Thanks to William Hyde, the same British physicist and Chemist who gave the world palladium, investors can invest in rhodium, the rarest of the six palladium metals. Despite gold being rare, approximately 2300 tons of gold are mined annually compared to only 28 tons of rhodium.

Rhodium is not viewed as a store of value despite its rarity, making it purely an industrial metal. The result is a rare metal commodity whose price is at the mercy of the forces of demand and supply, with minor geopolitical risk influences due to limited global rhodium mines.

Its rise in prominence is only in infancy, fueled by the worldwide appetite for zero carbon emission and rhodium’s ability to catalyze nitrogen oxide to nitrogen. Couple this with its other use as a coating against corrosion, and what you have is a metal commodity expected to grow at a CAGR of 5.7% by 2027 to have the market valued at upwards of $3 billion.

Rhodium ETFs for the hottest trades: how do they work?

Rhodium’s anti-corrosive properties sound like an industrial metal in jewelry, unlike other palladium metals. As such, rhodium ETFs either track the spot price of rhodium or comprise organizations along the rhodium value chain; exploration and mining, refinement, rhodium utilization in the jewelry segment and the industrial sector, and all rhodium-related ancillary services.

The best rhodium ETFs for hot trades

Historically, rhodium, just like all the palladium metals, has exhibited more than average volatility calling for nuanced investment. This volatility results from limited supply and high susceptibility to geopolitical risks. Despite these challenges, being part of the green metals has seen its popularity rise, resulting in it outperforming not only the S&P 500 but its base metal palladium.

It is expected to continue as more countries sign into the zero-greenhouse gas emission bandwagon, proven to be a very volatile precious metal due to limited supply options. It necessitated investing in palladium via an investment vehicle that offers mitigation against these volatilities.

However, despite its volatility, it has outperformed its sister metal platinum and the S&P 500 over the last half a decade. The ETFs below allow investors to be part of the next earning phase of this rare precious metal.

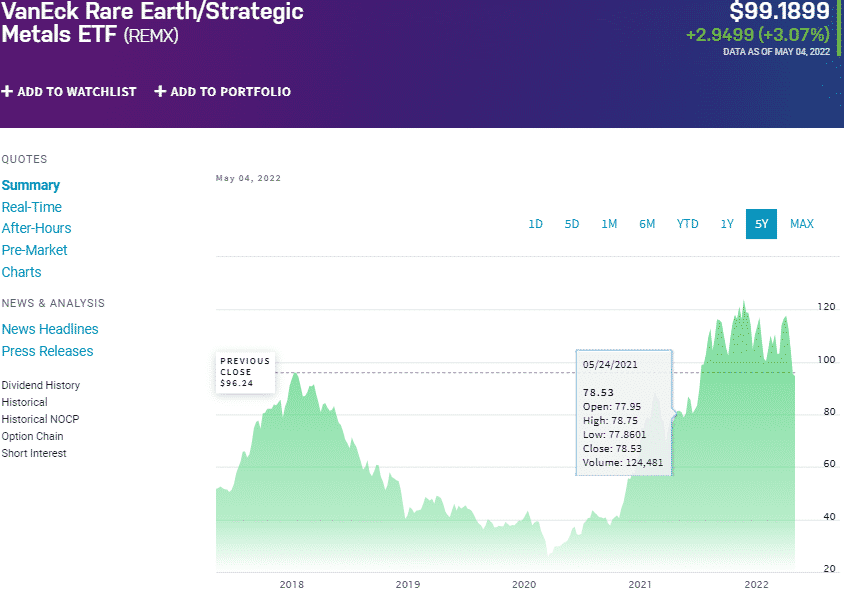

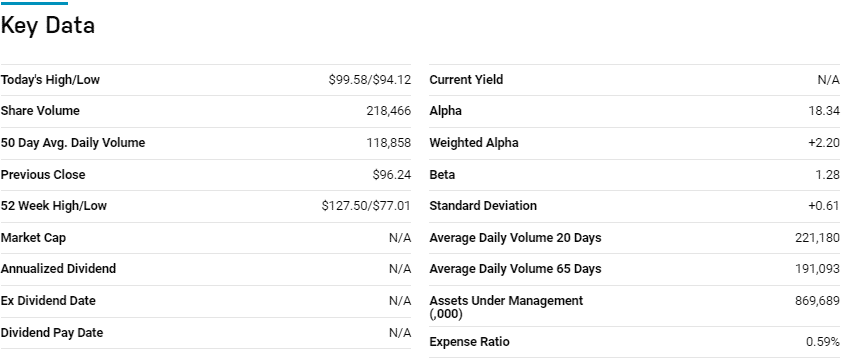

№ 1. VanEck Rare Earth/Strategic Metals ETF (REMX)

