Thanks to Hollywood, most of the world’s populace has no idea how far artificial technology is part of our everyday lives. While many people first thought artificial technology was robots with super intelligence, artificial technology improves specific operational activities and tasks across all industries, subtly running every aspect of our lives.

From complicated AIs such as IBM’s Watson utilized in medicine to the most mundane smart house appliances, the human appetite for task simplification will only grow, driving increased adoption of AI technology. The AI market’s estimated annual compound growth rate is 40.2% from 2021 to 2028.

To get ahead of this race, investors need to invest in the AI market strategically. Not all market participants thrive, making it difficult to pick a single stock or a pool of individual stocks. The prudent investing step is to go the Buffett way, invest in AI exchange-traded funds and bet on the entire AI technology niche.

What is an AI ETF?

AI ETFs comprise organizations whose primary activities are artificial intelligence research, development, production, application, and organizations providing ancillary services to all of the earlier mentioned organizations. The norm is for organizations to derive at least 25% of their revenues from AI-related activities from qualifying as holdings in an AI ETF.

Best AI ETFs for 2022

The AI market valuation in 2020 was $62.35 billion, with 2021 expected to grow to $93.53 billion. It translates to year-on-year growth of 50%. With the world recovering from the coronavirus pandemic and economic resurgence to normalcy, 2022 might surpass this phenomenal market growth rate. The three AI ETFs below, if played right, can make a ton of money for investors.

№ 1. AI Powered Equity ETF (AIEQ)

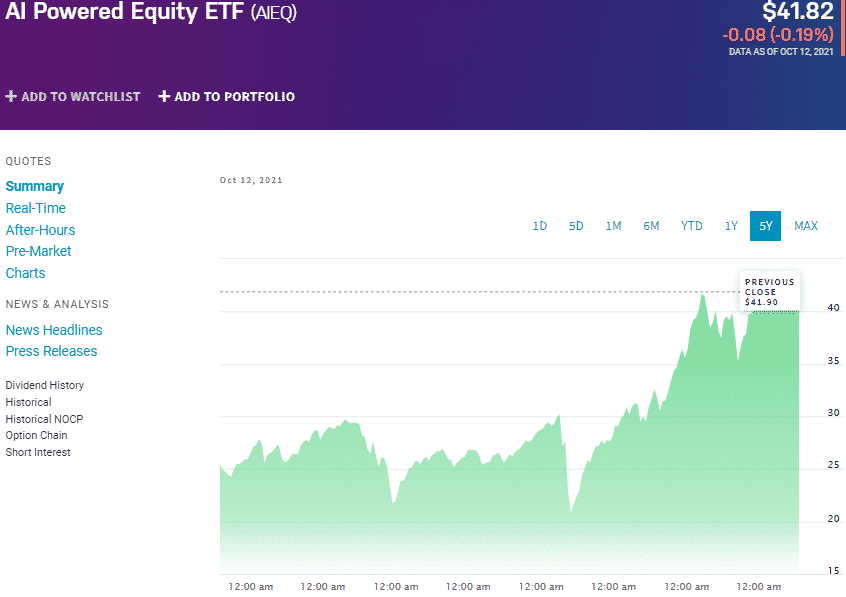

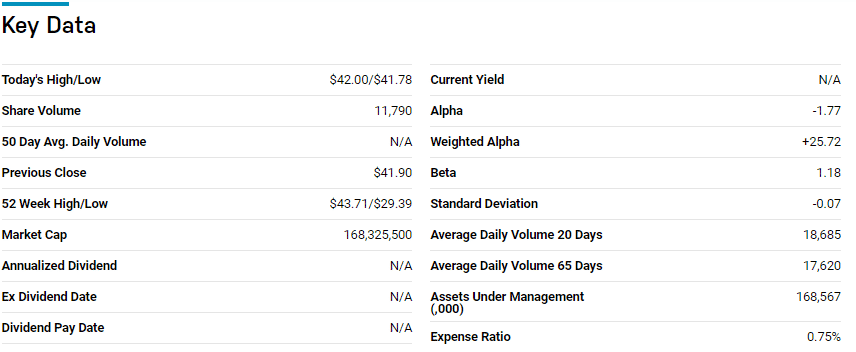

Price: $41.82

Expense ratio: 0.80%

AIEQ chart

AI Powered Equity ETF is an actively managed fund that seeks capital appreciation. Rather than concentrate on AI equities, the AIEQ utilizes artificial intelligence as its fund’s subadvisor, the EquBot model by EquBot LLC, to pick US equities with the greatest growth and returns potential.

