In times of economic turmoil, like the present situation, the industrial sector experiences the brunt of things since it reflects the prevailing economic conditions the most. Constant lockdowns and cessation of movement during the pandemic had the most significant impact on the industrial sector resulting in disruption of manufacturing and low production capacities, especially for the labor-intensive firms.

What is the composition of industrial ETFs?

The industrial sector mirrors the overall economy because it cuts across so many economic niches. Therefore, we define the industrial ETFs here to include those that supply and produce equipment used in construction and manufacturing and all organizations offering ancillary services to these organizations.

Industrial ETFs thus comprise organizations in machinery aerospace, logistics, defense, and professional consultancy services firms.

The best industrial ETFs to buy in 2021/2022

Due to its far-reaching tentacles, different market niches making up the industrial sector perform independently of the overall industrial market. However, by mirroring the economic conditions, resurgence post coronavirus pandemic means a bullish run for the industrials; current year-to-date performance already has the industrial sector via the XLI outperforming the SPY, which is representative of the economic health of the US.

№ 1. Invesco DWA Industrials Momentum Fund (PRN)

Price: $115.52

Expense ratio: 0.60%

Dividend yield: 0.07%

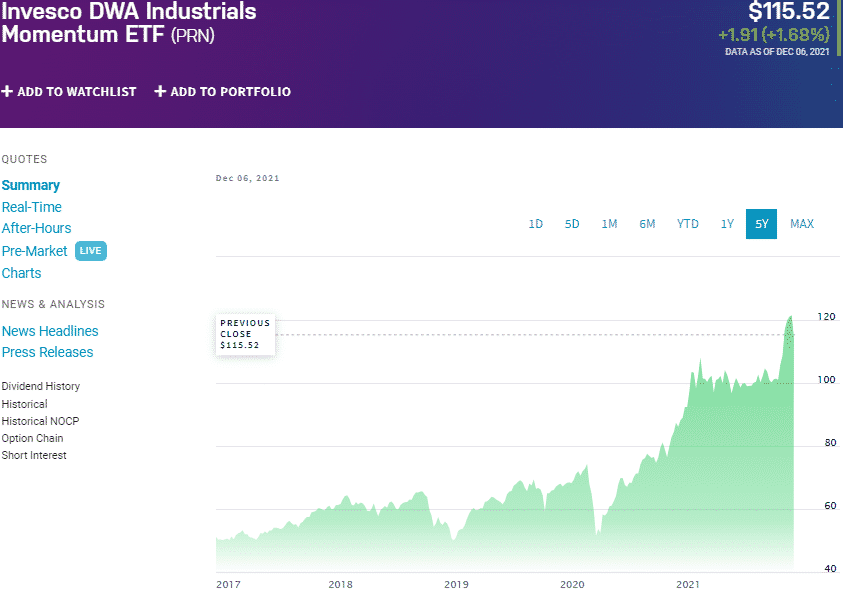

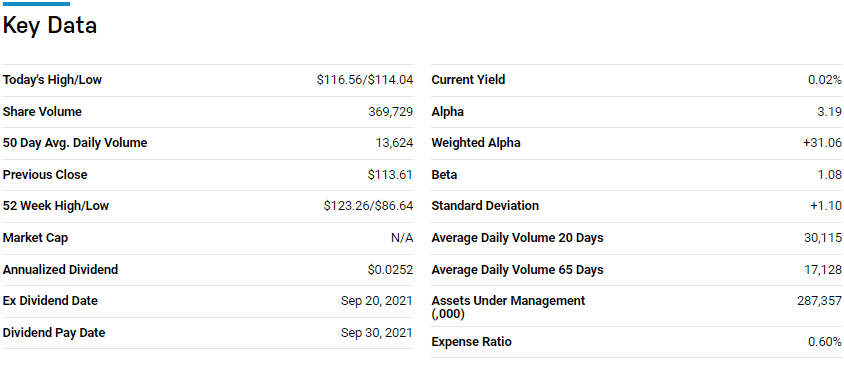

PRN chart

The Invesco DWA Industrials Momentum ETF tracks the performance of the Dorsey Wright Industrials Technical Leaders Index, which uses a proprietary indexing methodology that utilizes quant-based filters to select its holdings hence ensuring alpha generation.

As a result, despite the PRN being an index fund, it has only 30 holdings in its portfolio; the composite index comprises the best 30 industrial holdings with the most potent relative strength. USNews evaluated the best 30 industrial ETFs for long-term investing, and the PRN is ranked No.14.

