At the end of World War 2, Italy was among the poorest countries in Europe. However, just like when hardest hit by the coronavirus, fiscal stimulus and sound monetary policies turned this economy into the second largest industrial producer in Europe.

Similarly, having been among the hardest-hit countries by the Covid-19 pandemic, Italy’s economy expected at a faster rate the expected in 2021, 6.6%, on the updraft of less than anticipated fiscal deficits, export, and consumer spending resumption, and increased investments. Couple EU’s recovery fund for Italy is close to €200 billion, and it is time to consider investing in this European industrial powerhouse by backing the whole economy via these ETFs.

What is the composition of Italian ETFs?

Italian ETFs comprise investment assets solely domiciled in Italy and those with significant assets or drawing significant revenues off the Italian economy. As a result, this includes exchange-traded funds with considerable exposure to the Italian economy, in essence, all those with Italy as part of its top seven country weightings.

Top 7 Italian ETFs

Italy is the third-largest economy in the eurozone, and its manufacturing and industrial sectors have ranked as the second-largest for both niches in Europe. With the Italian government encouraging foreigners to invest via favorable policies for foreign investors, these seven ETFs offer excellent exposure to one of the fastest recovering economies from the coronavirus.

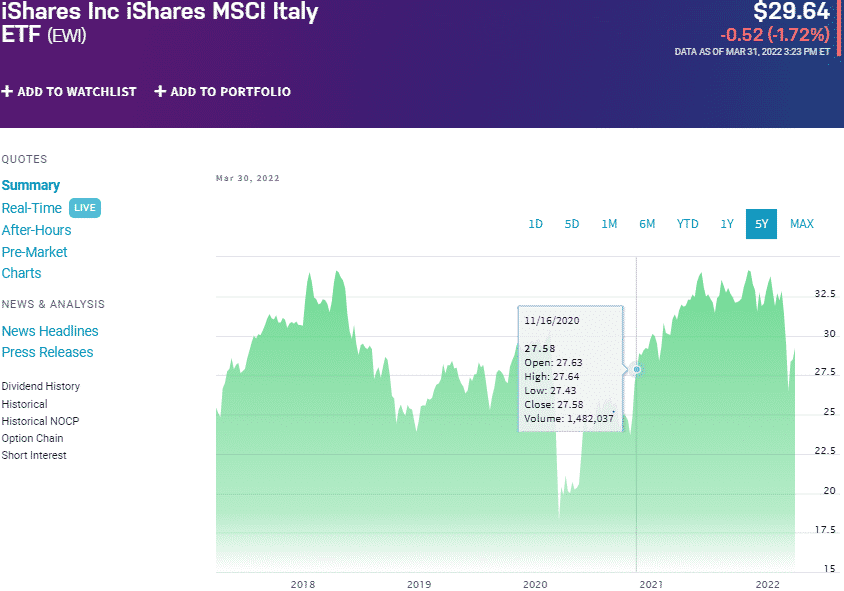

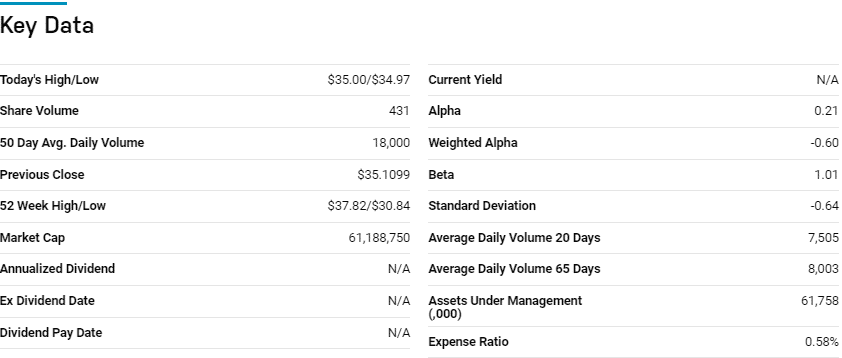

iShares MSCI Italy ETF (EWI)

Price: $29.63

Expense ratio: 0.51%

Dividend yield: 1.91%

EWI chart

iShares MSCI Italian ETF tracks the MSCI Italy Index, investing at least 80% of its assets in the holdings of its composite index, and other investment assets with similar economic characteristics to the composite index holdings. The result is a non-diversified fund exposing investors to large-cap and mid-cap equity segments of the Italian economy.

