ETF full name: Energy Select Sector SPDR ETF

Segment: Energy

ETF provider: State Street Bank and Trust Company

|

XLE key details |

|

| Issuer | State Street Global Advisors |

| Dividend | $0.52 |

| Inception date | December 16, 1998 |

| Expense ratio | 0.12% |

| Management company | Global Equity Beta Solutions |

| Average 3-5 EPS | 7.51% |

| Average Annualized Return | 4.7% |

| Investment objective | Replication |

| Investment geography | The Financial Services Sector |

| Benchmark | Financial Select Sector Index |

| Leveraged | N/A |

| Median market capitalization | $115.45 billion |

| ESG rating | BBB: 7.79 out of 10 |

| Number of holdings | 23 |

| Weighting methodology | Market capitalization |

About the XLE ETF

The Energy Select Sector SPDR ETF was launched in December 1998. This ETF tracks the performance of publicly-traded companies in the energy select sector index; invests in companies in the said industry that make the S&P 500 cut. The XLE fund has a market capitalization of $22.9 billion and, since inception, an average yearly return of 5.8%.

XLE Fact-set analytics insight

The XLE ETF comprises 23 companies from the oil industry, energy equipment and services industry, and the gas and consumable fuel industry.

The Energy Select Sector SPDR ETF invests in growth and value stocks, making it a diversified portfolio in market capitalization, combining small, medium, and large-cap companies across the energy sector. However, just two companies account for 45% of the market weight for this fund, Exxon Mobil — 22.83% and Chevron Corp — 21.89%, making it a non-diversified exchange-traded fund.

Like most S&P 500 based ETFs, the XLE adopts a weighted market capitalization for its methodology.

XLE performance analysis

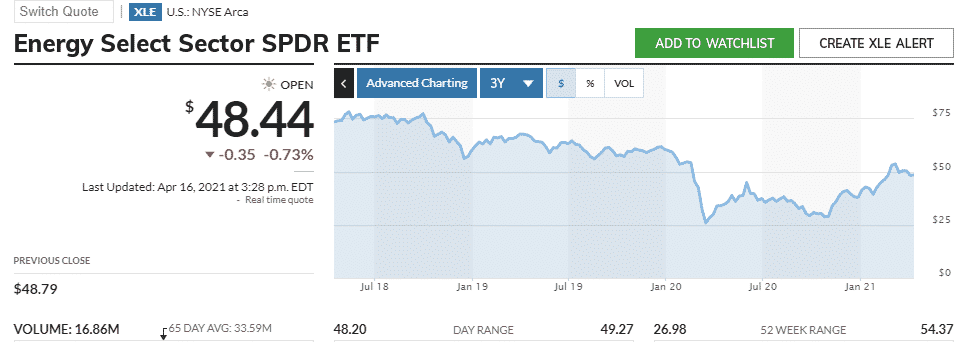

Most industries and their associated ETFs have taken a beating from the coronavirus but this is not the case for the energy sector. It is reaping big on the back of economic recovery resurgent and the need for normalcy quickly. The last three years to the end of October 2020 have had the XLE fund on a bearish run resulting in -19.57%, translating to a 61% fall in its share price.

This trend has reversed, as evidenced by the year-to-date return of 30.11%. The expectation is for the bullish run rally until the burst of the post covid economic bubble.

The XLE ETF pays quarterly dividends, and its investors just enjoyed dividends of $0.52 on the share at an expense ratio of 0.12%.

On the MSCI scale, XLE ETF has a BBB rating, according to most experts; the fund is of average resilience in the face of environmental, governmental, and social changes.

|

XLE ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| XLE Rating | A | A 86 | 2 | ***** | №5 in passively managed long-term Equity Energy ETFs |

| XLE ESG Rating | BBB: 5.32 out of 10 | BBB: 5.32 out of 10 | N/A | A: 34.03 out of 50 | BBB: 4.7 out of 10 |

XLE key holdings

The top 10 holdings making up the XLE ETF are among the largest and best-performing companies in the energy sector, as evidenced by their cumulative weight taking up 58.5% of this fund.

The top two companies in this list are Exxon Mobil Corp. and Chevron Corp. Exxon Mobil Corp is a Texan company in control of the entire oil and gas supply chain, from exploration to marketing and distribution. As long as the global community needs gas and oil-based products, this company will lead the overall bullish run of this ETF.

Exxon Corp is coupled to California-based Chevron Corp., another energy company in control of the entire upstream and downstream supply chain, and you already have the energy sector locked. Both companies are part of the Dow Jones industrial average which speaks volumes about the volumes they pull.

Here are the top 10 holdings making up the XLE ETF.

| Ticker | Holding name | % of assets | Shares held |

| XOM | Exxon Mobil Corporation | 22.90% | 91,785,490 |

| CVX | Chevron Corporation | 21.90% | 48,398,828 |

| COP | EOG Resources Inc. | 5.00% | 15,798,614 |

| SLB | Schlumberger NV | 4.40% | 37,854,760 |

| COP | ConocoPhillips | 4.30% | 18,801,506 |

| MPC | Marathon Petroleum Corporation | 4.23% | 17,407,228 |

| PSX | Phillips 66 | 4.11% | 11,674,848 |

| KMI | Kinder Morgan Inc. Class P | 3.85% | 52,035,620 |

| PXD | Pioneer Natural Resources Company | 3.65% | 5,499,411 |

| VLO | Valero Energy Corporation | 3.54% | 10,920,072 |

Industry outlook

Global economic recovery from the covid19 pandemic is pegged on organizations resuming normal operations and going full throttle to make up for lost opportunities. The energy sector will drive this recovery, translating to quite the bullish run. According to Lee, Fundstrat’s head of research, energy is at saturation due to overselling hence ripe for a correction in the long-term.

Comments