The top three holdings of this ETF are:

- Avis Budget Group, Inc. – 7.12

- Old Dominion Freight Line, Inc. – 3.83%

- Pool Corporation – 3.53%

PRN has $287.2 million in assets under management, with an expense ratio of 0.60%. Past performance is not a guarantee of future returns, but no industrial ETF has ramped up returns like the PRN; 5-year returns of 136.24%, 3-year returns of 111.02%, and pandemic year returns of 32.91%.

This ETF has higher volatility than other funds on this list due to its limited holding base, but it is worth looking into as a short-term play on the industrial niche.

№ 2. Industrial Select Sector SPDR Fund (XLI)

Price: $105.19

Expense ratio: 0.12%

Dividend yield: 1.23%

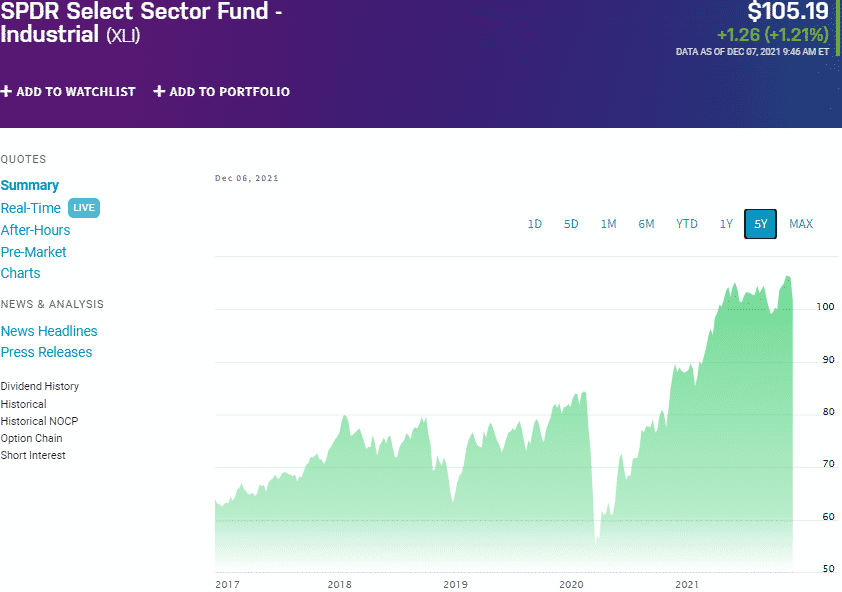

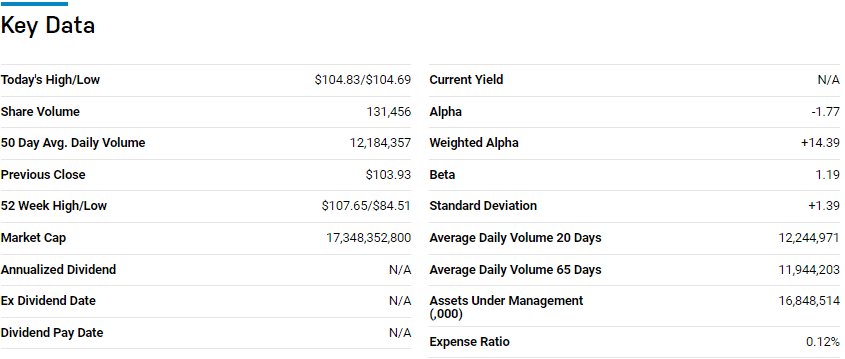

XLI chart

Industrial Select Sector SPDR ETF tracks the performance of the Industrial Select Sector Index, investing at least 95% of its net assets in the securities of its composite index. XLI investors gain exposure to companies in the following sector; machinery, commercial services, logistic services, aerospace and defense, supplies and industrial conglomerates, air freight and transportation infrastructure, and road and rail.

XLI ETF is ranked No 4 among the best 30 industrials ETFs by USNews, for long-term investing.

The top three holdings of this ETF are:

- Union Pacific Corporation – 5.10%

- United Parcel Service, Inc. Class B – 4.74%

- Honeywell International Inc. – 4.59%

XLI boasts an impressive asset under management portfolio, $16.85 billion, with investors coughing up just $12 annually for a $10000 investment. XLI returns might not be as phenomenal as those of more targeted firms, but it is a representative of how the sector and the economy at large; 5-year returns of 81.97%, 3-year returns of 56.45%, pandemic year returns of 18.09%, and year to date returns of 18.48%.

