At present, there are 89 leveraged ETFs, excluding those with less than $50 million in assets under management. Whereas this value sounds like a drop in the ETF market’s ocean, leveraged ETFs aren’t for long-term trading.

They are investment vehicles for taking advantage of short-term market volatility to amass profits, usually a day. Where traditional ETFs are a low-risk moderate return investment asset, leveraged ETFs are a high-risk, high-reward asset class.

What is a leveraged ETF?

Exchange-traded funds offer investors an avenue to own several investment assets within one investment instrument. The performance of these instruments is dependent on the performance of the pooled assets.

Similarly, leveraged ETFs comprise a basket of investment securities. However, where conventional ETFs invest in the underlying holdings of their composite index with an objective of similar returns, leveraged ETFs focus more on the debts and financial derivatives of the underlying holdings to help amplify the returns. The result is a highly liquid investment asset adaptable to volatile market conditions for a quick buck.

Bankrate’s three best-leveraged ETF to buy in 2022

With the coronavirus still rearing its ugly head and the majority of the world economies operating below capacity, the markets are full of uncertainty resulting in high volatility.

Leveraged ETFs on the surface might exhibit a short ETF with magnified returns, but the truth is that there is much more intricacy to trading them, calling for high-level expertise. In addition, they are high-risk, high-reward investment instruments calling for investors with relatively higher risk tolerance.

If you have the requisite expertise and matching risk tolerance levels, these three leveraged ETFs are pipped by Bankrate to be the best to take advantage of the market volatilities in 2022.

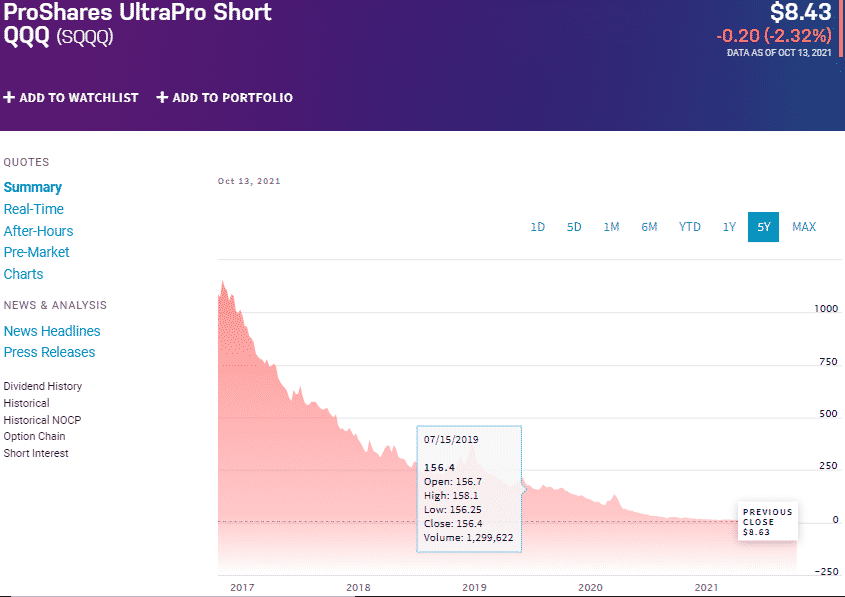

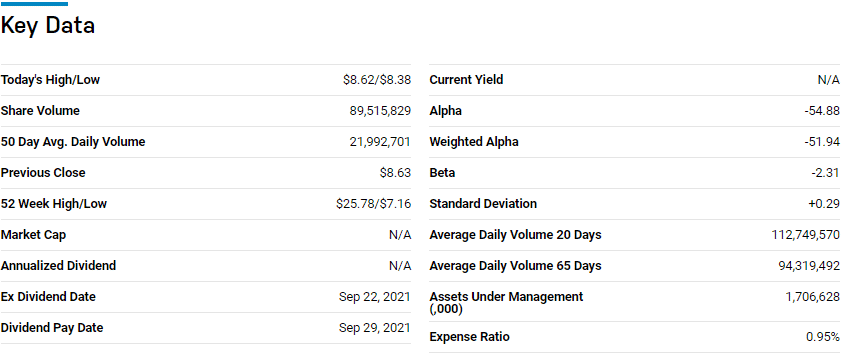

№ 1. ProShares UltraPro Short QQQ (SQQQ)

Price: $8.43

Expense ratio: 0.95%

SQQQ chart

The ProShares UltraShort QQQ seeks the returns of the Nasdaq 100 thrice daily. When the nonfinancial equity market looks bearish, the SQQQ provides shorting exposure to investors. It resets daily, compounding either the profits or losses made, calling for a cautious investment strategy to avoid ruin.