The top three holdings of this ETF as of now are:

- Apple Inc. – 7.28%

- Microsoft Corporation – 7.03%

- Alphabet Inc. Class A shares – 4.26%

Compared to some artificial intelligence ETFs, the AIEQ assets under management value of $168.68 million are meager. It also has a relatively higher expense ratio of 0.8%. However, a look at the historical performance shows that this ETF has been able to pick winning stocks consistently with artificial intelligence.

Thus, 3-year returns of 55.22%, 1-year returns of 28.41%, and year-to-date returns of 17.92%.

According to EquBot developers, this technology works more efficiently than 1000 investment analysts, quants, and traders working 24/7. It is thus not only highly adaptable and efficient but is a cost-saver, putting in a strong case for it to be on the crosshairs.

№ 2. First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT)

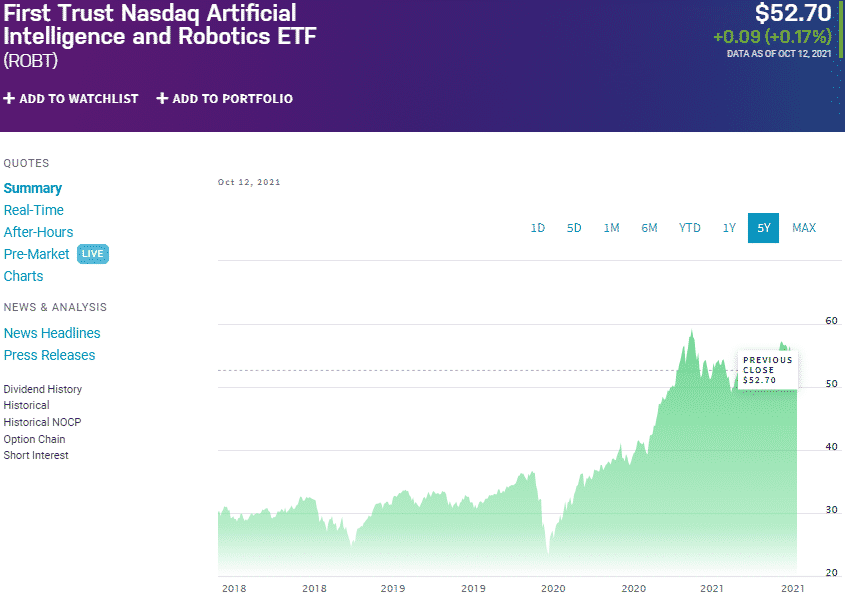

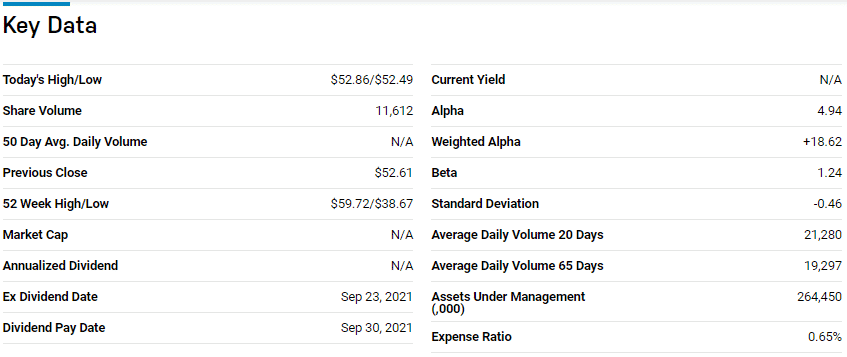

Price: $52.70

Expense ratio 0.5%

ROBT chart

The First Trust Nasdaq Artificial Intelligence and Robotics ETF tracks the performance of the Nasdaq CTA Artificial Intelligence and Robotics Index, investing at least 90% in the holdings of its composite index coupled to the index’s ADRs and securities. This non-diversified fund exposes investors to all sectors of the economy utilizing artificial intelligence.

ROBT is ranked №27 by US News among ninety-six technology ETFs for long-term investing.

The top three holdings of this ETF as of now are:

- Ambarella Inc. – 3.07%

- Gentex Corporation – 2.49%

- Palo Alto Networks, Inc. – 2.29%

ROBT has $263.41 million in assets under management, with an expense ratio of 0.65%. Past performance is not a guarantee of future returns, but it sure is a sign of the potential of an ETF. A look at the historical performance of the ROBT shows that it is worth a second look when debating on whether to invest in the AI space.

