ETF full name: SPDR Portfolio Europe ETF

Segment: Equity: Developed Europe – Total Market

ETF provider: State Street Global Advisors Funds Distributors, LLC

| GLD key details | |

| Issuer | State Street |

| Dividend | $0.20 |

| Inception date | October 15, 2002 |

| Expense ratio | 0.09% |

| Management company | Global Equity Beta Solutions |

| Average 3-5 EPS | 18.76% |

| Average Annualized Return | 28.48% |

| Investment objective | Tracks a market-cap-weighted index of Western European companies |

| Investment geography | Developed Europe |

| Benchmark | STOXX® Europe Total Market Index |

| Leveraged | N/A |

| Median market capitalization | $76,188 million |

| ESG rating | AA (8.03 / 10) |

| Number of holdings | 1,812 |

| Weighting methodology | Market cap |

About the SPEU ETF

SPDR Portfolio Europe ETF inception onto the New York Stock Exchange Arca was on 15 October 2002. The fund is issued and managed by State Street Global Advisors. The fund tracks an index of European and benchmarks the Stoxx Europe Total Market Index.

SPEU Fact-set analytics insight

The SPEU fund has a total of $298.88 million assets under management, and the fund exceeds 1000 securities which makes it a well-diversified fund. Furthermore, the fund has a low expense ratio of 0.09%.

The SPDR Portfolio Europe ETF follows a market cap weighting methodology, and it has a median market cap of $76,188 million. Furthermore, the fund has 7.25 million shares outstanding.

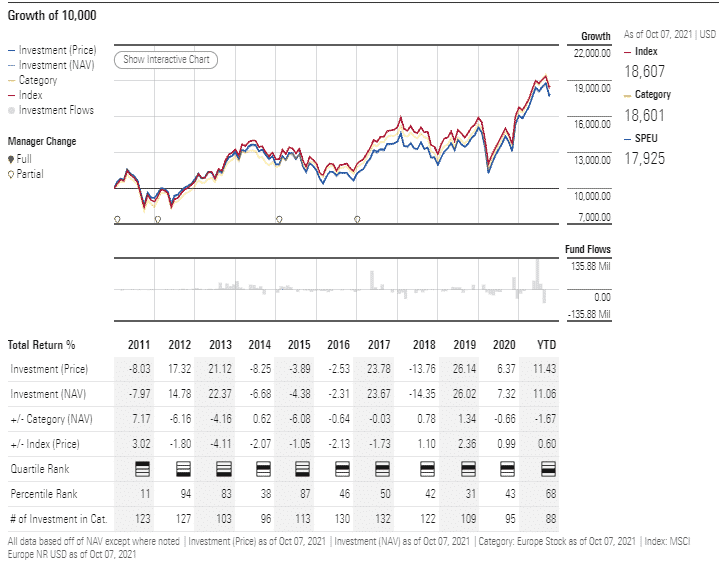

SPEU performance analysis

In terms of performance, the SPDR Portfolio Europe ETF generated an annualized return of 28.48%. The average 3–5-year EPS (earnings per share) growth is 18.77%. The most recent dividend payment was 20 September 2021, which was $0.20. The fund has an annual dividend rate of $1.09.

SPEU ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| SPEU Rating | A+ | B / 98 | Quintile 4

(73rd percentile) |

*** | 7.1 / 10 |

| SPEU ESG Rating | 8.34 / 10 | AA

8.03 / 10 |

N/A | N/A | N/A |

SPEU key holdings

The SPDR Portfolio Europe ETF has holdings of 1,812. The fund has 99% of its securities invested in European companies and 0.11% in North, Central, and South America. The remaining 0.4% holdings are in other countries.

In terms of sector breakdown, the top five sectors are finance (18.56%), consumer non-durables (12.94%), health technology (12.87%), producer manufacturing (10%), process industries (5.41%), and technology services (4.85%).

Below is the list of the fund’s top ten holding companies, which make up 15.95%.

| Ticker | Holding name | % of assets |

| NESN | Nestle S.A. | 2.59% |

| ASML | ASML Holdings MV | 2.36% |

| ROCH | Roche Holding Ltd | 2.00% |

| NOVN | Novartis AG | 1.52% |

| MC | LVMH Moet Hennessy Louis Vuitton SE | 1.47% |

| AZN | AstraZeneca PLC | 1.42% |

| NOVO.B | Novo Nordisk A/S Class B | 1.23% |

| LIN | Linde plc | 1.17% |

| SAP | SAP SE | 1.11% |

| ULVR | Unilever PLC | 1.07% |

Industry outlook

The SPDR Portfolio Europe ETF has had consistent performance over the last five years. The fund has solid annual returns and has been largely unaffected by the Covid-19 pandemic. This is primarily due to the extensive holdings and diversity of European stocks.

The fund’s share price increased from $26.94 in March 2020 to $41.13, where it currently trades, averaging a 52-week increase of 23.37%.

The fund is ideal for investors seeking to benefit from stable European equities since it also offers a competitive expense ratio of only 0.09%, making it very affordable in terms of management fees.

Comments