The top three holdings of this ETF as of now are:

- The US Dollar — 46.48%

- The United States Treasury Bills 0.0% 21-APR-2022 — 7.53%

- The United States Treasury Bills 0.0% 04-NOV-2021 — 4.79%

The SQQQ ETF boasts $1.70 billion in assets under management, with an expense ratio of 0.95%. It distributes its dividends quarterly, and currently, its investors are enjoying dividends of $0.33 to the share.

As the economic resumption picks up pace, the SQQQ fund is in pole position to take advantage of the volatility in the largest nonfinancial organizations globally. Remember to keep in mind the daily reset which has a compounding effect.

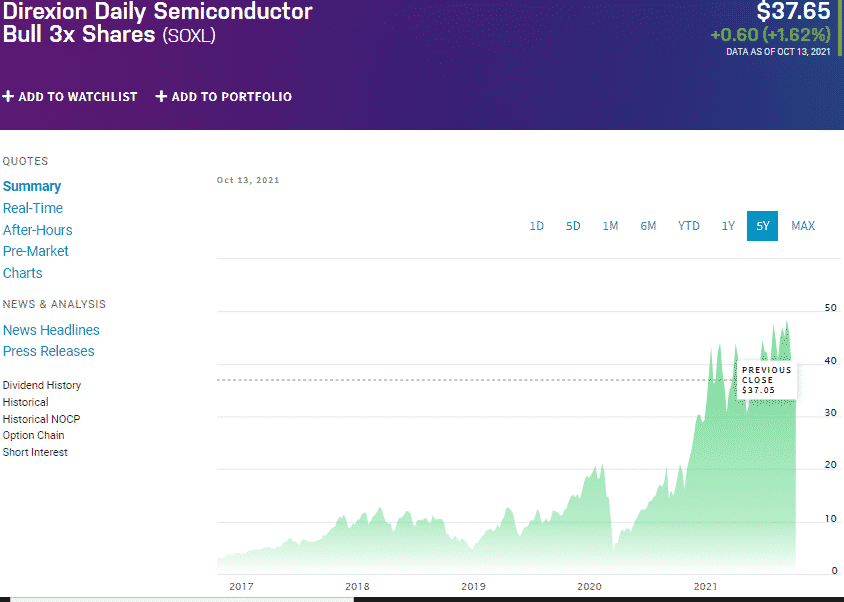

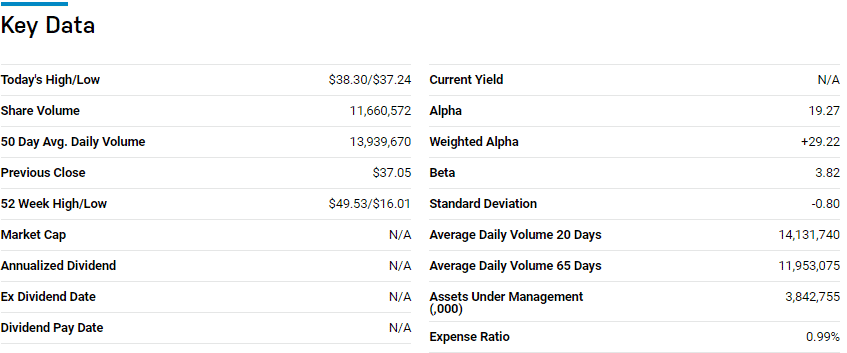

№ 2. Direxion Daily Semiconductor Bull 3x Shares (SOXL)

Price: $37.65

Expense ratio: 0.96%

SOXL chart

In the investment world, the SOXL brand has pulled ahead of the pack in the provision of leveraged ETFs, meaning a list of leveraged ETFs without this fund on it is nigh impossible to find.