Thus, 3-year returns of 85.56%, pandemic year returns of 27.03%, and current year-to-date returns of 5.14%. Except for the current year, its returns are consistently above the category average, making it the prospective AI ETF investment choice.

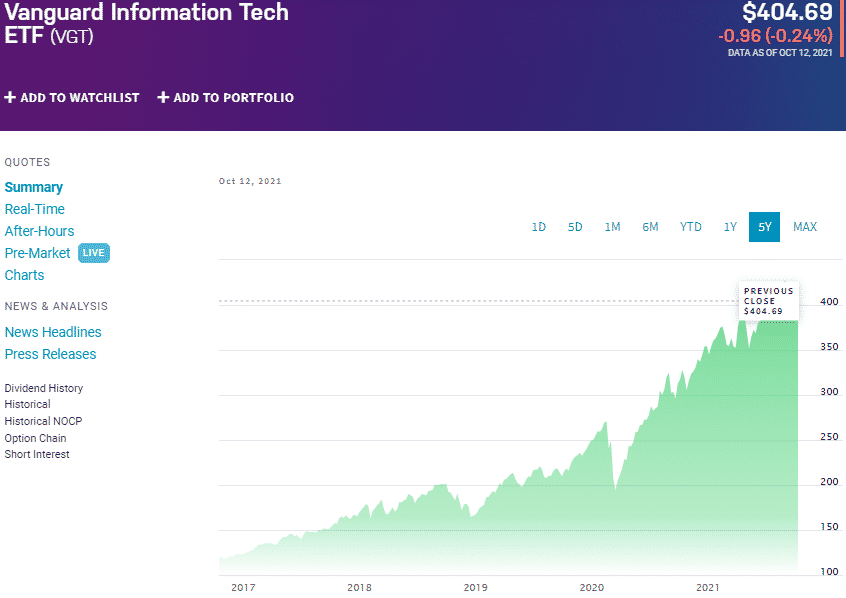

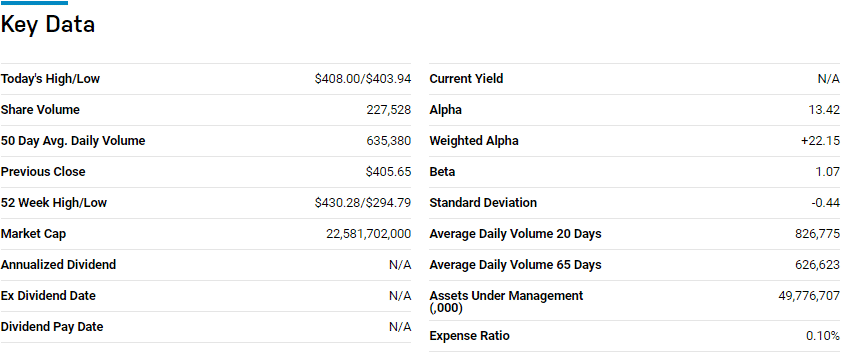

№ 3. Vanguard Information Technology ETF (VGT)

Price: $404.69

Expense ratio:0.10%

VGT chart

Vanguard Information Technology ETF utilizes an indexing investment approach, tracking the performance of the MSCI US Investable Market Index/Information Technology 25/50. The composite index cuts across the cap divide of the information technology sector to include large-cap, mid-cap, and small-cap holdings. This non-diversified fund invests at least 95% of its total assets in the holdings of the tracked index with the exact weighting.

VGT is ranked №3 by US News among ninety-six technology ETFs for long-term investing.

The top three holdings of this ETF as of now are:

- Apple Inc. – 19.98%

- Microsoft Corporation – 17.03%

- NVIDIA Corporation – 4.40%

VGT is one of the most significant funds with artificial intelligence exposure with $49.40 billion in assets under management, with a meager expense ratio of 0.10%, compared to the other funds on this list.

With diversification in terms of the equities represented, VGT combines leg room for growth through its small-cap holdings with stability through the large-cap equities. A look at the historical performance shows that VGT has outperformed its average segment and the category average in the last five years.

Thus, 5-year returns of 258.2%, 3-year returns of 127.66%, pandemic year returns of 22.99%, and current year-to-date returns of 15.02%.

Final thoughts

Since the internet launch, AI technology has been the next disruptive technology, with tech companies involved in artificial intelligence already having reaped big rewards. Artificial intelligence is no longer a futuristic theme for movies but a part of our daily lives that has enhanced the profitability and efficiency of all the industries it utilizes.

As the investment world looks to 2022 for complete economic resurgence to normalcy, the AI ETFs above have the potential for massive returns.

Comments