Green technology, also known as a clean fuel, is a concept known to almost everyone in the world currently, if not every single soul. Its popularity is attributable to the adverse effects of fossil fuels that can no longer be ignored-tsunamis, adverse change in weather patterns, to mention the significant observable impact.

Among all this cloud of a thunderstorm, a ray of sunshine exits, recent innovations, and technological advancements make the cost of green technology production and distribution affordable and readily available. Scientists say that reversing what has been done will take time but agree the widespread adoption of clean energy is the first significant step in the global climate sustainability fight.

This guide highlights the best green technology stocks to safeguard our future to buy in Q2 2021.

What are green technology ETFs?

Green technology is an all-inclusive term for using science and technology to reduce the impact of human activity on the environment and climate. It includes energy from natural resources or those that continuously replenish naturally and all technological solutions to reduce and reverse global warming.

Green technology stocks and related investments are in for significant growth driven by global pro-clean energy policies and increased consumer awareness and behavioral changes. The best way to take advantage of this inevitable change is investing in green technology ETFs rather than the headache of trying to pick individual stock winners.

How to be part of the ETF market safeguarding the future?

There are two approaches to get into the green technology ETF market, either through investing or trading. Investing involves owning part of the ETF with dividends as the returns, while trading involves speculation on the price change of the ETF through CFDs-contracts for differences.

Both trading and investing are through either traditional broker-dealer firms or online brokers. The latter provides investment portfolio access and control at your convenience 24/7 and all the green technology stocks under one platform.

Whether trading or investing, it is a simple three-step process.

| Step 1 | Step 2 | Step 3 |

| Shop for a broker providing green technology ETFs and open a trading account with them-use broker platform or screener. | Analyze the green technology ETF and establish its liquidity, risk exposure, and returns. | Buy the green technology ETF of choice. |

Top 3 green technology ETFs worth buying in Q2 2021

Green technology ETFs invest in companies involved in reducing, eliminating, and reversing anything leading to global warming, hence adverse climate change. To be a part of this fight, the following three green technology ETFs are worthy investments.

