2022 has not been the best start for the investment markets, more so to the bullish SPY investors even without having to contend with the Ukraine-Russia crisis.

Would the escalating Ukraine-Russia crisis bring the markets tumbling, or would the markets defy logic and show resilience?

A 1.3% opening market gap-down was a familiar sight to investors and, if recent weeks are anything to go by, a sign of yet another bearish week. This opening, $432.14, was below the previous week’s resistance level and another ominous sign for the bullish investors.

However, despite all these bearish signals, the SPY would show resilience and go on a bullish rampage that had prices testing the $437.51 resistance level set last week. From here on, it was a largely sideways market with a bearish inclination culminating in the markets testing the $428.28 February pivotal level.

Powell’s stance that interest rate hikes would start with a 25-bps rate infused this level with integrity for it to act as a launchpad for SPY’s second bullish run of the week. Since the FED’s hawkish view last year, the markets have been prepared for rate hikes and, with a confirmation that it would be less than the expected 50-bps, buoyed the markets further.

Russia is the primary exporter of several commodities. Despite the discussion around global sanctions, news that the FED would not be aggressive in its rate hikes amid rising inflation and this crisis drove the markets. The truth is that amid unchecked inflation rates, dwindling profit margins due to the high cost of inputs, and Putin’s terror to the world, investors’ optimism in the markets and the resultant investment inflows don’t make sense, but that is the investment market for you. The result of all this has been a bullish week for the SPY to end the week in the green, +1.43%, cutting the year-to-date deficit to -8.79%.

Top gainers of the current week

Energy Sector

The world agrees that Putin’s invasion of Ukraine is an act of terror. Despite being Europe’s primary supplier for natural gas and the third-largest global oil supplier, governments are looking for an alternative to Russian energy in preparations for energy sanctions. Couple this to OPEC passing that oil output increase should remain at 400K BPD for April, and it comes as no surprise that the energy sector surged to a +6.22% weekly change.

Utilities Sector

Investors are looking to invest in more defensive sectors despite the newfound confidence in the markets, with Powell toning down aggressive rate hikes. The utility sector took advantage of this to end the week in the green, +2.53%.

Industrial Sector

The industrial sector is yet another sector to take advantage of the Russia-Ukraine sector and experience inflows, especially on the face of Russia being the primary supplier of some industrial metals, aluminum, platinum, and palladium. The result was a weekly change of +1.42% to end the week green.

Losers of the current week

Sectors that was not resilient enough in the face of the Russian-Ukraine crisis and denied the SPY a record bullish run were:

Information Technology sector at — 1.25%

Communication Services sector at — 1.29%

Financial Services sector at — 2.97%

Russian markets and stocks have become toxic, and the sectors hardest hit by the resulting investment outflows and ongoing sanctions are those above.

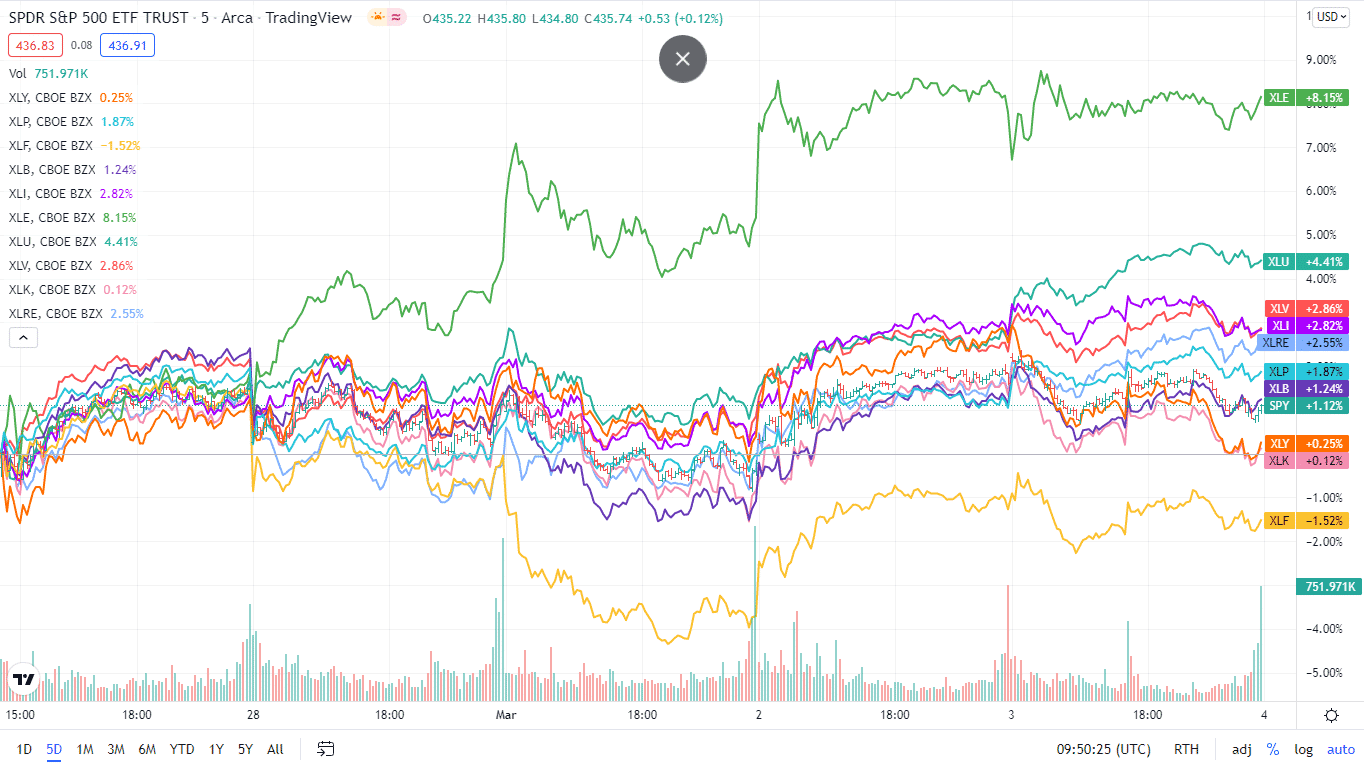

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week, using their corresponding ETFs. The SPY was resilient enough to end the week in the green despite the Ukraine-Russia crisis, although some sectors are still red.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Energy | XLE | +6.22% with the accompanying energy select sector ETF |

| 2. | Utilities | XLU | +2.53% with the accompanying utilities select sector ETF |

| 3. | Industrial | XLI | +1.42% with the accompanying industrial select sector ETF |

| 4. | Real Estate | XLRE | +0.88% with the accompanying real estate select sector ETF |

| 5. | Healthcare | XLV | +0.68% with the accompanying healthcare select sector ETF |

| 6. | Consumer Staples | XLP | -0.22% with the accompanying consumer staples select sector ETF |

| 7. | Consumer Discretionary | XLY | -1.14% with the accompanying consumer discretionary select sector ETF |

| 8. | Materials | XLB | -1.18% with the accompanying materials select sector ETF |

| 9. | Information Technology | XLK | -1.25% with the accompanying information technology select sector ETF |

| 10. | Communication Services | XLC | -1.29% with the accompanying communication services select sector ETF |

| 11. | Financial Services | XLF | -2.97% with the accompanying financial select sector ETF |

Comments