What if there was a way to solve the intermittency challenges associated with renewable energy and at the same time achieve decarbonization in the energy-hungry economic sectors such as transportation, chemical and industrial?

We would conserve the environment for future generations. The good news is that it is possible. The bad news is that at present, only 0.1% of the global energy is green hydrogen. However, for investors, this means that this market is profound.

Given the ever-increasing appetite for sustainable renewable energy and world economies being pro-green energy, the market is bound to accelerate more than the estimated CAGR annual growth 5.4%-$129.6 billion to $219.2 billion by 2030.

What is the composition of Hydrogen ETFs?

Hydrogen ETFs comprise organizations in the hydrogen value chain from its production, hydrogen-related technology firms, fuel cells producers, and hydrogen implementation. In addition, some hydrogen funds go ahead and include all organizations providing ancillary services to the organizations mentioned above and those that stand to gain significantly from the growth of the hydrogen industry.

Top five hydrogen ETFs to buy and hold

Increased lobbying for environmental and climate reclamation globally has resulted in an increased appetite for green energy. With hydrogen energy solving the intermittency challenge associated with renewable energy and technological advancements making it a scalable clean energy option, the ETFs below are in pole position to benefit from the growth of this energy niche.

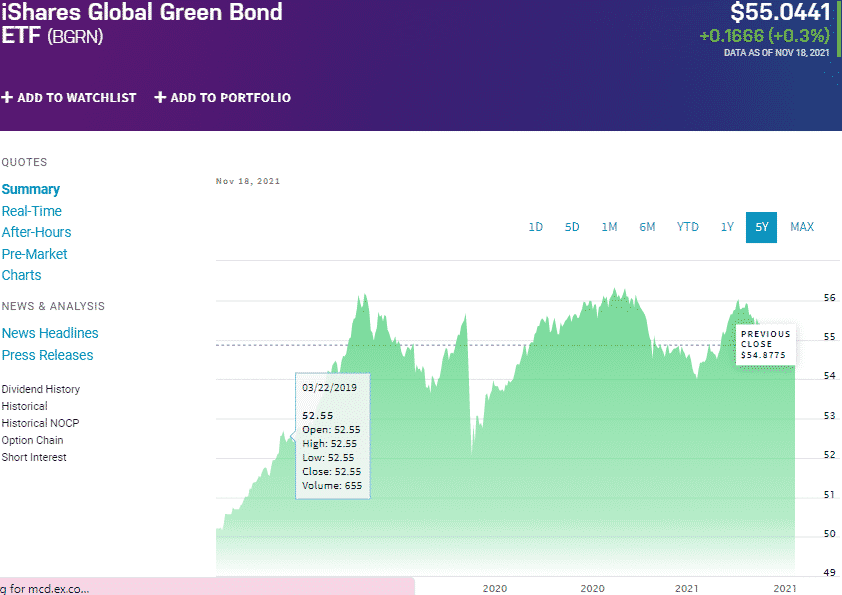

№ 1. iShares Global Green Bond ETF (BGRN)

Price: $55.04

Expense ratio: 0.20%

Dividend yield: 0.29%

BGRN chart

iShares Global Green Bond Fund tracks the performance of the Bloomberg MSCI Global Green Bond Select (USD Hedged) Index, investing at least 90% of its total assets in tracked index securities. Therefore, it exposes investors to the US hedged investment-grade bonds whose sole purpose is to fund green environmental projects.

The top three holdings of this ETF as of now are:

- France 1.75% 25-JUN-2039 — 4.83%

- AGENCY BOND — 2.68%

- Belgium 1.25% 22-APR-2033 — 1.85%

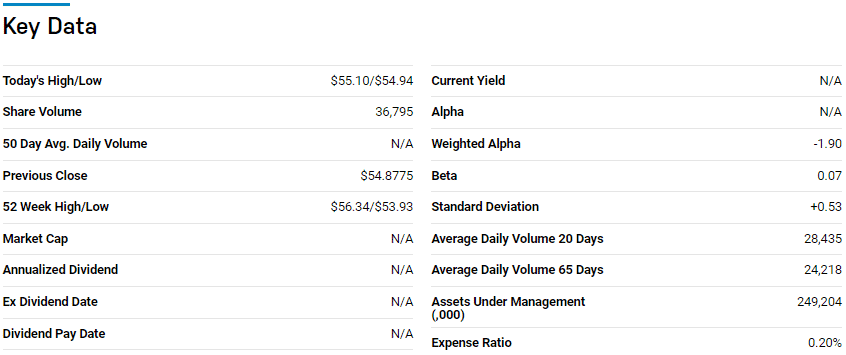

№ 2. Global X Hydrogen ETF (URA)

Price: $26.15

Expense ratio: 0.50%

Dividend yield: N/A

HYDR chart

The Global X Hydrogen ETF tracks the Solactive Global Hydrogen Index, exposing investors to multiple industries involved in hydrogen-related technologies globally. It invests at least 80% of its total assets in the securities making up its benchmark index.