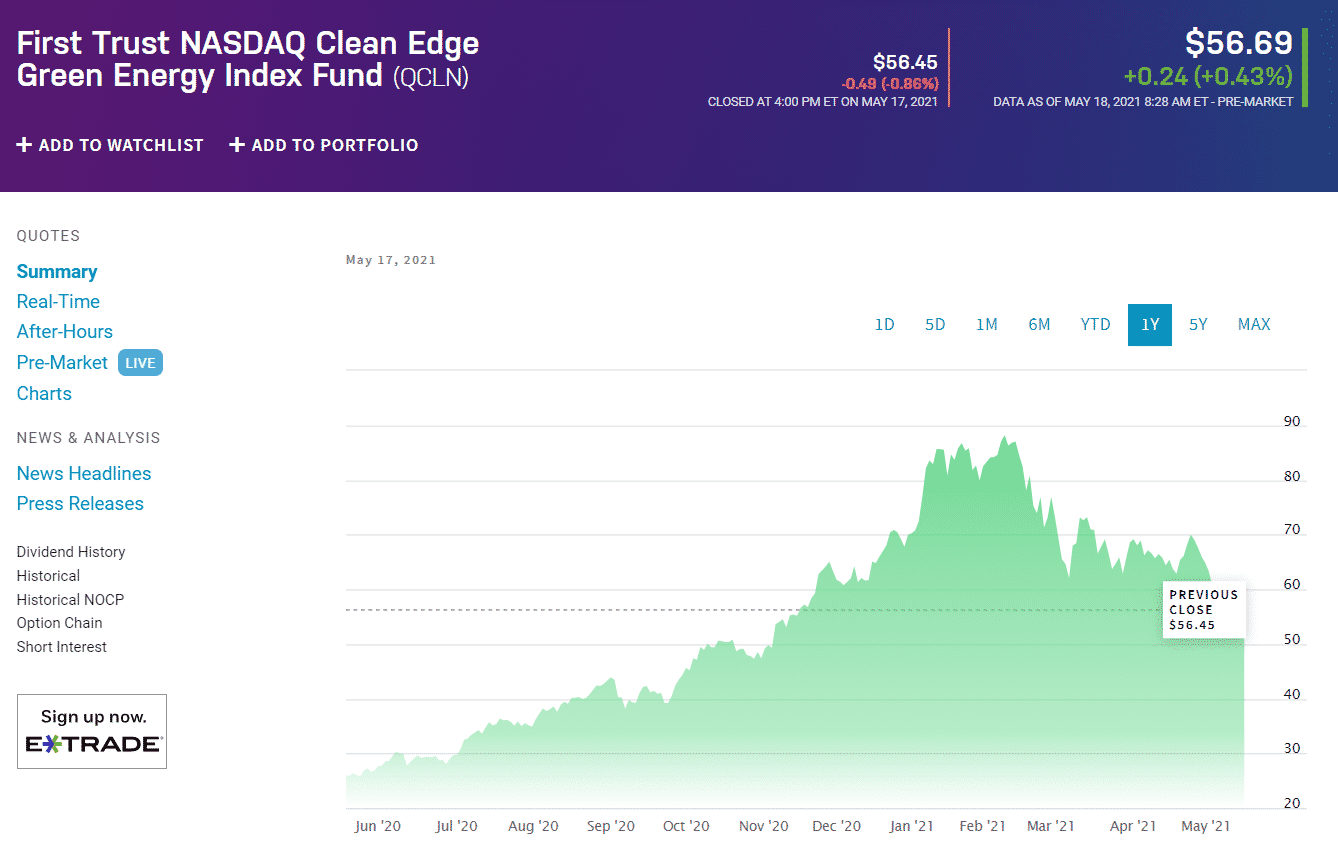

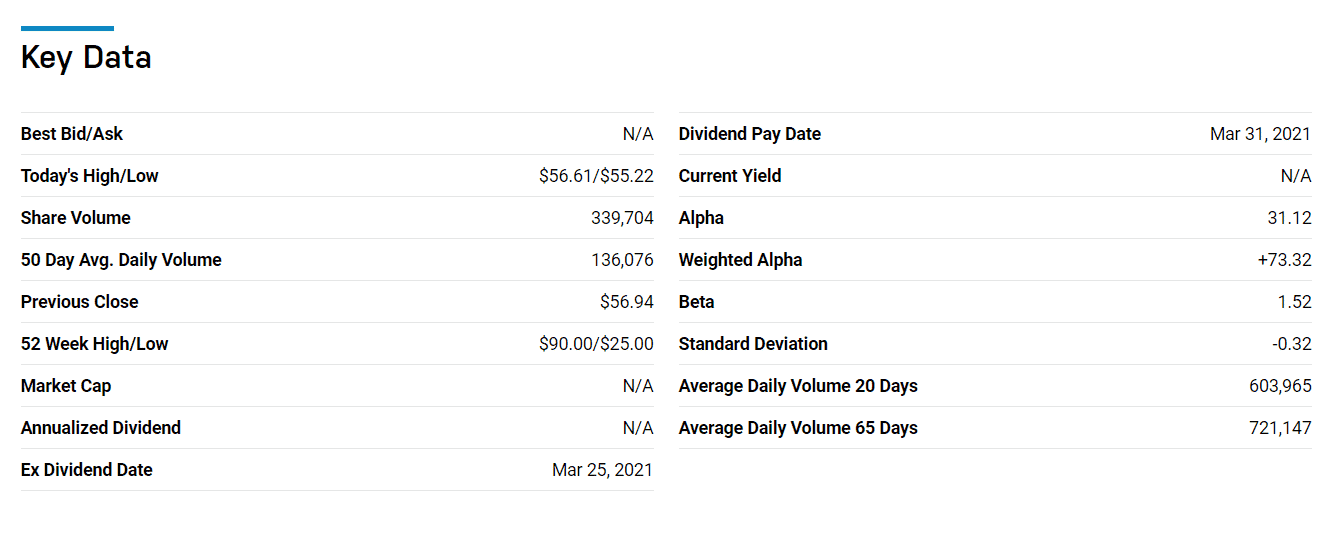

№ 1. First Trust Nasdaq Clean Edge Green Energy Index Fund (QCLN)

Price: $56.69

ESG rating: 6.06/10

With over 50 holdings cutting across different industry sectors, the QCLN is a diversified green technology ETF providing exposure to green energy as long as it’s green. It tracks the Nasdaq Clean Edge Green Energy Index.

