ETF full name: VanEck Vectors Rare Earth/Strategic Metals ETF

Segment: metals

ETF provider: VanEck

| REMX key details | ||

| Issuer | VanEck | |

| Dividend | $0.54 | |

| Inception date | October 27, 2010 | |

| Expense ratio | 0.59% | |

| Management company | VanEck | |

| Average 3-5 EPS | N/A | |

| Average Annualized Return | 172.47% | |

| Investment objective | Replication | |

| Investment geography | Metals | |

| Benchmark | MVIS Global Rare Earth/Strategic Metals | |

| Leveraged | N/A | |

| Median market capitalization | $6.59 billion | |

| ESG rating | MSCI 4.8/10 | |

| Number of holdings | 22 | |

| Weighting methodology | Weighted Market capitalization |

About the REMX ETF

VanEck Vectors Rare Earth/Strategic Metals ETF REMX started in October 2010, and it tracks the MVIS Global Rare Earth/Strategic Metals index. Its market capitalization came in at above $6.5 billion, with an average yearly return of more than 172%.

REMX Fact-set analytics insight

The REMX consists of 22 holdings, more than half of which have headquarters in China or Australia. The United States-based firms account for around 17% of the fund’s units. The rest of the holdings spread across Canada, France, Netherlands, Japan, and Hong Kong.

As far as the industries go, almost all companies have ties with rare-earth-metals mining.

The REMX, like other ETFs based on the MVIS index, uses weighted market capitalization for its methodology.

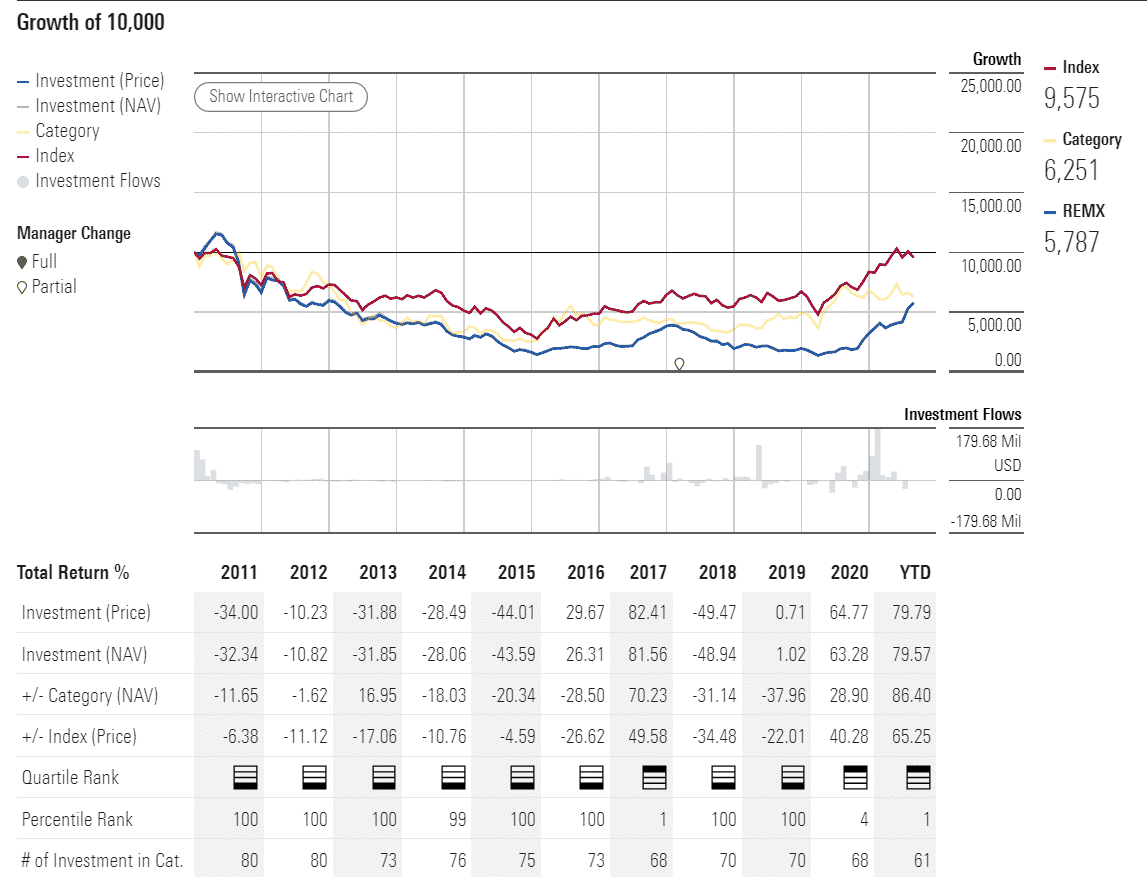

REMX performance analysis

Since most of the fund’s companies are somehow involved in mining cerium, manganese, titanium, and tungsten, there isn’t too much to draw from compared to your usual ETFs.

Of course, the fund was impacted by the Covid-19 pandemic, primarily due to strict lockdowns in Australia and China. Afterward, as the chart shows, the fund managed to recover quite nicely, and its three-digit annual return shows just how quick the bounce-back was.

The REMX ETF pays dividends quarterly. The dividend amounted to $0.54 on the share at an expense ratio of 0.59% for the last quarter.

On the MSCI ESG scale, REMX ETF has a 4.8/10 rating. The fund seems to be of average resilience in terms of environmental, governmental, and social changes.

REMX ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| REMX Rating | BBB | BBB | 1 | *** | 3.1/10 |

| REMX ESG Rating | 4.8/10 | BBB | 4th percentile | N/A | N/A |

REMX key holdings

There is no one key player among the fund’s holdings. The ETF is niche-oriented, and it offers investors a chance to invest in rare metals, such as the ones we mentioned before, like cerium, manganese, and tungsten.

The show’s stars are Chinese companies that deal in the mining and refining of titanium and molybdenum.

Here are the top 10 holdings making up the CGW ETF.

| Ticker | Holding name | % of assets |

| 600111 | China Northern Rare Earth (Group) High-Tech Co., Ltd. Class A | 12.35% |

| ORE | Orocobre Limited | 8.37% |

| 603899 | Zhejiang Huayou Cobalt Co. Ltd. Class A | 7.84% |

| 1772 | Ganfeng Lithium Co., Ltd. Class H | 7.41% |

| 600392 | Shenghe Resources Holding Co., Ltd. Class A | 7.05% |

| 600549 | Xiamen Tungsten Co. Ltd. Class A | 5.58% |

| LYC | Lynas Rare Earths Limited | 5.46% |

| PLS | Pilbara Minerals Limited | 5.10% |

| 601598 | Jinduicheng Molybdenum Co., Ltd. Class A | 4.47% |

| LTHM | Livent Corporation | 4.23% |

Industry outlook

REMX is a valid option for investors who think that the price of rare earth metals will rise in the future. To illustrate why they might be right, keep in mind that the United States imported more than 80% of rare metals from China in the past year, according to the US Geological Survey data.

With Joe Biden in office and his new policy focusing on the competition with Beijing, it is reasonable to expect an increase in the US interest in the niche. That means more growth for the companies already in business.

An essential piece of advice is to keep an eye on the Delta strain and the fresh lockdowns that might arise, especially regarding Australia and its “zero Covid” approach.

Comments