The top three holdings of this ETF as of now are:

- Bloom Energy Corporation Class A — 13.75%

- Plug Power Inc. — 12.86%

- Ballard Power Systems Inc. — 10.85%

HYDR has amassed $32.7 million in assets under management, since its launch in July of 2021, with an expense ratio of 0.50%. This niche is expected to grow upwards of 75% by 2026. Thus, this hydrogen ETF is worth a second look when considering green investing; since its launch has recorded three months returns of 23.61%.

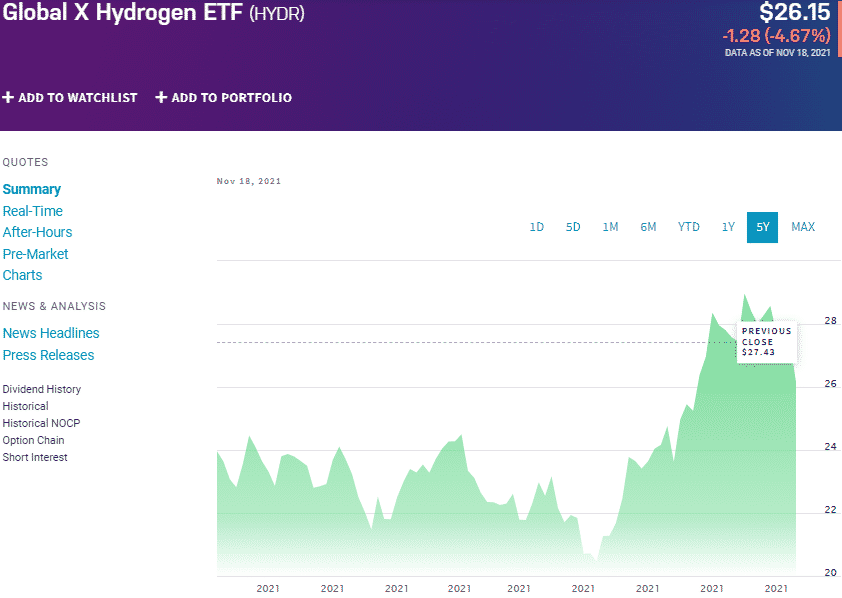

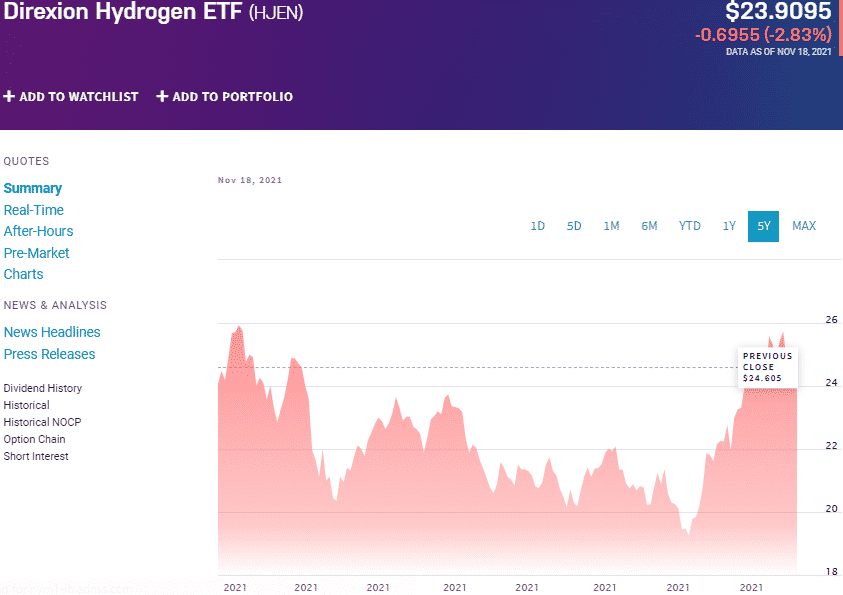

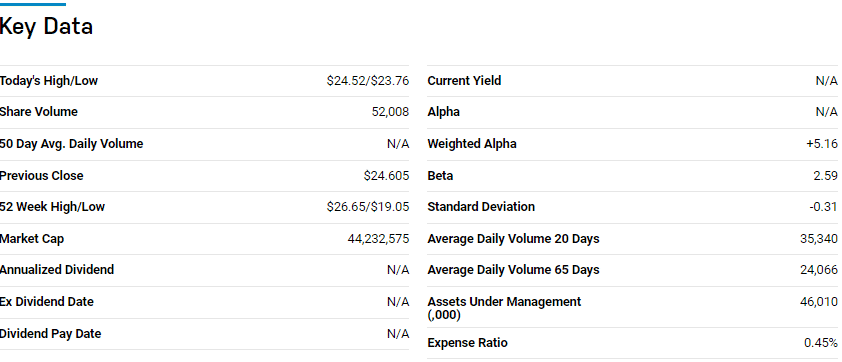

№ 3. Direxion Hydrogen ETF (HJEN)

Price: $23.91

Expense ratio: 0.45%

Dividend yield: 0.32%

HJEN chart

The Direxion Hydrogen ETF tracks the Indxx Hydrogen Economy Index, investing at least 80% of its total assets in the securities making up its benchmark index. HJEN investors gain exposure to global companies providing goods and/or services to the hydrogen energy niche; generation and storage, stations, hydrogen-based automakers, and fuel cells.

The top three holdings of this ETF as of now are:

- Bloom Energy Corporation Class A — 10.24%

- Plug Power Inc. — 9.39%

- FuelCell Energy Inc. — 8.93%

HJEN has amassed $46 million in assets under management, since its launch in March of 2021, with an expense ratio of 0.45%. Despite launching earlier than its counterpart, HYDR ETF, HJEN has lagged in returns, 3-months returns of 19.60%. However, it cuts across the five hydrogen sub-niches, making it a must-have when considering hydrogen investing.