In addition, investors get to enjoy annual dividend yields to the tune of 1.23%. Concentrating on the industrial firms in the S&P 500 might result in some concentration bias. Still, the large-cap nature of the holdings results in a fund with the ability to withstand market volatilities.

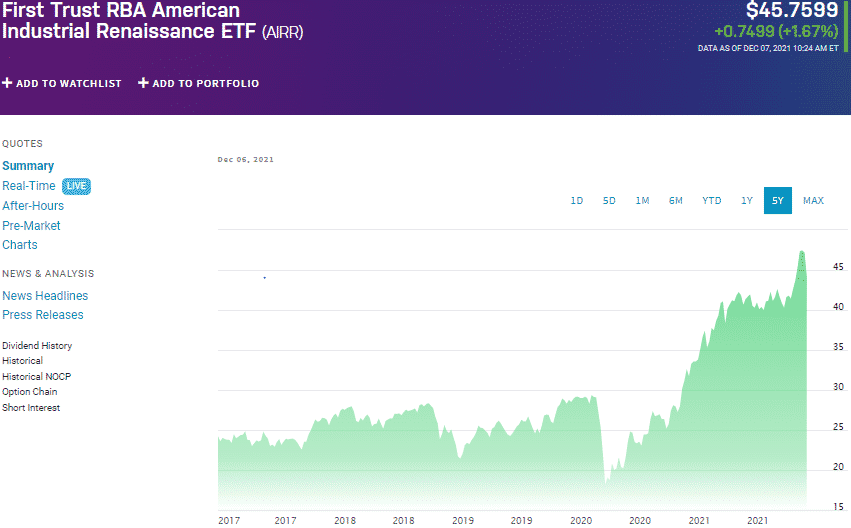

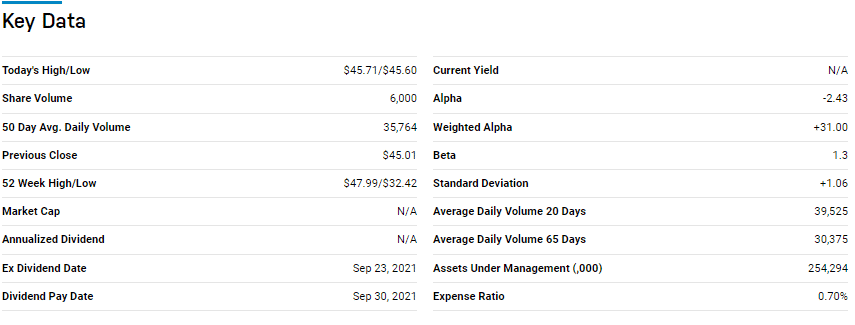

№ 3. First Trust RBA American Industrial Renaissance Fund (AIRR)

Price: $45.76

Expense ratio: 0.70%

Dividend yield: 0.05%

AIRR chart

The First Trust RBA American Industrial Renaissance ETF tracks the performance of Richard Bernstein Advisors American Industrial Renaissance Index, investing at least 90% of its net assets in the securities contained in the Russel 2500 index. It is an option that exposes investors to the industrial sector via small and medium-capitalization equities in the industrial and manufacturing niches.

AIRR ETF is ranked No 6 among the best 30 industrials ETFs by USNews, for long-term investing.

The top three holdings of this ETF are:

- Encore Wire Corporation – 3.81%

- Evoqua Water Technologies Corp. – 3.43%

- Comfort Systems USA, Inc. – 3.39%

AIRR ETF has $254.2 million in assets under management, with an expense ratio of 0.70%. This ETF provides an alternative to industrial sector investing by combining minor and medium cap companies with the best fundamentals compared to their peers to develop a diversified fund with growth and stability.

The historical performance also puts a strong case for pro-AIRR investing; 5-year returns of 95.58%, 3-year returns of 90.70%, pandemic year returns of 37.48%, and year-to-date returns of 32.63%.

If still unconvinced, this ETF includes financial services sector equities that qualify as manufacturing organizations, and these equities thrive in an interest-rising environment-2022 expected financials environment.

Final thoughts

The industrial sector is experiencing changes in terms of automation, post Covid-19 recovery, and green manufacturing. The result is a sector full-on investment opportunity for the savvy investor to make a quick buck. In addition, the Biden infrastructure bill had been passed, setting the stage for several of the industrial sub-sectors to benefit. In light of this, the ETFs above stand to gain the most and result in investor returns if played right.

Comments