Despite the previous week closing with all the segments in the green, equities continue to drop at staggering rates.

Is the bloodbath finally over, and we have seen the bottom, or was last week’s temporary respite before another dive?

Monday morning saw prices open at $407.96, which was a 0.7% gap up compared to Friday’s closing price of $405.11, a phenomenon was seen for the second week in the running to replicate what was happening next year when the SPY made consecutive record highs. Riding on the fortunes that drove inflows last week after a gap up, bullish investors pushed prices up to the $415.68 price level, a significant pivotal level for the previous two months.

However, this level proved its integrity, providing the foothold the bears needed to push back prices to the $407.24 level. Bulls would wrestle control back from the bears to have the markets trade in the $417.36 price region.

So, what were the most significant drivers for the sideways bullishly inclined price movement for the week? Improving infrastructure, targeted global efforts to unlock supply chain bottlenecks, lower than expected inflation data, and positive earnings reports for the consumer-based segments have investors bullish again on accelerating economic growth. The FED is also working on reducing its federal deficit to help ease the price pressures. The result was a buoying of energy, tech, and food stocks to have the SPY finishing another excellent week for the year with an encouraging +4.72% change.

Top gainers of the current week

Consumer Discretionary sector

The consumer discretionary sector continues to get investment inflows on increased consumer earnings to close the week as the topper gainer with a +2.94% change.

Communication Services sector

Unlocking supply chain bottlenecks speaks to the microchip supply shortages, which are crucial for the communications sector. The result was continuous inflows to close at +2.28% weekly change.

Information Technology sector

Similar to the communication sector, the information technology sector benefits from unlocking supply chain bottlenecks and the newfound bullish sentiments to finish the week with a +1.38% change.

Losers of the current week

Utilities Sector at — 0.94%

Real Estate Sector at — 1.00%

Health Care Sector at — 2.02%

The newfound investor confidence in an expanding economy coupled with a quelling of recession fears due to reduced inflation saw conventional defensive sector experience outflows with the three above losing the most for the week.

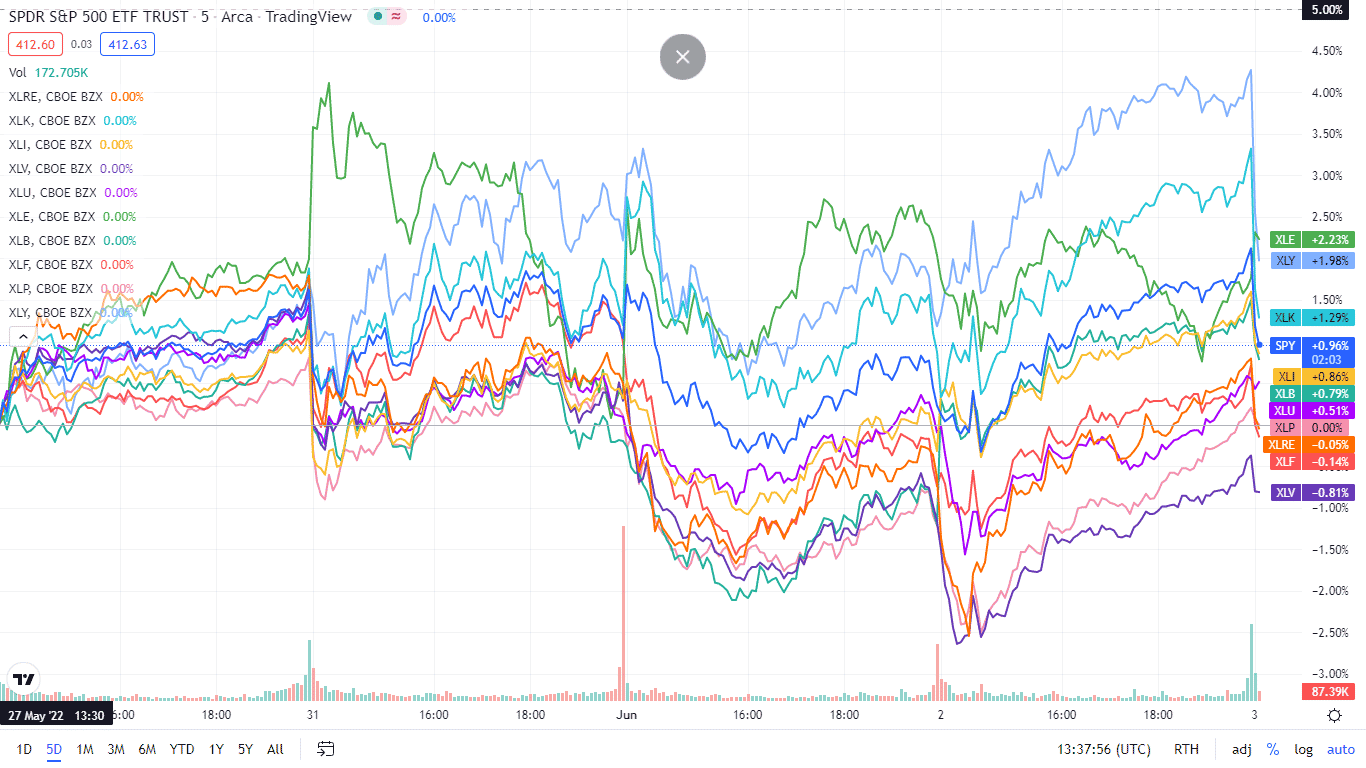

Below is a performance chart of the SP 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

In another excellent week for the SPY, the S&P 500 ended the week green. Below is the respective sector breakdown, using their corresponding ETFs.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Consumer Discretionary | XLY | +2.94% with the accompanying consumer discretionary select sector ETF |

| 2. | Communication Services | XLC | +2.28% with the accompanying communication services select sector ETF |

| 3. | Information Technology | XLK | +1.38% with the accompanying information technology select sector ETF |

| 4. | Industrial | XLI | +0.40% with the accompanying industrial select sector ETF |

| 5. | Materials | XLB | +0.01% with the accompanying materials select sector ETF |

| 6. | Energy | XLE | -0.22% with the accompanying energy select sector ETF |

| 7. | Financial Services | XLF | -0.61% with the accompanying financial select sector ETF |

| 8. | Consumer Staples | XLP | -0.69% with the accompanying consumer staples select sector ETF |

| 9. | Utilities | XLU | -0.94% with the accompanying utilities select sector ETF |

| 10. | Real Estate | XLRE | -1.00% with the accompanying real estate select sector ETF |

| 11. | Healthcare | XLV | -2.02% with the accompanying healthcare select sector ETF |

Comments