Which precious metal is rarer than gold? Platinum by a factor of 30. How is this possible? Platinum is found more profound in the earth’s core than gold, and only South Africa and Russia mine it in significant quantities for export.

On the backdrop of this, the increased appetite for zero carbon emission and the Ukraine war means that the supply of these rare earth metals is constrained compared to its demand setting the stage for the significant price increase and a chance to post enviable returns.

The following three ETFs with platinum exposure give investors exposure to this precious metal expected to grow at an annual CAGR of 5% between 2022 and 2025.

Platinum ETF for new opportunities: how do they work?

Platinum ETFs either comprise financial instruments that help track the spot price of platinum or organizations plying their trade along the platinum value chain; platinum exploration, mining, refining, and conversion, firms utilizing platinum as their primary input, and all organizations deriving significant revenues providing ancillary services to this industry.

The best platinum ETFs to invest in as haven assets

As nuanced investors refer to platinum too, the white metal is expected to be bullish soon, driven by the increased demand from the automobile industry, catalytic converters, and consumer electronics — coupled with limited supply due to the Russian trade sanctions. You have a precious metal that can act as a store of value in this inflation-rising environment, hence a hedge asset and one with significant upside potential. The following three ETFs are in pole position to benefit.

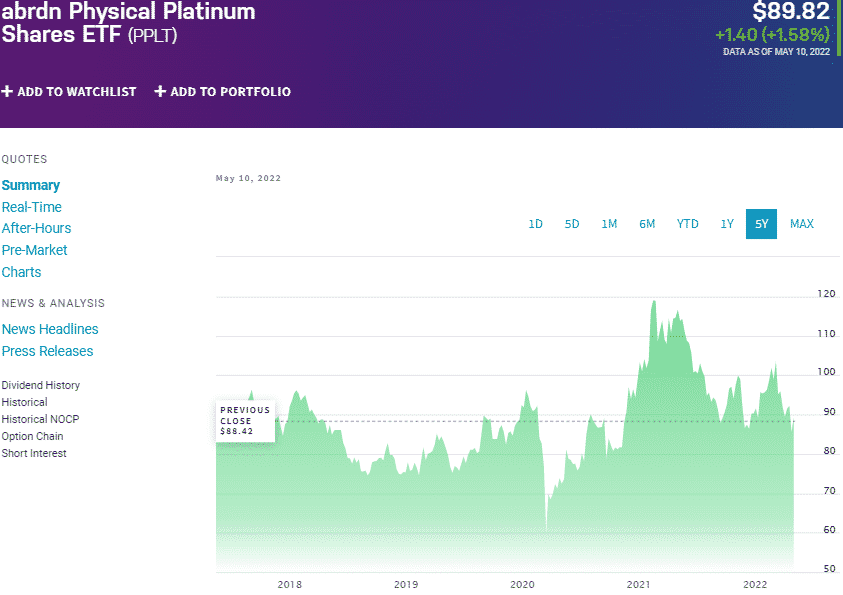

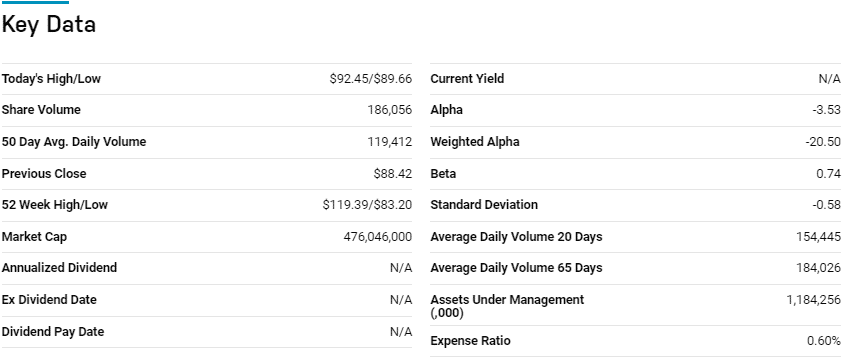

№ 1. Aberdeen Standard Physical Platinum Shares Fund (PPLT)

Price: $89.92

Expense ratio: 0.60%

Dividend yield: N/A

PPLT chart

No ETF tracks the spot price of platinum as closely as the Aberdeen Standard Physical Platinum Shares ETF. It is a passively managed fund that holds physical palladium bullion in vaults, exposing investors to the spot price of palladium without the need for physically acquiring them and the hassle of their storage.

The PPLT ETF currently has $1.15 billion in assets under management, with an expense ratio of 0.60%. The rarity of palladium and supply shortage due to the ongoing Ukraine-Russia war is enough to invest in this precious metal.

