Mention metals market and the most common names out of lips will be gold, copper, silver, aluminum, and platinum. However, within the metals commodity market corner, there is a niche that is globally accepted as a store of value and has been the go-to investment in times of economic turmoil, rising inflation, and rising interest rates, the precious metals market.

It is a $192.9 billion industry with an expected CAGR growth of 9% annually by 2027. A worthy investment, to say the least, right?

There is a catch. Like all commodity ETFs, precious metals equities are highly volatile due to geopolitical risk since most of them are explored in significant amounts in specific regions and countries. Couple this with the storage challenges faced when investing in precious metal bullions, and investors need an alternative hassle-free investment avenue. Precious metals ETFs are the answer.

What is the composition of precious metal ETFs?

Precious metal ETFs are in two categories:

- Those that track the spot price of specific precious metal.

- Those comprising equities involved in the exploration, mining, refining, processing, and utilizing of precious metals.

Nevertheless, due to the interdependence in the metal market, this list includes ETFs with exposure to base metals, albeit with a higher weighting assigned to the precious metals niche.

Top 3 precious metals ETFs to invest in base and industrial metals

Precious metals’ rarity, industrial use, and investment properties make them excellent stores of value and hedge investment assets. The economic conditions in 2022 are a perfect stage to tap into the rich vein of returns in the precious metals market, rising inflation, rising interest rates, and an uncertain post-pandemic economic environment. The three precious metal ETFs below are in pole position to thrive in the current environment.

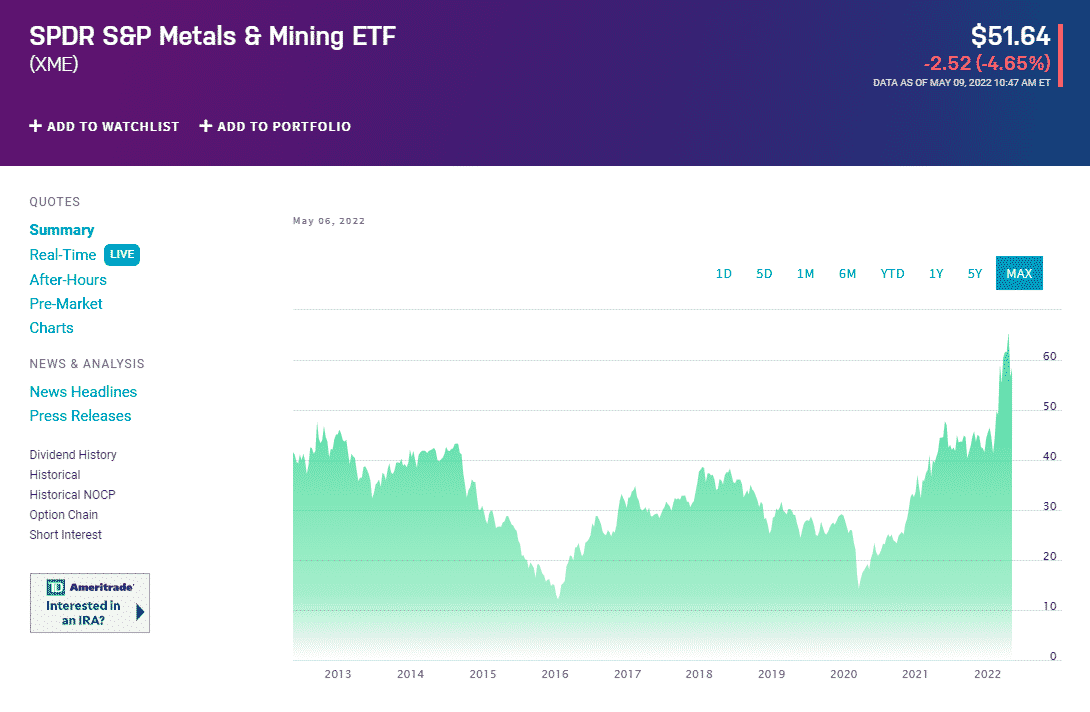

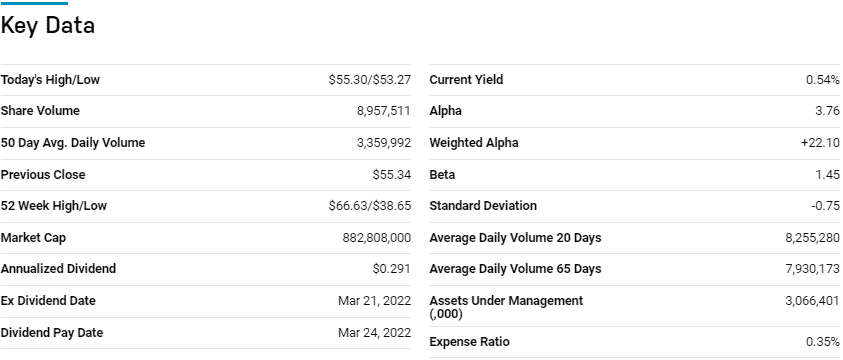

№ 1. SPDR S&P Metals and Mining ETF (XME)

Price: $51.64

Expense ratio: 0.35%

Dividend yield: 0.66%

XME chart

The SPDR S&P Metals and Mining ETF tracks the performance of the S&P Metals & Mining Select Industry Index, investing 80% of its total assets in the underlying holdings of the tracked index via a sampling strategy. It exposes investors to the entire US metals and mining segments.