The Direxion Daily Semiconductor Bull 3X Shares fund seeks the returns of the PHLX Semiconductor Sector Index thrice. When the semiconductor technology niche market looks bearish, the SOXL provides shorting exposure to investors. It resets daily, giving investors a chance to compound their returns, but the same applies to losses that call for prudence and close monitoring of trades.

The top three holdings of this ETF as of now are:

- Other Derivative Securities — 28.69%

- Dreyfus Government Cash Management Funds Institutional — 12.34%

- Goldman Sachs Trust Financial Square Treasury Instrument Fund Institutional — 10.39%

Boasting $3.7 billion in assets under management, SOXL is one of the largest leveraged ETFs in market capitalization terms. For a $10,000 annual investment, investors part with $96 as expense fees.

Historical performance is no guarantee of future returns, more so when dealing with leveraged ETFs since they are short-term volatility trading instruments. However, SOXL historical performance calls for this leveraged ETF’s scrutiny in times of market volatility.

Thus, 5-year returns of 1199.20%, 3-year returns of 386.10%, and pandemic year returns of 77.65%. At present, the SOXL objective is being met given that the semiconductor segment average year-to-date returns is 6.84%, and its returns stand at 21.11%, 308.6% returns. In addition, it distributes quarterly returns, which at present are $0.02 to the share.

№ 3. ProShares UltraPro Short Dow30 (SDOW)

Price: $31.87

Expense ratio: 0.95%

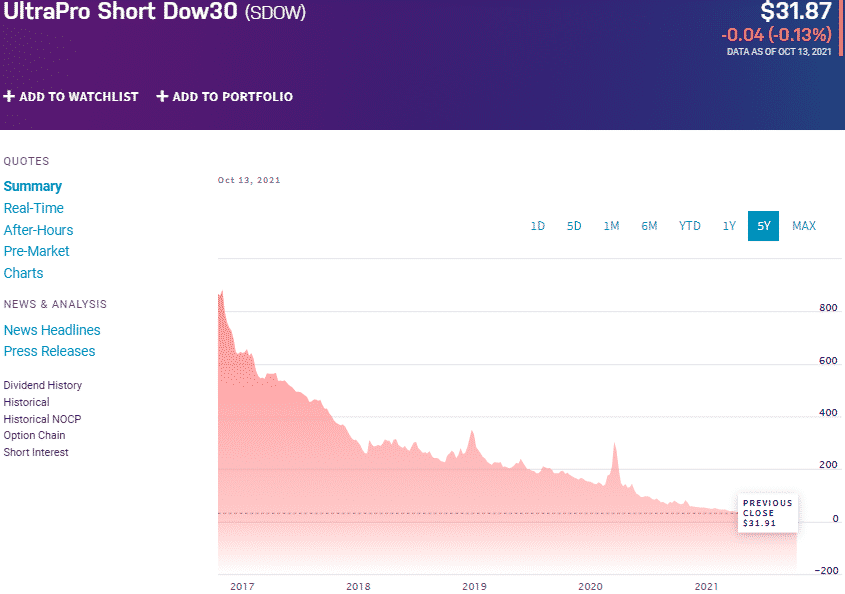

SDOW chart

The ProShares UltraShort Dow30 ETF seeks the returns of the Dow Jones Industrial Average Index thrice daily. When the US large-cap equity market looks bearish, the SDOW provides shorting exposure to investors. With daily resetting, this non-diversified leveraged fund is a powerful tool for the savvy investor to amass returns over the short term.

The top three holdings of this ETF as of now are:

- The US Dollar — 47.91%

- The United States Treasury Bills 0.0% 12-NOV-2021 — 5.54%

- The United States Treasury Bills 0.0% 28-OCT-2021 — 5.54%

The SDOW has $456.18 million in assets under management, with an expense ratio of 0.95%. It distributes its dividends every quarter, and currently, its investors are enjoying dividends of $0.26 to the share.

The majority of the large-cap equities have weathered the coronavirus storm pretty well. However, this does not mean they haven’t been volatile, and there won’t be in the future, which is reason enough to have this ETF on the crosshairs to take advantage when this happens.

Final thoughts

The leveraged ETFs above are among the most popular, enhancing their liquidity, facilitating volatility trading. In addition, leveraged ETFs have a loan options feature that enables large volume trading increasing the probability of significant returns. To enjoy the full benefits of leverage trading, learn the intricacies of this niche market to avoid financial ruin.

Comments