The rising gas price might have arrested the demand growth of gas, a 4.6% rebound in 2021. Still, the Ukraine-Russia war, below-par supply, and accelerated economic resurgence in 2022 set up this market for a bullish run.

Couple this to the global drive for zero-emissions which rules out coal and oil as gas substitutes, and what you have is a market with unsatiable demand and limited supply. How do you take advantage of this imbalance and the resulting price increase? It is either natural gas equities or through natural gas ETFs.

With natural gas equities, you would have to sift through a ton of information to try and identify those with the potential to grow. However, with natural gas ETFs, you invest in the whole natural gas market performance, and with these factors acting as fuel, it is bound to be bullish.

Natural gas ETFs for profits in 2022: how do they work?

The world is quickly moving to a zero-green gas emission era, emphasizing renewable and sustainable energy sources. However, these efforts are still in infancy making natural gas the only low emission option to coal and oil. However, a dig into the energy sector shows that most oil companies also deal in natural gas. As such, natural gas ETFs comprise organizations that derive significant revenues from the exploration, production, distribution, marketing, and selling of natural gas.

Top three natural gas ETFs for triple profits in 2022

In the last 12 months, natural gas futures have significantly outperformed the S&P 500. This market is poised to outperform the economy when utilized as fuel heating and cooling, electricity generation, and plastics making, among other organic chemicals. These three natural gas ETFs have the potential to triple your returns.

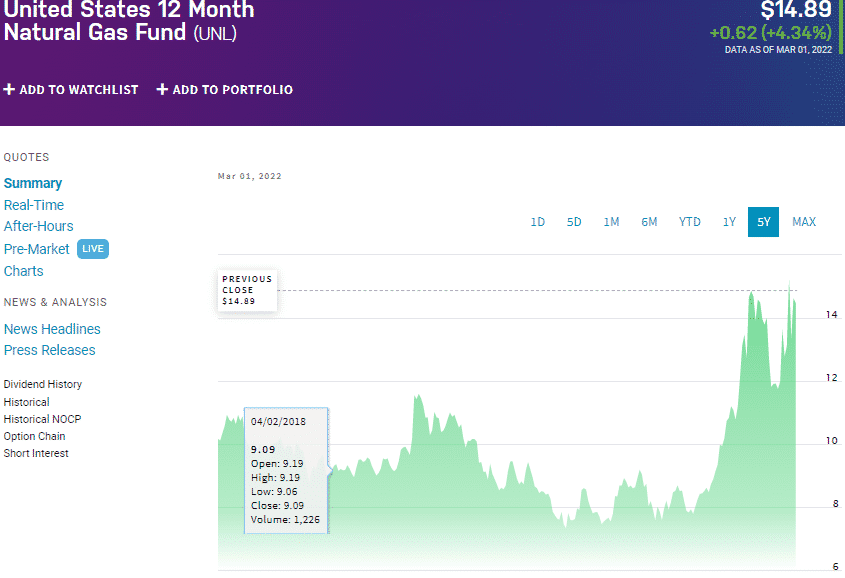

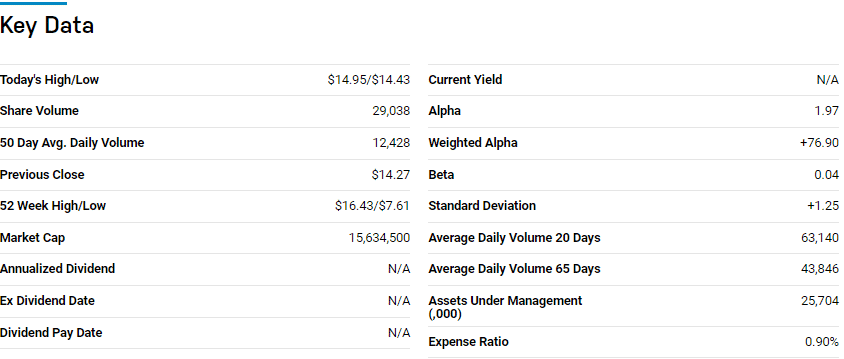

№ 1. The United States 12-month Natural Gas Fund LP (UNL)

Price: $14.89

Expense ratio: 0.90%

Dividend yield: N/A

UNL chart

The natural gas niche of the energy sector is limited when it comes to pure-play exchange-traded funds. However, investors choose the United States Natural Gas Fund as a pure-play natural gas ETF option. This fund tracks the spot price of natural gas by investing in natural gas futures contracts, petroleum-based-fuel futures contracts, diesel-heated oil futures, and crude oil.

key data

UNL ETF has $26.1 million in assets under management, with an expense ratio of 0.90%. With its targeted exposure and contango of its futures, this fund is an ideal tactical tilt to take advantage of rising natural gas prices, and a hedge option against rising inflation, upwards of 7.5%. Its historical returns also call for close monitoring for investment if considering phenomenal returns in 2022; 5-year returns of 52.25%, 3- year returns of 36.98%, and 1-year returns of 76.63%.

