What if you could invest with a very high chance of amplified market returns in the long run, whether in a bullish or bearish market? Warren Buffett is one of the world’s billionaires that do precisely this to grow his wealth. It is all about investing in large value equities that are undervalued. However, this is a time-intensive and thorough research-oriented exercise that might not yield returns without the specific investment nuances akin to Warren Buffett’s.

Therefore, rather than screen through thousands of equities and not bear fruits, these three large-cap value ETFs expose you to this corner of the investment market and a chance to grow your portfolio in 2022.

What is the composition of large-cap value ETFs?

Before getting into large-cap value stock ETFs, we define large-cap value equities. Value is created when there is a bargain. Large-cap value stocks are equities above the $10 billion capitalization value, with a consistent dividend payment history but with lower pricing than the market value. Therefore, large-cap value ETFs comprise stocks whose intrinsic value exceeds the prevailing market prices.

The best large-cap value ETF portfolio growth in 2022

Historically, large-cap stocks outperform the markets in rising interest rate environments. As the world recovers from the ravages of the coronavirus, central banks are raising the interest rates to spur a resurgence to pre-pandemic levels. Large-cap value stocks have sufficient free cash due to low debt to equity ratios to thrive in rising interest rates and, with their low valuation, provide an avenue for portfolio growth.

№ 1. First Trust Morningstar Dividend Leaders Index Fund (FDL)

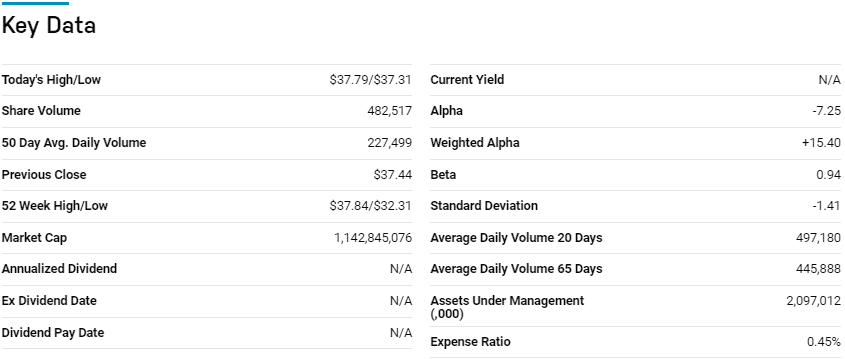

Price: $37.78

Expense ratio: 0.45%

Annual dividend yield: 3.58%

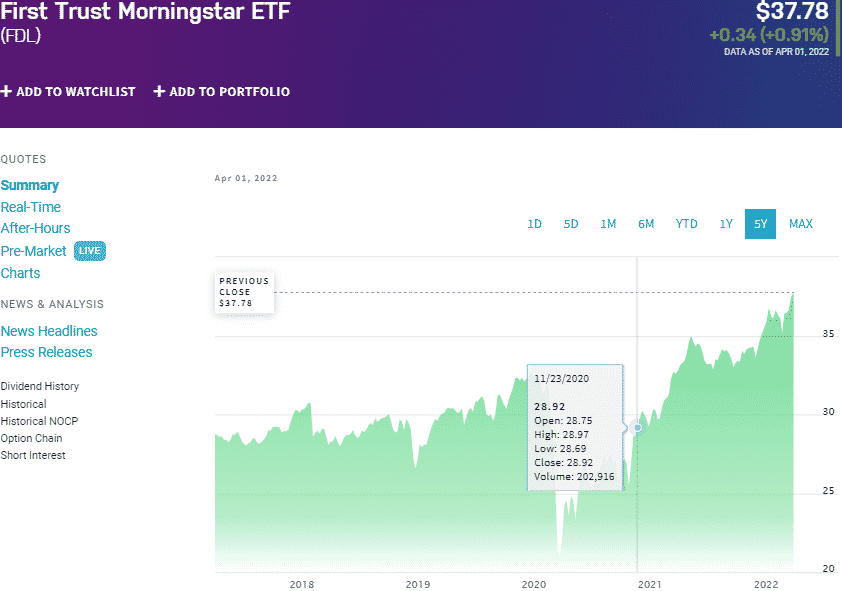

FDL chart

This fund tracks the performance of the Morningstar Dividend Leaders IndexSM, which measures the performance of the best 100 high-yield equities with consistent, sustainable dividend payouts. It invests at least 90% of its total assets in the tracked index equities.

In a list of 119 global large value funds, the FDL ETF is ranked № 58 for long-term investing.

