The world we live in is now cognizant of the adverse effects of crude oil for energy. Nevertheless, it still accounts for a third of the global energy source, making it the largest global industry when you factor in oil and gas exploration, extraction refining, transportation, and sales and marketing.

Add to these dynamic economic sanctions on Russia, the 3rd largest oil producer globally, and resistance by OPEC to review supply quota upwards, and the record-high oil prices are bound to soar even further. However, it remains one of the most volatile industries requiring prudent investing. The following leveraged oil ETFs give you relatively stable exposure to the oil industry and a chance at slick investment for amplified returns.

What is the composition of leveraged oil ETFs?

Conventional oil ETFs comprise organizations in the oil value chain, from oil exploration to its selling and crude oil spot price. On the other hand, leveraged oil ETFs comprise financial instruments tied to natural energy resources with an objective of magnified returns. They, therefore, provide exposure to crude oil, heating oil, and gasoline.

Leveraged oil ETFs to watch and buy

Despite the Ukraine-Russia war, investors in oil, unlike other industries, are not fretting but smiling to the bank, a bullish run that has seen oil prices grow by 63.4% over the last 12 months. The expectation is for the oil industry to continue outperforming the markets. Still, there are bound to be dramatic swings in between, and these three leveraged ETFs give investors a straightforward way to play these volatilities and generate significant returns.

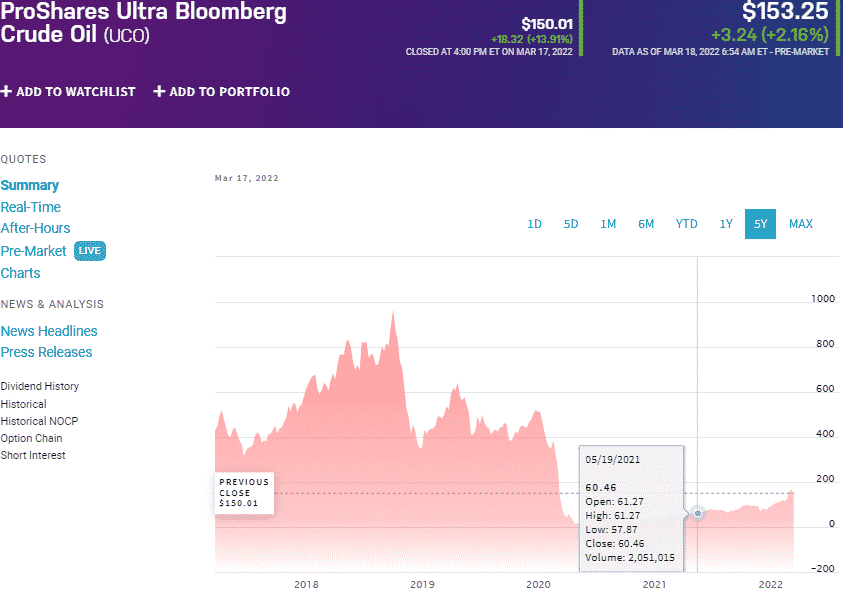

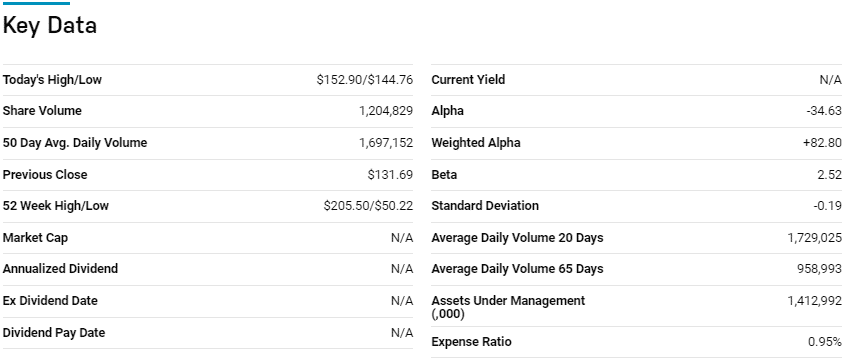

№ 1. ProShares Ultra Bloomberg Crude Oil ETF (UCO)

Price: $153.25

Expense ratio: 0.95%

UCO chart

The ProShares Bloomberg Crude Oil ETF seeks double the returns of the Bloomberg Commodity Balanced WTI Crude Oil IndexSM daily. It invests under the fund manager’s discretion in any or a combination of the following financial instruments of its composite index; future contracts, swap deals, options, and future agreements, attached to the WTI sweet light crude oil.

UCO ETF is one of the largest leveraged funds boasting $1.36 billion in assets under management, with an expense ratio of 0.95%. Daily reset features and explicit leverage allow a fund to compound return in the short term if closely monitored and result in significant returns; 1-year returns of 113.82, year-to-date returns of 51.75%, and 3-month returns of 66.02%.