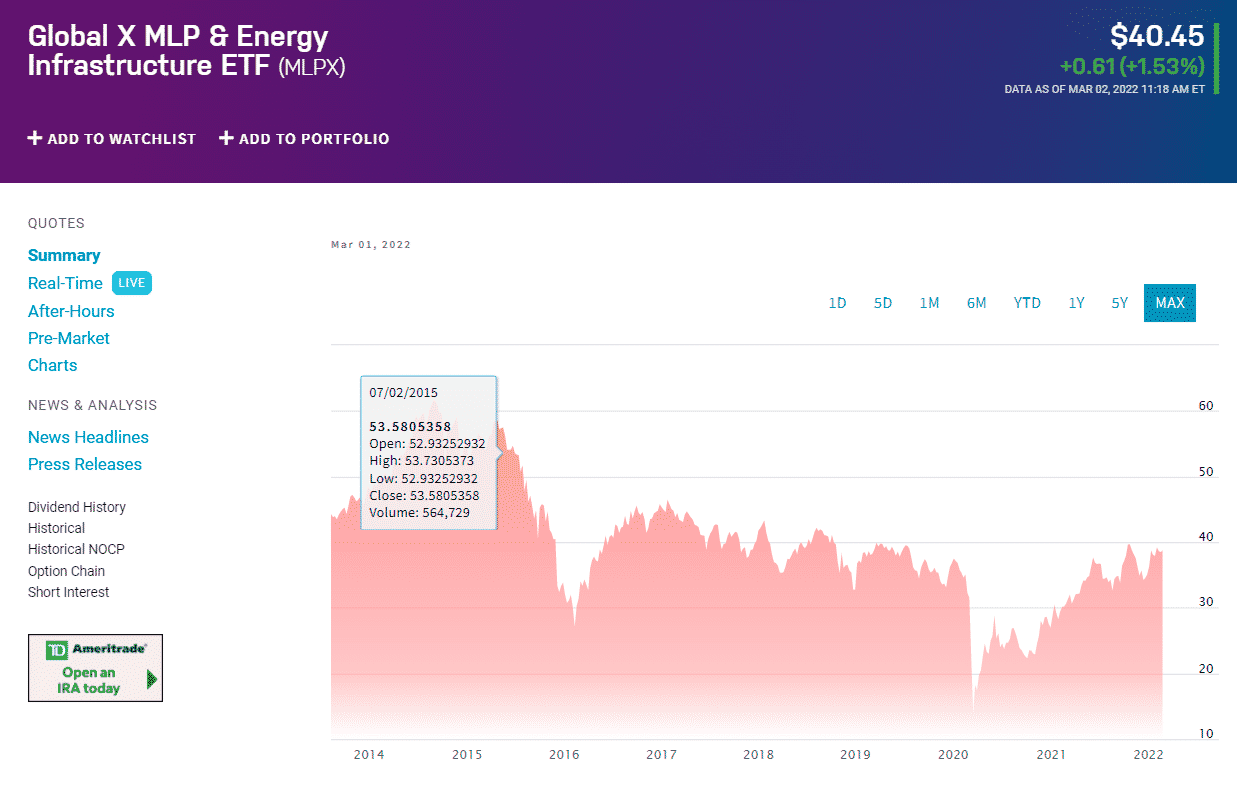

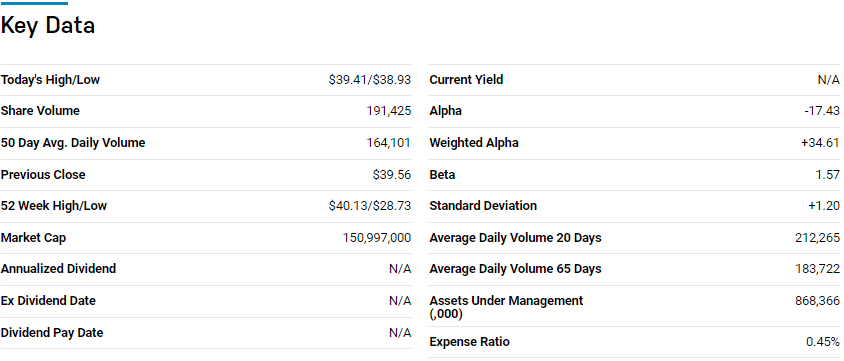

№ 2. Global X MLP & Energy Infrastructure ETF (MLPX)

Price: $40.45

Expense ratio: 0.45%

Dividend yield: 5.54%

MLPX chart

Global X MLP & Energy Infrastructure ETF tracks the ISE-Revere Natural Gas Index, investing at least 90% of its total assets in the holdings of its composite index, including master limited partnerships, depository receipts, and other energy infrastructure organizations of like economic characteristics. This fund exposes investors to midstream energy infrastructure equities, MLPs, and common stock of companies deriving significant revenues from natural gas exploration and production.