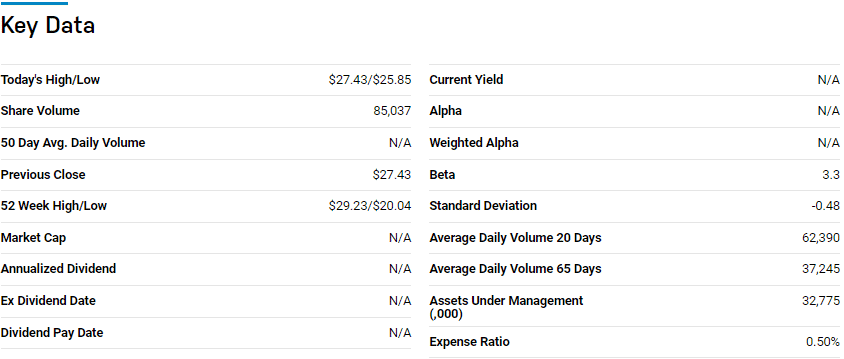

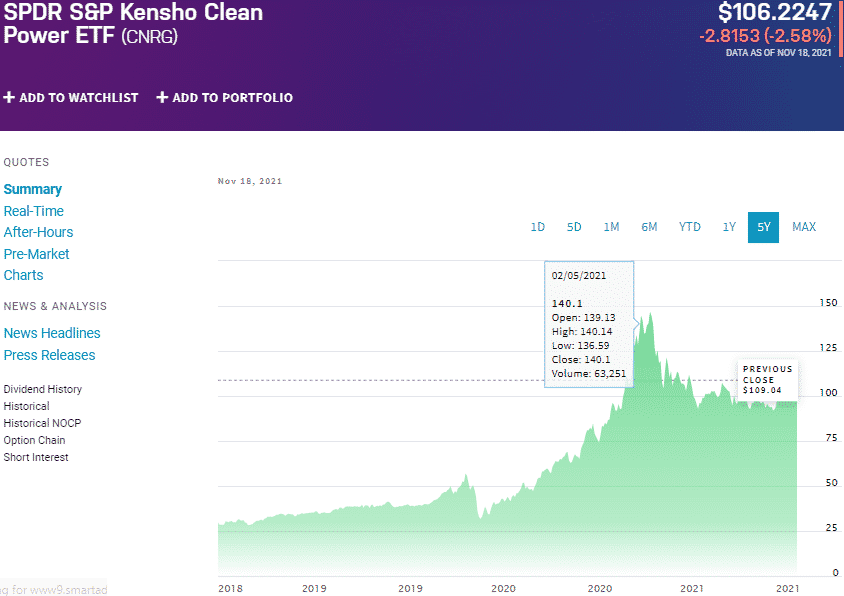

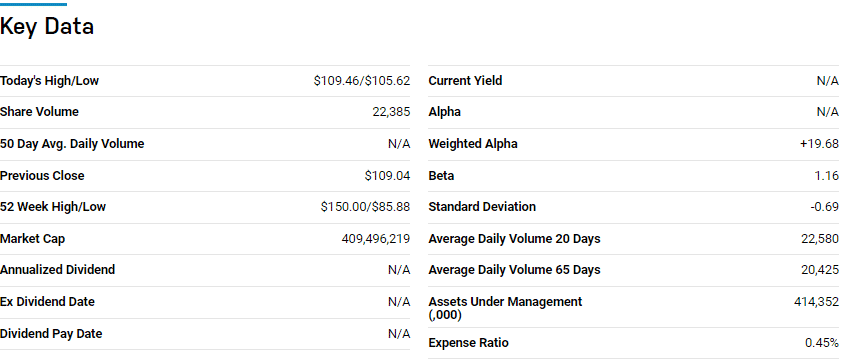

№ 4. SPDR S&P Kensho Clean Power Fund (CNRG)

Price: $106.22

Expense ratio: 0.45%

Dividend yield: 0.74%

CNRG chart

The SPDR S&P Kensho Clean Power ETF tracks the S&P Kensho Clean Power Index, exposing investors to organizations at the forefront of providing products and services essential for the drive towards clean power adoption. Therefore, it invests at least 80% of its total assets in the securities making up its composite index.

The top three holdings of this ETF as of now are:

- Enphase Energy, Inc. — 4.32%

- Tesla Inc. — 4.15%

- Array Technologies Inc. — 4.01%

CNRG has $412.88 million in assets under management, with an expense ratio of 0.45%. Since its inception, it has had a history of outperforming its category and segment average returns; 3-year returns of 278.91% and pandemic year returns of 29.55%. With interests in all things clean, from generation to the underlying technologies, this ETF has the diversification to take advantage of any opportunities in the hydrogen market and the green energy niche.

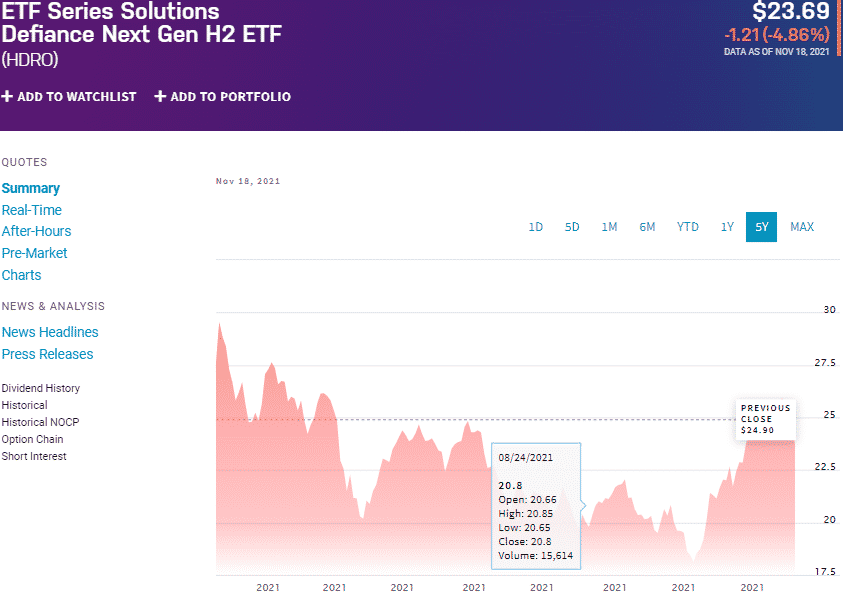

№ 5. Defiance Next Gen H2 ETF (HDRO)

Price: $23.69

Expense ratio: 0.30%

Dividend yield: 0.02%

HDRO chart

The Defiance Next Gen H2 ETF tracks the BlueStar Hydrogen & NextGen Fuel Cell Index, investing at least 80% of its total assets in the securities making up its benchmark index. As such, HDRO investors gain exposure to global companies involved in developing Hydrogen-based energy sources and fuel cell technologies.

The top three holdings of this ETF as of now are:

- Plug Power Inc.— 14.18%

- FuelCell Energy, Inc. — 9.06%

- Bloom Energy Corporation Class A — 7.76%

HDRO has amassed the most significant asset base among hydrogen firms launched in 2021, $75.46 million in assets under management, with an expense ratio of 0.30%. So far, this ETF has managed 23.10% 3-months returns, showing how much this abundant resource is gaining traction as an alternative resource option.

Final thoughts

As the global population grows and natural resources become scarcer, sustainable and renewable energy appetite grows. With hydrogen as the most abundant natural resource and technology evolution continuing to slash the operational costs involved, these ETFs have phenomenal potential to soar.

Comments