Price: $99.18

Expense ratio: 0.59%

Dividend yield: 0.45%

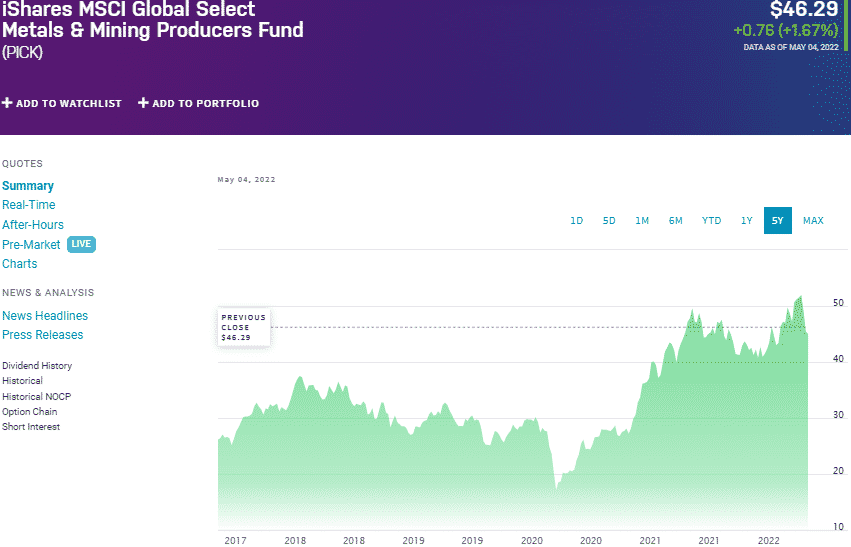

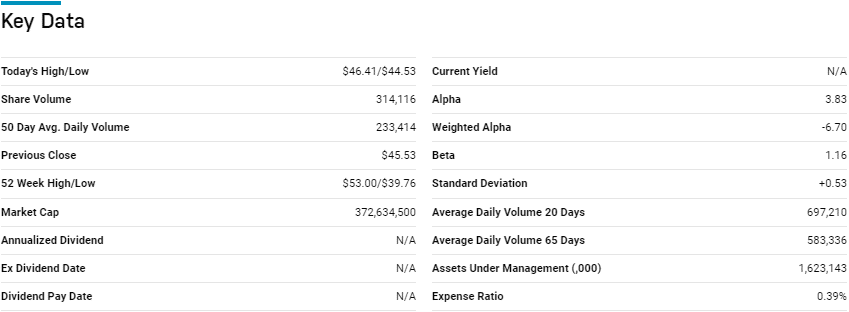

PICK chart

If you have to invest in rare metals with strategic use in the current world, you must consider the VanEck Rare Earth/Strategic Metals ETF. The REMX is a pureplay rare earth metal fund that tracks the MVIS Global Rare Earth/Strategic Metals Index, investing at least 80% of its total assets in the equities making up the tracked index. The result is a fund that exposes investors to equities operating in the rare earth metals and minerals space and strategic minerals and metals space.

USNews ranks the REMX fund at № 6 for long-term investing, among the best 14 equity precious metal funds.

The top three holdings of this rare metals fund are:

- Allkem Limited — 7.50%

- Zhejiang Huayou Cobalt Co. Ltd. Class A — 7.25%

- Lynas Rare Earths Limited — 6.55%

The REMX ETF has $869.7 million in assets under management, with an expense ratio of 0.59%. The global cognizance of the need to reclaim the environment and the climate patterns has resulted in the expansion of green metal demand, making this fund an indirect play on rhodium metals, given its zero-greenhouse gas emission role.

Combine this with the rarity of rare earth metals and minerals. This fund provides significant upside potential and historical performance; 5-year returns of 129.49%, 3-year returns of 144.62%, and 1-year returns of 26.43%. The year-to-date returns of -14.22% provide an opportunity to buy the dip.