EWI ETF is ranked № 13 by US News analysts among 78 of the best miscellaneous region funds for long-term investing.

The top three holdings of this fund are:

- Enel SpA – 14.02%

- Intesa Sanpaolo S.p.A. – 10.13%

- Eni S.p.A. – 9.41%

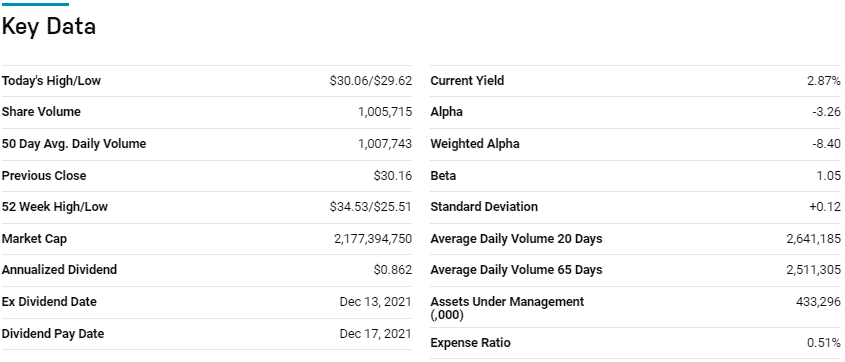

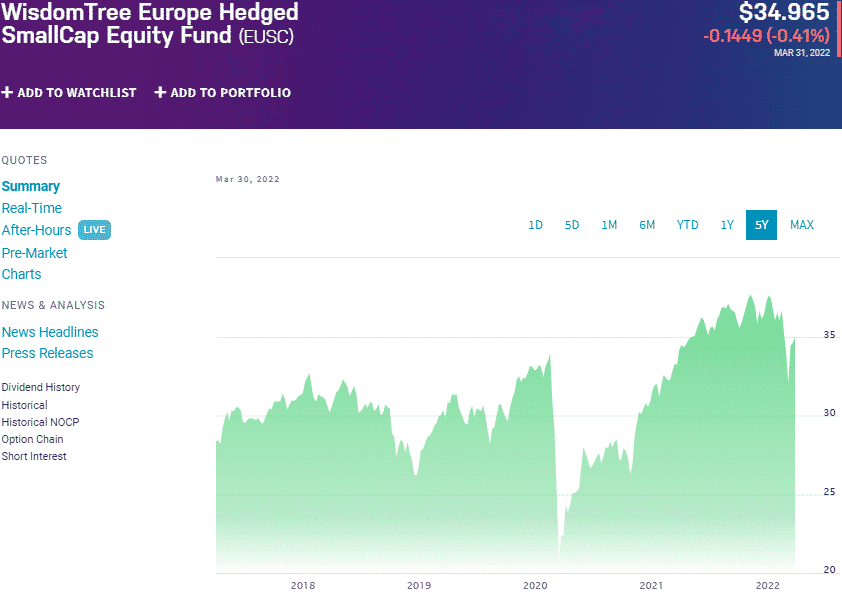

WisdomTree Europe Hedged SmallCap Equity Fund (EUSC)

Price: $34.96

Expense ratio: 0.58%

Dividend yield: 2.47%

EUSC chart

WisdomTree Europe Hedged SmallCap Equity Fund tracks the performance and yield of the WisdomTree Europe Hedged SmallCap Equity Index, net of fees and expenses. It invests at least 80% of its assets in the holdings of the tracked index and other securities exhibiting similar economic characteristics.

The top three holdings of this fund are:

