The corner of the commodity market known as the metal market has for the longest of time been constrained just to a few names, gold, silver, copper, and platinum. However, other metals are rarer and used in various industries to make this market a rich profit vein.

These metals are known as Rare Earth metals. This corner of the commodities market is currently valued at $5.3 billion, with a projected CAGR of 13.3% by 2026. With their multiple uses and supply constrained to only a few countries, the most significant being China, their various applications show that demand will continue outpacing supply, feeding into the rarity and bullish run.

Unlike gold and silver, it is quite a hassle to get physical exposure to Rare Earth metals, unlike gold and silver. To be a part of this budding metal industry, exchange-traded funds offer a stress-free and inexpensive investment option.

What is the composition of Rare Earth Metal ETFs?

There are not many pure-play Rare Earth ETFs choices available to investors. Therefore, this article explores all ETFs with significant exposure to equities involved in exploring, mining, production, refinement, and recycling Rare Earth metals and elements.

The best three materials sector ETFs to buy in 2022

The ever-present trade tensions between China, a leading Rare Earth metal supplier, and the United States, the globally leading market for these metals, have sparked a race to produce economically strategic earth elements.

Couple this to an insatiable demand for these metals driven by their multiple utilization, especially in decarbonization efforts, and what you have is a market on the brink of a significant bullish rally. The three ETFs below are in a prime position to benefit from the explosion in this industry and provide a rich vein of returns in 2022.

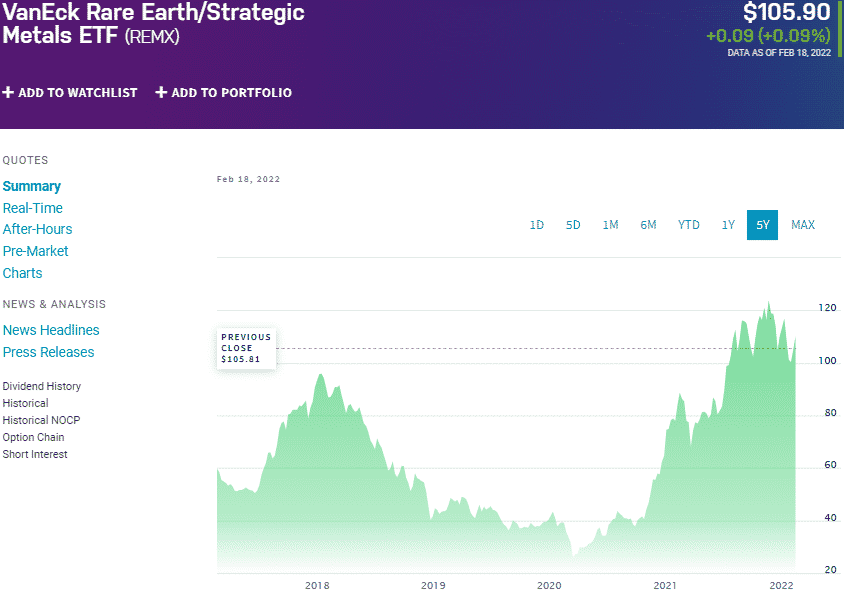

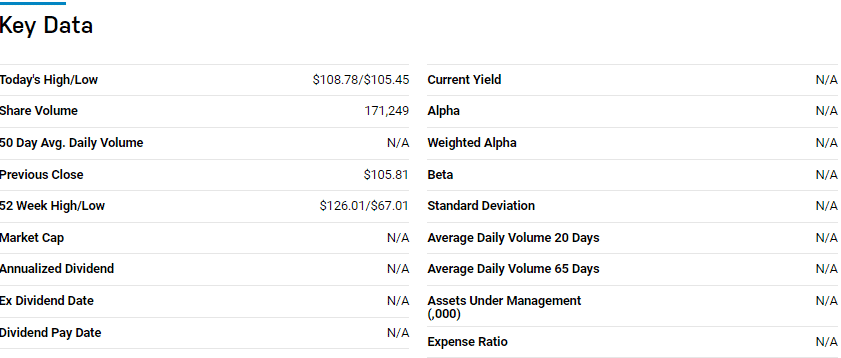

№ 1. VanEck Rare Earth/Strategic Metals ETF (REMX)

Price: $105.90

Expense ratio: 0.59%

Dividend yield: 0.45%

REMX chart

At present, investors only have one pure-play Rare Earth metal fund as an investment choice, the VanEck Rare Earth/Strategic Metals ETF. This metal fund tracks the MVIS Global Rare Earth/Strategic Metals Index, investing at least 80% of its total assets in the underlying holdings of its composite index. It exposes investors to a corner of the metals and mining industry dealing in global Rare Earth metals and minerals and strategic metals and minerals.

