For the longest of time, the S&P 500 has been the go-to ETF to gauge the economic situation of the world-leading economy. However, it would be a grievous mistake to assume that the eleven representative sectors have equal weighting in this fund. An in-depth dive into the most popular exchange-traded fund globally reveals that the materials sector is among the smallest niches represented in the fund. Historically, this small weighting has not impeded the materials sector, but it experienced one of the most significant contractions during coronavirus.

This is quite understandable given that the materials sector is dependent on the later stages of the business cycle hence highly cyclical, which was hurt with lockdowns and below-average production capacities. However, the global economic scene is expected to gain some headwind and resurge from the clutches of the coronavirus.

When you couple this with mounting supply constraints and an appetite for inflation-hedged assets, this sector is about to blossom, and the ETFs below are the orchard your portfolio needs.

What is the composition of materials ETFs?

The materials sector comprises firms involved in discovering and converting raw materials for production purposes. Therefore, it includes the containers and packaging industry, chemical industry, forestry, and paper industry, construction materials industry, and the metals and mining industry. Materials ETFs comprise miners, agricultural producers, homebuilders, chemical companies, and timber companies.

The best 3 materials sector ETFs to buy in 2022

The materials sector cuts across other sectors since any industry dependent on raw materials is joined to the hip with this industry. Thus said, as the world recovers from the ravages of the coronavirus, raw materials will be the driving input for economic resurgence, placing this sector in pole position to reap the full benefits. Add to this the inflationary pressure and the attribute of a corner of this sector, commodities, to play the devil’s advocate as a hedge.

What you have is a sector that, if played right, can provide portfolio diversification, value, and growth. Rather than scour the materials equity market trying to find the stocks that will flourish, why not invest in these three ETFs for instant exposure to the entire sector.

№ 1. Materials Select Sector SPDR Fund (XLB)

Price: $82.46

Expense ratio: 0.12%

Dividend yield: 1.55%

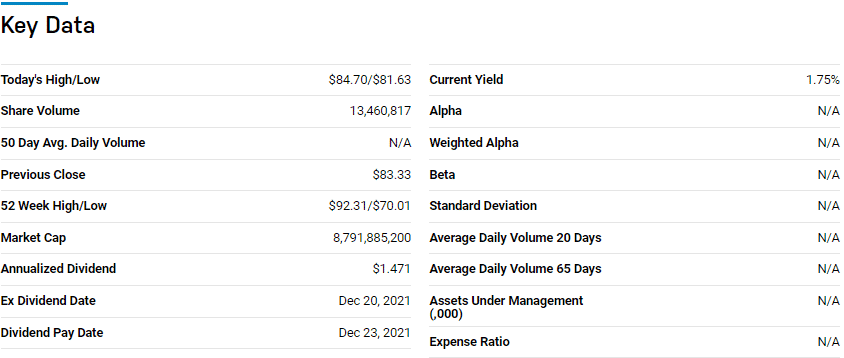

XLB chart

There is no investment in the materials sector without mentioning the Materials Select Sector SPDR ETF. It is the most liquid and popular fund in the materials industry. The XLB tracks the Materials Select Sector Index, investing at least 95% of its total assets in securities making up its composite index. As a result, it exposes investors to publicly traded equities with significant exposure to the materials industry.

An analysis of 38 natural resource funds by USNews has the XLB ranked № 8 for long-term investing.

The top three holdings of this ETF as of now are:

- Linde plc. — 16.89%

- Sherwin-Williams Company — 7.50%

- Air Products and Chemicals, Inc. — 6.52%

XLB has $7.94 billion in assets under management, with an expense ratio of 0.12%. Despite the significant concentration on its top holdings, this ETF traverses the entire US materials sector, making it the most liquid materials fund available to investors.

Its diversity ensures it can weather market downturns, as evidenced by its historical performance; 5-year returns of 75.08%, 3-year returns of 69.82%, and 1-year returns of 14.66%. Raw materials are the building blocks for the wall street economy and the larger global economy providing the inputs needed to drive all sectors. As the world rebounds from the coronavirus pandemic, XLB can provide portfolio growth and value.

