of ETFs. With this broker, you can invest in stocks, options trades, CDS, and bonds.

Discounts

- $0 commission on online option trades, ETF, and online stock

- Free account service for voyage clients and Voyage select clients

- Portfolio management and investment professionals for low fees for Voyager clients and Voyager select clients

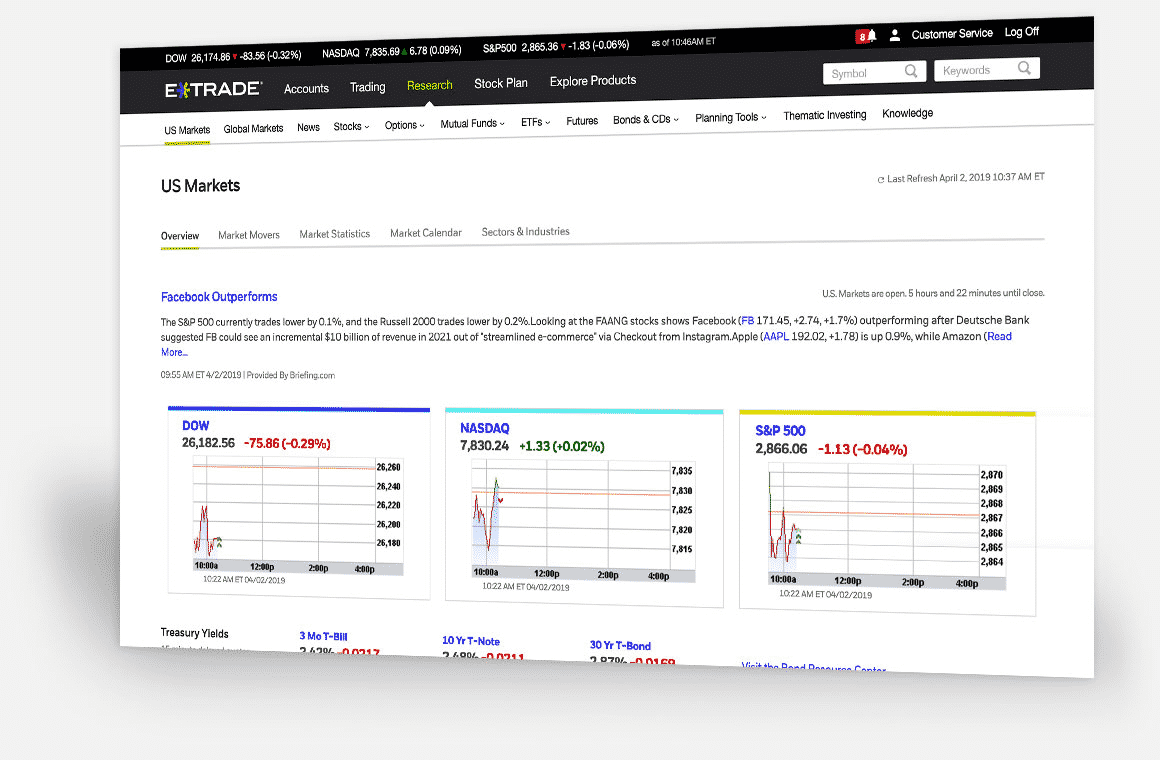

TOP 6. E-Trade: Excellent research/tools

E-Trade was founded in 1982 and is an American stockbroker. It is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). E-Trade is considered safe as it has extensive experience, is listed on the stock exchange, has a banking background, discloses its finances, and is regulated by top-level regulators.

E-Trade is the ETF online broker to consider if you’re after one that offers retirement planning help and free commissions. It’s the best broker for research and data, frequent traders, and beginner investors. If you’re an active trader, you will enjoy the broker’s fee commissions for all options trades, stock, and ETF.

In-person customer support is another top-notch feature offered by E-Trade. Besides this, the company allows you to enjoy exceptional customer service via live chat, email, and phone at any time of the week.

Discounts

- $0 commission on online option trades, ETF, and online stock

- $0 monthly fee

- Low opening deposit

- Volume discounts for an active trader

Conclusion

ETF products are stable and promising. Anyone can buy shares, and it is enough to have at least $ 200-300 in his pocket. And you don’t have to take risks: professional advice from employees of brokerage firms and banks, as well as numerous tools that simplify the analysis, provide 100% transparency — this attracts innumerable investors.

ETFs are also the perfect option contrasted with mutual funds because of the more significant tax efficiency and expense ratios. Besides this, you can trade ETFs easily because the transactions follow procedures similar to those of stocks on restricted exchanges.

ETFs don’t feature short-term restrictions, and you can trade them on margin. They offer plenty of liquidity and intraday investing opportunities. Furthermore, with the several optionable ETFs, it means you can control your portfolio-related risk with the help of derivatives. In general, ETFs allow you to polish your trading strategy and maximize the several speculative opportunities they expose you to.

Investment strategy

Before proceeding with a broker’s choice for ETF trading, we need to determine the future investment strategy precisely, or rather, what will be your investment style — passive or active. This is because some brokers provide the best conditions for passive investors while others are for active ones.

Passive style

The passive style is based on the classic ‘buy and hold’ investment approach. Passive investors rarely buy securities, but aptly and, as a rule, make no more than a couple of transactions every 2-3 months. And for passive investors to bring more income, some brokers, in addition to commissions for trades, add monthly commissions to their tariffs. Thus, if you plan to invest in a passive mode, first of all, you need to choose a broker in whose tariff conditions there are no monthly commissions — since their number is growing every year.

Active style

The active style implies the performance of several transactions for the purchase/sale of securities (in our case, ETF fund shares) per month. In this case, it is necessary to pay attention to the commission’s size. When making several trades per month, the prevailing majority of brokers do not charge a deposit fee and an account maintenance fee.

How can I make money investing in ETFs?

In the vast majority of cases, you will be making money investing in ETFs through capital gains. Some ETFs also allow you to receive a share of dividend payments if they track real-world stocks. Let’s take a look at an example.

Let’s say you want to invest in S&P 500 companies. You have a favorable view of the US economy, so you decide to go long. The ETF tracking the S&P 500 — SPY is currently valued at $400 points. You invest $1,000 in SPY through an online broker. So you place a buy order. A few months later, the S&P 500 is now valued 20% higher. You cash out your investments with the online broker of your choice. Your balance will be $1200, and you’ve made a $200 profit.

Comments