The first week of October saw the SPY surge and end a five-week bearish run, -3.2%, that had investors questioning if it was time to fold on further bullish outlook.

Was the SPY back to winning ways and signaling the start for another record-breaking earning season, or was it all a gimmick?

With analysts doubling down on their Q3 expected SPY growth after the September doldrums, 29.6% compared to Q2 growth of 96.3%, Monday’s opening price was a shocker. In addition to the lowered expectations, SPY investors are used to the Monday morning gap down, making this week’s gap up of 0.4% a rare occurrence. Trading started at $438.55, starting a bullish frenzy that drove prices up to the 441.43 September resistance level.

With the coronavirus claws still deep in economic activities, the weaker than expected jobs market report from last week coupled, SPY upward steam vanished. In addition, the IMF sounded a warning that the alarm on the global economy being at the doorstep of inflationary risk. These factors resulted in the SPY downward slide for the better part of Tuesday and Wednesday, testing the now-familiar July pivotal level at $433.08.

The consumer price index data came in better than expected to arrest SPY’s slide and buoy it back upwards, starting with the Thursday price gap up of 0.5%. Consumers are aware of the supply chain bottlenecks attributable to the coronavirus and have started early Christmas shopping since the backlog might lead to empty shelves come December.

The SPY might not finish in the green this week, but several sectors have benefited from the supply chain challenges and the rising cost of inputs.

Gainers of the current week

Real Estate sector

As a safe haven investment option, real estate has taken a backseat to the other sectors in recent weeks. Still, it seems to have shaken off rising mortgage rates and increasing pandemic-related foreclosures to surge ahead of the pack at +2.07% for the week.

Materials sector

With the increasing cost of inputs and rising consumer demand, it is no wonder the materials sector witnessed considerable cash inflows to close to record a +0.92 change for the week.

Consumer Discretionary sector

Fueled by early Christmas shopping due to supply chain bottlenecks that might lead to a shortage of festive season items, the consumer discretionary sector surged into the green with a +0.76% change.

Losers of the current week

Sectors that took the most significant blow as October settles in were:

Healthcare sector at — 1.14%

Financial Services sector at — 1.95%

Communication Services sector at — 2.00%

The rising cost and inflation are undercutting economic recovery, and the sectors above took the worst beating among all the SPY sectors. In the same breath, September added only 194K jobs against the expected 500K showing that the economy has slowed down and tapering might not happen as soon as Powell had earlier stated.

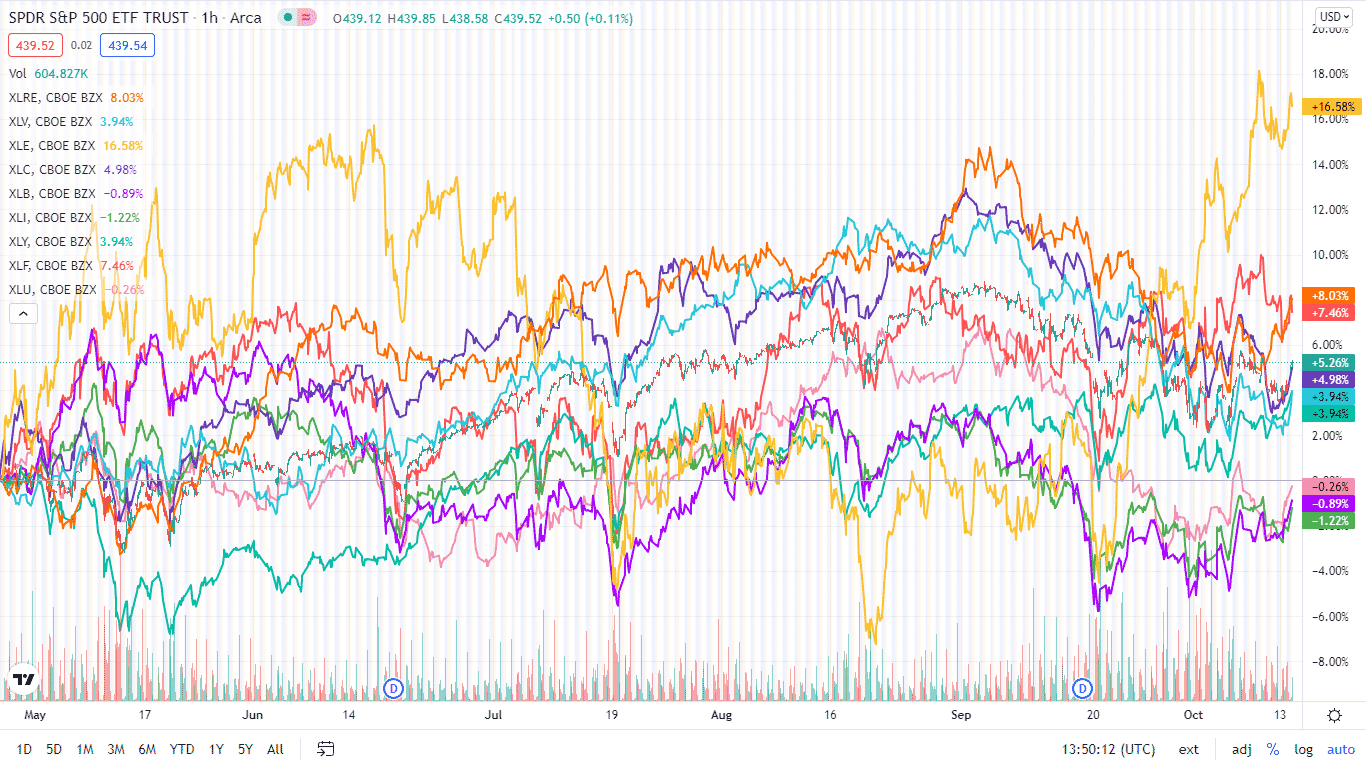

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week in the green by breaking down the individual sector performances using their corresponding ETFs.

| The S&P 500 individual sector, weekly performance breakdown | |||

| 1. | Real Estate | XLRE | +2.07% with the accompanying real estate select sector ETF |

| 2. | Materials | XLB | +0.92% with the accompanying materials select sector ETF |

| 3. | Consumer Discretionary | XLY | +0.76% with the accompanying consumer discretionary select sector ETF |

| 4. | Utilities | XLU | +0.43% with the accompanying utilities select sector ETF |

| 5. | Consumer Staples | XLP | +0.21% with the accompanying consumer staples select sector ETF |

| 6. | Information Technology | XLK | -0.48% with the accompanying information technology select sector ETF |

| 7. | Energy | XLE | -0.53% with the accompanying energy select sector ETF |

| 8. | Industrial | XLI | -0.91% with the accompanying industrial select sector ETF |

| 9. | Healthcare | XLV | -1.14% with the accompanying healthcare select sector ETF |

| 10. | Financial Services | XLF | -1.95% with the accompanying financial select sector ETF |

| 11. | Communication Services | XLC | -2.00% with the accompanying communication services select sector ETF |

Comments