China, Japan, and South Korea might be the most talked-about Asian markets. Still, since the early 1980s, several economies in the region have embraced technology and presented alternative Asian investment markets. One of these economies is Indonesia, which has grown into the largest economy in Southeast Asia in the last three decades.

As more and more regulations are reviewed to spur foreign investments in Indonesia, they present a host of investment opportunities that might be the updraft to revolutionize this emerging market into a quasi-developed one.

These seven ETFs expose investors to this fast-paced Asian economy, with significant upside potential.

What is the composition of Indonesian ETFs?

Indonesian ETFs comprise either equities solely domiciled in Indonesia, a combination of equities domiciled in Indonesia and those that draw significant revenues from the Indonesian economy, or those with significant resources invested in the Indonesian economy. The ETFs on this list are those with significant exposure to the Indonesian economy.

Top 7 Indonesian ETFs

Full of natural resources, a large and fast-growing domestic market, an increased global profile, a young and technically trained populace, and an improving investment climate propel this vibrant economy to the next level. These seven ETFs give investors exposure to this giant Southeast Asia economy.

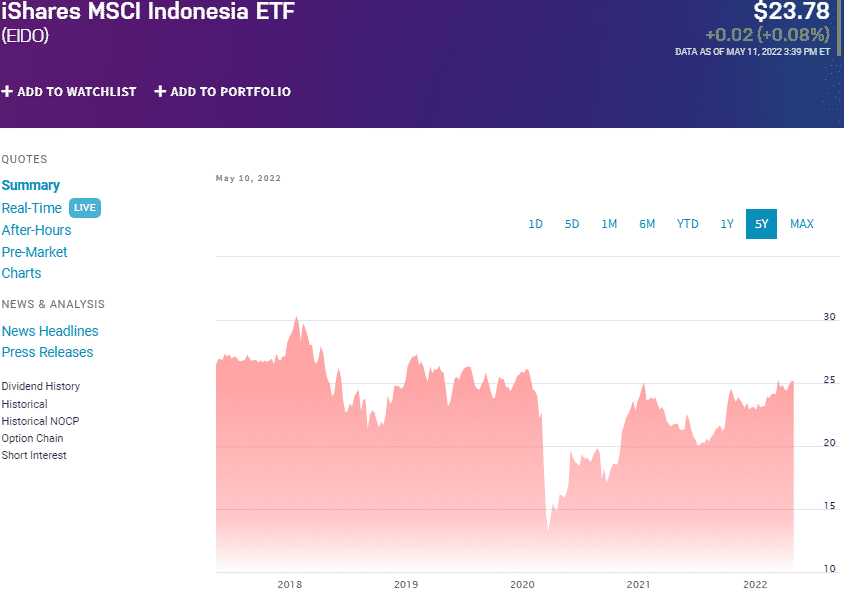

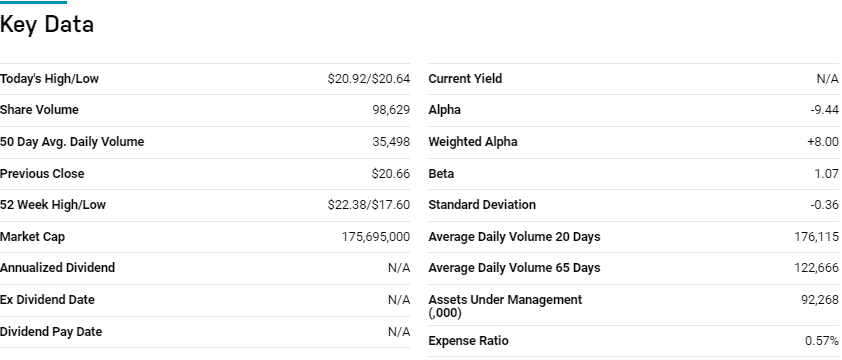

iShares MSCI Indonesia ETF (EIDO)

Price: $23.78

Expense ratio: 0.57%

Dividend yield: 1.31%

EIDO chart

The most popular and liquid fund providing pureplay exposure to the Indonesian economy is the iShares MSCI Indonesian ETF, which tracks the performance of the MSCI Indonesia IMI 25/50 Index. It invests at least 80% of its assets in its composite index and investment assets that exhibit similar economic characteristics to these under holdings. It exposes investors to the entire Indonesian equity market spectrum.