№ 2. VanEck Rare Earth/Strategic Metals ETF (REMX)

Price: $101.27

Expense ratio: 0.59%

Dividend yield: 0.45%

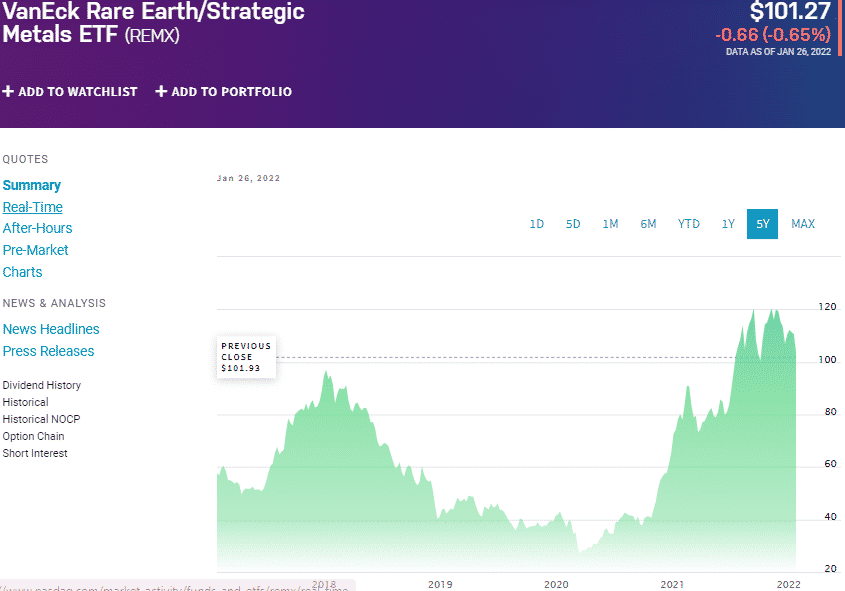

REMX chart

VanEck Rare Earth/Strategic Metals ETF tracks the MVIS Global Rare Earth/Strategic Metals Index, investing at least 80% of its total assets in the underlying holdings of the benchmark index. This non-diversified fund exposes the metals and mining industry to corners dealing in rare earth metals and minerals and strategic metals and minerals.

An analysis of 13 equity precious metal funds by USNews has the REMX ranked № 6 for long-term investing.

The top three holdings of this non-diversified ETF are:

- Pilbara Minerals Limited — 9.25%

- Zhejiang Huayou Cobalt Co. Ltd. Class A — 7.09%

- Ganfeng Lithium Co., Ltd. Class H — 6.65%

The REMX ETF has $939.2 million in assets under management, with an expense ratio of 0.59%. The appetite for strategic and rare earth metals and minerals increases with the world moving towards a green globe while their supply is still limited.

The imbalance between supply and demand in this corner of the materials sector has minted money for investors in the last half a decade. The same is expected to continue; 5-year returns of 125.13%, 3-year returns of 161.11%, and 1-year returns of 29.86%.

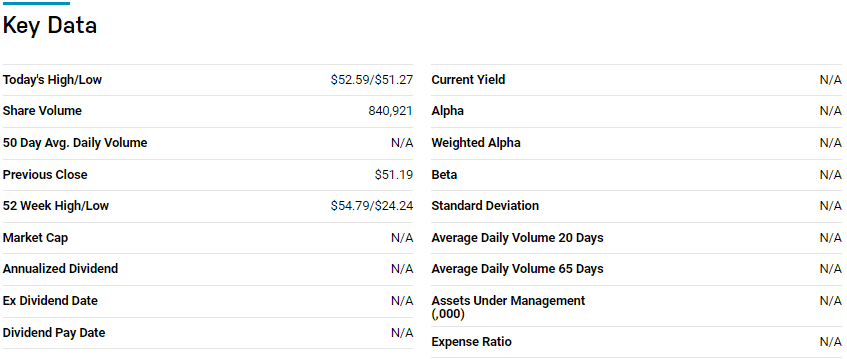

№ 3. KranShares Global Carbon ETF (KRBN)

