One of the most volatile industries to invest in is the oil and gas industry. In the corner of this industry lies the gasoline niche. As a byproduct of crude oil, gasoline is the most widely used fuel globally, mainly due to its multiple uses.

Highly dependent on the price of crude oil, gasoline prices have been a thorn in the pockets of the global masses. Primarily used as a low-density fuel, other industry sectors use it as a solvent. It then comes as no surprise that this industry’s value stands at $716.7 billion.

The result is a market that exhibits wild swings, making it impossible to predict market movements. Then how do you invest in such a market? Warren Buffett has the answer: “Invest in gasoline exchange-traded funds and have a stake in the entire industry.”

Gasoline ETFs for returns in 2022: how do they work?

The world is quickly moving to a zero-green gas emission era. However, before this complete shift, gasoline is still in high demand and drives upwards of 60% of the transportation industry. Investors have access to gasoline ETFs to be a part of this industry while mitigating against volatilities, and investors have access to gasoline ETFs. These funds comprise organizations in the gasoline value chain and futures contracts tracking the change in petrol price.

Top 3 gasoline ETFs to accrue profits in 2022

The global economy is in uncertain economic times, making highly volatile industries even riskier to invest in at the moment. The three ETFs below expose investors to the gasoline industry cost-efficient and relatively less strenuous while providing an opportunity to pump up profits from this segment of the energy sector.

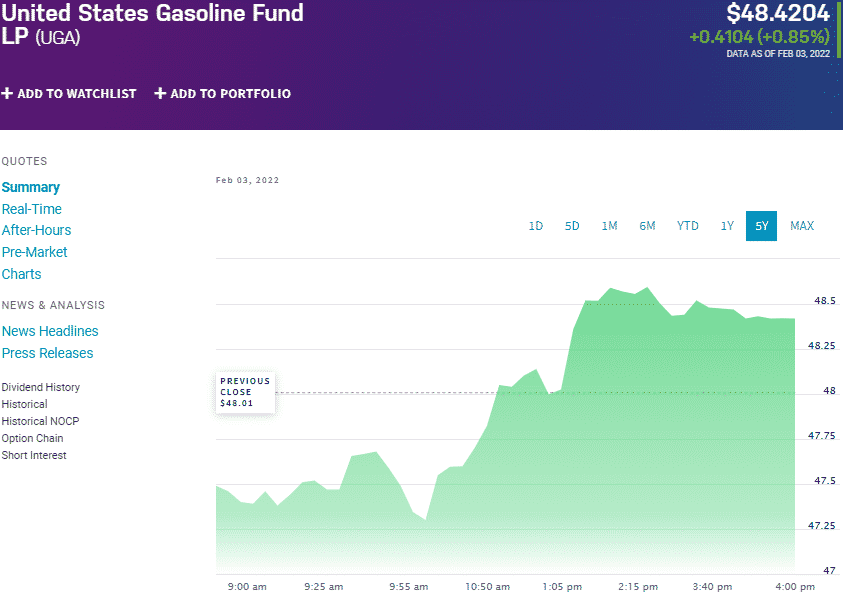

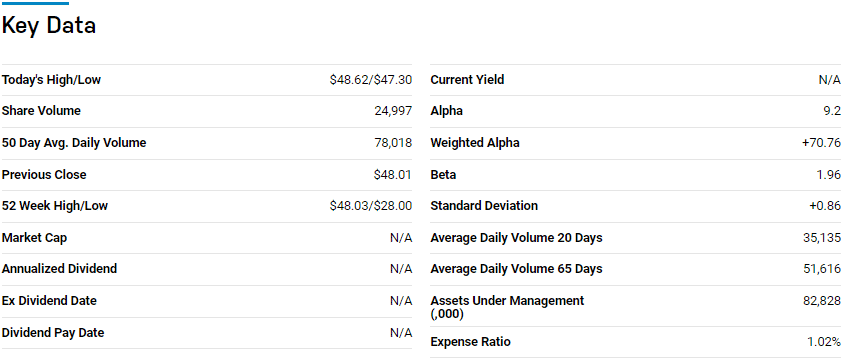

№ 1. United States Gasoline Fund LP (UGA)

Price: $48.42

Expense ratio: 1.02%

Dividend yield: N/A

UGA chart

The gasoline sector is limited when it comes to pureplay exchange-traded funds. Investors have only the United States Gasoline Fund LP as the only gasoline pureplay ETF option. This fund tracks the spot price of gasoline by investing in the gasoline futures contract, petroleum-based-fuel futures contracts, diesel-heated oil futures, and crude oil.