The top three holdings of this balanced ETF are:

- AT&T Inc. – 9.28%

- AbbVie, Inc. – 8.43%

- Chevron Corporation – 6.60%

The FDL ETF has $2.10 billion in assets under management, with investors parting with $45 annually for a $10000 investment. Investing in this fund results in regular and consistent income in addition to portfolio stability due to a blend of large and mega-cap equities. Despite some concentration risk, the combination of high-yield dividend and cheap acquisition price results in a fund that provides both value and growth; 5-year returns of 61.81%, 3-year returns of 44.03%, and 1-year returns of 20.64%, and more than the decent dividend yield of 3.58%.

№ 2. Pacer Global Cash Cows Dividend ETF (GCOW)

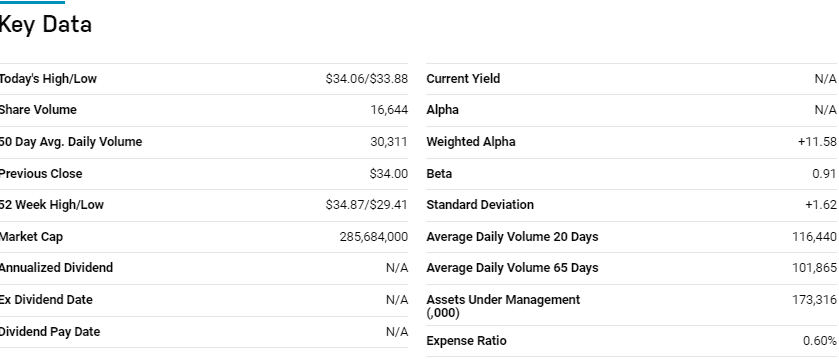

Price: $33.94

Expense ratio: 0.60%

Annual dividend yield: 4.38%

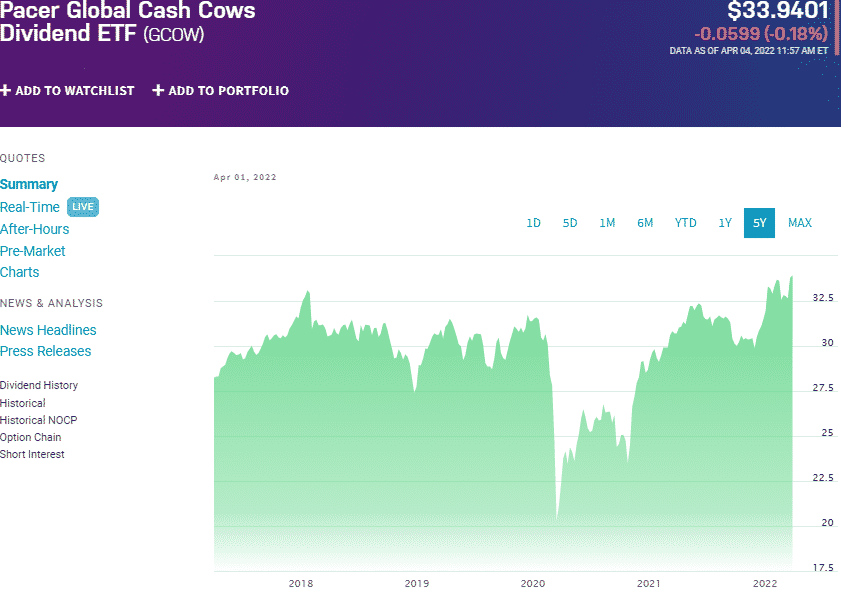

GCOW chart

This fund tracks the total return performance of the Pacer Global Cash Cows Dividend Index, net of expenses and fees. It invests at least 80% of its total assets, excluding collateral securities, in the tracked index underlying holdings and other investment securities exhibiting similar economic characteristics. It exposes investors to the best 100 companies with a history of high dividend yield and high free cash flow yield.

The top three holdings of this global large-cap value ETF are:

- Chevron Corporation – 2.52%

- BHP Group Ltd Sponsored American Depositary Receipt Repr 2 Shs – 2.44%

- AbbVie, Inc. – 2.41%

The GCOW ETF has $273.2 million in assets under management, with an expense ratio of 0.60%. It first screens for the best 300 developed markets global equities on consistent dividend payout with the best positive cashflows. For global large-cap value investing, it does not get better than this fund.

These 300 finalists are then wilted to a further 100 equities by considering the best dividend yields and then weights them on aggregate cash dividend. The result is a global cash cow fund providing stability, regional diversification, value, and growth; 5-year returns of 45.89%, 3-year returns of 27.17%, 1-year returns of 15.07%, and a dividend yield of 4.38%.

