ETF full name: The Real Estate Select Sector SPDR® Fund (XLRE)

Segment: real estate

ETF provider: SSGA Funds Management, Inc.

| XLY key details | |

| Issuer | State Street Global Advisors |

| Dividend | $0.30 |

| Inception date | October 7, 2015 |

| Expense ratio | 0.12% |

| Management company | Global Equity Beta Solutions |

| Average 3-5 EPS | 13.61% |

| Average Annualized Return | 19.38% |

| Investment objective | Replication |

| Investment geography | Real estate |

| Benchmark | S&P Real Estate Select Sector Index |

| Leveraged | N/A |

| Median market capitalization | $51.31 billion |

| ESG rating | MSCI 7.11/10 |

| Number of holdings | 29 |

| Weighting methodology | Weighted Market capitalization |

About the XLRE ETF

The foundation’s date of The Real Estate Select Sector SPDR® Fund (XLRE) is October 2015, and it looks to correspond with the S&P 500 S&P Real Estate Select Sector Index. It holds a weighted average market capitalization of $51.31 billion and an average annualized return of 19.38%.

XLRE Fact-set analytics insight

The XLRE comprises 29 holdings based in the United States. They are from the real estate sector, with approximately 97% of them falling under the real estate investment trust category. Some 45% of holdings are specialized REITs, more than 40% are commercial REITs, while around 11% are residential funds. The remaining 3% are the real estate services.

The XLRE, similarly to other ETFs based on the S&P 500 benchmark, utilizes a weighted market capitalization for its methodology.

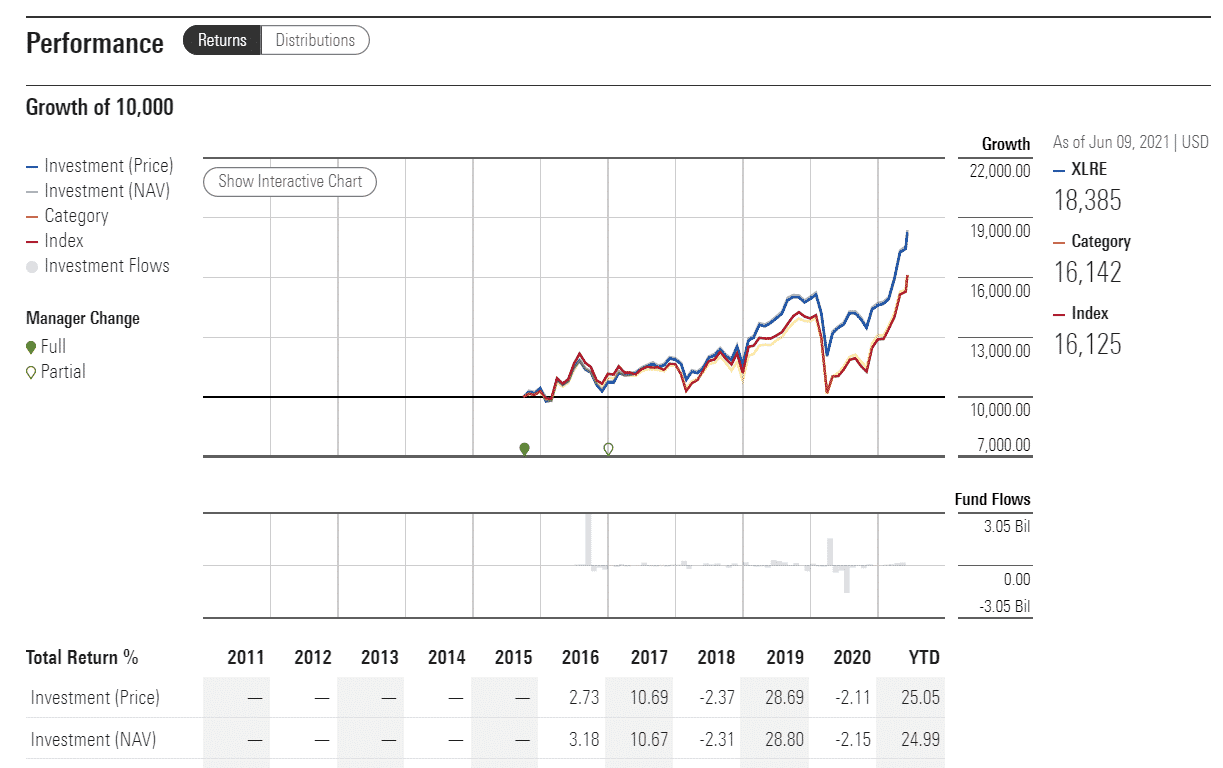

XLRE performance analysis

Unlike ETFs that rely more on the technology sector, XLRE’s reliance on the real estate sector caused moderate volatility since the start of the Covid-19 crisis. Putting aside the two downfalls from March and May, prompted mainly through inflation-fear induced selloff on Wall Street, the ETF’s been showcasing a continuous upward trend ever since.

While the house prices in the United States have been hit with the coming of the pandemic, both S&P/Case-Shiller’s reading and those of the Federal Housing Finance Agency have shown optimistic expectations amid upbeat data since the start of the year, which falls in line with the ETF’s trend.

The XLRE ETF pays dividends quarterly. The last payment was posted at $0.38 on the share at an expense ratio of 0.12%.

On the MSCI ESG scale, XLRE ETF has a 7.11/10 A rating. In addition, the fund is of slightly higher-than-average resilience in terms of environmental, governmental, and social changes.

|

XLRE ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| XLRE Rating | A | A | 5 | ***** | 6.2/10 |

| XLRE ESG Rating | 7.11/10 | A | N/A | N/A | N/A |

XLRE key holdings

WIth the XLRE, the ETF holdings’ niche operates in bears more significance than any of the companies on their own. With a portfolio-wide enough to cover all the significant regions in the United States, the state of the housing market is closely mirrored in the fund’s constituents. Six out of the top ten XLRE’s holdings sum up to less than 5% of its pull. It proves the even distribution among the holdings.

Here are the top 10 holdings making up the XLRE ETF.

| Ticker | Holding name | % of assets |

| AMT | American Tower Corporation | 12.87% |

| PLD | Prologis Inc. | 9.68% |

| CCI | Crown Castle International Corp | 9.07% |

| EQIX | Equinix, Inc. | 7.5% |

| PSA | Public Storage | 4.7% |

| DLR | Digital Realty Trust, Inc. | 4.67% |

| SPG | Simon Property Group, Inc. | 4.65% |

| SBAC | SBA Communications Corp. Class A | 3.66% |

| WELL | Welltower, Inc. | 3.41% |

| AVB | AvalonBay Communities, Inc. | 3.16% |

Industry outlook

With the home financing giant Fannie Mae revealing in its monthly report that the number of people who think it’s an excellent time to buy a house now fell to an all-time low of 35% in the US. It is safe to say that the housing market rally is looking at a pause. Reuters analysts’ poll hinted that the house prices would grow at double the predicted pace just three months ago.

With a 10.6% jump, the figure is expected to outrun the GDP growth and inflation. However, the situation isn’t necessarily as dire as it looks. The housing market is not an island, and other economic factors need to be considered to get a clearer picture.

Lawrence Yun, a chief economist at the National Association of Realtors, provided a hint of relief, predicting that the overall state of the housing market will be an improvement on the year prior. However, given the freeze registered during 2020, that statement doesn’t necessarily mean much in and of itself. As an analyst at Realtor.com stated: “Expect a dip, but not a crash.”

Comments