ETF full name: Consumer Discretionary Select Sector SPDR Fund (XLY)

Segment: Consumer services

ETF provider: SSGA Funds Management, Inc.

| XLY key details | |

| Issuer | State Street Global Advisors |

| Dividend | $0.26 |

| Inception date | September 16, 1998 |

| Expense ratio | 0.12% |

| Management company | Global Equity Beta Solutions |

| Average 3-5 EPS | 35.18% |

| Average Annualized Return | 6.54% |

| Investment objective | Replication |

| Investment geography | Consumer services |

| Benchmark | S&P Consumer Discretionary Select Sector Index |

| Leveraged | N/A |

| Median market capitalization | $565.52 billion |

| ESG rating | MSCI 6.8/10 |

| Number of holdings | 63 |

| Weighting methodology | Weighted Market capitalization |

About the XLY ETF

The Consumer Discretionary Select Sector SPDR Fund (XLY) was founded in September 1998 and is intended to mirror the price and yield performance of the Consumer Discretionary Select Sector Index. It has a weighted average market capitalization of $565.52 billion and an average annualized return of 6.54%.

XLY Fact-set analytics insight

The XLC ETF consists of 63 companies. So 45% of these companies are from the internet & direct marketing retail and specialty retail. The hotels & restaurants sector and the automobile industry take up the next 35%.

The Communication Services Select Sector SPDR Fund XLY, much like other ETFs based on the S&P 500, uses a weighted market capitalization for its methodology.

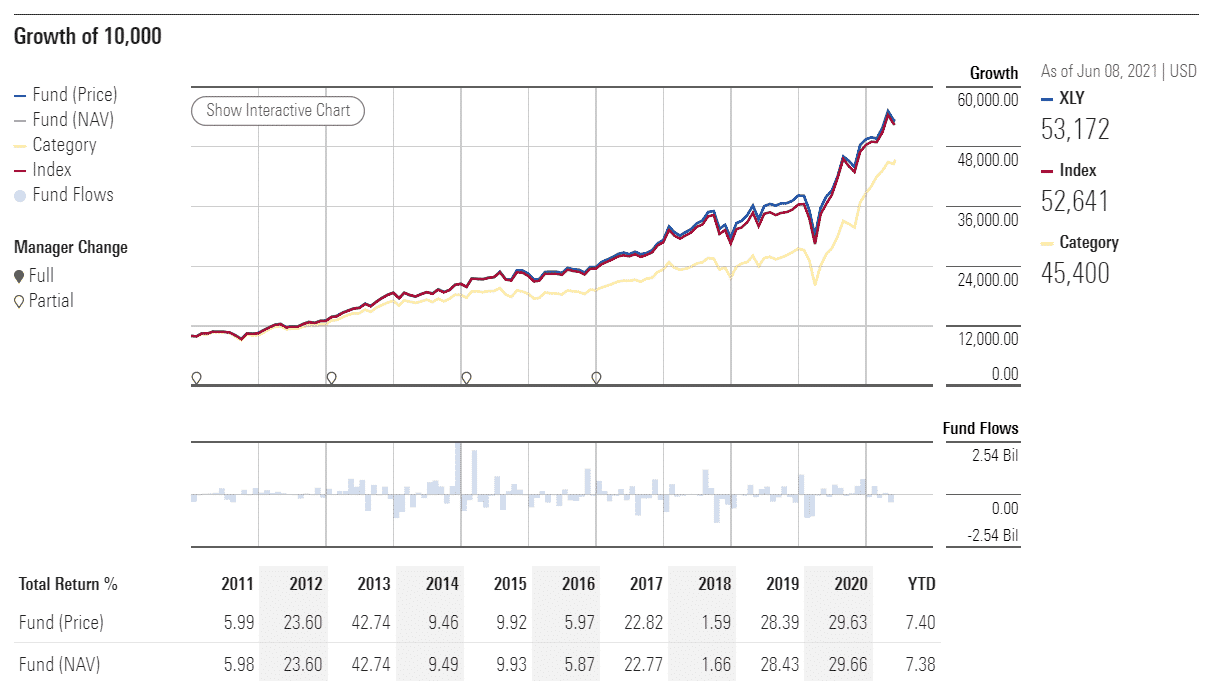

XLY performance analysis

After the initial tumble that most of the major benchmarks experienced due to the introduction of Covid-19 lockdowns, the XLY showed admirable resilience, with only one major hiccup in early March. When it happens, most of the indexes plunged after Federal Reserve Chairman Jerome Powell sent jitters among traders with his remarks on inflation.

While many of the ETF’s holdings are from the hospitality sector, which was hit hard during the pandemic, the internet businesses helped it buoy out of the crisis unscathed.

The ETF’s year-to-date gains came in at 7.18%, primarily thanks to the retailers. With more and more countries slowly winding down the virus containment measures, it is reasonable to expect the leisure and services sector to start carrying its weight and contributing to the growth.

The XLY ETF pays dividends quarterly. So the last payment was posted at $0.26 on the share at an expense ratio of 0.12%. On the MSCI ESG scale, XLY ETF has a 6.8/10 rating, according to analysts. In addition, the fund is of average resilience in terms of environmental, governmental, and social changes.

XLY ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| XLY Rating | A+ | A | 5 | **** | 6.6/10 |

| XLY ESG Rating | 6.82/10 | A | N/A | A: 34.03 out of 50 | N/A |

XLY key holdings

While a solid number of the XLY’s top holdings fall under the category of services, including Seattle-based coffeehouse chain Starbucks and fast-food giant McDonald’s, the lion’s share of the ETF’s weight lies with Elon Musk’s Tesla Inc. But even more so, with soon-to-be-astronaut Jeff Bezos’ retailer behemoth Amazon.com.

The two companies stand for more than a third of the ETF’s weight. Apart from the two firms, XLY is more diversified than the most, with seven out of the top ten holdings accounting for less than 5% of its pull. Regarding the volume, Amazon and Tesla are usually a guarantee enough that the volume will not disappoint.

Here are the top 10 holdings making up the XLY ETF.

| Ticker | Holding name | % of assets |

| AMZN | Amazon.com Inc. | 23.21% |

| TSLA | Tesla Inc. | 12.31% |

| HD | Home Depot Inc. | 8.84% |

| MCD | McDonald’s Corporation | 4.61% |

| NKE | NIKE Inc. Class B | 4.18% |

| LOW | Lowe’s Companies Inc. | 3.71% |

| SBUX | Starbucks Corporation | 3.5% |

| TGT | Target Corporation | 3.08% |

| BKNG | Booking Holdings Inc. | 2.51% |

| GM | General Motors Company | 2.14% |

Industry outlook

While some analysts expressed concerns of Tesla Inc. being “a bubble,” the stock has, so far, proved resilient amid the crisis, even after the five-for-one stock split.

While the stock price of the ETF’s most significant contributor, Amazon, jumped by more than 25% over the last year, Tesla’s shares rocketed more than 220% during the same period. Depending on the tempo of the economic bounce-back worldwide, but especially in the United States, other holdings, most notably the ones within the hospitality and services sector, are expected to contribute more to the ETF’s gains.

Comments