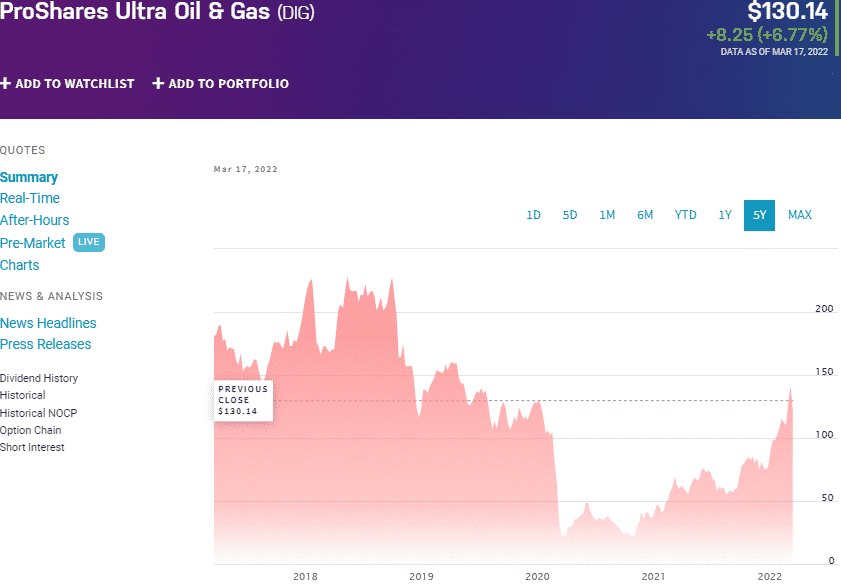

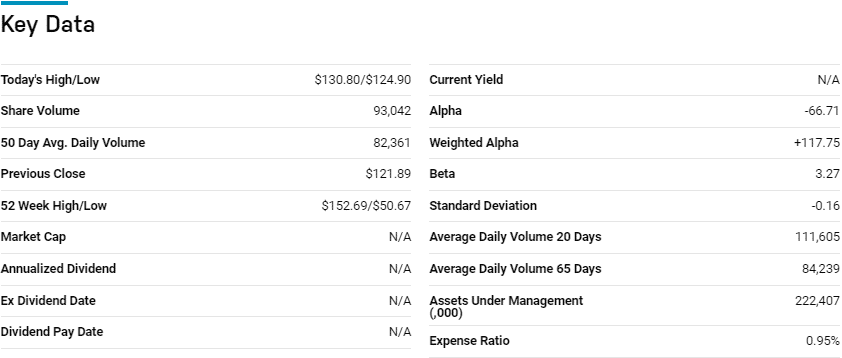

№ 2. ProShares UltraShort Oil and Gas (DIG)

Price: $130.14

Expense ratio: 0.95%

DIG chart

The ProShares Ultrashort Oil and Gas ETF seeks double the returns of the Dow Jones U.S. Oil & GasSM Index daily. It invests 95% of its resources in the tracked index financial instruments believed to result in twice the daily returns of its composite index; future contracts, swap agreements, options, and forward agreements.

The DIG ETF has $222.4 million in assets under management, with investors having to part with $95 annually for every $10000 investment. Unlike the UCO ETF, DIG concentrates on providing leveraged bullish exposure to US large-cap energy equities rather than the actual price of oil. Daily reset sets a platform for returns compounding over a short time if monitored closely; 5-year returns of 91.34%, year-to-date returns of 59.15%, and 3-month returns of 63.74%.

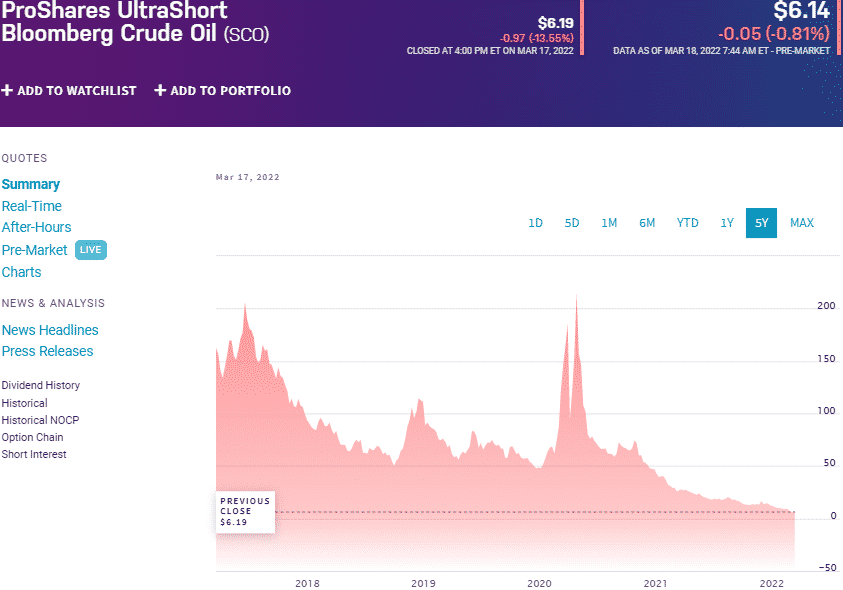

№ 3. ProShares Ultrashort Bloomberg Crude Oil ETF (SCO)

Price: $6.12

Expense ratio: 1.37%

SCO chart

The ProShares Ultrashort Bloomberg Crude Oil ETF seeks double the returns of the Bloomberg Commodity Balanced WTI Crude Oil IndexSM daily. It invests 95% of its resources in the tracked index financial instruments believed to result in twice the daily returns of its composite index; future contracts, swap agreements, options, and forward agreements. This ETF does not invest in physical oil.

The SCO ETF has $354.8 million in assets under management, with an expense ratio of 0.95%. This leveraged oil exchange-traded fund gives investors a way to profit off bearish movements in oil price. Unlike the other leveraged fund on this list that plays off the bullish movement and has been aligned to the general market movement hence being positive, the SCO has had negative returns but can still be a powerful tool to take advantage of bearish volatilities.

Final thoughts

Since mid-2020, oil and gas prices have soared to unprecedented levels. The same phenomenon is expected to continue in the backdrop of the Russian-Ukraine war and OPEC’s resistance to increase supply. This does not mean that there have been no volatilities between this largely bullish movement. The leveraged oil ETFs above provide a slick and hassle-free way to play the soaring oil prices and volatilities and make significant returns.

Comments