EIDO ETF is ranked № 20 by US News analysts among 77 of the best miscellaneous regional funds for long-term investing.

The top three holdings of this fund are:

- PT Bank Central Asia Tbk – 19.60%

- PT Bank Rakyat Indonesia (Persero) Tbk Class B – 14.18%

- PT Telkom Indonesia (Persero) Tbk Class B – 9.74%

The EIDO ETF has $492.6 million in assets under management, at an expense ratio of 0.57%. Despite the top three holdings making up for more than a third of this fund’s weight, diversification across the cap divider ensures a pretty resilient fund; 5-year returns of -3.82%, 3-year returns of 3.07%, and 1-year returns of 10.35%. An annual dividend yield of 1.31% ensures consistent income for investors in this fund.

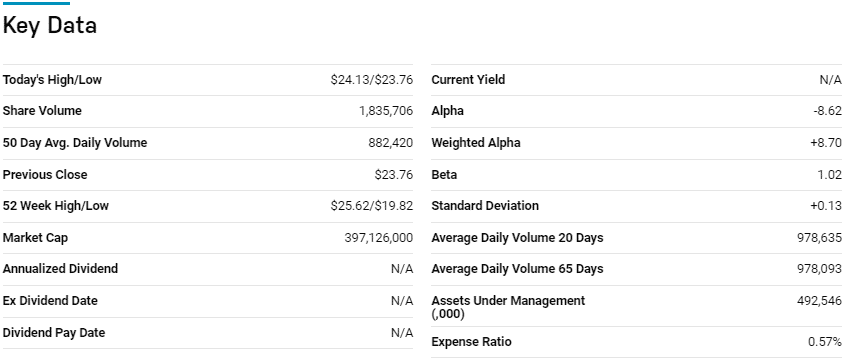

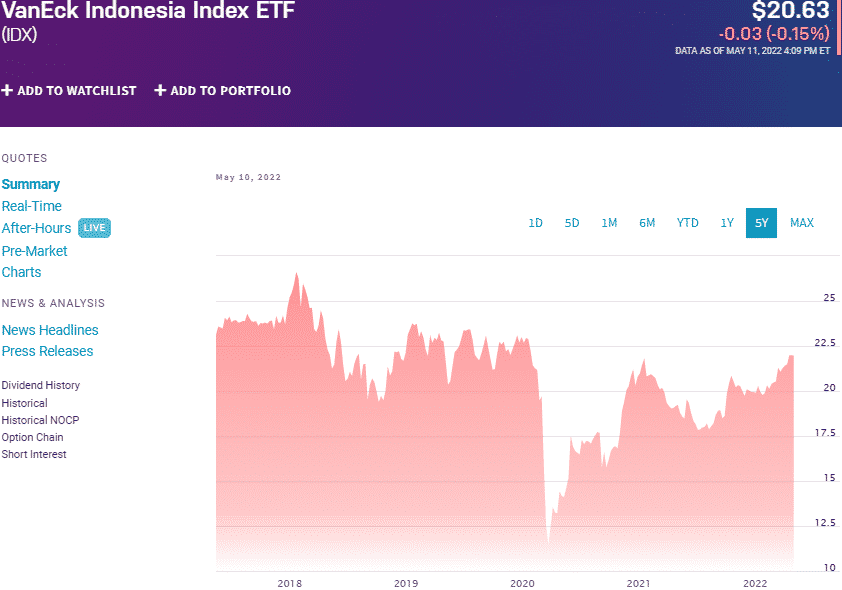

VanEck Indonesia Index ETF (IDX)

Price: $20.63

Expense ratio: 0.57%

Dividend yield: 1.68%

IDX chart

The VanEck Indonesia Index ETF is another pureplay option for the Indonesian economy. It tracks the yield and price performance of the MVIS Indonesia Index, net of fees and expenses. To meet its investment objective, it invests at least 80% of its total assets in its underlying index holdings, exposing investors to Indonesian equities, either domiciled in Indonesia or those with 50% assets in Indonesia or deriving 50% revenues from the Indonesian economy.