UGA ETF has $82.8 million in assets under management, with an expense ratio of 1.02%. With its targeted exposure and contango of its futures, this fund is an ideal tactical tilt to take advantage of rising gasoline prices. Its historical returns also call for close monitoring for investment if considering making returns off the volatile gasoline market; 5-year returns of 64.64%, 3- year returns of 93.59%, and 1-year returns of 72.20%.

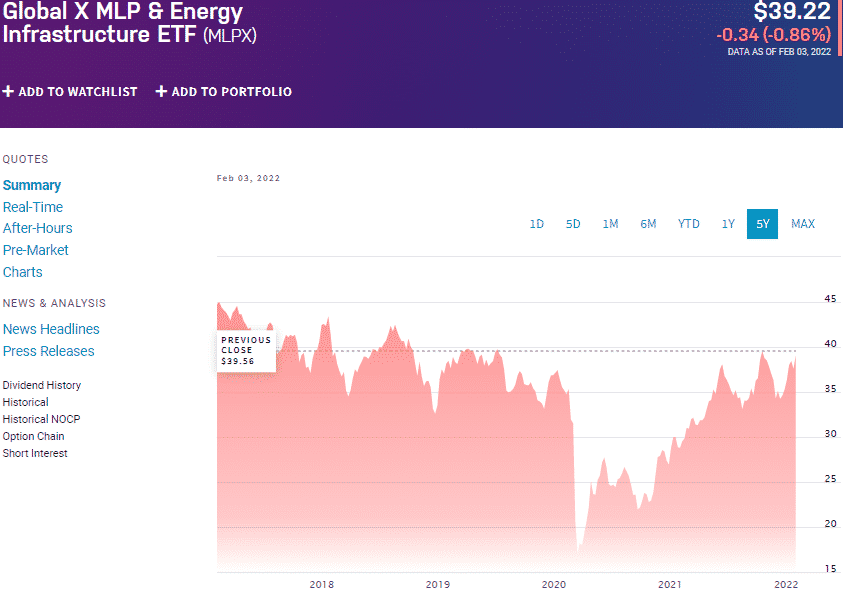

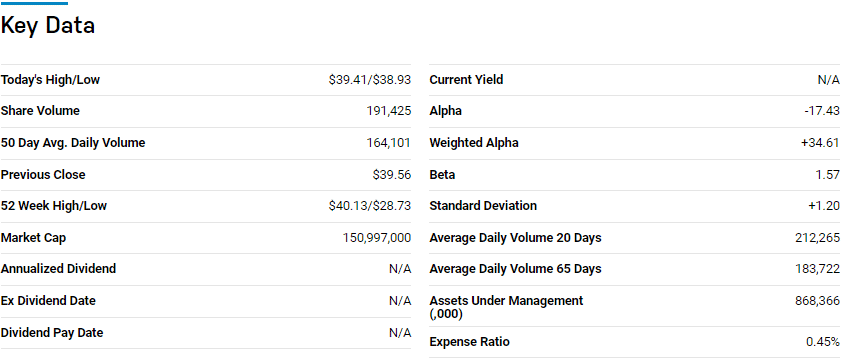

№ 2. Global X MLP and Energy Infrastructure ETF (MLPX)

Price: $39.22

Expense ratio: 0.45%

Dividend yield: 5.54%

MLPX chart

This fund tracks the Solactive MLP & Energy Infrastructure Index, investing at least 80% of its total assets in the holdings of its composite index, including master limited partnerships and other energy infrastructure organizations of like economic characteristics. This fund exposes investors to midstream energy infrastructure equities and MLPs.

In a list of 21 funds with exposure to energy MLPs, the MLPX ETF is ranked № 2 for long-term investing, among passively managed funds.

The top three holdings of this non-diversified ETF are:

- Williams Companies, Inc. – 9.31%

- Enbridge Inc. – 9.18%

- TC Energy Corp. – 8.93%

The MLPX ETF has $868.3 million in assets under management, with investors’ parting with $45 annually for every $10000 invested. This fund indirectly influences the gasoline industry by exposing investors to ancillary services such as pipelines and gasoline storage facilities.

Combining equities and MLPs capped at 24% results in a hybrid fund with the agility to take advantage of highly dynamic gasoline prices while mitigating against the volatilities of this market. Reduced sensitivity to the gasoline prices and the more significant crude oil industry has ensured consistent positive returns for its investors; 5-year returns of 22.54%, 3- year returns of 31.06%, and 1-year returns of 47.04%.