- Enagas SA – 2.26%

- Proximus SA de droit public – 2.03%

- BAWAG Group AG – 1.92%

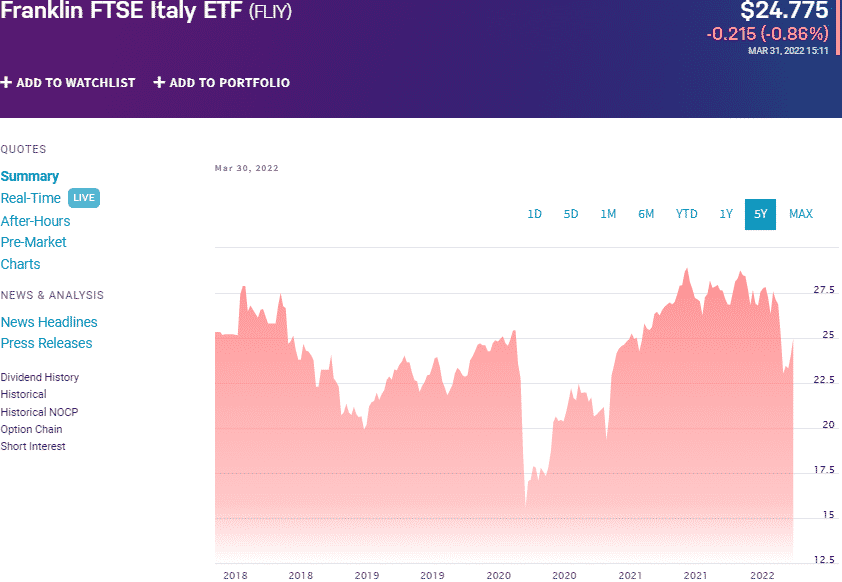

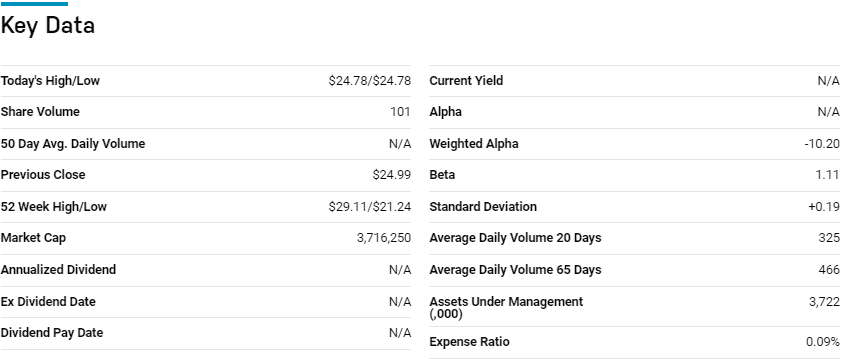

Franklin FTSE Italy ETF (FLIY)

Price: $24.77

Expense ratio: 0.09%

Dividend yield: 2.08%

FLIY chart

Franklin FTSE Italy ETF tracks the performance of the FTSE Italy RIC Capped Index, net of expenses, and fees. It invests, under normal conditions, at least 80% of its assets in the holdings of its composite index and depository receipts representative of the underlying holdings, exposing investors to the best Italian large-cap, mid-cap, and small-cap equity segments.

The top three holdings of this fund are:

- Enel SpA – 11.24%

- Intesa Sanpaolo S.p.A. – 8.72%

- Eni S.p.A.– 7.88%

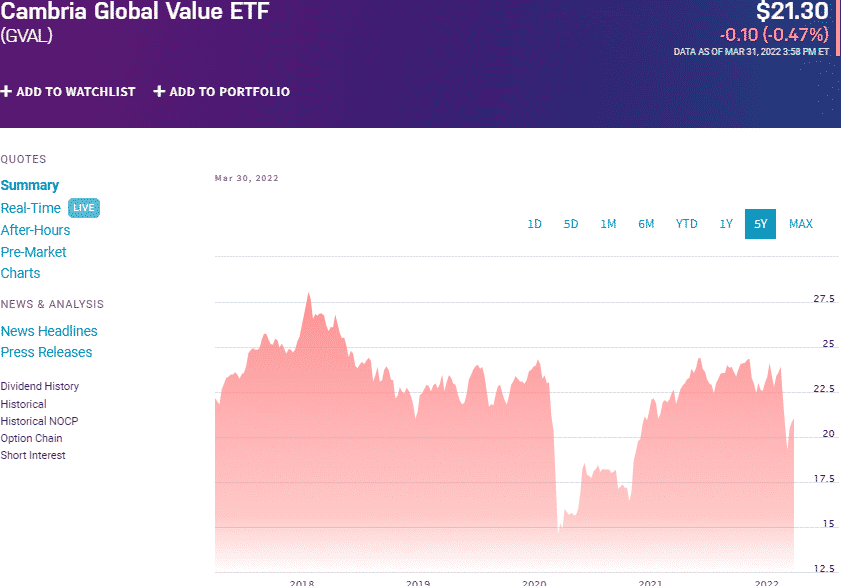

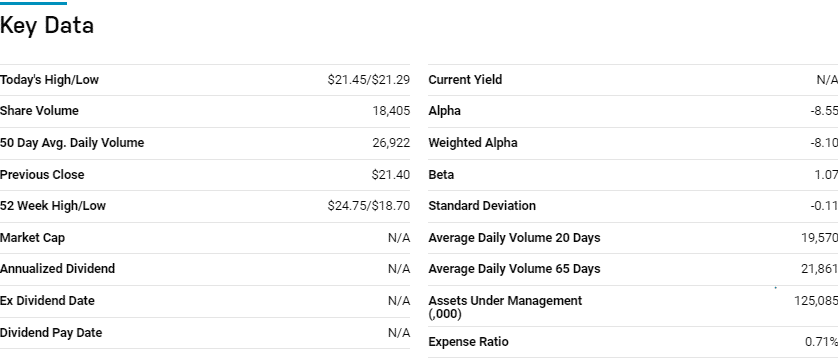

Cambria Global Value ETF (GVAL)

Price: $21.30

Expense ratio: 0.71%

Annual dividend yield: 2.56%

GVAL chart

Cambria Global Value ETF is an actively managed fund that seeks capital appreciation. It invests at least 80% of its total assets in equity securities, common stocks, and depository receipts issued by companies domiciled in developed and emerging markets, with tremendous potential for value.

The top three holdings of this non-diversified ETF are:

- iShares MSCI Colombia ETF – 9.18%

- CEZ as – 4.54%

- Jastrzebska Spolka Weglowa S.A. – 3.71%

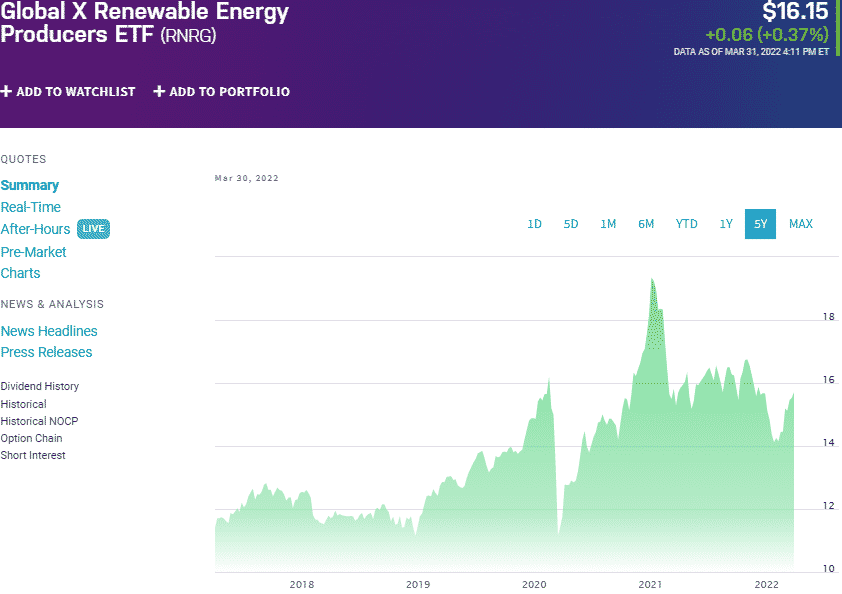

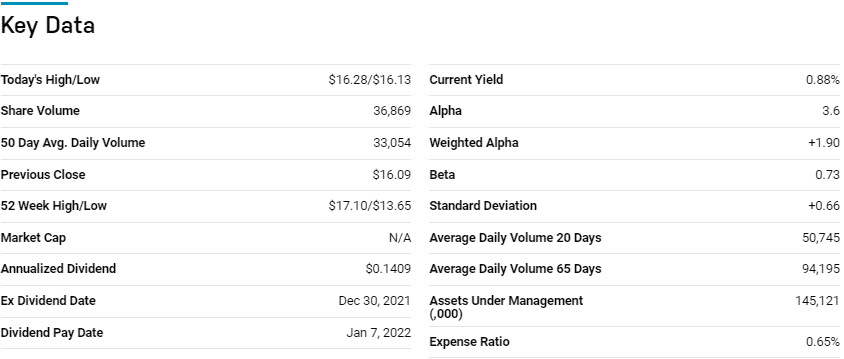

Global X Funds Global X Renewable Energy Producers ETF (RNRG)

Price: $16.15

Expense ratio: 0.65%

Dividend yield: 2.00%

RNRG chart

The Global X Funds Global X Renewable Energy Producers ETF tracks the performance and yield of the Indxx Renewable Energy Producers Index, net of expenses and fees. It invests at least 80% of its net assets in the tracked index in addition to American and global depository receipts, ADRs, and GDRs, that represent the composite index securities.