The top three holdings of this non-diversified fund are:

- PT Bank Rakyat Indonesia (Persero) Tbk Class B – 7.64%

- PT Bank Central Asia Tbk – 7.50%

- PT Bank Mandiri (Persero) Tbk – 6.85%

The IDX ETF has $82.9 million in assets under management, with an expense ratio of 0.57%. This fund provides a more evenly weighted pureplay Indonesian investment vehicle than the EIDO ETF, mitigating against concentration risk and consistent returns; 5-year returns of -3.46%, 3-year returns of 1.72%, and 1-year returns of 7.86%, and an annual dividend yield of 1.68%.

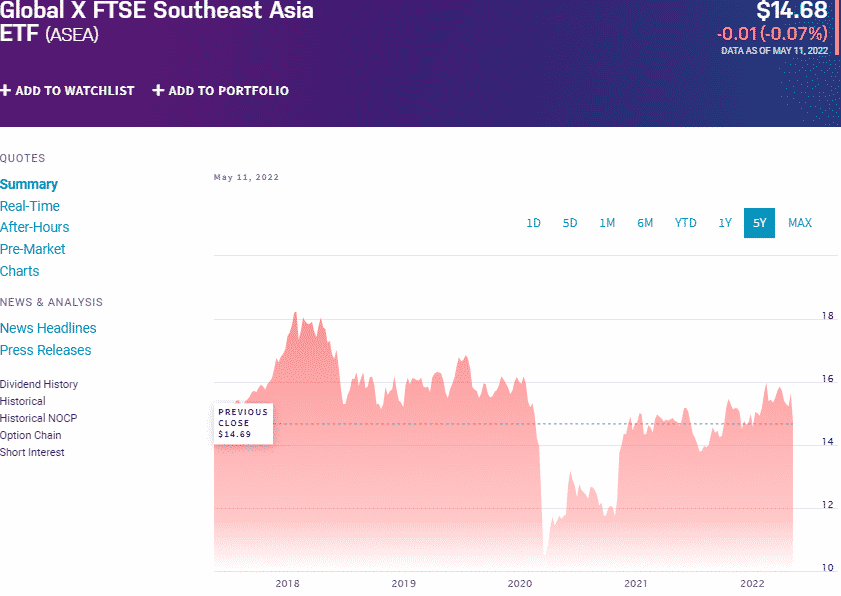

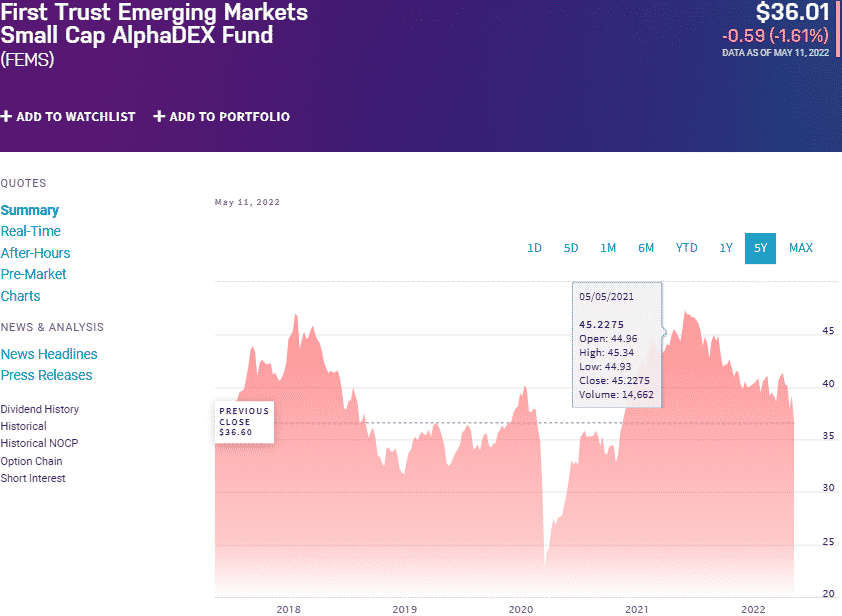

Global X FTSEA Southeast Asia ETF (ASEA)

Price: $14.68

Expense ratio: 0.65%

Dividend yield: 1.77%

ASEA chart

Many ETFs offer exposure to the vibrant South-East Asia economy; Singapore, Indonesia, Malaysia, Thailand, and the Philippines. The Global X FTSEA Southeast Asia ETF is the only fund that offers pureplay exposure to this corner of the Asian market by tracking the price and yield performance of the FTSE/ASEAN 40 Index.