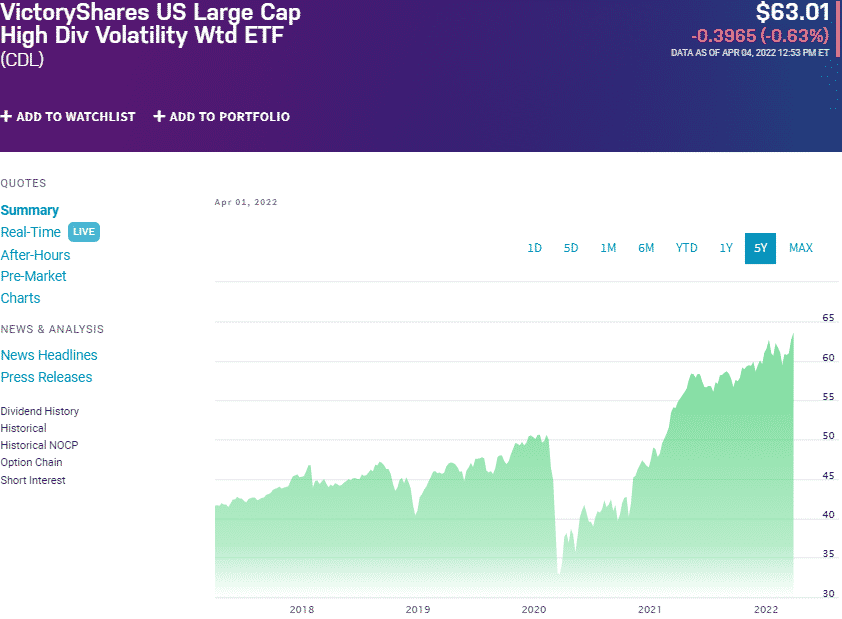

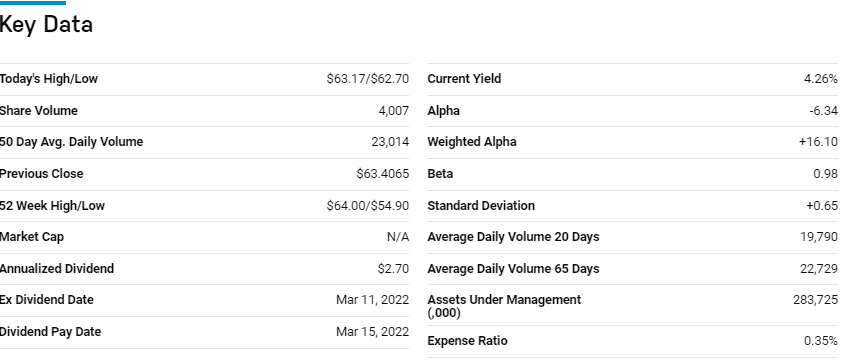

№ 3. VictoryShares US Large Cap High Dividend Volatility Wtd ETF (CDL)

Price: $63.01

Expense ratio: 0.35%

Annual dividend yield: 2.51%

CDL chart

VictoryShares US Large Cap High Dividend Volatility Wtd ETF tracks the total return performance of the Nasdaq Victory US Large Cap High Dividend 100 Volatility Weighted Index, net of expenses and fees. It invests at least 80% of its total assets in the tracked index underlying holdings, both directly and indirectly. It exposes investors to the best 500 publicly traded companies in the US, with not only a history of high dividend yield but also high free cash flow yield.

In a list of 119 global large value funds, the CDL ETF is ranked № 45 for long-term investing.

The top three holdings of this global internet fund are:

- PepsiCo, Inc. – 1.56%

- Johnson & Johnson – 1.55%

- Southern Company – 1.53%

The CDL ETF has $283.5 million in assets under management, with the lowest expense ratio among all the funds on this list, 0.35%. Concentrating on the best dividend-paying US equities with positive earnings among the largest fortune 500 companies and then weighting them on inverse historical volatility results in a fund that provides not only value and growth but the ability to outperform the markets; 5-year returns of 78.02%, 3-year returns of 52.21%, 1-year returns of 19.03%, and a dividend yield of 2.51%.

Final thoughts

Given the skyrocketing commodity prices, investors need relatively low-cost investments that will result in consistent and regular income and unstable segments that protect portfolios against volatility. Large-cap value ETFs usually comprise established blue-chip companies with outstanding debt to equity ratios, which is a feature that enables them to thrive in interest-rising and inflation-rising economic conditions. The three large-cap value ETFs above have the potential to outperform their large-cap growth ETFs and the market at large in 2022.

Comments