After three straight weeks of the bearish slide, the SPY investors were starting to wonder if the 2022 earnings season would ever kick-off.

How does constricting liquidity to curb out-of-control inflation affect the markets?

Monday market opening was a sight for sore eyes. It was in 2021 the investors last experienced a Monday opening gap up. The markets opened trading at $442.62 to post a 0.2% gap. Was the SPY finally ready to start its earnings season? Bears took charge of the market from the opening price to push this to a $439.63 pivotal level set last week that had proven problematic to break.

This level turned into the support the prices needed to launch a bullish run that would see the SPY finish the week in the green for the first time since the turn of the year. The good news for bullish SPY investors was that this was the only control the bears would have for the rest of the week.

The FED has no choice now but to tighten its spending to reduce market liquidity in an attempt to curb the out-control inflation. In addition, the world is still under the Covid-19 pandemic resulting in unprecedented supply chain challenges that further push prices of inputs and commodities.

The week saw several reports on Q4 2021 earnings for the technology sector, and their positivity seems to have launched SPY’s earnings season for 2022. Despite the imminent tightening of financial conditions, Wall Street is hawkish about how many times the FED will raise rates in 2022. The consensus is five rate hikes for the year, quelling jitters that have plagued the market to have the SPY trading in the $448 region after setting the weekly resistance level at $457.86. As such, the SPY started its Feb and 2022 earnings season with a 1.56% positive change for the week.

Top gainers of the current week

Energy sector

The energy sector continued to take advantage of rising oil and gas prices to lead the pack and kickstart SPY’s earnings season with another impressive +3.31% weekly change.

Financial Services sector

Quelling jitters saw inflows go into the financial sector despite most banks reporting below expected 2021 Q4 earnings to see this sector finish the week with a 1.83% weekly change.

Healthcare sector

The healthcare sector and its continued fight against the pandemic experienced renewed investor confidence to end the week in the green with +1.76% weekly change.

Losers of the current week

Despite a largely bullish week, investors seem to be reluctant to invest in the communication services sector. The week ended as the sole sector in the red, -0.40%.

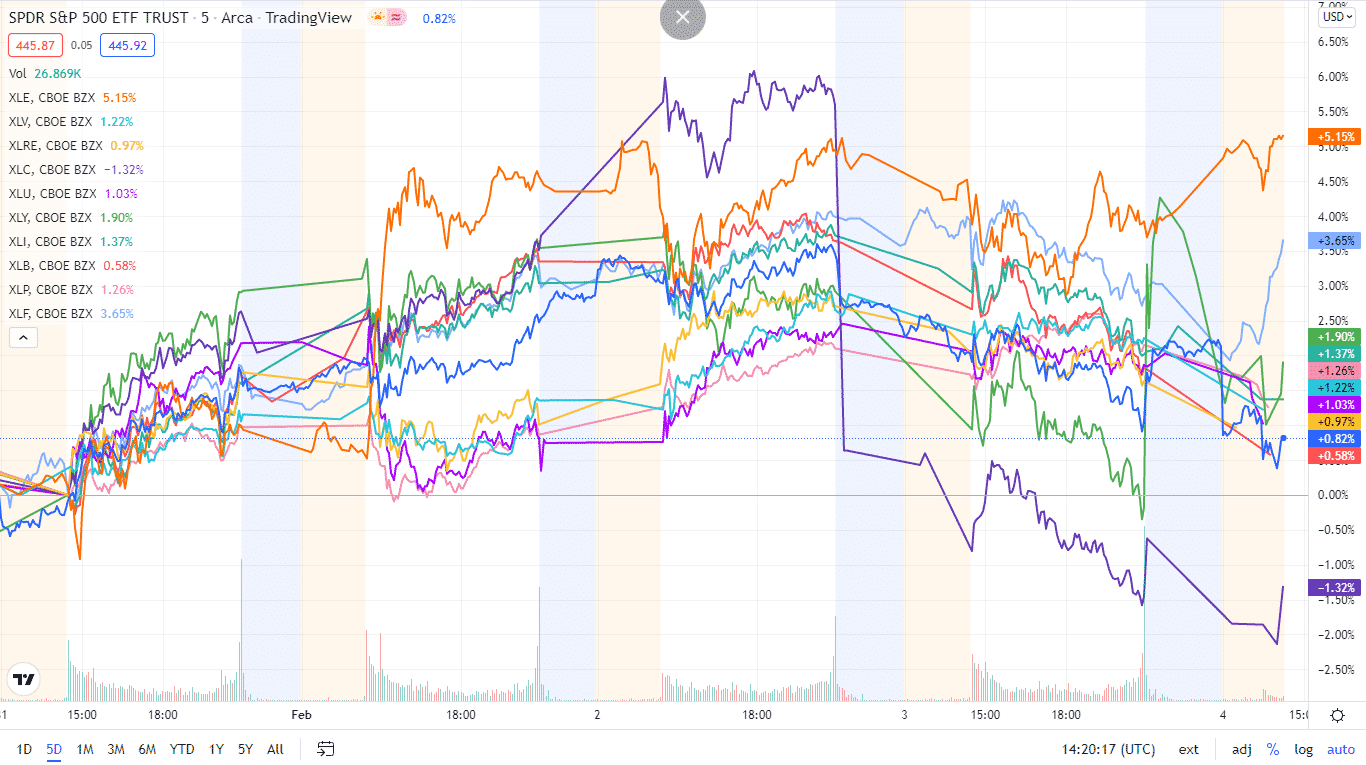

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week, using their corresponding ETFs. The year finally seems to have turned to sunshine, with all the sectors finishing the week in the green except for one.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Energy | XLE | +3.31% with the accompanying energy select sector ETF |

| 2. | Financial Services | XLF | +1.83% with the accompanying financial select sector ETF |

| 3. | Healthcare | XLV | 1+.76% with the accompanying healthcare select sector ETF |

| 4. | Consumer Staples | XLP | +1.62% with the accompanying consumer staples select sector ETF |

| 5. | Utilities | XLU | +1.57% with the accompanying utilities select sector ETF |

| 6. | Materials | XLB | +1.54% with the accompanying materials select sector ETF |

| 7. | Industrial | XLI | +1.50% with the accompanying industrial select sector ETF |

| 8. | Real Estate | XLRE | +1.06% with the accompanying real estate select sector ETF |

| 9. | Information Technology | XLK | +0.58% with the accompanying information technology select sector ETF |

| 10. | Consumer Discretionary | XLY | 0.20% with the accompanying consumer discretionary select sector ETF |

| 11. | Communication Services | XLC | -0.40% with the accompanying communication services select sector ETF |

Comments