It invests at least 80% of its total assets in the holdings of the tracked index and ADRs and GDRs coupled to the composite index holding. It exposes investors to the forty largest and most liquid equities domiciled within the association of the Southeast Asian Nations, ASEA.

The top three holdings of this fund are:

- DBS Group Holdings Ltd – 10.83%

- Oversea-Chinese Banking Corporation Limited – 7.60%

- United Overseas Bank Ltd. (Singapore) – 6.90%

The ASEA has $42.0 million in assets under management, with investors having to part with $65 annually for a $10000 investment. This ETF is a diversified play on the largest Southeast Asia economy by incorporating other large-cap equities domiciled in the neighboring emerging markets. The result is a fund that provides consistent returns and incomes; 5-year returns of 14.44%, 3-year returns of 1.40%, 1-year returns of 2.67%, and a decent annual dividend yield of 1.77%.

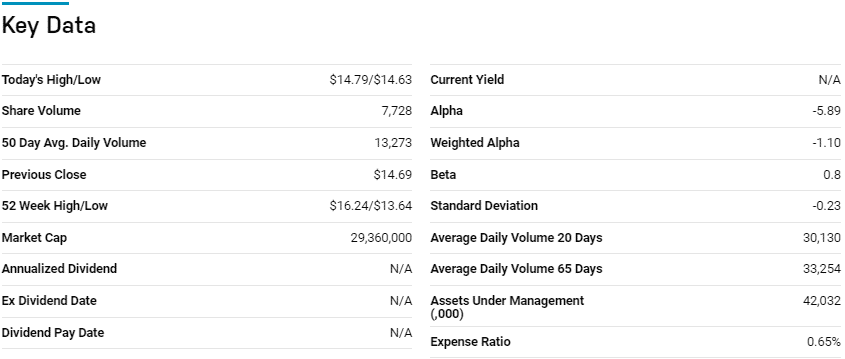

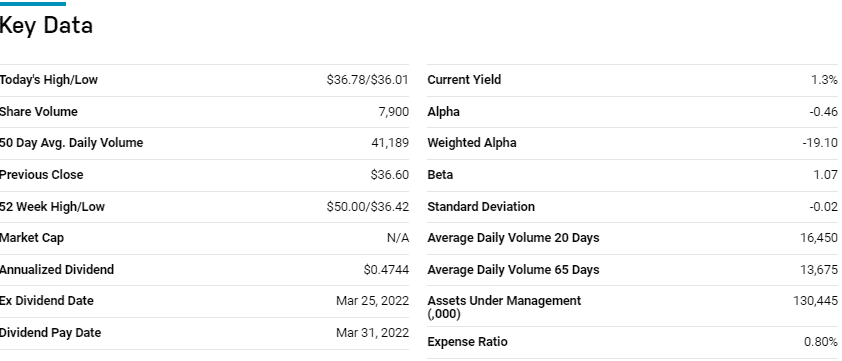

First Trust Emerging Markets Small Cap AlphaDex Fund (FEMS)

Price: $36.01

Expense ratio: 0.80%

Annual dividend yield: 4.56%

FEMS chart

The First Trust Emerging Markets Small Cap AlphaDex Fund tries to replicate as closely as possible the yield and price performance of the NASDAQ AlphaDex Emerging Markets Small Cap Index, net of expenses, and fees. It invests at least 90% of its net assets, including debt capital, in the holdings of the tracked index, depository receipts, REITs, and common stocks.

Among 87 diversified emerging markets funds, USNews has the FEMS ETF at No 26 for long-term investing.

The top three holdings of this ETF are:

- Inner Mongolia Yitai Coal Company Limited Class B – 1.15%

- Turk Hava Yollari A.O. – 1.14%

- Aygaz A.S. – 1.11%

The FEMS ETF has $131.0 million in assets under management, with an expense ratio of 0.80%. Multi-indicator analysis screens for equities in emerging markets can generate the most significant positive alpha. A pretty even weighting across the 200 holdings coupled with mitigation against single country overexposure deters concentration risk.