The top three holdings of this fund are:

- EDP Renovaveis SA – 6.29%

- Orsted – 5.92%

- Brookfield Renewable Partners LP – 5.69%

The RNRG fund has $147.1 million in assets under management, with an expense ratio of 0.65%. A weight capping mitigates against concentration bias while investing in renewable energy equities aligns with the global theme of green financing, providing an avenue for the growth of this fund, as well as consistent returns and income; 5-year returns of 67.04%, 3-year returns of 33.95%, 1-year returns of 4.64%, and a dividend yield of 2%. It is an indirect play on the next revolution of the Italian industrial and manufacturing sectors.

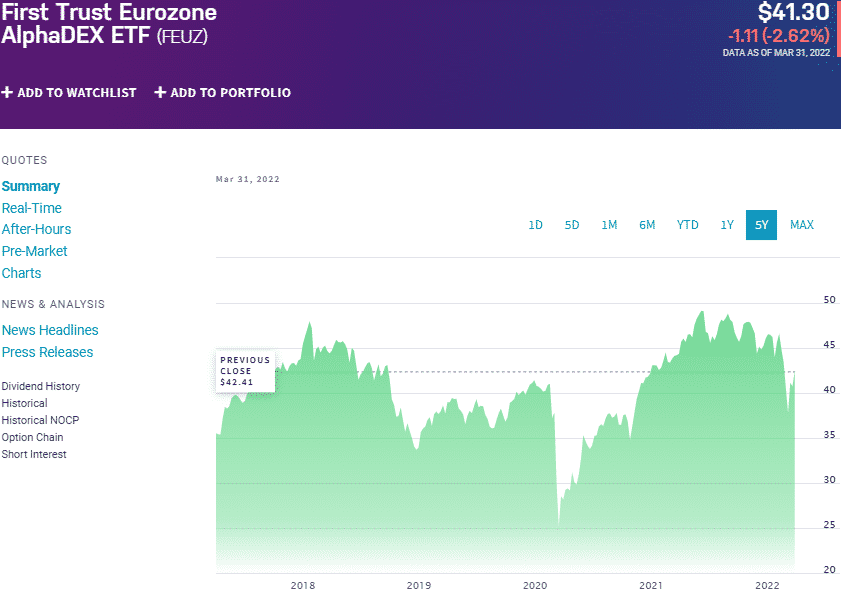

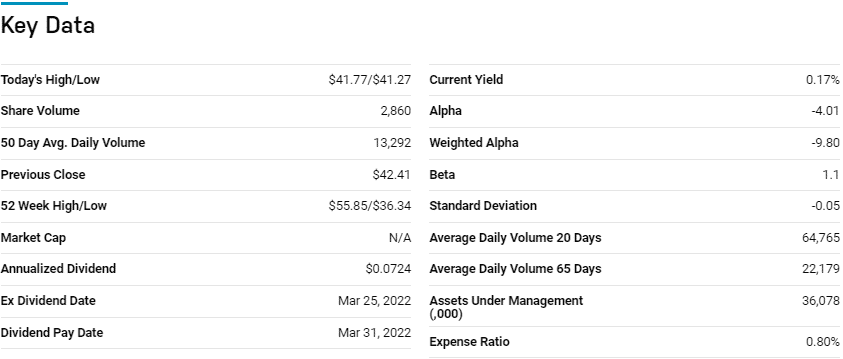

First Trust Eurozone AlphaDEX Fund (FEUZ)

Price: $41.30

Expense ratio: 0.80%

Annual dividend yield: 2.30%

FEUZ chart

The First Trust Eurozone AlphaDEX Fund tracks the performance of the NASDAQ AlphaDEX Eurozone Index, net of expenses and fees. FEUZ invests at least 90% of its total assets in the underlying holdings of its composite index and REITs and ADRs associated with the underlying holdings. It exposes its investors to eurozone equities chosen via the AlphaDex methodology to generate positive alpha, ensuring risk-adjusted returns.