Among 40 natural resource ETFs, the XME is ranked № 6 by USNews.

The top three holdings of this non-diversified ETF are:

- Arch Resources, Inc. Class A — 5.38%

- Steel Dynamics, Inc. — 5.30%

- Reliance Steel & Aluminum Co. — 4.93%

The XME ETF boasts $3.03 billion in assets under management, with an expense ratio of 0.35%. The equal weighting of this fund ensures investment mitigation against concentration risk and the inherent volatility in the precious metal market. A concentration on mining equities also ensures a hedge against the precious metal spot price volatility.

The result of all these factors is a resilient fund capable of withstanding market downturn while providing consistent returns; 5-year returns of 103.36%, 3-year returns of 93.75%, and 1-year returns of 24.42%.

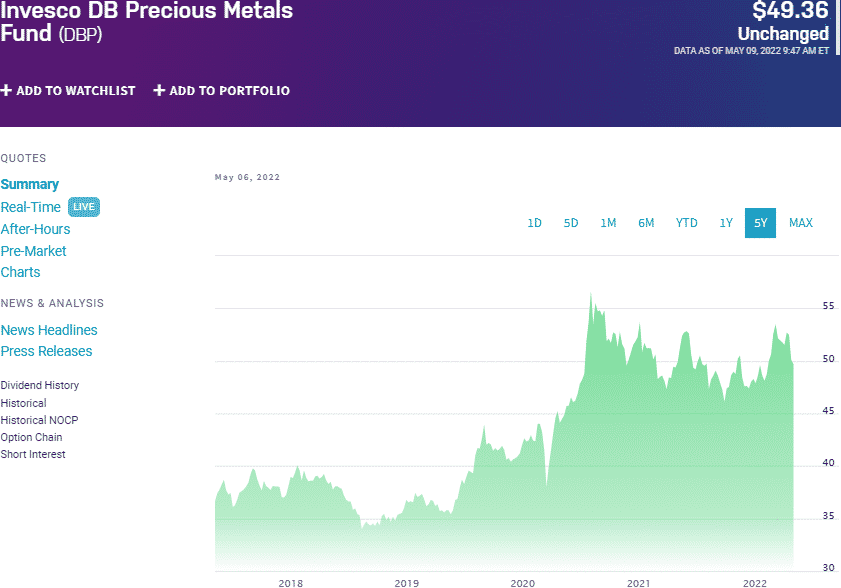

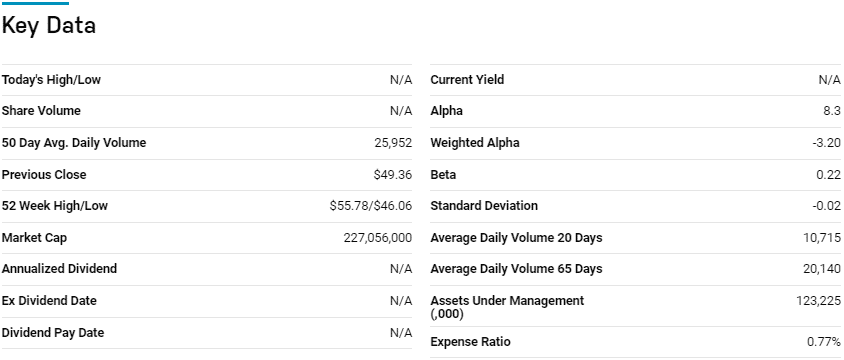

№ 2. Invesco DB Precious Metals Fund (DBP)

Price: $49.36

Expense ratio: 0.77%

Dividend yield: N/A

DBP chart

The Invesco DB Precious Metals Fund tracks the performance of the DBIQ Optimum Yield Precious Metals Index, investing in a futures contract to ensure it reflects the returns of its composite index as closely as possible. It exposes investors to the precious metal niche of the metals market, specifically silver and gold.

The top three holdings of this non-diversified ETF are:

- MUTUAL FUND (OTHER) — 70.32%

- The United States Treasury Bills 0.0% 12-MAY-2022 — 12.20%

- Invesco Treasury Collateral ETF — 9.30%

The DBP ETF has $122.8 million in assets under management, with investors parting with $77 for every investment worth $10000 annually. This fund provides an opportunity to invest in the two most traded metals that act as a store of value and inflation hedge under a single investment vehicle.