The REMX fund is ranked № 6 for long-term investing by USNews in a list of 13 equity precious metal funds.

The top three holdings of this fund are:

- Pilbara Minerals Limited — 7.61%

- China Northern Rare Earth (Group) High-Tech Co., Ltd. Class A — 7.42%

- Zhejiang Huayou Cobalt Co. Ltd. Class A — 7.21%

The REMX ETF has $980.5 million in assets under management, with investors parting with $59 annually for a $10000 investment. The global accelerated appetite for a green globe with everyone pushing for zero greenhouse gas emissions fuels the increased demand for Rare Earth metals and minerals. Couple to this limited supply and their other applications, and what you have is a corner of the commodity market with the potential for significant real returns if played right; 5-year returns of 120.78%, 3-year returns of 156.52%, and 1-year returns of 25.94%.

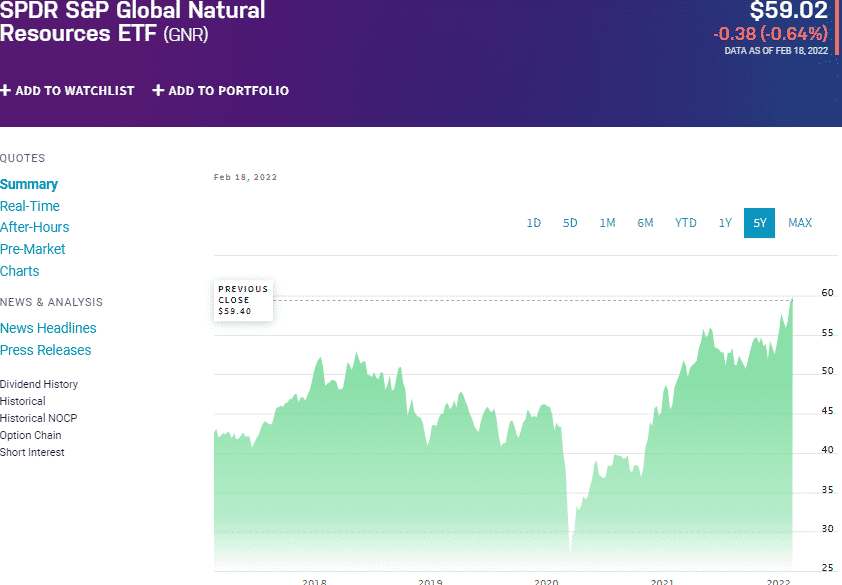

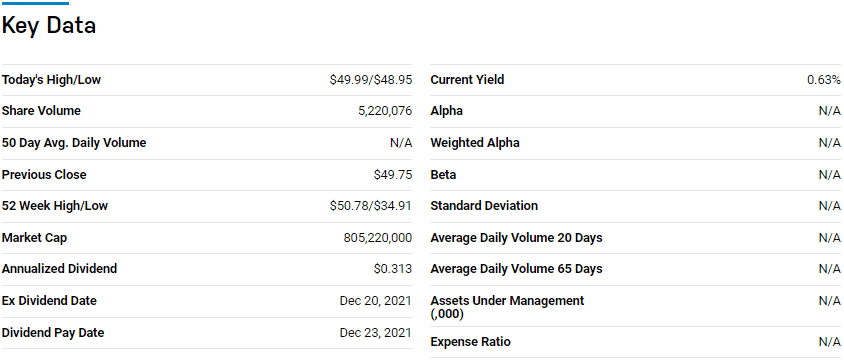

№ 2. SPDR S&P Global Natural Resources ETF (GNR)

Price: $59.02

Expense ratio: 0.40%

Dividend yield: 2.66%

GNR chart

The SPDR S&P Global Natural Resources ETF tracks the performance of the S&P Global Natural Resources Index, investing 80% of its total assets in the underlying holdings of the tracked index in combination with their ADRs. This diversified fund offers investors broad exposure to the global commodities market; precious metals, grains, livestock, industrial metals, energy, coal, water, and timber.

