The previous week saw the markets and the SPY defy the recession indicator to finish the week in the green despite a largely sideways movement for most of the week.

Would investor completely quell their jitters for a bullish week, or would the realities of geopolitical risk and rising global interest rates rattle the newfound upward trajectory?

SPY Monday prices reflected the wait-and-see approach that investors are taking with the investment markets. Prices opened at $453.16, continuing the closing prices on Friday at 452.95. Like last week, the prices moved sideways from opening but with a bullish inclination to test the $456.34 resistance level. However, the much-awaited FED minutes confirmed this level by confirming aggressive balance sheet reduction. This statement resulted in a 1% gap-down on Wednesday and the subsequent downward price slide to the $444.83 support level.

The market movement was largely sideways with a bearish inclination due to mounting investor jitter on the backdrop of increased geopolitical risk due to the Ukraine-Russia war. Couped to this was also a close watch on the Asian front with the ongoing China lockdowns due to Covid-19. The inverted yield curves are also being considered while investing, with experts pointing to a recession in 2023.

All of these factors might have weighed heavily on the aggressive stance taken by the FED, with the only way to achieve price stability and check the rising inflation being a highly restrictive monetary policy. Unlike last week where equities recovered later for the SPY to squeak a positive week, the investor jitters this week and the FEDs statement on tighter policies proved too much turbulence, with the SPY finishing the week in the red, -0.99%.

Top gainers of the current week

Healthcare sector

Covid-19 is rearing its head again, resulting in inflows back into the health sector, with experts researching what a fourth covid jab would mean for the global populace.

The result was an excellent fortune for a sector that has been mainly in the red this year to finish the week with a +2.84% change.

Consumer Staples sector

The inflexibility of the consumer staples sector demand means despite the high prices of commodities, it is a haven sector. It continues to endear to investors, with a +2.32% weekly change.

Utilities sector

With investor jitters taking over for the week, the utilities sector, viewed as a safe-haven investment option, continued to thrive and ended the week with a +1.60% change.

Losers of the current week

Industrial sector at — 2.02%

Consumer Discretionary sector at — 2.33%

Information Technology Sector at — 2.63%

With inverted yield curves, rising inflation, and slowing down economic growth, sectors with growth stocks took the brunt of the market jitters, with the three above the most affected sectors.

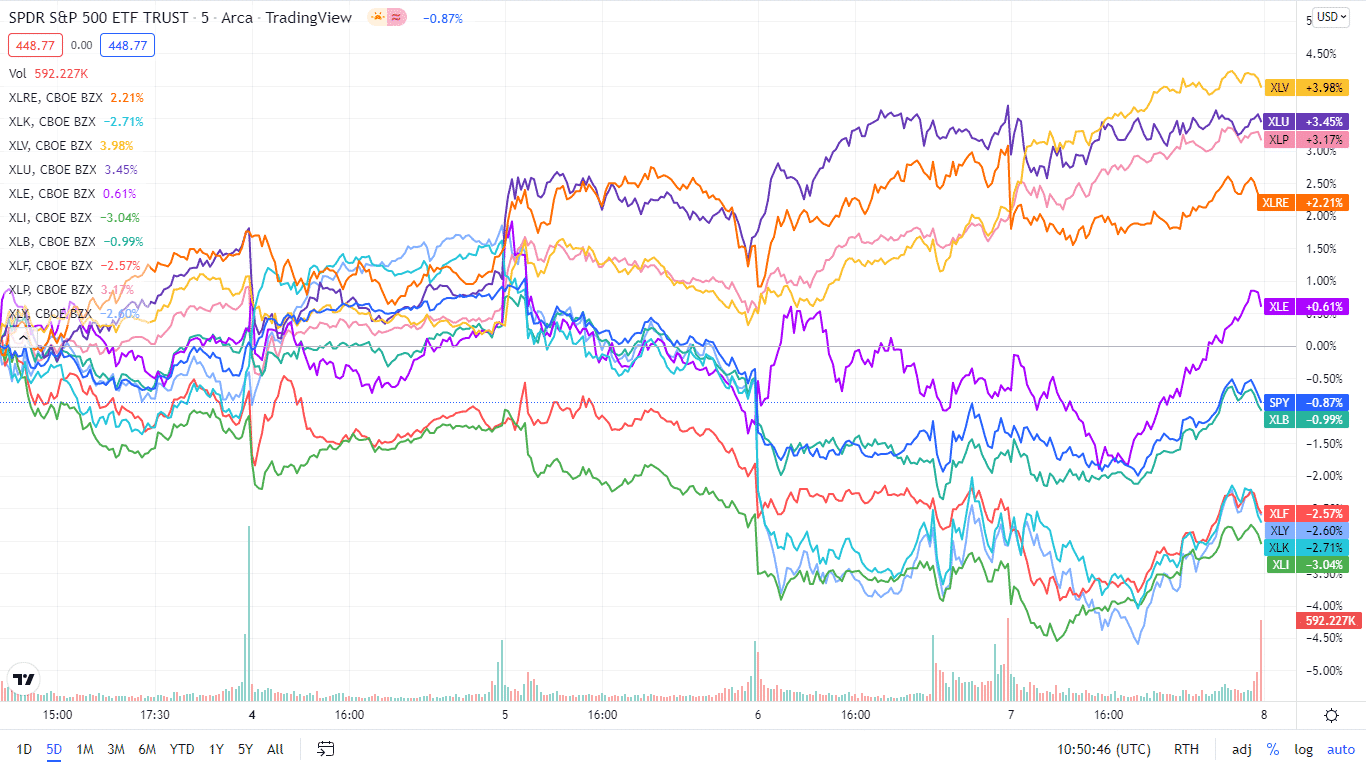

Below is a performance chart of the SP 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week using its corresponding ETFs. The SPY was largely sideways with a bearish inclination, with a majority of the sectors in the red.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Healthcare | XLV | +2.84% with the accompanying healthcare select sector ETF |

| 2. | Consumer Staples | XLP | +2.32% with the accompanying consumer staples select sector ETF |

| 3. | Utilities | XLU | +1.60% with the accompanying utilities select sector ETF |

| 4. | Energy | XLE | +0.44% with the accompanying energy select sector ETF |

| 5. | Real Estate | XLRE | +0.42% with the accompanying real estate select sector ETF |

| 6. | Materials | XLB | -1.33% with the accompanying materials select sector ETF |

| 7. | Financial Services | XLF | -1.96% with the accompanying financial select sector ETF |

| 8. | Communication Services | XLC | -1.99% with the accompanying communication services select sector ETF |

| 9. | Industrial | XLI | -2.02% with the accompanying industrial select sector ETF |

| 10. | Consumer Discretionary | XLY | -2.33% with the accompanying consumer discretionary select sector ETF |

| 11. | Information Technology | XLK | -2.63% with the accompanying information technology select sector ETF |

Comments