As inflation continues to rise, this fund provides a hedge option with a track record of consistent returns; 5-year returns of 37.66%, 3-year returns of 39.755%, and 1-year returns of -2.87%.

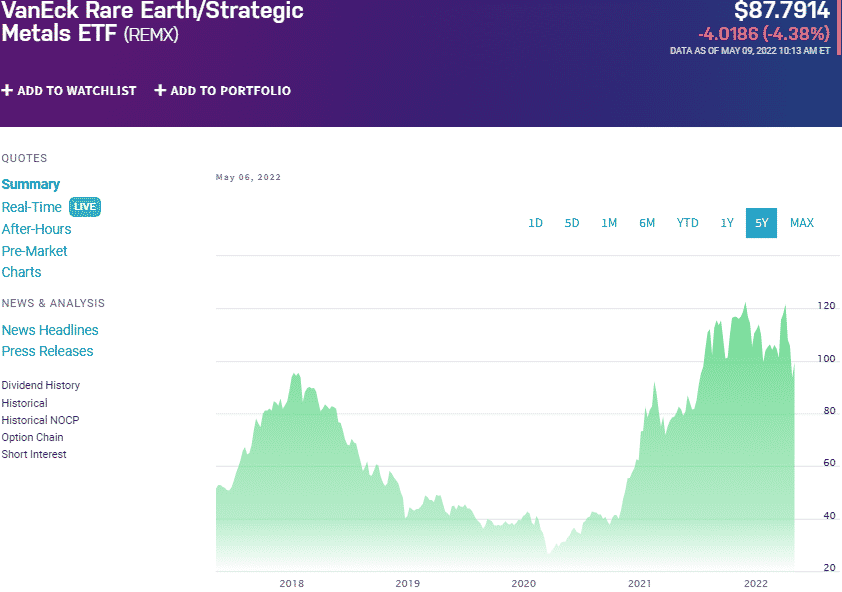

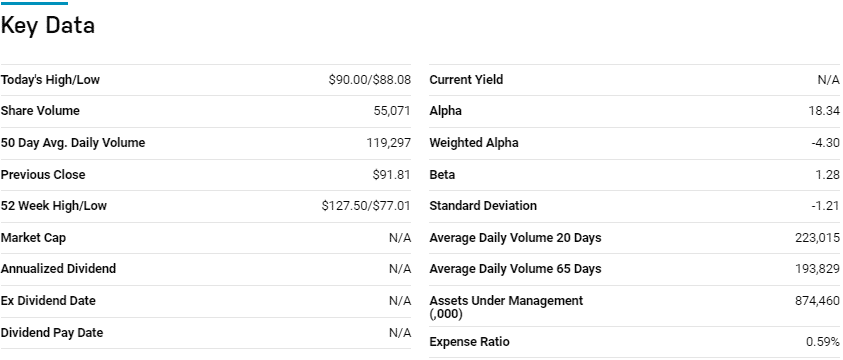

№ 3. VanEck Rare Earth/Strategic Metals ETF (REMX)

Price: $87.79

Expense ratio: 0.59%

Dividend yield: 0.45%

REMX chart

Traditionally, the word precious metal was synonymous with gold and silver. However, the globe is at a tipping point with the drive towards environmental and climate reclamation, presenting a whole set of new rare metals that will be at the forefront of this drive, making them highly precious.

The VanEck Rare Earth/Strategic Metals ETF exposes investors to this new crop of precious rare earth metals by tracking the MVIS Global Rare Earth/Strategic Metals Index. It invests at least 80% of its total assets in the underlying holdings of its composite index, exposing investors to a corner of the metals and mining industry dealing in global rare earth metals and minerals and strategic metals and minerals.

Among 13 equity precious metal ETFs, the REMX ETF is ranked № 7 by USNews.

The top three holdings of this non-diversified rare metals fund are:

- Allkem Limited — 7.58%

- Zhejiang Huayou Cobalt Co. Ltd. Class A — 7.14%

- Lynas Rare Earths Limited — 6.59%

The REMX ETF has $901.0 million in assets under management, with investors parting with $59 annually for a $10000 investment. Exposure to the entire rare earth and minerals value chain, from exploration to utilization, ensures that as the global community moves towards zero-greenhouse gas emissions, investors in this ETF reap the full benefits of the next crop of precious industrial metals.

Despite historical returns not being a guarantee of future returns, the historical performance of these metal ETFs calls for its consideration if investing in base and industrial metals; 5-year returns of 123.15%, 3-year returns of 127.12%, and 1-year returns of 17.26%.

Final thoughts

The world is changing tremendously, resulting in the reclassification and redefinition of every facet of our lives. The same holds for the metals market. Many industries move from traditional industrial metals to the newer green metals to conform to regulation and consumer and investor demands for ESG sustainable metals.

The three ETFs above are in pole position to benefit from the changing metal dynamic by breeding conventional precious metals exposure with the newer strategic metals while also hedging against the current inflation-rising environment.

Comments