Palladium follows its platinum’s footsteps as a precious metal rarer than gold but rarely as exciting as gold and silver. Similar to platinum, it is found more profound in the earth’s core than other precious metals, and significant deposits are only in Russia and South Africa.

It is purely an industrial metal that leaves its price at the mercy of demand and supply forces, albeit coupled to geographical and political risks due to the limited source point. Therefore, limited pure play palladium ETFs are tracking their spot prices because their liquidity and market size do not qualify in the eyes of investors as a store of value.

Nevertheless, its use in the electronics and technology industry is expected to grow this precious metal by a CAGR of 5.7% by 2027 to have the market valued at upwards of $5 billion.

Palladium ETFs for new opportunities: how do they work?

Unlike other metals such as gold, platinum, copper, silver, aluminum, palladium is an industrial metal with no applications in the jewelry space. As such, palladium ETFs either track the spot price of palladium or comprise organizations along the palladium value chain; exploration and mining, refinement, palladium utilization in the industrial sector, and all palladium-related ancillary services.

The best palladium ETFs for 2022

Historically, palladium has proven to be a very volatile precious metal due to limited supply options. It necessitated the need for investing in palladium via an investment vehicle that offers mitigation against these volatilities. However, despite its volatility, it has outperformed its sister metal platinum and the S&P 500 over the last half a decade. The ETFs below allow investors to be part of the next earning phase of this rare precious metal.

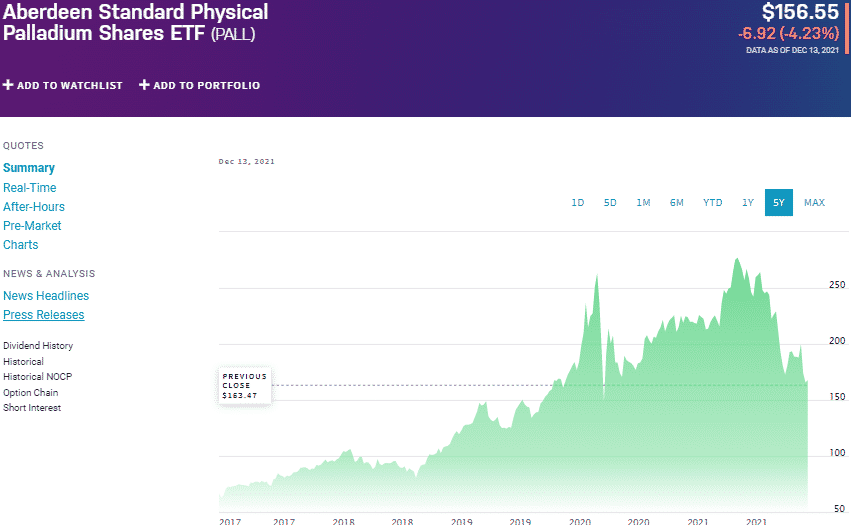

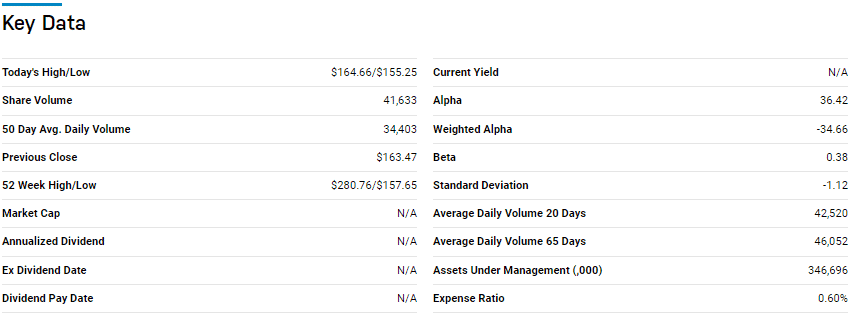

№ 1. Aberdeen Standard Physical Palladium Shares Fund (PALL)

Price: $156.55

Expense ratio: 0.60%

Dividend yield: N/A

PALL chart

The Aberdeen Standard Physical Palladium Shares ETF is a passively managed fund seeking to reflect the performance of palladium as a commodity, net of liabilities, and fund’s operational cost. It holds physical bars of this rare metal in vaults exposing investors to this precious industrial metal without the need for storage.

The PALL ETF currently has $346.7 million in assets under management, with an expense ratio of 0.60%. Unlike platinum, the multiple industrial uses of palladium in the industrial sector ensure it weathers market downturns of the automotive industry. It is also highly used in catalytic converters, with 5-year returns of 131.91% and 3-year returns of 39.54%.

The economic resurgence will increase demand for vehicles and technology chipsets that use palladium as a critical ingredient. PALL ETF offers the only pureplay palladium ETF to cash in on the increasing price of palladium on the back of this increased demand.