However, coupled with the rising automotive demand and growing appetite for zero emissions, these metals are a critical ingredient in ensuring minimal emissions in the automotive industry. It is time to take a platinum look.

Despite negative returns in the last 12 months, a bullish outlook on palladium calls for having it, especially as a haven asset against inflation due to its multiple industrial utilization and scarcity; 5-year returns of 0.37%, 3-year returns 8.56%, and 1-year returns of -24.83.

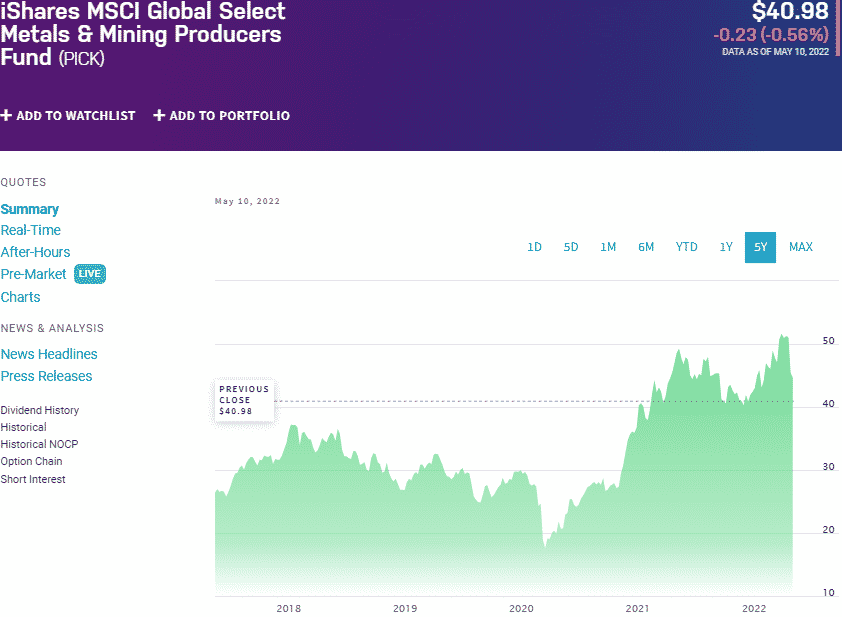

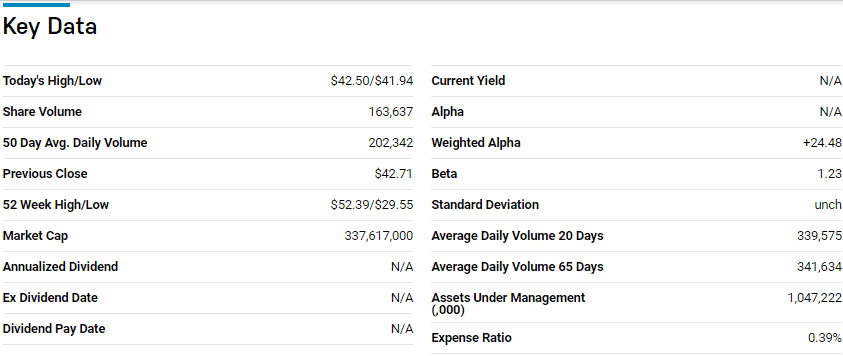

№ 2. iShares MSCI Global Metals and Mining Producers ETF (PICK)

Price: $40.98

Expense ratio: 0.39%

Dividend yield: 2.74%

PICK chart

If you want diversified exposure to all kinds of metals, you must consider the iShares MSCI Global Metals & Mining Producers Fund. The metals ETF offers a diversified play on platinum through the global mining and exploration industry, ex-gold and silver. It tracks the performance of the MSCI ACWI Select Metals & Mining Producers ex Gold and Silver Investable Market Index, investing at least 80% of its total assets in the holdings making up the tracked index.

Among 14 equity precious metal ETFs, PICK is ranked № 1 by USNews.

The top three holdings of this metals and mining ETF are:

- BHP Group Ltd — 14.70%

- Rio Tinto plc. — 6.60%

- Vale S.A. — 5.70%

PICK ETF has $1.66 billion in assets under management, with an expense ratio of 0.39%. Diversification across the broader metal and mining market as well as concentration on the most liquid and stable equities results in a resilient fund capable of not only returns but consistent income hence a hedge against inflation; 5-year returns of 94.67%, 3- year returns of 59.80%, 1-year returns of -13.46%, and a more than the average annual dividend yield of 2.74%.

