ETF full name: Utilities Select Sector SPDR Fund

Segment: Utilities Sector

ETF provider: State Street Global Advisors

| XLU key details | |

| Issuer | State Street Global Advisors |

| Management | Schneider, Hancock, and Feehily |

| Quarterly Dividend | $0.46 |

| Inception date | December 16, 1998 |

| Expense ratio | 0.12% |

| Average 3 Year Return | 14.39% |

| Average Annualized Return | 11.35% |

| Investment objective | Replication Strategy |

| Investment geography | Broad Utilities Sector |

| Benchmark | Thomson Reuters US Utilities |

| Leveraged | N/A |

| Median market capitalization | N/A |

| ESG rating | AA: 7.16 out of 10 |

| Number of holdings | 28 |

| Weighting methodology | Market capitalization |

About the XLU ETF

From December 16, 1998, investors got an avenue for volatility reduction coupled with regular incomes through the SPDR Utilities Select Sector ETF, XLU. This exchange-traded fund tracks the performance of the SPDR Utilities Select Sector Index with a view of replicating the performance net of expenses. It has $11.63 billion in assets under management in its arsenal, with its 15-year returns standing at 8.83%.

XLU Fact-set analytics insight

Investing in the Utilities Select Sector SPDR Fund exposes one to 28 companies in the utility sector, the largest organization in the industry listed in the S&P 500.

Therefore, this is non-diversified hence not fit for neutral investors with interests in the broader utility market. However, it is among the largest ETFs in its sector regarding assets and trading volume, making it a dominant force in this sector of the economy, making it a wise investment choice.

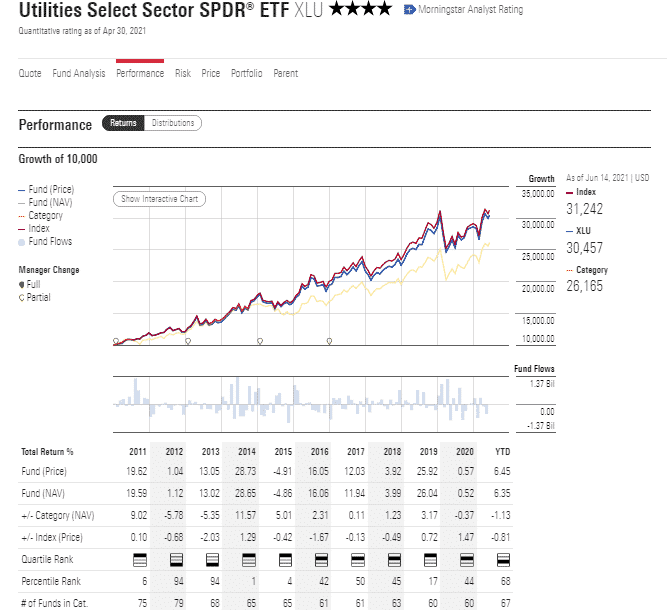

XLU performance analysis

The global shift from traditional energy sources has seen the utility sector benefit from subsidized loans for capital projects with a skewness towards environmental and climate protection.

As the world population grows and industries emerge, there is always a need for utilities and associated services, so utility funds are investors’ safe-haven. XLU performance in the last 12 months, 6.06%, shows how resilient the fund is given the other sector drops during the pandemic. The year-to-date returns so far show the demand for utilities as the world recovers post-pandemic, 16.22%.

This is by no means an anomaly given that this fund’s 3-year, 5-year, and 10-year returns are 16.68%, 9.03%, and 11.02%, respectively. Utility companies might not offer the same equity growth in other sectors, but they make up for it in the dividend yield. As a result, investors view utilities ETFs as a hybrid giving the best of both stocks and bond markets.

XLU ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| XLU Rating | A+ | A 47 | 4 | **** | Rank 2 in utilities |

| XLU ESG Rating | AA: 7.16 out of 10 | AA: 7.16 out of 10 | N/A | A: 30.8 out of 50 | A: 6.1 out of 10 |

XLU key holdings

The top XLU holding is electric powerhouse NextEra Energy Inc. To ensure economies of scale and returns, this company is segmented into two, NEER and FPL. NEER concentrates on the production of green and renewable energy. On the other hand, the FPL segment deals with Florida’s complete electricity supply chain, generation, transmission, distribution, and selling.

The company occupying the number two berth is Duke Energy Corp. Another energy company provides electricity and gas to industries, corporations, and residential homes through several subsidiaries across stateliness; Florida, South and North Carolina, Ohio, Tennessee, and Kentucky. It also interests clean energy, solar and wind, nuclear energy, coal-fired facilities, natural gas-powered facilities, and oil-fired facilities. According to their data, the company currently serves more than 1.6 million gas customers and 7.6 million electric customers.

Occupying the 3rd spot is Southern Company, a holding that sells electricity through different segments, southern company gas, Conventional Electric Operating Companies, and Southern power. This Atlanta-based company generates, distributes, and sells electricity and gas in Georgia, Florida, Mississippi, Virginia, New Jersey, Alabama, Maryland, Tennessee, and Illinois.

It also has tentacles in the green energy sector through its Southern Power segment; construction acquisition, ownership, and management of generation assets.

The top 10 holdings of XLU are.

| Ticker | Holding name | % of assets |

| NEE | NextEra Energy Inc. | 17.70% |

| DUK | Duke Energy Corp. | 7.75% |

| SO | Southern Co. | 7.37% |

| D | Dominion Energy Inc. | 6.85% |

| EXC | Exelon Corp. | 4.63% |

| AEP | American Electric Power Co. Inc. | 4.57% |

| SRE | Sempra Energy | 4.11% |

| XEL | Xcel Energy Inc. | 3.79% |

| ES | Eversource Energy | 3.35% |

| PEG | Public Service Enterprise Group Inc. | 3.35% |

Industry outlook

Portfolios with utility funds and stocks invest in the US and International public utility companies with the primary purpose of capital appreciation. These are companies in the gas industry, electricity provision and distribution, and telephone service providers. The world runs on energy making the utility sector a must-own for regular incomes through dividends. So it also hedges the ETF in times of downturn.

Comments