ETF full name: Financial Select Sector SPDR ETF

Segment: Financial Services

ETF provider: State Street Bank and Trust Company

| SPY key details | |

| Issuer | State Street Global Advisors |

| Dividend | $0.15 |

| Inception date | December 16, 1998 |

| Expense ratio | 0.12% |

| Management company | Global Equity Beta Solutions |

| Average 3-5 EPS | 13.92 |

| Average Annualized Return | 4.7 |

| Investment objective | Growth |

| Investment geography | The Financial Services Sector |

| Benchmark | Financial Select Sector Index |

| Leveraged | N/A |

| Median market capitalization | $30.6 billion |

| ESG rating | AA: 7.79 out of 10 |

| Number of holdings | 65 |

| Weighting methodology | Market capitalization |

About the XLF ETF

The XLF ETF was available to investors in December 1998. The unabbreviated name for this ETF is Financial Select Sector SPDR ETF, with the SPDR acronym representing Standard & Poor’s Depositary Receipts.

The XLF tracks the financial select sector index with securities of publicly-traded companies in the capital markets industry, the insurance industry, mortgage and real estate investment trusts, banks, consumer finance, thrifts, and financial services. Since its inception, the XLF ETF has recorded an average annualized return of 4.7%.

XLF Fact-set analytics insight

The financial select sector index comprises 65 companies. Therefore, investors in the XLF ETF have a non-diversified financial equity portfolio, cutting across the broad North American banking and investment industry.

The XLF ETF has been one of SPDR’s significant products. The US economic recession of 2008 led to governmental intervention in the financial sector to ensure transparency and avert another economic meltdown due to financial malpractices.

Investors in this fund should therefore be wary of any governmental reforms affecting financial institutions. Despite all this, the XLF has proven to be a decent dividend payer and a consistent income source during market downturn periods.

The XLF is cap-weighted, made up of large financial institutions in the S&P 500 portfolio only.

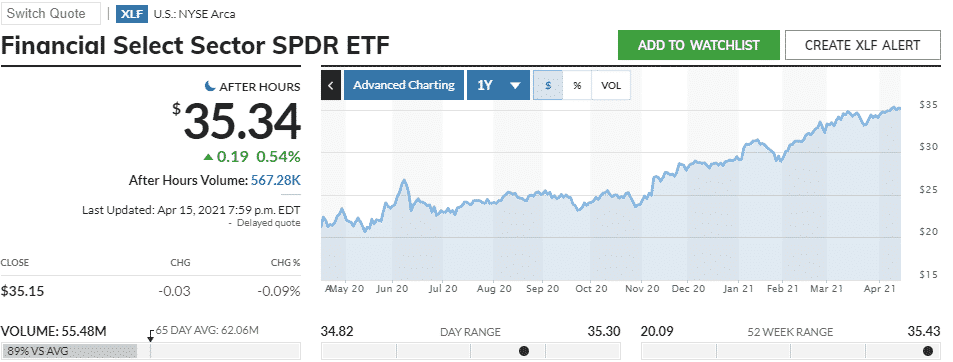

XLF annual performance analysis

The novel coronavirus had not been kind to the financial institutions in 2020, and most of their stocks took a beating. The disruption of economic activities and the lockdown resulted in other economic sectors scaling down their activities and reducing the need for finances.

However, the YTD return of 19.93% for this ETF is evidence of the economy’s resurgence and the need for finances by firms and individuals for speedy post-covid recovery. This correction, according to Abbot, is expected to boost the 3-year return from its current 9.62% by 12%, year on year growth. The expectation is to continue the recent bullish rally driven by mass inoculation from the Covid19 virus and return to “normalcy,” hence economic recovery globally.

The Financial Select Sector SPDR ETF pays quarterly dividends, and its investors enjoyed a $0.15 payout per share in the last quarter against an expense ratio of 0.12%.

On the MSCI scale, XLF ETF has a rating of AA, according to most experts; the fund is quite resilient in the face of social, governmental, and environmental changes.

|

XLF ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| XLF Rating | A | A 84 | 4 | **** | №6 in passively managed financial ETFs |

| XLF ESG Rating | AA: 7.79 out of 10 | AA: 7.79 out of 10 | N/A | BBB: 22.08 out of 50 | A: 6.2 out of 10 |

XLF key holdings

The top holding company of the XLF ETF is Berkshire Hathaway Inc. Class B, 12.95%, affectionately nicknamed the “Oracle of Omaha,” by Warren Buffet immediately after investing in it. Buffet transformed the company from a struggling textile manufacturer to one of the largest holding companies globally. It takes part in the financial sector through consumer financing and mobile home financing.

The next big-name company contributing to this ETF is JPMorgan Chase & Co, 11.72%. With operations in over 60 countries providing banking and investment services to consumers and both large- and small-scale businesses, this is yet another company in this ETF poised to reap bigtime from the post-covid recovery.

The top 10 holdings of this ETF are all large-cap institutions in the financial sector and contribute 55% of the total assets. As long as the bullish outlook for banking and financial services continues, the XLF investors can expect their bullish positions to keep rallying.

Here are the top 10 holdings making up the XLF ETF as of April 2021.

| Ticker | Holding name | % of assets | Shares held |

| BRK.B | Berkshire Hathaway Inc. Class B | 13.04% | 18,896,622 |

| JPM | JPMorgan Chase & Co. | 11.8% | 30,242,360 |

| BAC | Bank of America Corporation | 7.48% | 75,293,160 |

| WFC | Wells Fargo & Company | 4.44% | 40,971,616 |

| C | Citigroup Inc. | 3.85% | 20,686,686 |

| MS | Morgan Stanley | 3.08% | 14,872,385 |

| GS | Goldman Sachs Group Inc. | 2.96% | 3,409,928 |

| BLK | BlackRock Inc. | 2.95% | 1,406,774 |

| SCHW | Charles Schwab Corporation | 2.49% | 14,831,565 |

| AXP | American Express Company | 2.46% | 6,466,987 |

Industry outlook

The improving Covid19 metrics due to mass distribution of the vaccine and resulting vaccination of the populace are driving more and more investors to seek out ETFs. According to analysts at Zacks, the financial sector is pretty bullish on the back of resurging economic activities and yield rise.

The recovery of all other industry sectors will be driven by the availability of financial solutions extended by the financial industry. The XLF ETF is thus in a ripe position to cash in.

Comments