The top three holdings of this non-diversified ETF are:

- Western Midstream Partners, LP – 4.69%

- ConocoPhillips – 4.61%

- Occidental Petroleum Corporation – 4.51%

key data

The MLPX has $557.9 million in assets under management, with investors’ parting with $45 annually for every $10000 invested. This fund indirectly influences the natural gas sector by exposing investors to ancillary services such as pipelines and natural gas storage facilities. Combining equities and MLPs results in a hybrid fund with the agility to take advantage of highly dynamic natural gas prices while mitigating against the volatilities of this market.

Reduced sensitivity to the spot price of natural gas has ensured consistent positive returns for its investors; 5-year returns of 3.56%, 3-year returns of 46.63%, and 1-year returns of 78.01%. A leveraged play on the underlying natural resource, this fund is a powerful tool if betting on increased commodity prices.

№ 3. VanEck Vectors Unconventional Oil and Gas ETF (FRAK)

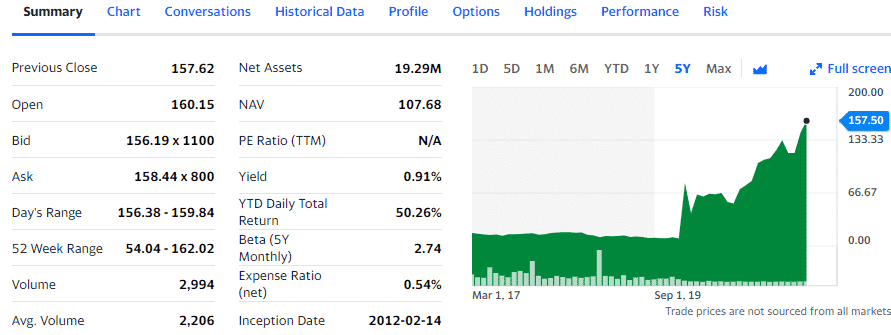

Price: $157.50

Expense ratio: 0.35%

Dividend yield: 1.26%

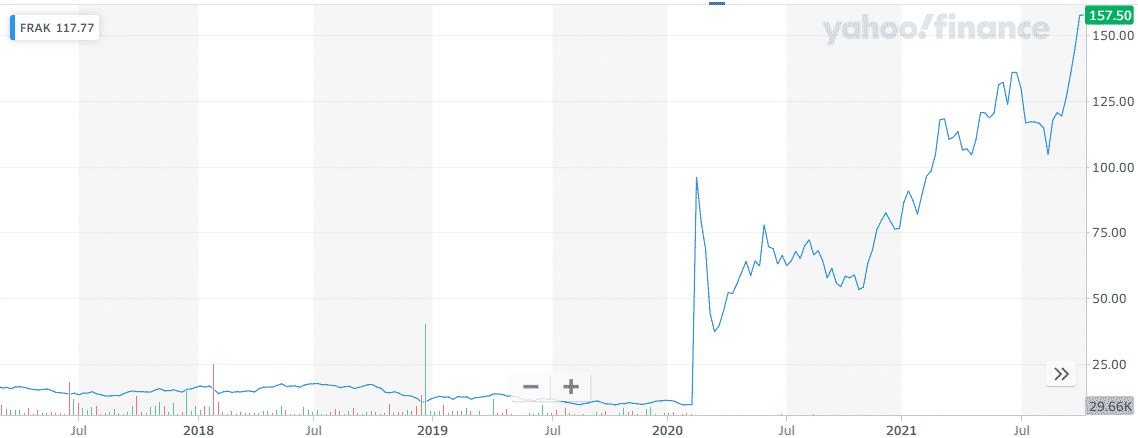

FRAK chart

The VanEck Vectors Unconventional Oil & Gas ETF tracks the S MVIS® Global Unconventional Oil & Gas Index, investing at least 80% of its total assets in the composite index holdings and investment assets of similar economic interest characteristics. It exposes investors to global equities that derive a minimum of 50% revenues from conventional oils and natural gas-related activities.

The top three holdings of this non-diversified ETF are:

- ConocoPhillips – 8.03%

- EOG Resources Inc – 7.65%

- Pioneer Natural Resources Co – 6.67%

FRAK chart

The FRAK ETF has $19.29 billion in assets under management, with an expense ratio of 0.54%. This ETF is an indirect and diversified play on the natural gas industry and alternative fuels since its under holdings consist of firms involved in exploring and producing all things natural gas and unconventional oils.

Its composition is a fresh twist to the natural gas industry by shunning large caps and ensuring a pretty even weight distribution against concentration risk. This balance has paid dividends in the last year to take advantage of natural gas prices and the call for unconventional fuel sources with minimal emissions, propelling it’s to a year-to-date daily total return of 50.26%, and the first quarter is not yet done.

Final thoughts

The world is moving away from fossil fuels to sustainable renewable energy. However, as of now, there is no scalable and efficient fuel source to rival natural gas. ETFs above provide stability and a way to play the rising price of natural gas.

Comments