At the close of last week, a better-than-expected quarter-point rate hike could not rescue the SPY from the breakdown in the Ukraine-Russia negotiations, resulting in a late Friday last, minute bearish rally.

Would the Powell and FEDs tightening cycle impact the markets, or would the Ukraine-Russia conflict continue being the primary market driver?

Monday’s market opening price of $420.86 was a continuation from where the markets had closed left off on Friday at $420.06, which was slightly off the monthly pivotal level.

Would the pivotal level hold to become support, or would it break and start an unprecedented bearish run? The bears and bulls seesawed around this pivot level with no technical and fundamental indicator resulting in advantage and a clear market direction. However, immediately after the official release of the expected quarter-point rate hike by Powell and dot plot, bulls took this as hawkish sentiments on the economy resulting in a 0.9% gap up and the start of the week’s bullish rally.

This statement and dot plot calmed investor jitters, with Powell claiming that the balance sheet drawdown pointed to an additional hike later on, which would cascade into a slight easing of goods inflation. With the current inflation rates at a record 40-year high, it is not a wonder that this statement was taken as a positive. In addition, Biden’s talks with China’s president Xi resulted in China issuing an official communication to their neutrality, which all worked to buoy the markets further. All these results showed the SPY the week strongly and in the green with a +4.26% weekly change.

Top gainers of the current week

Consumer Discretionary sector

With the fear of World War Three, it is no surprise that countries are marshaling up their defenses with resulting inflows benefiting the consumer discretionary sector. Couple this to Powell’s statements of reduced goods inflation prices, and this sector was the biggest gainer of the week to finish the week with +6.94% weekly change.

Financial Services sector

The result of the FED acknowledging that Inflation and markets are behind the curve seems to have quelled fears, especially on the backdrop of some assurances that it won’t slam the brakes too hard. This vote of confidence resulted in a surge of the financial services sector to a +6.82% weekly change.

Information Technology sector

The weekly market correction buoyed the giant tech stocks resulting in the information. Sector posting weekly change to the tune of +5.56%.

Losers of the current week

For the current week, only the Energy sector was in the red, despite looming supply bottlenecks and the energy sanction on Russia, finishing the week with -3.67%.

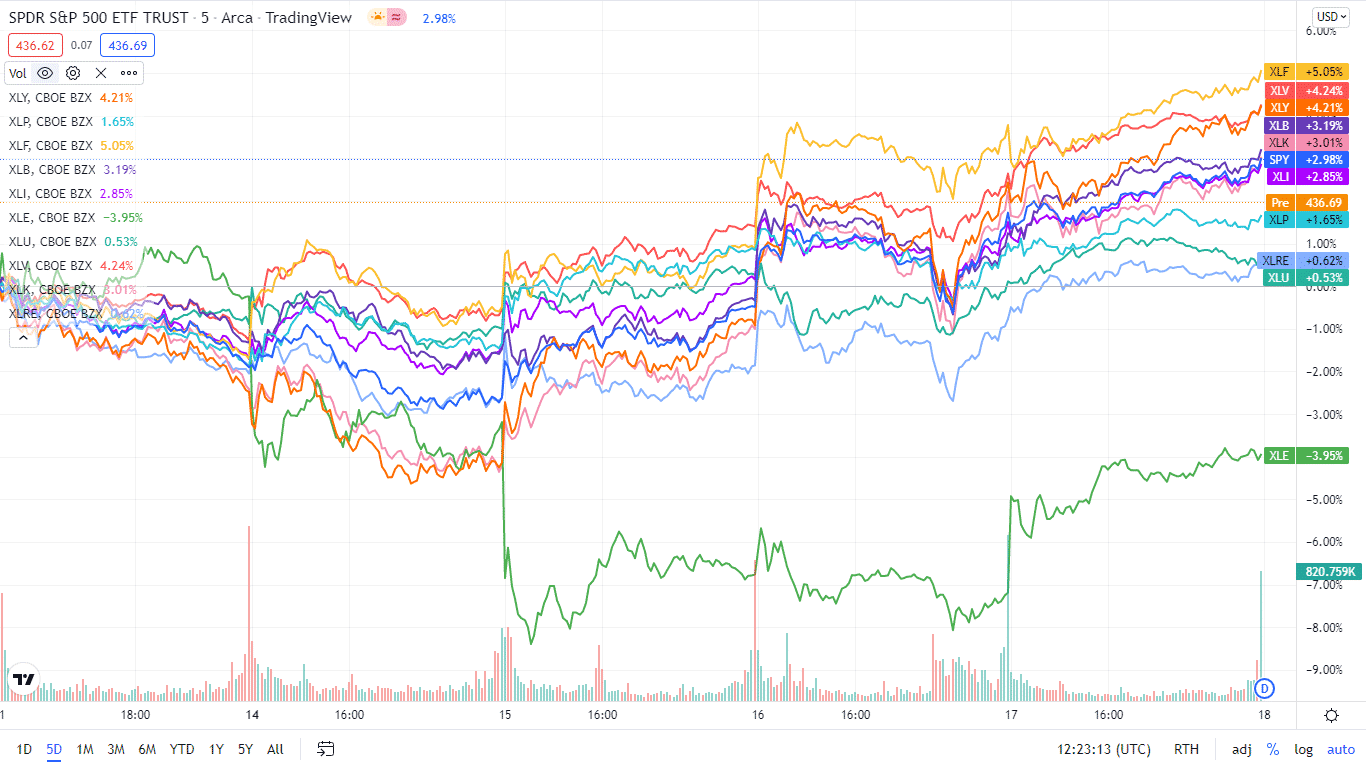

Below is a performance chart of the SP 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week, using their corresponding ETFs. The SPY bull roared back at the bears with all the sectors finishing the week in the green except for the energy sector.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Consumer Discretionary | XLY | +6.94% with the accompanying consumer discretionary select sector ETF |

| 2. | Financial Services | XLF | +6.82% with the accompanying financial select sector ETF |

| 3. | Information Technology | XLK | +5.56% with the accompanying information technology select sector ETF |

| 4. | Healthcare | XLV | +5.55% with the accompanying healthcare select sector ETF |

| 5. | Industrial | XLI | +4.61% with the accompanying industrial select sector ETF |

| 6. | Materials | XLB | +4.56% with the accompanying materials select sector ETF |

| 7. | Communication Services | XLC | +4.29% with the accompanying communication services select sector ETF |

| 8. | Consumer Staples | XLP | +3.55% with the accompanying consumer staples select sector ETF |

| 9. | Real Estate | XLRE | +2.48% with the accompanying real estate select sector ETF |

| 10. | Utilities | XLU | +1.44% with the accompanying utilities select sector ETF |

| 11. | Energy | XLE | -3.67% with the accompanying energy select sector ETF |

Comments