Couple this with a significant dose of small-cap inclusion in the fund, and the FEMS Fund has the potential to provide both value and growth to a portfolio; 5-year returns of 25.87%, 3-year returns of 25.46%, 1-year returns of -16.38%, and a more than the decent dividend yield of 4.56%. Being one of the premier tourist countries in Europe, the GII gives investors a diversified play on the Spanish infrastructure segment.

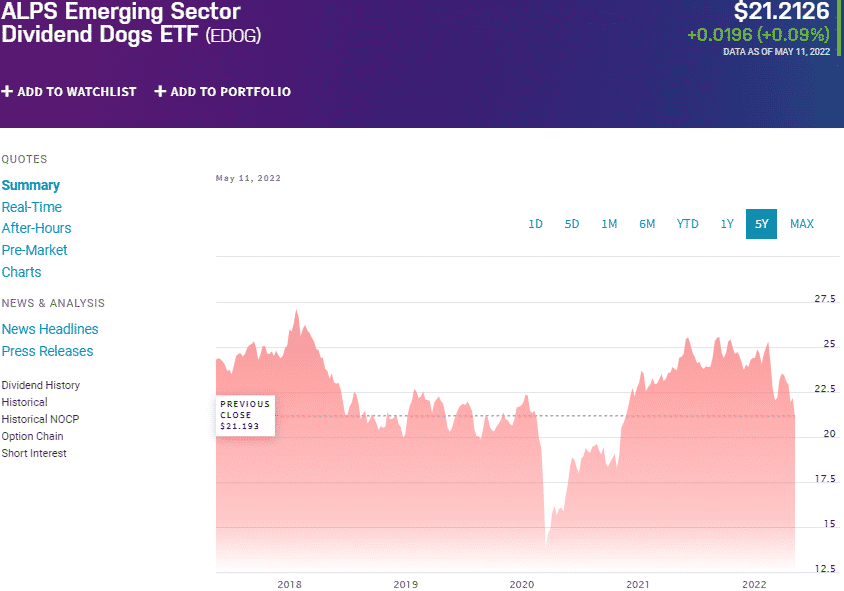

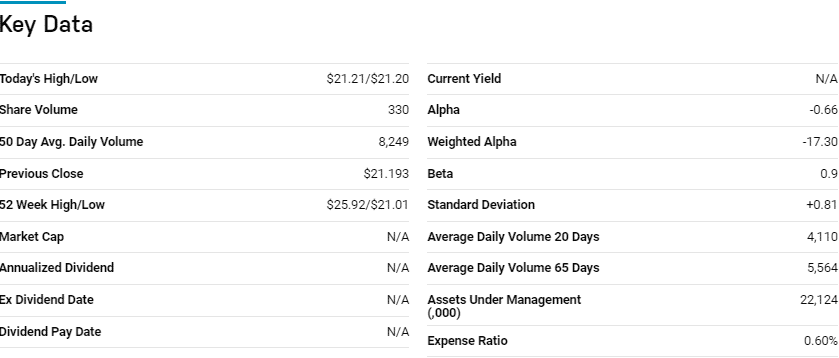

Alps Emerging Sector Dividend Dogs ETF (EDOG)

Price: $21.21

Expense ratio: 0.60%

Annual dividend yield: 2.56%

EDOG chart

Alps Emerging Sector Dividend Dogs ETF tracks the performance of the S-Network® Emerging Sector Dividend Dogs Index, net of fees and expenses. It invests all of its assets in the holdings of its composite index, exposing investors to the best dividend-paying equities domiciled in emerging markets.

The top three holdings of this ETF are:

- Ford Otomotiv Sanayi A.S. – 2.45%

- CEZ as – 2.38%

- China Shenhua Energy Co. Ltd. Class H – 2.37%

The EDOG ETF has $22.1 million in assets under management, with an expense ratio of 0.60%. Even weight distribution across the 50 holdings of this ETF mitigates against concentration risk. In addition to this, EDOG’s proprietary equity screening methodology ensures a holding base of undervalued but high dividend-paying stocks, creating both value and consistent income; 5-year returns of 9.60%, 3-year returns of 13.72%, 1-year returns of -10.01%, and a decent annual dividend yield of 3.74%.