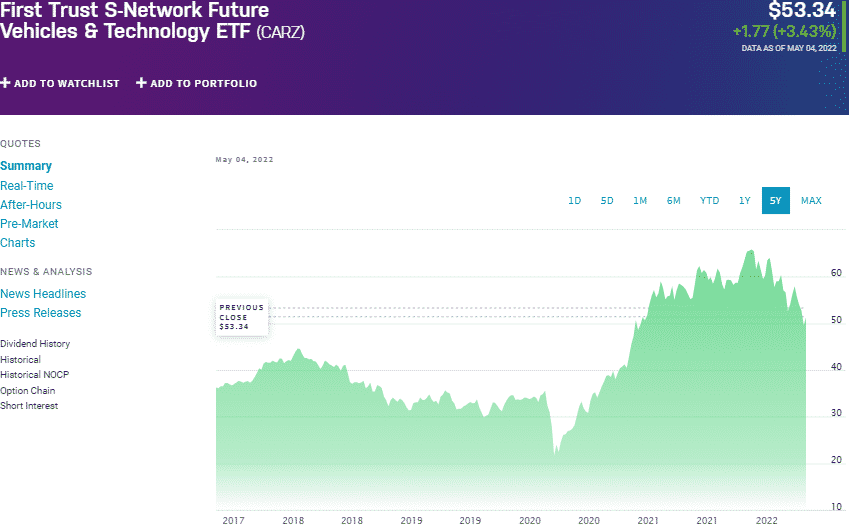

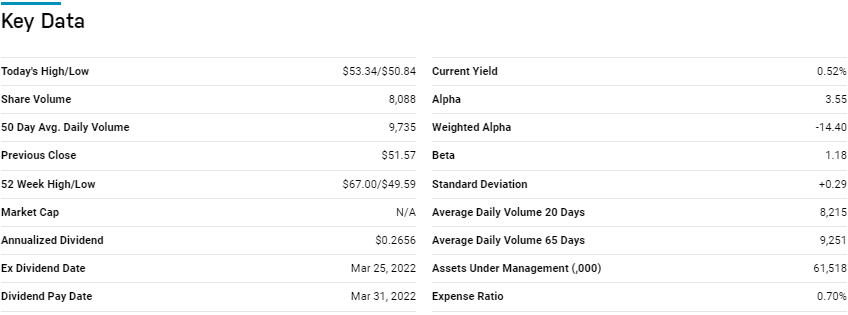

№ 2. First Trust NASDAQ Global Auto Index Fund (CARZ)

Price: $53.34

Expense ratio: 0.70%

Dividend yield: 0.72%

CARZ chart

The First Trust NASDAQ Global Auto Index Fund tracks the price and yield results of the S-Network Electric & Future Vehicle Ecosystem Index, investing at least 90% of its total assets in common stocks making the tracked index and the holdings’ associated ADRs. It exposes investors to global automotive companies, with more weighting on those involved in the next disruptive automotive technology.

The top three holdings of this non-diversified global automotive fund are:

- Qualcomm Incorporated — 4.95%

- Toyota Motor Corp. — 4.68%

- Texas Instruments Incorporated — 4.64%

Despite comprising the most prominent automotive companies globally, the CARZ ETF has garnered a meager $61.6 million in assets under management since its launch over a decade ago. Investors have to part with $70 annually for every $10000 invested. Being a pureplay automotive fund offers indirect exposure to the industry utilizing rhodium the most and a chance to cash in on the increased demand for vehicles with minimal greenhouse emissions. Except for the last 12 months, CARZ has been consistently putting a smile on the faces of its investors; 5-year returns of 59.66%, 3-year returns of 57.20%, and 1-year returns of -6.12%.

№ 3. iShares MSCI Global Metals and Mining Producers Fund (PICK)

Price: $46.29

Expense ratio: 0.39%

Dividend yield: 0.50%

PICK chart

The iShares MSCI Global Metals and Mining Producers Fund tracks the SCI ACWI Select Metals & Mining Producers ex Gold and Silver Investable Market Index, investing at least 80% of its total assets in the underlying holdings of the composite index and other investment assets exhibiting similar economic characteristics. It offers exposure to equities in developed and emerging markets operating within the base metals, minerals, and precious and rare metals niche, silver and gold.

Among 14 equity precious metal funds, the PICK ETF is ranked №2 by USNews for long-term investing.

The top three holdings of this ETF are:

- BHP Group Ltd —14.46%

- Rio Tinto plc — 6.70%

- Vale S.A. — 5.70%

The PICK ETF boats $1.62 billion in assets under management, with an expense ratio of 0.39%. It offers diversified play on rhodium by exposing investors to global companies that extract metals and minerals.

Being the most diversified fund within the corner of the commodity market dealing with all things metal and minerals provides for a resilient fund capable of withstanding market downturn; 5-year returns of 107.40%, 3-year returns of 73.86%, and 1-year returns of 3.79%.

Final thoughts

The green energy and achievement of the zero-greenhouse gas emissions movement are just taking off, providing a host of opportunities for green metals with a strategic role in this environment.

Before the globe goes fully electric on the automotive industry, rhodium continues to prove its strategic value in ensuring minimal carbon emissions in the automotive industry and, coupled with its rarity and use in the consumer electronic space, will continue to be bullish. These three ETFs provide hot trades into the rhodium space and a chance at significant returns.

Comments