ETF full name: The Materials Select Sector SPDR® Fund

Segment: materials

ETF provider: SSGA Funds Management, Inc.

| XLK key details | |

| Issuer | State Street Global Advisors |

| Dividend | $0.33 |

| Inception date | December 16, 1998 |

| Expense ratio | 0.12% |

| Management company | Global Equity Beta Solutions |

| Average 3-5 EPS | 14.81% |

| Average Annualized Return | 60.31% |

| Investment objective | Replication |

| Investment geography | Materials |

| Benchmark | S&P Materials Select Sector Index |

| Leveraged | N/A |

| Median market capitalization | $58.28 billion |

| ESG rating | MSCI 8.57/10 |

| Number of holdings | 28 |

| Weighting methodology | Weighted Market capitalization |

About the XLB ETF

The Materials Select Sector SPDR® Fund XLB was initiated in December 1998 and is made to correspond to the Materials Select Sector Index. Its market capitalization stands at $58.28 billion, with an average yearly return of 60.31%.

XLB Fact-set analytics insight

The XLB consists of 28 holdings, 100% of which are based in the United States. As far as the industries go, almost 70% of the companies are related to chemicals, with 14% more in metals & mining and 12% in containers & packing. The remaining part, a bit under 5%, are the holdings focusing on the construction materials.

The XLB, like other ETFs based on the S&P 500 index, uses weighted market capitalization for its methodology.

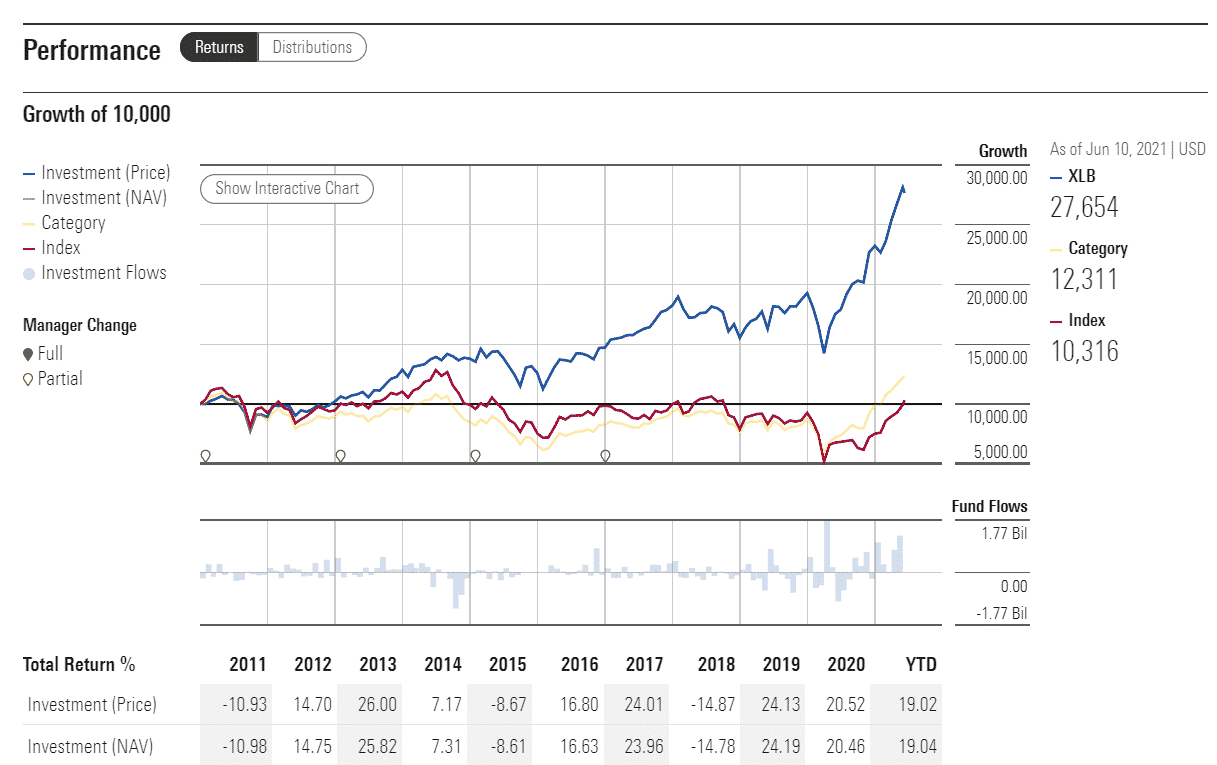

XLB performance analysis

XLB corresponds with the markets’ general, recovery-dependent movements with the lion’s share of its holdings in materials. After diving into the initial phase of the Covid-19 pandemic, the fund’s recovery seemed solid. With the vaccine rollout gaining speed, more and more sectors recovering their pre-pandemic activity levels, the XLB looks like it follows the general upward trend.

The XLB ETF pays dividends quarterly. For the last trimester, the dividend amounted to $0.33 on the share at an expense ratio of 0.12%.

On the MSCI ESG scale, XLK ETF boasts an 8.57/10 double-A rating. In addition, the fund was declared to be of higher-than-average resilience in terms of environmental, governmental, and social changes.

XLB ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| XLB Rating | AA | AA | 4 | **** | 4.9/10 |

| XLB ESG Rating | 8.57/10 | AA | N/A | N/A | N/A |

XLB key holdings

The XLB ETF relies on materials, which closely tracks the stocks related to the industry itself. The fund’s leading betting horse is Lince plc, an international chemical company that boasts the largest market share and revenue among industrial gas businesses. While the stock itself took a beating during the first phase of the pandemic, the latest earnings report from May showed that Linde is on the right track to a significant bounce-back. Its revenue during the first three months of fiscal 2021 was 7% higher than it was a year ago.

Along with Linde, the ETF’s prominent holdings are paint & coating company Sherwin-Williams, Ohio, and chemical commodity giant Dow Inc., which spun off from DowDuPont in 2019. Another star among the constituents is, of course, the giant’s other spinoff DuPont de Nemours, Inc.

Here are the top 10 holdings making up the XLB ETF.

| Ticker | Holding name | % of assets |

| LN | Linde plc | 15.33% |

| SHW | Sherwin-Williams Company | 6.82% |

| APD | Air Products and Chemicals, Inc. | 6.65% |

| FCX | Freeport-McMoRan, Inc. | 6.05% |

| ECL | Ecolab Inc. | 5.3% |

| DOW | Dow. Inc. | 5.18% |

| NEM | Newmont Corporation | 4.82% |

| DO | DuPont de Nemours, Inc. | 4.58% |

| PPG | PPG Industries, Inc. | 4.32% |

| IFF | International Flavors & Fragrances, Inc. | 3.67% |

Industry outlook

Although the materials sector doesn’t look as exhilarating as pharmaceuticals or technology, tracking it can pay off due to the higher predictability of the movements across the industry. Given the nature of both businesses and their products, it’s no wonder that active traders use investments in raw materials as a hedge to the market’s general volatility. As a bonus, the trend seems to correspond with the general state of the economy’s main sectors, which makes it somewhat easier to anticipate its future moves and choose the correct positions for the most likely scenario.

Comments