ETF full name: The Industrial Select Sector SPDR® Fund XLI

Segment: industry

ETF provider: SSGA Funds Management, Inc.

| XLY key details | |

| Issuer | State Street Global Advisors |

| Dividend | $0.30 |

| Inception date | December 16, 1998 |

| Expense ratio | 0.12% |

| Management company | Global Equity Beta Solutions |

| Average 3-5 EPS | 8.18% |

| Average Annualized Return | 19.03% |

| Investment objective | Replication |

| Investment geography | Industry |

| Benchmark | S&P Industrial Select Sector Index |

| Leveraged | N/A |

| Median market capitalization | $78.42 billion |

| ESG rating | MSCI 6.19/10 |

| Number of holdings | 74 |

| Weighting methodology | Weighted Market capitalization |

About the XLI ETF

The Industrial Select Sector SPDR® Fund XLI came into existence in December 1998, aiming to track and correspond with the Industrial Select Sector Index. Its market capitalization stands at $78.42 billion, and it boasts an average return of 19.03% on an annual level.

XLI Fact-set analytics insight

The XLI consists of 74 United States-based holdings. Businesses with dealings in machinery and defense have a 20% share, each, in the holdings’ weight, while the industrial conglomerates and road & rail firms come behind with 14% and 11%, respectively. It is essential to mention that air freight and airlines also participate in the ETF with an 8% and a 3% share.

The XLI, like other ETFs based on the S&P 500 index, uses weighted market capitalization for its methodology.

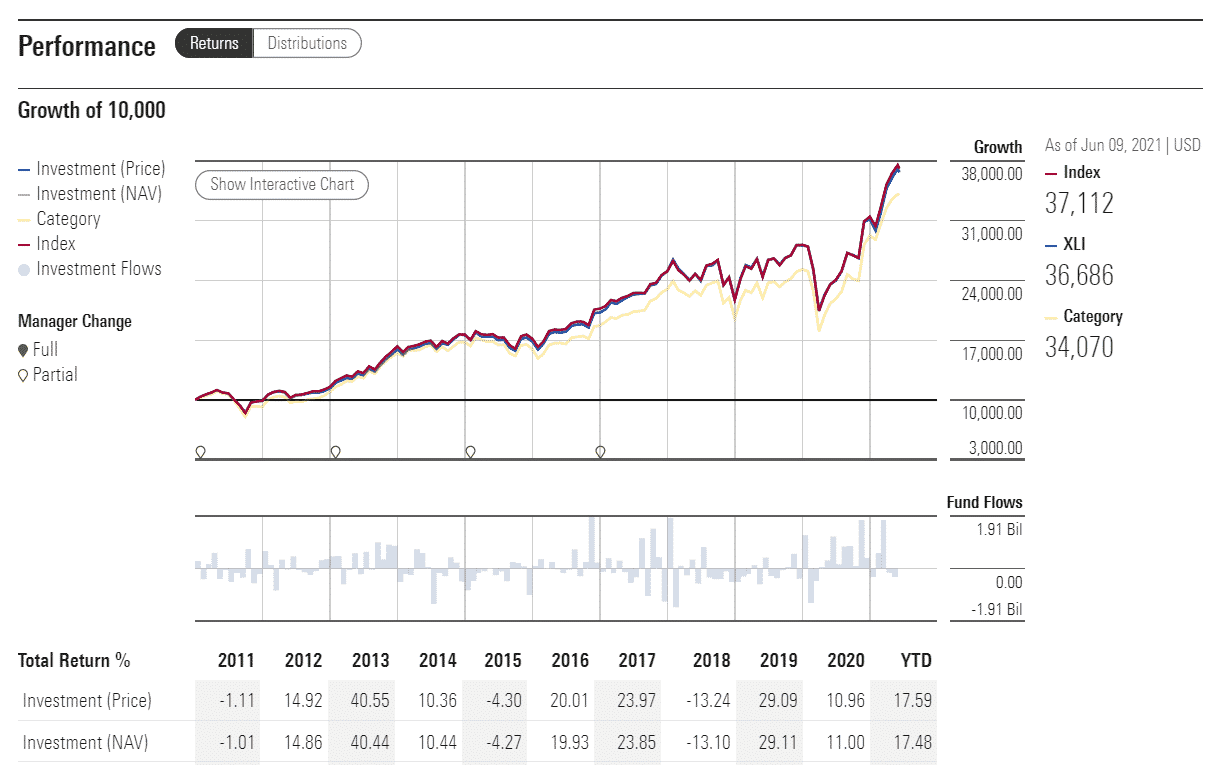

XLI performance analysis

Given the nature of the XLI ETF and its heavy reliance on industry and machinery, it is easy to grasp why the ETF was struck harder than some other funds during the pandemic, especially in its initial phase.

However, as the optimism regarding the economic recovery grew, the ETF gained speed. While inevitable volatility emerges from time to time, usually spiked by inflation woes or worries over the spread of new Covid-19 variants, the fund has proved a solid resilience during the time.

The XLI ETF pays dividends quarterly. After the last three-month period, the dividend was reported at $0.30 on the share at an expense ratio of 0.12%.

The XLI rating on the MSCI ESG scale is 6.19/10 A. Hence, the fund is declared slightly higher-than-average resilience in terms of environmental, governmental, and social changes.

|

XLI ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| XLI Rating | A | A | 2 | **** | 6.6/10 |

| XLI ESG Rating | 6.19/10 | A | N/A | N/A | N/A |

XLI key holdings

With a portfolio as XLI ETFs has, it is clear that it aims to cover various industries. Thus, these industries could prove to be less attractive in the short term than the recent rise of tech shares but more convenient for those not interested in dealing with the volatility that sharper gains usually come hand in hand with.

XLI doesn’t rely too heavily on any single company for growth but invests equally across the board. So the names such as Boston-based multinational conglomerate General Electric or machinery behemoth Caterpillar are a reason enough for a substantial volume pull.

On an additional note, the ETF also relies on the defense industry. So the most prominent example is the US army contractor 3M Company (NYSE: MMM).

Here are the top 10 holdings making up the XLI ETF.

| Ticker | Holding name | % of assets |

| HON | Honeywell International Inc. | 5.01% |

| UPS | United Parcel Service, Inc. Class B | 4.83% |

| UNP | Union Pacific Corporation | 4.71% |

| BA | Boeing Company | 4.37% |

| RTX | Raytheon Technologies Corporation | 4.27% |

| CAT | Caterpillar Inc. | 4.13% |

| GE | General Electric Company | 3.85% |

| MMM | 3M Company | 3.72% |

| DE | Deere & Company | 3.52% |

| LMT | Lockheed Martin Corporation | 3.05% |

Industry outlook

Due to the profile of the XLI’s holdings, this ETF is not of a make-it-or-break-it kind. However, with the airline industry still lagging due to the pandemic, more concrete moves are expected to understand future travel arrangements, especially from the United States to Europe and maybe even more so, Asia.

The machinery area is expected to have a less vague path to recovery, especially if the vaccine rollout would be successful. Covid-19 jabs stand the test of time against the emerging virus strains. On the end note, regarding the defense industry, the Biden administration already announced it would raise the military budget by 1.6%, so the army contractors should be in the clear.

Comments