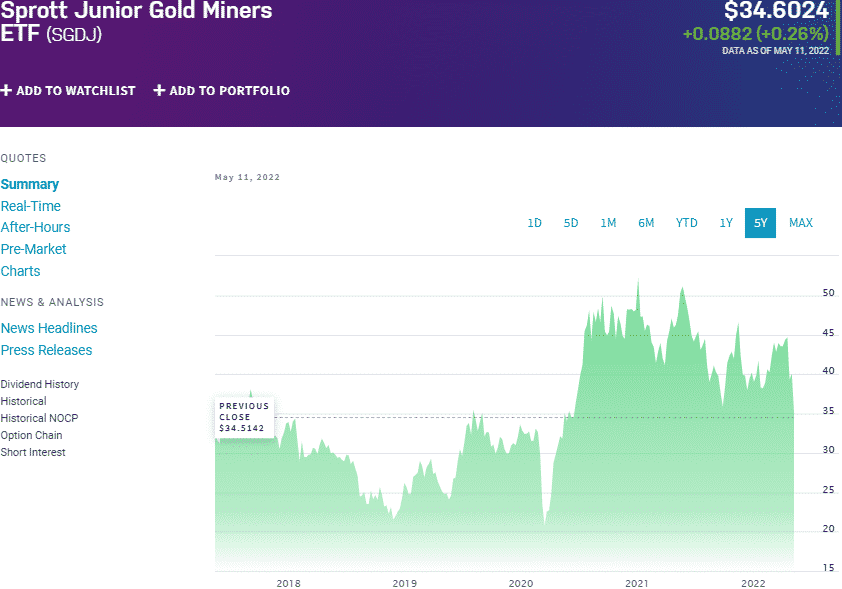

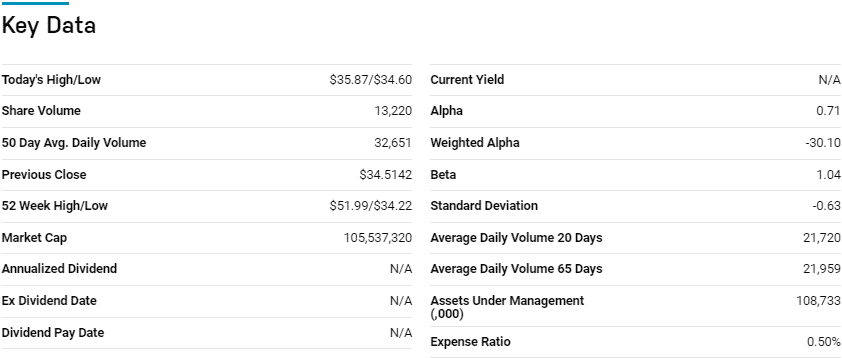

Sprott Junior Gold Miners ETF (SGDJ)

Price: $34.60

Expense ratio: 0.50%

Dividend yield: 2.10%

SGDJ chart

The Sprott Junior Gold Miners ETF tracks the performance of the Solactive Junior Gold Miners Custom Factor Index, net of expenses, and fees. By investing at least 90% of its total assets in the equities making up its composite index, it exposes investors to global junior gold companies, including their ADRs and GDRs.

The top three holdings of this fund are:

- Pan African Resources PLC –5.98%

- Aurelia Metals Limited – 5.20%

- Perseus Mining Limited – 4.80%

The SGDJ ETF has $108.7 million in assets under management, with an expense ratio of 0.50%. This fund diversified the Indonesian gold equity market by concentrating on small-cap global equities plying their trade along the gold value chain. There is always a demand for gold, given its global acceptance as a currency and store of value.

Couple this with a fund largely made up of small-cap equities, which tend to outperform the markets after economic turmoil, and this fund has a ton of potential for value, growth, and consistent income; 5-year returns of 20.91%, 3-year returns of 46.63%, 1-year returns of -27.10%, and a decent annual dividend yield of 2.10%.