Price: $51.31

Expense ratio: 0.79%

Dividend yield: N/A

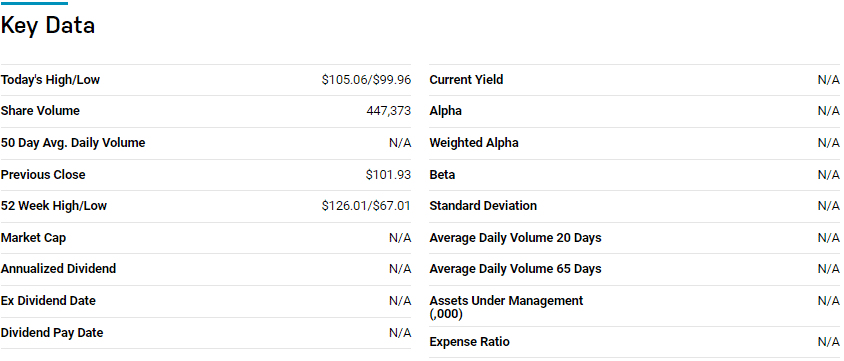

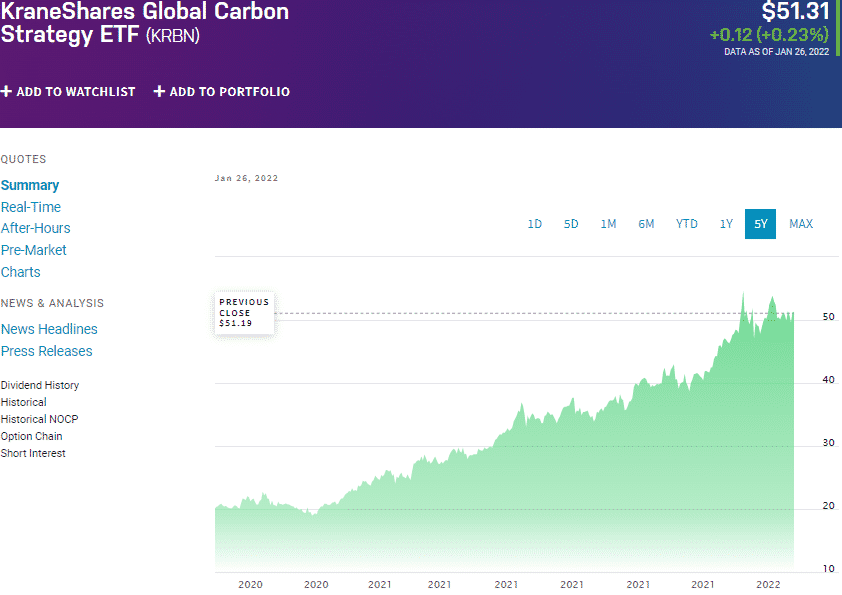

KRBN chart

The KranShares Global Carbon ETF tracks the IHS Markit Global Carbon Index, investing in credit carbon features with similar economic characteristics to those in its composite index.

The top three holdings of this non-diversified ETF are:

- US Dollar — 55.82%

- EQUITY OTHER — 42.06%

- Schwab Short-Term US Treasury ETF — 2.12%

KRBN ETF has $1.66 billion in assets under management, with investors having to part with $79 for every investment worth $10000 annually. Investors seek inflation-hedged holdings in the commodity industry in inflation-rising environments, with the go-to niches being energy and agriculture.

The KRBN provides an alternative to this conventional investing school of thought by concentrating on equities at the forefront of facilitating a green world by limiting carbon emissions to very low levels. Despite launching in 2020, at the height of the coronavirus pandemic, this ETF rode the headwinds of clean and sustainable investing in posting 1-year returns of 104.70%.

Final thoughts

The materials sector is the most direct and hassle-free investment in rising inflation and uncertain economic times. The globe is yet to break free of the coronavirus clutches. Still, the ETFs above ensure exposure to the materials sector-inflation-hedged assets with massive upside potential as the global economy recovers.

Comments