The top three holdings of this eurozone ETF are:

- OCI NV – 1.45%

- D’Ieteren Group – 1.41%

- Kojamo Oyj – 1.40%

The FEUZ ETF has $36.3 million in assets under management, with an expense ratio of 0.80%. Utilizing the AlphaDex formula has resulted in consistent returns for investors of this fund except for the last 12 months; 5-year returns of 30.60%, 3-year returns of 19.61%, 1-year returns of -1.93%, and a dividend yield of 2.30%. A pretty even weighting provides for a diversified play on the Italian economy coupled with other eurozone equities with the potential for significant value.

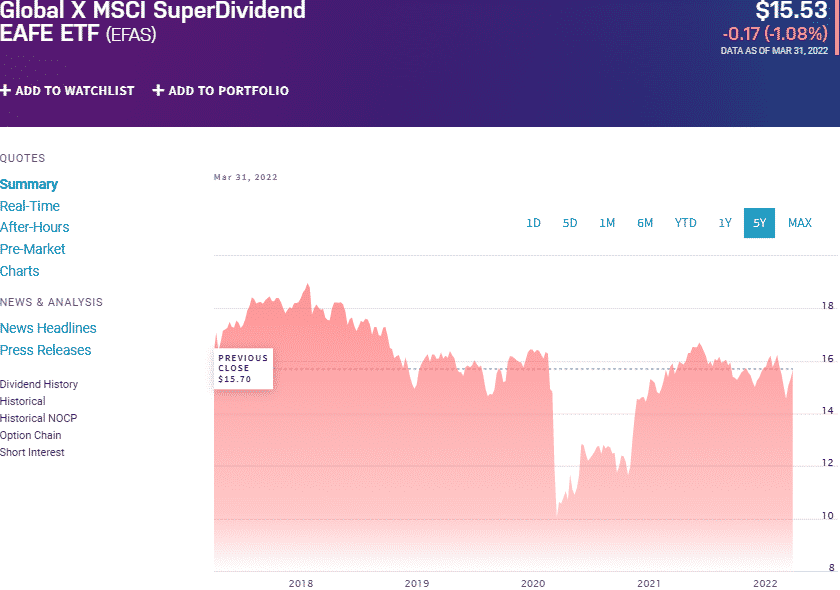

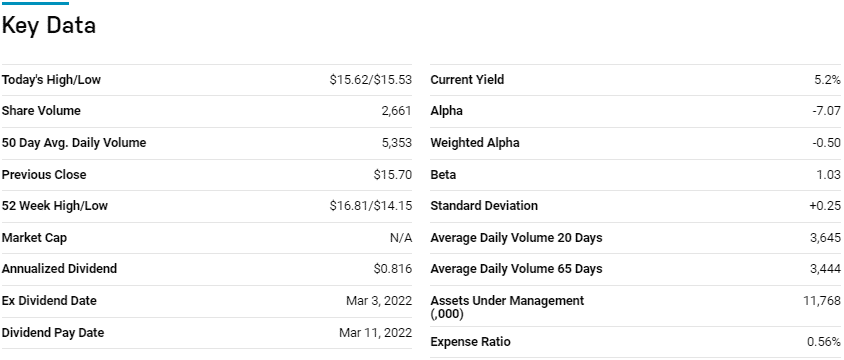

Global X MSCI Super Dividend EAFE ETF (EFAS)

Price: $15.53

Expense ratio: 0.56%

Dividend yield: 4.66%

EFAS chart

Global X MSCI Super Dividend EAFE ETF tracks the performance and yield of the MSCI EAFE Top 50 Dividend Index, net of fees and expenses. It invests at least 80% in its underlying index and securities of like economic characteristics to the composite index under holdings. It exposes investors to the best dividend-paying equities in the eurozone, Australasia, and the far east.

The top three holdings of this fund are:

- BHP Group Ltd – 4.43%

- CNP Assurances SA – 2.83%

- Lundin Energy AB – 2.58%

Final thoughts

The quick turnaround of the Italian economy after the coronavirus, after being one of the hardest-hit countries in the Eurozone, speaks to the soundness of the fiscal policies in this industrial economy.

Despite the rising energy cost due to the Ukraine-Russia war, the Italian government has an €8 billion energy subsidy fund to ensure its fiscal deficit remains on track, a target of 5.6% of GDP. With such a tested and effective fiscal stimulus, the seven ETFs are a great starting point to generate significant returns from the Italian economy, which is expanding faster than expected.

Comments