Among 38 natural resource ETFs, the GNR is ranked № 3 by USNews.

The top three holdings of this fund are:

- Exxon Mobil Corporation — 4.48%%

- BHP Group Ltd — 4.37%

- TotalEnergies SE — 3.78%

GNR ETF boasts $2.73 billion in assets under management, with an expense ratio of 0.40%. GNR provides a diversified and broad global exposure to Rare Earth metals for growth, value, and inflation hedge. The broad diversification across the commodity market ensures low volatility and resilience to weather chaotic investment markets while consistently providing returns; 5-year returns of 60.21%, 3- year returns of 43.84%, and pandemic year returns of 24.42%.

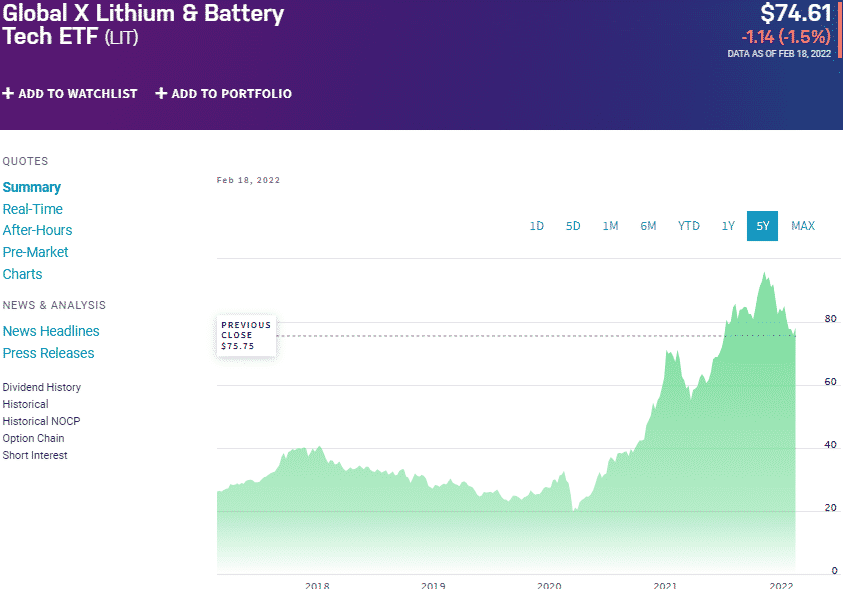

№ 3. Global X Lithium and Battery Technology ETF (LIT)

Price: $74.61

Expense ratio: 0.75%

Dividend yield: 0.13

LIT chart

There might be a limited choice in Rare Earth ETFs, but plenty of solid exchange-traded funds offer indirect exposure to this corner of the metals market. One such choice is the Global X Lithium and Battery Technology ETF. This fund tracks the Solactive Global Lithium Index, investing at least 80% of its total assets in the holdings of its composite index, as well as its ADRs and GDRs.

Among 38 natural resource ETFs, the LIT is ranked № 21 by USNews.

The top three holdings of this non-diversified ETF are:

- Albemarle Corporation — 10.02%

- TDK Corporation — 6.54%

- Tesla Inc — 5.46%

The LIT ETF has $4.88 billion in assets under management, with investors having to part with $75 for every investment worth $10000 annually. Rare Earth metals are heavily used in Lithium battery production and magnetic motors for electric vehicles. These are activities at the forefront of decarbonization efforts.

Given the global appetite for electronics using this technology, this ETF provides a perfect indirect play on Rare Earth metals and minerals. With their increased use in technological advancements, especially in the consumer electronics, telecommunications, and automotive industries, this ETF is a potentially powerful returns minting tool; 5-year returns of 207.22%, 3-year returns of 167.65%, and 1-year returns of 9.55%.

Final thoughts

Rare Earth metals and minerals occur naturally and in abundance, but at present, only very few countries are producing them at scale, making their supply extremely rare. With the global focus on green technology and the push for zero emissions, this corner of the commodities market has been thrown in the limelight, and the ETFs above stand to gain the most and make real returns for those bold enough to invest.

Comments