After a turbulent week that saw the SPY slide downwards to close the week in the red for the first time in over five weeks, the thought that the SPY’s rampaging bullish updraft had come to an end crossed many an investor.

Would the new week feed these jitters, or would the SPY soar and make a believer out of the doubters yet again?

Monday’s opening gap up of 0.2% to have the SPY start its trading at $468.43 might not have been the largest opening gap in several weeks, but it settled some of the jitters; 90% of weekly opening gap ups have been followed up by bullish week. Try as it might, however, Monday trading could not break the monthly resistance level, $469.13-$470.24, resulting in a short-term bearish move that had the Spy test the November pivot level of 466.13-$467.44.

More companies are coming to light with their third-quarter numbers, and despite most analysts agreeing that economic recovery has slowed down, they are reporting better than expected numbers. As a result, the monthly pivotal level held its support integrity to have prices recover lost ground and go on a bullish run that had them testing the weekly resistance level again on Tuesday evening.

Come Wednesday, the debit around the US national debt had the SPY prices pause their upward assault on the monthly resistance level. The US economy and government have assured investors that government debts will always be honored for the longest time. However, it looks more and more as if the debt ceiling with the additional funding approved some time ago is way over the roof, with experts and legislators afraid that current debt won’t be honored, resulting in a global financial crisis. Despite all these fears, investors seem to be still riding the euphoria from the energy bill passing to have the SPY trade sideways for the rest of the week but in a bullish inclination resulting in an overall positive week, +0.98%.

Top gainers of the current week

Consumer Discretionary sector

In addition to the US opening its borders, supply disruptions and push for sustainability continue to drive the commodity boom, with consumer discretionary continuing to take full advantage and close the week again in the green and as the top sector gainer, +3.46%.

Information Technology sector

The medical field is warning people to get vaccinated and for the vaccinated to get booster shots in light of a Covid-19 the fourth wave. Countries and organizations alike are accelerating to ensure remote working is a viable option, with the information sector reaping the benefits to end the week with a +1.59% change.

Real Estate sector

Jitters persist on increasing inflation with apprehensive investors looking into inflation-protected sectors hence the positive weekly change, +0.5% for the Real Estate sector.

Losers of the current week

Sectors that had the worst the trading week were:

Energy sector at — 1.37%

Financial Services sector at — 1.73%

Materials sector at — 1.84%

Inflation figures have run so high that consumer pain at the sale point is no longer ignored due to increased inflation tax. As a result, the three sectors above have experienced massive cash outflows to close the week in the red and as the worst hit.

In addition, the energy sector is at a tipping point with the just concluded COP26 convention that upwards of 200 global countries commit to fight global warming and work towards zero emissions.

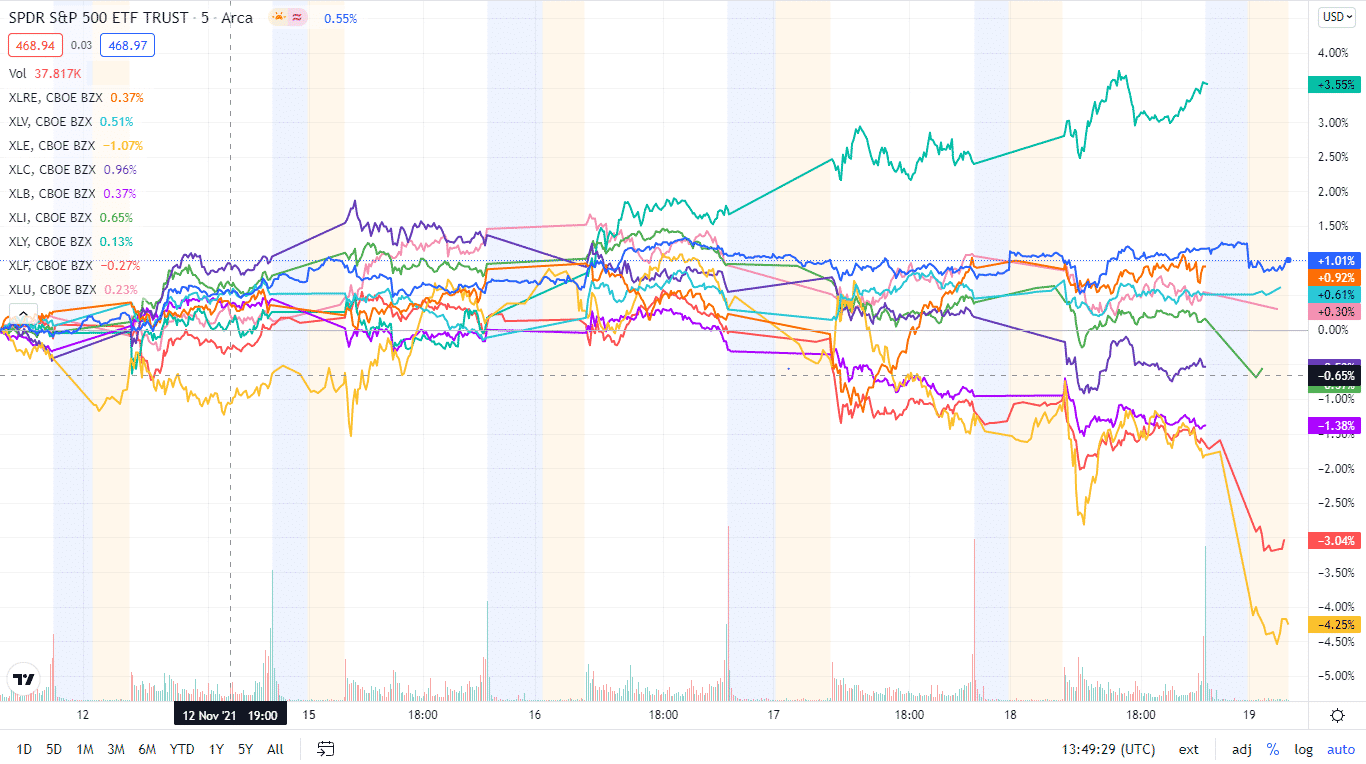

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week, using their corresponding ETFs, and despite some closing in the red, they are still within touching distance of record high.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Consumer Discretionary | XLY | +3.46% with the accompanying consumer discretionary select sector ETF |

| 2. | Information Technology | XLK | +1.59% with the accompanying information technology select sector ETF |

| 3. | Real Estate | XLRE | +0.5% with the accompanying real estate select sector ETF |

| 4. | Utilities | XLU | +0.33% with the accompanying utilities select sector ETF |

| 5. | Healthcare | XLV | -0.04% with the accompanying healthcare select sector ETF |

| 6. | Consumer Staples | XLP | -0.67% with the accompanying consumer staples select sector ETF |

| 7. | Industrial | XLI | -0.68% with the accompanying industrial select sector ETF |

| 8. | Communication Services | XLC | -0.71% with the accompanying communication services select sector ETF |

| 9. | Energy | XLE | -1.37% with the accompanying energy select sector ETF |

| 10. | Financial Services | XLF | -1.73% with the accompanying financial select sector ETF |

| 11. | Materials | XLB | -1.84% with the accompanying materials select sector ETF |

Comments