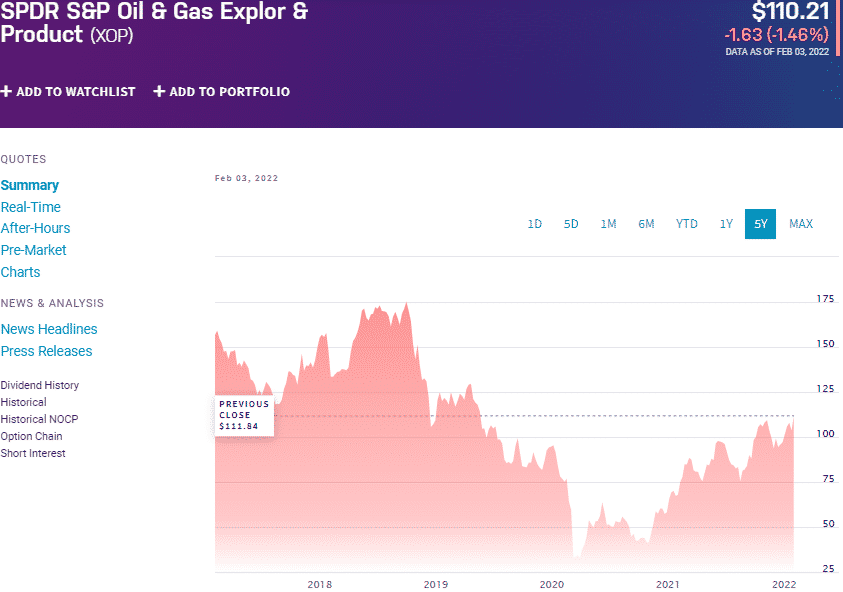

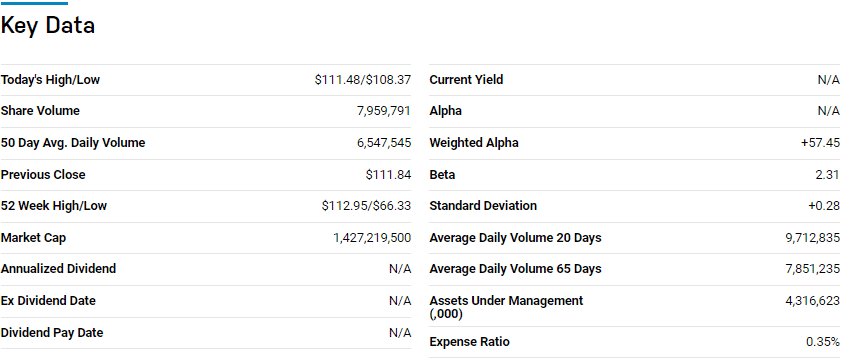

№ 3. SPDR S&P Oil and Gas Exploration and Production ETF (XOP)

Price: $110.21

Expense ratio: 0.35%

Dividend yield: 1.26%

XOP chart

The SPDR S&P Oil and Gas Exploration and Production ETF tracks the S&P Oil & Gas Exploration & Production Select Industry Index, investing at least 80% of its total assets in the composite index holdings and investment assets of similar economic characteristics. It exposes investors to mid-cap and small-cap equities specializing in the exploration and production of oil and gas.

In a list of two equity energy funds, the XOP ETF is ranked № 5 for long-term investing, among passively managed funds.

The top three holdings of this non-diversified ETF are:

- PBF Energy, Inc. Class A – 2.83%

- APA Corp. – 2.70%

- Exxon Mobil Corp. – 2.66%

The XOP ETF has $4.33 billion in assets under management, with an expense ratio of 0.35%. This balance has paid dividends in the last year to take advantage of rising oil and gas prices to post 12-month returns of 72.54%. This ETF is an indirect and diversified play on the gasoline industry since its underholding’s consists of firms involved in the exploration and production of all things oil and gas. Its composition is a fresh twist to the oil and gas industry by shunning large caps and ensuring a pretty even weight mitigating against concentration risk.

Final thoughts

The world is moving away from fossil fuels to sustainable renewable energy. However, gasoline is the most utilized crude oil byproduct providing numerous opportunities as the prices of energy and gases soar. Oil prices might be the most significant driver of gasoline prices but is not the only factor in play in this highly volatile corner of the oil and gas industry. The ETFs above provide a modicum of stability while investing in this energy niche while providing the potential to drive portfolio returns.

Comments