September was a month full of SPY bullish investors, with four straight weeks of losses. Since the start of Covid-19, September equity doldrums were the only thing to alter the record-breaking run of SPY.

Had the SPY exorcised the September equity curse to get back to winning ways, or would it slide further?

Monday morning’s gap down was not a shocker given the trend the market has set of the opening below where it left off on Friday of the previous week. A 0.5% gap down saw Monday trading start at $432.87.

In a week dominated by capitol hill is politicking on infrastructure and the debt ceiling. The Wall Street fears a slowing down economy, rising interest rates, and inflation saw the Monday opening gap down push the prices on a bearish rally, with the SPY testing the $427.12 level. Despite the market moving sideways while bombarding this July pivot level, it proved its mettle by maintaining its integrity and acting as the launchpad the SPY needed to get back to weekly winning ways.

With the week drawing to a close and economic data on the September jobs, consumer credit, factory orders, and trade balance expected to be negative given the September slide, investors were in for some good news. Led by a positive jobless claims report, down to 326K compared to the expected 345K, the SPY would push its rebound into a bullish rally that had it trading in the $439.14. Friday nonfarm payroll data would either affirm the new bullish and beginning of quarter three earning season or the start of yet another bearish month.

With the SPY in the green for the week, +1.78%, among the individual S&P 500 sectors, a chess game is afoot: the good news being that they were all in the green for the week.

Gainers of the current week

Utility sector

Most experts believe that the overall equity market is highly overbought, with most markets either over the top already, at the top, or just about to hit the top. The next logical step for the market is the start of a bear season. Combined with rising interests and slowing down, calls for investment in safe-haven sectors. As a result, the utility sector closes the week at +2.19%.

Energy sector

The Biden infrastructure bill is yet to be agreed upon. Still, all indicators show that the $1.2 trillion stalemates might end in favor of the democrats given their vote to continue funding the government. Coupled with supply chain challenges and the increasing cost of natural gas and crude oil, the energy sector experienced investment inflows to close a fourth straight week among the biggest gainers, +1.83%.

Industrial sector

A steadily improving labor market coupled to the containment of the Delta Covid-19 variant had the industrial sector, which is labor heavy, see investment inflows to close the week at +1.79%.

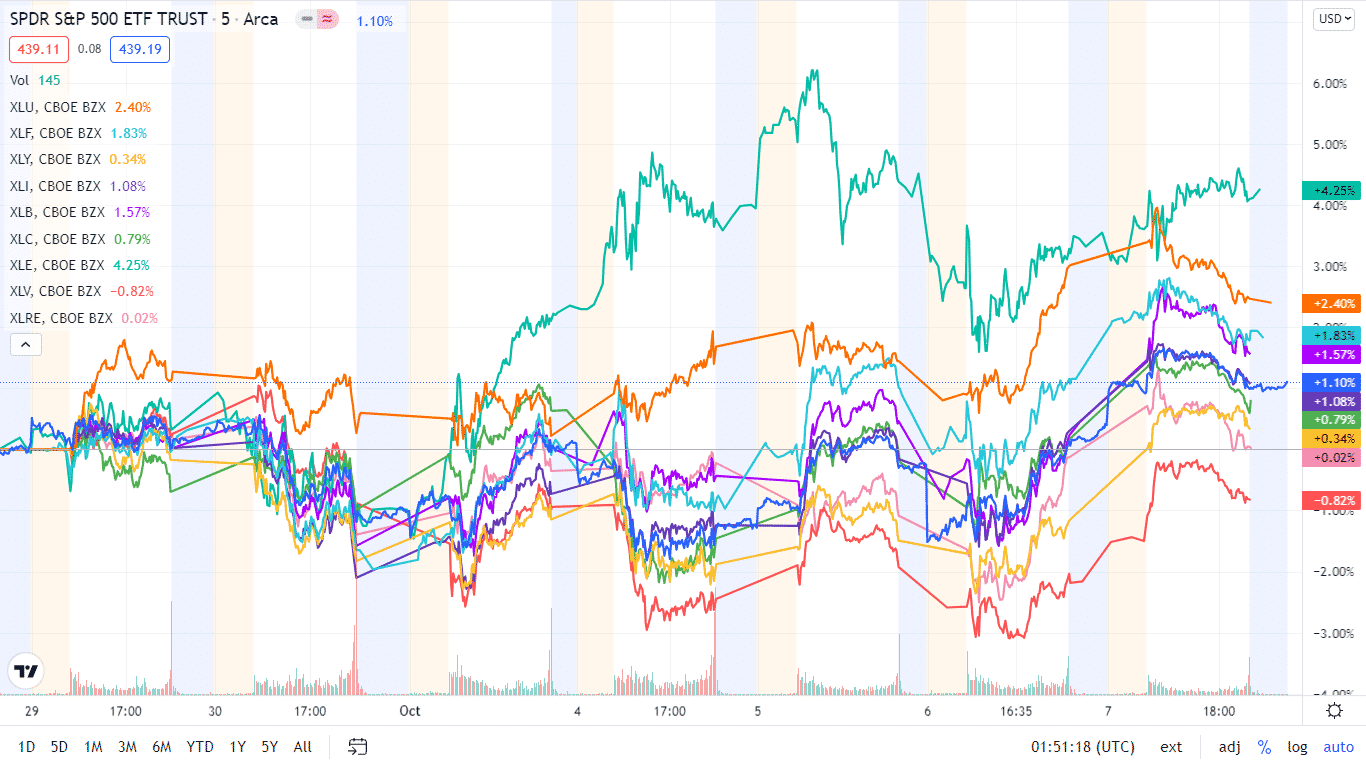

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week in the green by breaking down the individual sector performances using their corresponding ETFs.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Utilities | XLU | +2.19% with the accompanying utilities select sector ETF |

| 2. | Energy | XLE | +1.83% with the accompanying energy select sector ETF |

| 3. | Industrial | XLI | +1.79% with the accompanying industrial select sector ETF |

| 4. | Financial Services | XLF | +1.77% with the accompanying financial select sector ETF |

| 5. | Materials | XLB | +1.57% with the accompanying materials select sector ETF |

| 6. | Consumer Staples | XLP | +1.55% with the accompanying consumer staples select sector ETF |

| 7. | Consumer Discretionary | XLY | +1.36% with the accompanying consumer discretionary select sector ETF |

| 8. | Information Technology | XLK | +0.65% with the accompanying information technology select sector ETF |

| 9. | Real Estate | XLRE | +0.36% with the accompanying real estate select sector ETF |

| 10. | Communication Services | XLC | +0.22% with the accompanying communication services select sector ETF |

| 11. | Healthcare | XLV | +0.14% with the accompanying healthcare select sector ETF |

Comments