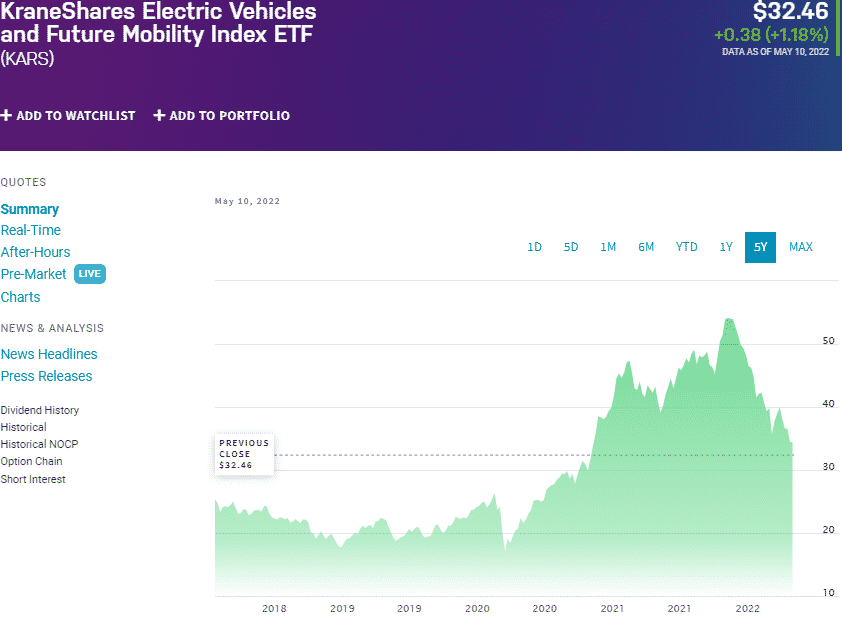

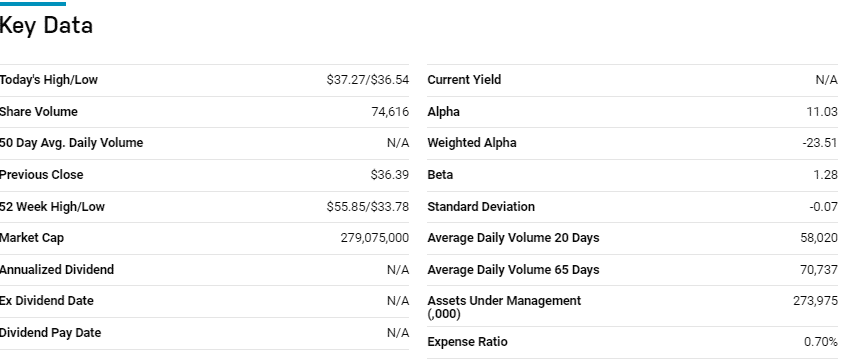

№ 3. KraneShares Electric Vehicles and Future Mobility ETF (KARS)

Price: $32.46

Expense ratio: 0.70%

Dividend yield: 0.11%

KARS chart

The transport sector is the most significant contributor to greenhouse gas emissions, leading the automotive industry. With the globe now focused on zero carbon emissions, new technologies have come up that utilize platinum as the main component in catalytic converters, significantly reducing automotive emissions before the globe moves entirely to electric vehicles.

The KraneShares Electric Vehicles and Future Mobility ETF track the total return and yield performance of the Bloomberg Electric Vehicles Index, net of fees and expenses. It exposes investors to next-generation automotive technologies, and indirect exposure to platinum correlates to the automotive industry.

It invests at least 80% of its total assets in the tracked index underholding’s’, including their associated ADRs GDRs. It also invests in other investment assets believed to exhibit similar economic characteristics to the tracked index.

The top three holdings of this ETF are:

- Tesla Inc — 5.55%

- Analog Devices, Inc. — 5.54%

- NXP Semiconductors NV — 5.25%

The KARS ETF has $243.4 million in assets under management, with an expense ratio of 0.70%. This ETF is an indirect play on platinum by backing equities of organizations utilizing platinum and next-generation technology to reduce the carbon footprint of the automotive industry. Diversification across the automotive value chain mitigates against volatility resulting in a resilient fund in a market downturn; 3-year returns of 66.34%, and 1-year returns of -17.07%.

As more countries commit to zero carbon emissions and more people adopt electric and autonomous vehicles, the KARS ETF provides an alternative indirect play on the increased demand for platinum and a chance at significant returns.

Final thoughts

Being a rare precious metal and highly susceptible to geopolitical risks, Russia as a primary platinum miner with the ongoing trade restrictions, means highly constricted supply. Despite these supply bottlenecks, car sales and production are on the rise.

With most emerging and developed markets jumping on carbon footprint minimization, platinum is geared for a prolonged bullish run. These three ETFs expose investors to the significant upside potential of this metal and a chance at precious returns that could be considered desirable.

Comments