The SPY seems hellbent on recovering its slide due to the September doldrums having closed the previous week, 11th October to 16th October, with the most significant weekly change since July, +1.8%.

Would the new week be one of new records for the SPY or heartbreak for investors?

SPY Monday opening prices have not been predictable in the previous weeks, leaving investors jittery. Despite a solid bullish run last week, the opening price was $443.23, a 0.2% gap down. Given that a bearish slide followed the prior experiences of a gap-down, it came as no surprise that a minor bearish trend followed the opening gap down.

However, despite CPI jumping to 5.4% and inflation data showing that its current rate is ahead of the FED’s target, the equity markets are continuing to show remarkable resilience. As such, the SPY experienced the bearish run for only a few hours on Monday, with the September resistance level of $443.31 flipping into the support level needed to start its bullish run for the week.

As November draws near and all indicators point to FED tapering, investors have gained confidence in the economy pumping money into the equity markets. However, it should be noted that with the current rate of inflation, investment inflows favor sectors and assets that result in inflation protection.

In addition to the increased investor confidence, the weekly economic news showed an economy in recovery fueling further bullish climb; jobless claims at 290K-the lowest since March 2020. The manufacturing business outlook survey also showed that most firms had increased activity for the month, with growth expectations for the next six months.

With all the SPY sectors pulling in one direction, it had another week of breaking records to finish with a +1.96% change.

Top Gainers of the current week

Real Estate sector

With accelerated inflation ahead of the FED’s target, combined with rising rates for commercial and home properties, the real estate sector benefited the most to close the week at +2.55%.

Healthcare sector

As more pharmaceutical companies get the Covid-19 booster shots approved and Biden seeks bill approval for mandatory vaccination for businesses with more than 100 employees, the healthcare sector has experienced investment inflows to close the week at 2.49%.

Consumer Discretionary sector

Supply chain bottlenecks have gotten to the point that discussions on using the national guard to help deal with the backlog have started. With the projected shortage of holiday products and rising inflation driving price increments, the consumer discretionary sector continues to be a crowd puller-+2.15% weekly change.

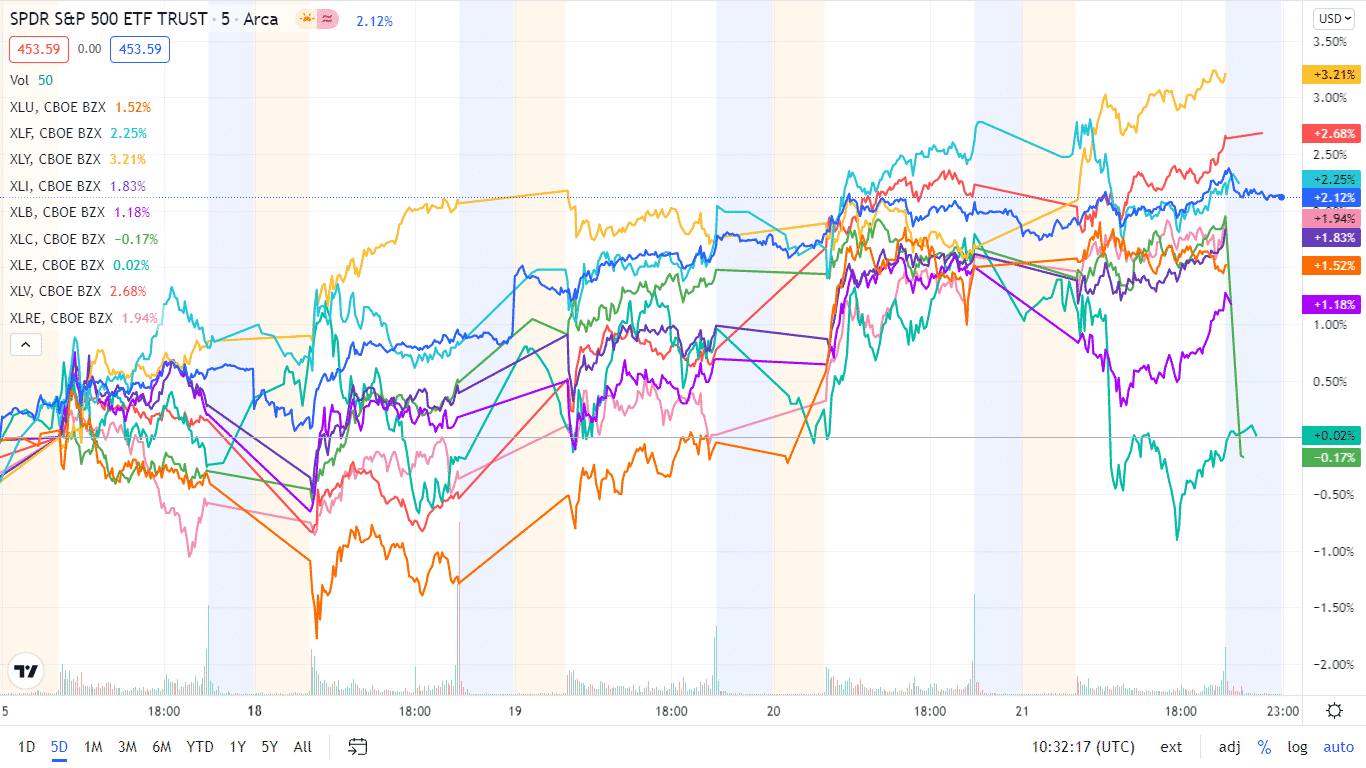

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week in the green by breaking down the individual sector performances using their corresponding ETFs.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Real Estate | XLRE | 2.55% with the accompanying real estate select sector ETF |

| 2. | Healthcare | XLV | 2.49% with the accompanying healthcare select sector ETF |

| 3. | Consumer Discretionary | XLY | 2.15% with the accompanying consumer discretionary select sector ETF |

| 4. | Information Technology | XLK | 1.95% with the accompanying information technology select sector ETF |

| 5. | Utilities | XLU | 1.87% with the accompanying utilities select sector ETF |

| 6. | Communication Services | XLC | 1.70% with the accompanying communication services select sector ETF |

| 7. | Industrial | XLI | 1.52% with the accompanying industrial select sector ETF |

| 8. | Financial Services | XLF | 1.44% with the accompanying financial select sector ETF |

| 9. | Materials | XLB | 1.04% with the accompanying materials select sector ETF |

| 10. | Energy | XLE | 0.24% with the accompanying energy select sector ETF |

| 11. | Consumer Staples | XLP | 0.03% with the accompanying consumer staples select sector ETF |

Comments