Boosting companies such as Tesla — 8.88%, NIO Inc. — 7.43%, Albemarle Corp. — 7.33%, as its top three holdings, comes as no surprise 280% bullish run in the last year.

Biden is in office, and the Democrats’ position on clean energy and technology has a bearish outlook-favorable policy. As such, despite the negative year-to-date returns so far, this fund is in a ripe situation for a market retracement. In addition, it comes at an expense ratio of 0.6%, with net assets under management of $2.23 billion, resulting in a $0.07 per share dividend.

ESG rating

The fund has an ESG rating of 6.06/10, which is above average in environmental impact.

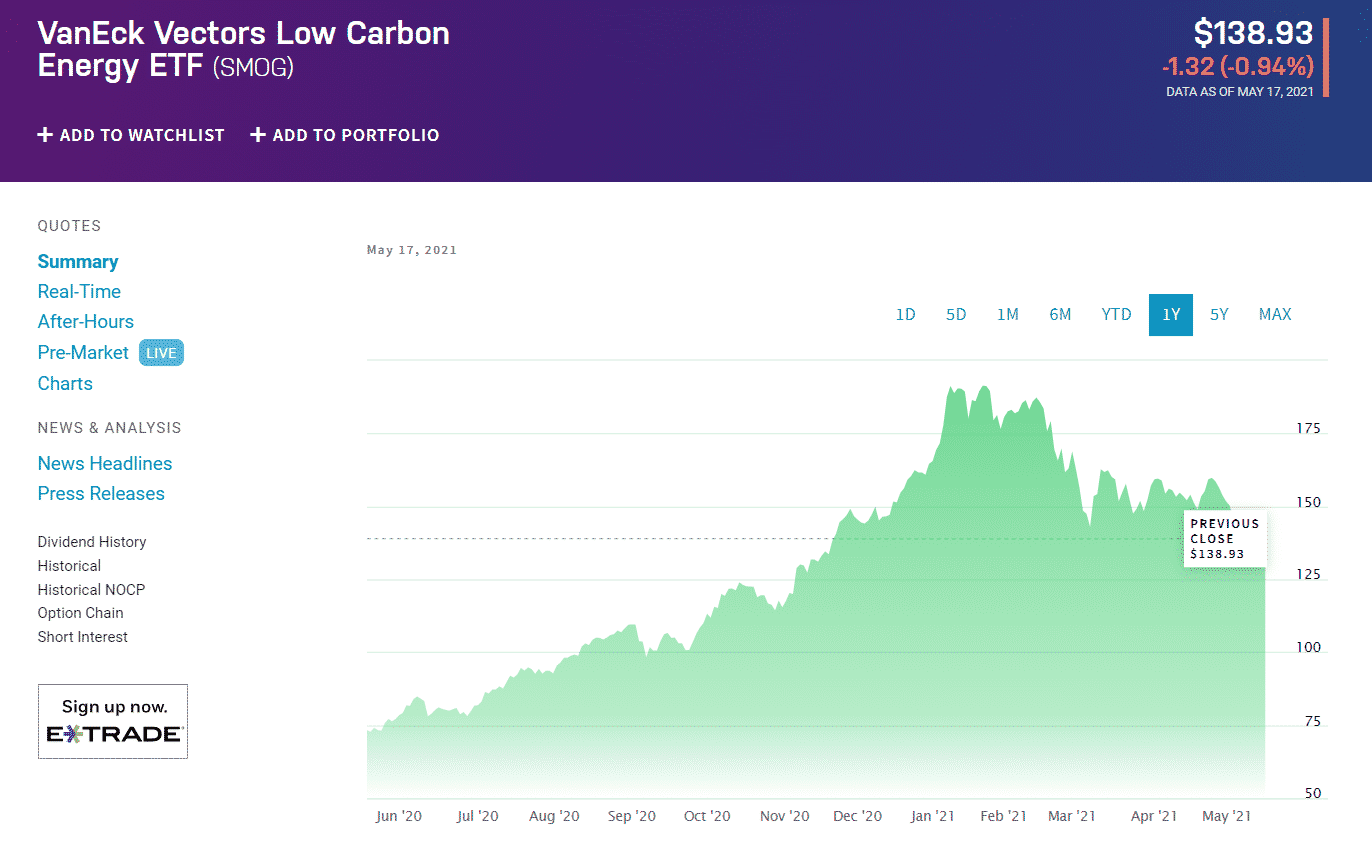

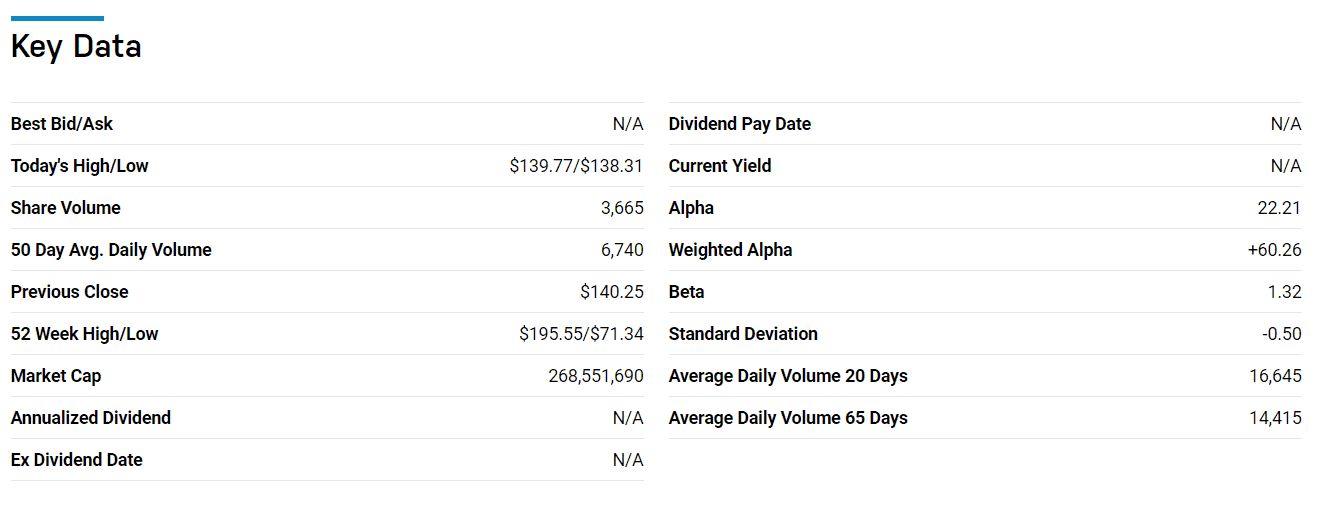

№ 2. VanEck Vectors Low Carbon Energy ETF (SMOG)

Price: $138.93

ESG rating: 6.47/10

This is a non-diversified fund that invests 80% or more in stocks of low carbon energy organizations. It tracks the performance of the MVIS Global Low Carbon Energy Index.

Its arsenal has companies such as NextEra Company Inc. — 8.46%, Tesla — 7.6%, NIO Inc. — 5.22%, as its top three holdings, it comes as no surprise 103% bullish run in the last year.

As more people adopt green energy use and shun high carbon emitters, this green technology ETF has running room for growth. It comes at an expense ratio of 0.62% with net assets under management of $270.99 million, resulting in a $0.09 per share dividend.

ESG rating

The fund has an ESG rating of 6.47/10, which is above average in environmental impact.

