ETF full name: Health Care Select Sector SPDR Fund

Segment: Healthcare Sector

ETF provider: State Street Global Advisors

|

XLV key details |

|

| Issuer | State Street Global Advisors |

| Management | Hancock, Schneider, and Feehily |

| Quarterly Dividend | $0.4 |

| Inception date | December 16, 1998 |

| Expense ratio | 0.42% |

| Average 3 Year Return | 15.93% |

| Average Annualized Return | 15.27% |

| Investment objective | Replication Strategy |

| Investment geography | Health and Biotech Equities |

| Benchmark | Thomas Reuters US Healthcare |

| Leveraged | N/A |

| Median market capitalization | N/A |

| ESG rating | BBB: 4.72 out of 10 |

| Number of holdings | 64 |

| Weighting methodology | Market capitalization |

About the XLV ETF

Investors got a chance to be a part of the healthcare sector through an ETF on December 16, 1998, via the SPDR Health Care Select Sector Fund, XLV.

The XLV tracks the performance of primarily large-cap organizations in healthcare provision, pharmaceuticals, healthcare technology, biotechnology, healthcare equipment and supplies, and life sciences services and tools. This exposure is through tracking of the Thomas Reuters US Healthcare Index. The fund has $26.38 billion in assets under management and, since its inception, an average 10-year return of 15.27%.

XLV Fact-set analytics insight

An investment in the XLV exchange-traded fund exposes one to 64 of the largest healthcare companies on the S&P 500 list. It is, therefore, a non-diversified fund that cuts across the healthcare sector and is the oldest healthcare ETF. Investors utilize it primarily for tactical and strategic investing.

The XLV utilizes a weighted market capitalization and generally exhibits skewness towards mega-cap healthcare companies.

XLV performance analysis

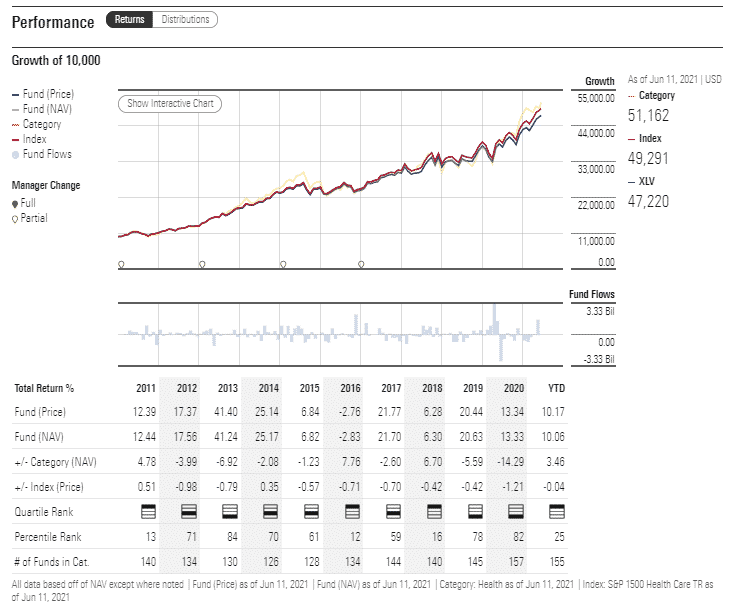

It would be a massive understatement to say that the healthcare sector was under a microscope in 2020 and 2021. With the pandemic and the closure of most economic activities, all eyes are on the healthcare sector to return to normalcy as first as possible. The performance of XLV in the last 12 months and year to date reflect the confidence and hope the health sector carries, 24.1% and 10.87%, respectively.

These numbers aren’t just because of the pandemic. The XLV has been a cash-cow for its investors since launching; 3-year returns of 15.62%, 5-year returns of 13.61%, and 10-year returns of 15.58%.

XLV ETF RATING |

||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com |

| XLV Rating | A+ | A 85 | 2 | **** |

| XLV ESG Rating | BBB: 4.72 out of 10 | BBB: 4.72 out of 10 | N/A | BB: 23.49 out of 50 |

XLV key holdings

Despite being a non-diversified fund, the XLV is a haven in times of market volatility. Households can scale down on other expenditures but not on healthcare issues. In most circles, health ETFs label is that of a recession-proof exchange-traded fund. The beauty of picking XLV as the go-to ETF is exposure to time-tested organizations in healthcare.

The top holding is Johnson and Johnson 9.35%, which just got an extension on its Covid-19 vaccine and is a global health conglomerate. Despite being a global brand in consumer products, beauty, the company is also a world leader in medicine production of chronic diseases such as HIV, Covid-19, diabetes, Alzheimer’s.

Next to JNJ is UnitedHealth Group Incorporated. This health insurance company provides services and health insurance plans to individuals, public and private sector employees, prescription medicine coverage, and medicare plans. It also provides information services, software, and advisory consultancy in the health industry.

Rounding off the top three is Pfizer Inc., a pharmaceutical company with roots in New York that serves the global community with vaccines, consumer health products, and medicine. Its diversification into Pfizer health innovative and Pfizer Essential health helps the organization serve its target markets better. Pfizer health’s innovation concentrates on the development, medicine registration and commercialization, consumer health care products, vaccines, and cancer treatments. On the other hand, Pfizer Essential health serves the generic medicine market segment.

The top 10 holdings of XLV are.

| Ticker | Holding name | % of assets |

| JNJ | Johnson & Johnson | 9.35% |

| UNH | UnitedHealth Group Incorporated | 8.08% |

| PFE | Pfizer Inc. | 4.83% |

| ABBV | AbbVie, Inc. | 4.37% |

| ABT | Abbott Laboratories | 4.15% |

| MRK | Merck & Co., Inc. | 4.1% |

| LLY | Eli Lilly and Company | 3.95% |

| TMO | Thermo Fisher Scientific Inc. | 3.9% |

| MDT | Medtronic Plc. | 3.58% |

| DHR | Danaher Corporation | 3.32% |

Industry outlook

The general economic uncertainty and the FED resolution for inflation rates to run high for the foreseeable future calls for an intelligent investment. As a hedge against the expected swings in the stock markets, health ETFs offer a haven, and it doesn’t get better than health ETFs.

It is also clear that the health care costs are rising year on year, meaning that health ETFs are not about to slow down their bullish run.

Comments