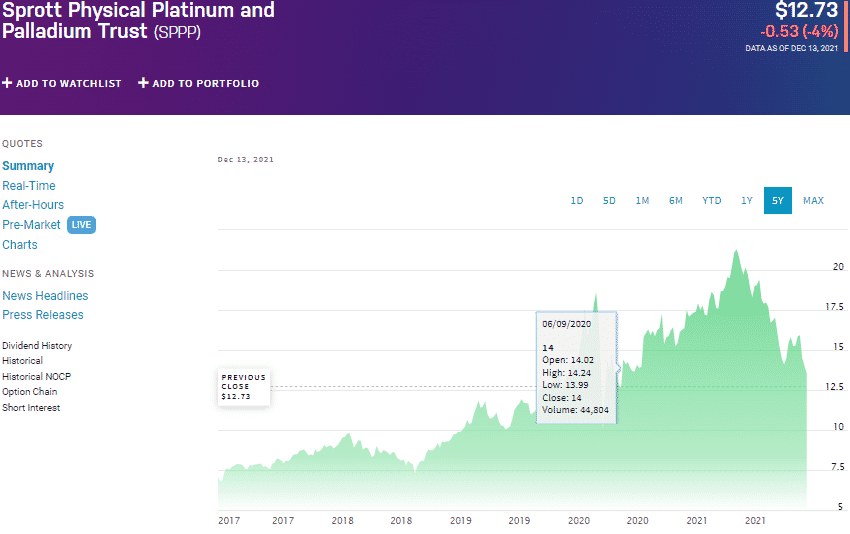

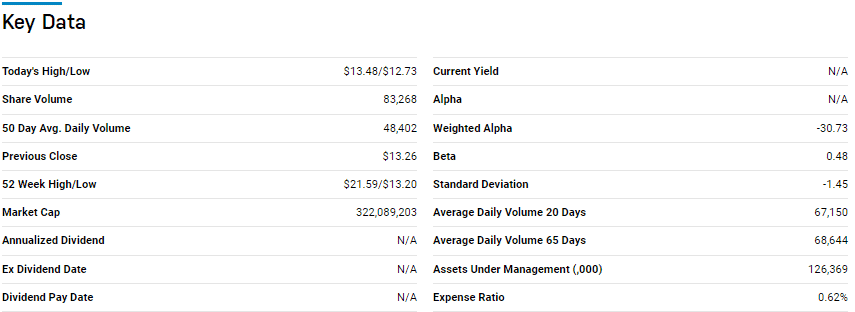

№ 2. Sprott Physical Platinum and Palladium Trust (SPPP)

Price: $12.73

Expense ratio: 0.62%

Dividend yield: N/A

SPPP chart

An alternative to the Aberdeen Standard Physical Platinum Shares fund is the Sprott Physical Platinum and Palladium Trust. It is a passively managed fund that seeks to reflect net expenses’ spot prices of physical platinum and palladium.

SPPP ETF has $120 in assets under management, with investors’ parting with $62 annually for every $10000 invested. Its returns have been trailing the category average in the last half a decade, but with the explosion in demand of both platinum and palladium, this ETF is poised for some significant strides; 5-year returns of 12.17% and 3-year returns of 11.53%.

№ 3. iShares MSCI Global Metals and Mining Producers ETF (PICK)

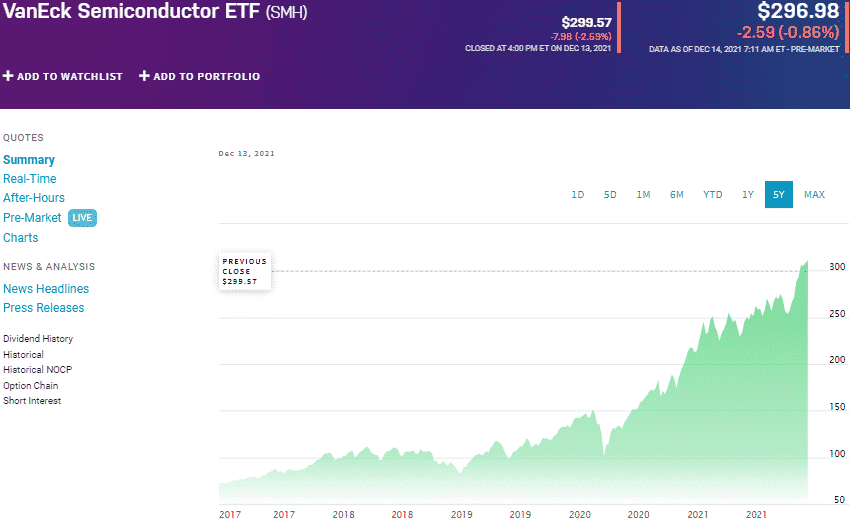

Price: $296.98

Expense ratio: 0.35%

Dividend yield: 0.50%

SMH chart

The VanEck Semiconductor ETF tracks the MVIS® US Listed Semiconductor 25 Index, investing at least 80% of its total assets in the underlying holdings of the composite index. This ETF offers diversified and indirect exposure to the palladium market through the global semiconductor equities listed in the US stock exchange-large-cap and medium-cap organizations.

Among 104 equity technology funds, the SMH is ranked № 14 by USNews.

The top three holdings of this non-diversified ETF are:

- Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR — 13.96%

- NVIDIA Corporation — 13.88%

- ASML Holding NV ADR — 5.89%

SMH ETF has $7.26 billion in assets under management, with an expense ratio of 0.35%. Being an equity-focused ETF, SMH has the potential for long-term gains, especially being a mix of both mid and large-cap equities. This ETF’s returns are unrivaled over the last five years in its category; 5-year returns of 355.43%, 3- year returns of 25783%, pandemic year returns of 44.55%, and year to date returns of 40.81%.

SMH investments expose investors to the largest and most liquid semiconductor equities relying on palladium heavily for their operations. As the global appetite for electric vehicles increases, palladium will be a critical component for semiconductor chipsets and catalytic converters, making this ETF an ideal palladium diversification option.

Final thoughts

Unlike other precious metals, industrial use of palladium is just gaining momentum given its affiliation to green energy and the achievement of zero emissions. In addition, the global consumer market appetite for supercomputing power in their everyday electronics will also add to the demand for palladium. With its rarity and limited supply, all these factors set the stage for short-term and long-term bullish runs, and the exchange-traded funds above are in pole position to benefit.

Comments