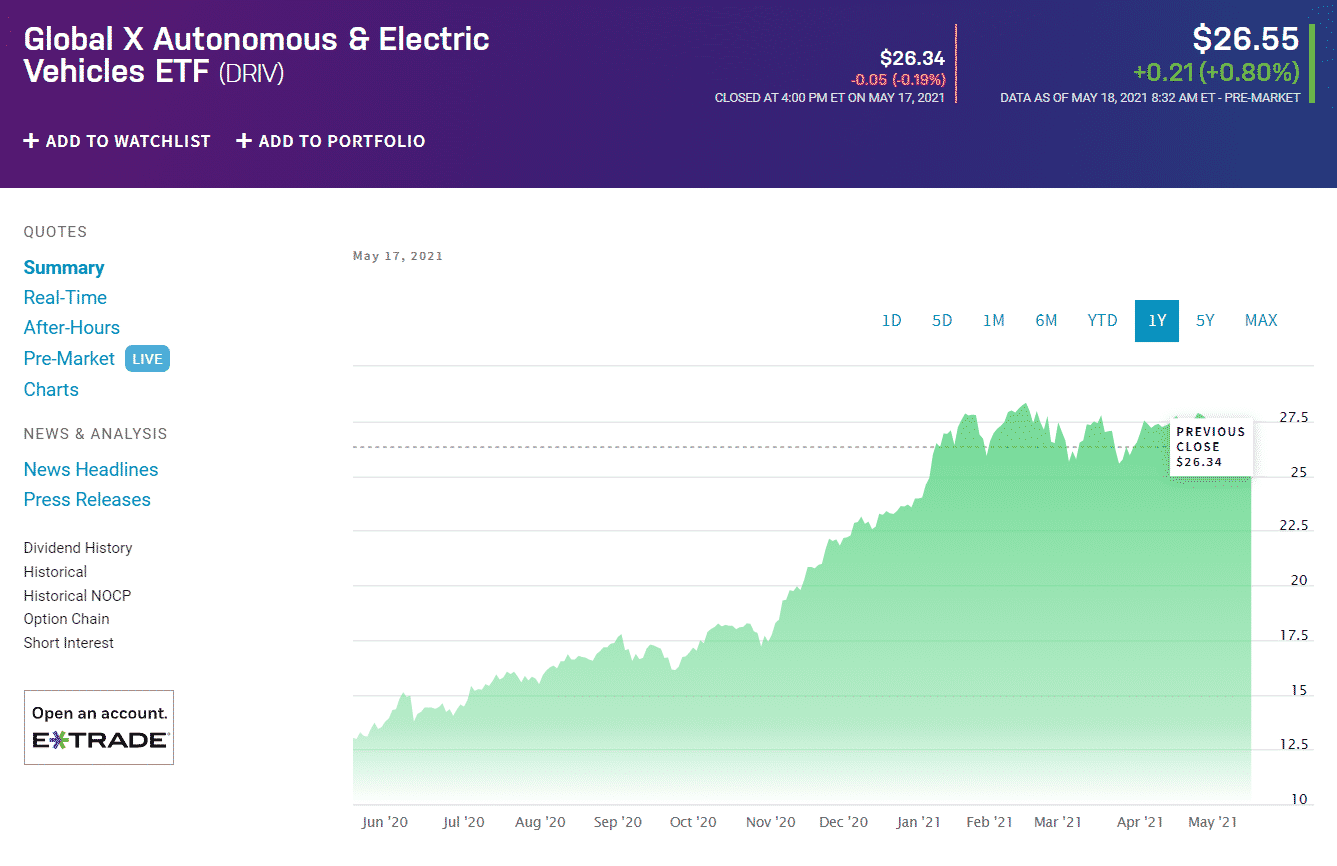

№ 3. Global X Autonomous & Electric Vehicles ETF (DRIV)

Price: $26.55

ESG rating: 5.64/10

This is a non-diversified fund skewed more towards electric cars and green tech-based batteries. The world is moving towards electric vehicles, with global adoption accelerating in the last 2-3 years. The fund seeks to replicate performance similar to the Solactive Autonomous & Electric Vehicles Index.

Its arsenal has companies such as Alphabet Inc., Ordinary Class A Shares — 3.94%, Microsoft Corporation — 3.48%, NVIDIA Corp. — 3.18%, as its top three holdings. The fund also has a sprinkle of NIO, Tesla, and Plug Power-leaders in EV vehicles for good measure.

As more people adopt EV vehicles and related technologies, this green technology ETF has running room for growth-year to date returns of 10.2% on the back of a 113.33% bullish run over the last 12 months. In addition, it comes at an expense ratio of 0.68%, with net assets under management of $861.58 million, resulting in a $0.02 per share dividend.

ESG rating

It has an ESG rating of 5.64/10-which is above average in terms of environmental impact.

Comments