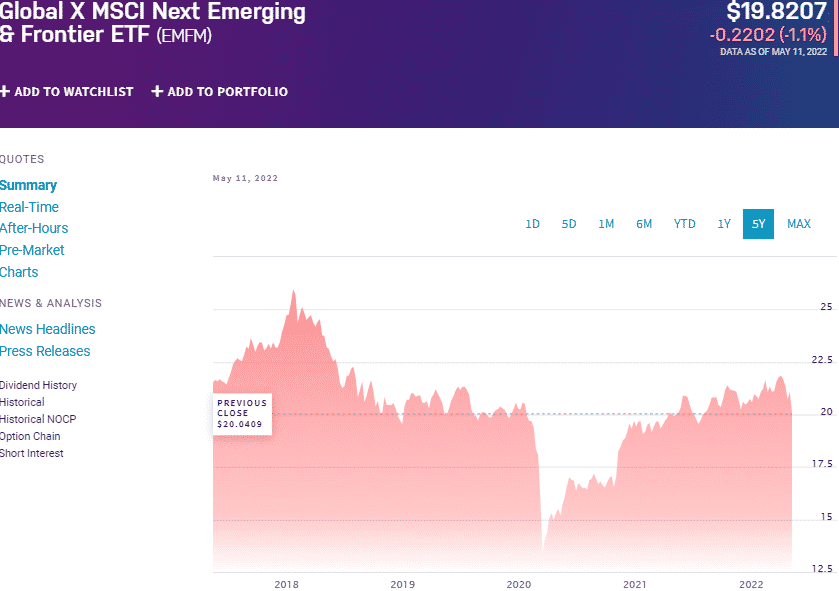

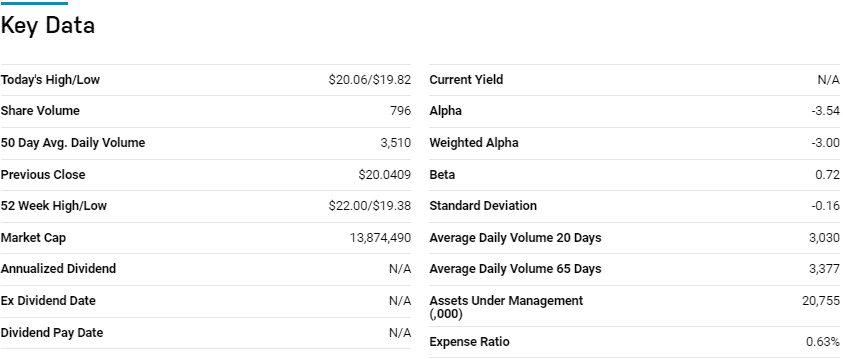

Global X Next Emerging and Frontier ETF (EMFM)

Price: $19.82

Expense ratio: 0.63%

Dividend yield: 2.27%

EMFM chart

The Global X Next Emerging and Frontier ETF seeks to replicate the yield and price performance of the MSCI Select Emerging and Frontier Markets Access Index, net of fees and expenses. It invests at least 80% of its assets in the holdings of the tracked index, coupled with ADRs and GDRs associated with these holdings. It exposes investors to the best-emerging markets equities and the next frontier markets in emerging economies.

The top three holdings of this fund are:

- Emirates Telecommunications Group Company PJSC – 2.19%

- PT Telkom Indonesia (Persero) Tbk Class B – 2.05%

- Al Rajhi Bank – 1.88%

The EMFM ETF has $20.8 million in assets under management, with an expense ratio of 0.63%. A pretty even weighting and concentration on the next frontier companies in emerging markets coupled with the most liquid companies in emerging markets results in a fund capable of withstanding market downturn; 5-year returns of 7.33%, 3-year returns of 6.52%, 1-year returns of 1.53%, and a decent dividend yield of 2.27%.

Final thoughts

As the fourth biggest global populace and with the increased reforms geared towards a more friendly foreign investment ground, Indonesia is on the brink of an economic revolution. In addition to its salient strengths, Indonesia’s political stability and monetary and fiscal policies saw its post-pandemic recovery in 2021 surpass experts’ projections by a mile. The seven ETFs above significantly benefit from the resulting investment upside.

Comments